What’s Ahead for the Global Bio/Pharma Market in 2022 & Beyond

What has been the impact of COVID-19 on the performance of the global bio/pharma market, and what can be expected in 2022 and the near term?

Impact of COVID on global medicines spending

Overall, the global bio/pharmaceutical industry is projected for moderate growth through 2026, which reflects large gains in spending on COVID-19 vaccines and therapeutics that offset reduced spending in non-COVID-19 areas.

Global spending on medicines—based on invoice price levels—is expected to grow at a compound average annual growth rate (CAGR) of between 3% and 6% through 2026 to reach about $1.8 trillion by 2026, including spending on COVID-19 vaccines and novel therapeutics, according to a new report, The Global Spending and Usage of Medicines 2022: Outlook to 2026 released last month (December 2021) by the IQVIA Institute for Human Data Science. Overall, non-COVID-19 medicines use and spending trends have been negatively impacted by the COVID-19 pandemic, but this is offset by spending on related COVID-19 vaccines and therapeutics. Global spending on COVID-19 vaccines is projected to total $251 billion from their first introduction in 2021 to 2026. This level of spending largely reflects the initial wave of vaccinations, which are expected to be completed by 2022 in developed countries and in 2023 in lower-income geographies. In subsequent years, booster shots are expected to be required annually or more often as the limited durability of immunity and the continued emergence of viral variants drive recommendations for additional inoculations. Novel therapeutics for the virus will total $58 billion over the same period (2022 to 2026), representing a total of $309 billion of COVID-19 vaccine and therapeutic spending, according to the IQVIA Institute analysis.

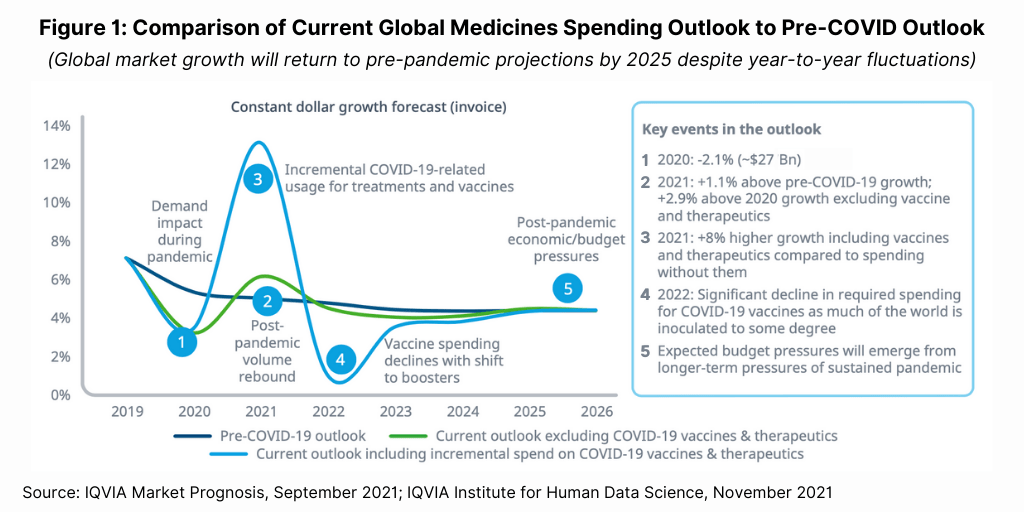

The outlook for global medicines spending shifted considerably in the years 2020 to 2022, but afterwards, global medicines spending is expected to be similar to the pre-COVID outlook, excluding the spending for COVID-19 vaccines, according to the IQVIA Institute analysis. As a result of lower spending in the near-term, non-COVID-19 medicines spending is expected to be $175 billion lower over seven years (2020 to 2026) than it would have been without the pandemic, excluding the spending on vaccines and therapeutics for COVID-19. Overall, the net increase in medicines spending globally is expected to be $133 billion through 2026, which represents about 3% of the cumulative global spend during that period. Figure 1 provides the adjusted forecast based on pre-pandemic and pandemic levels.

While the short-term impact from COVID-19 in 2020 and 2021 has been significant, the long-term impact on growth trends is more muted. Including estimates of higher spending growth from

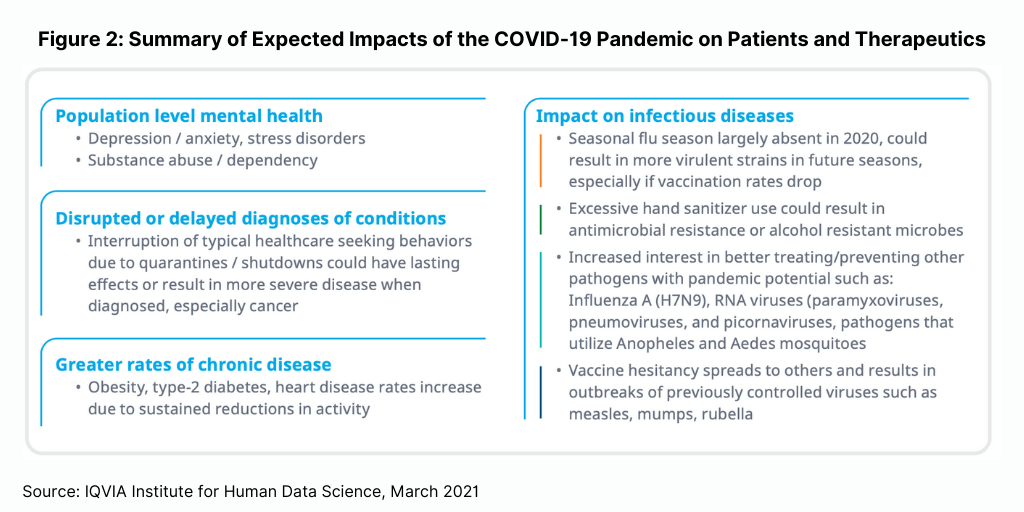

COVID-19 vaccines and lower spending from existing treatments due to disruptions from the pandemic, the five-year CAGR to 2025 is expected to be 4.6%, compared to 4.5% if the pandemic had not taken place, according to the IQVIA Institute analysis. The IQVIA Institute analysis points out that the largest uncertainty in the next five years will be the potential impact of economic factors on countries’ budgeting and whether there will be shifts in policies regarding healthcare and medicines spending. There also may be some shifts in specific therapeutic areas based on evolving needs emerging from the pandemic (see Figure 2).

Slowing growth for US market

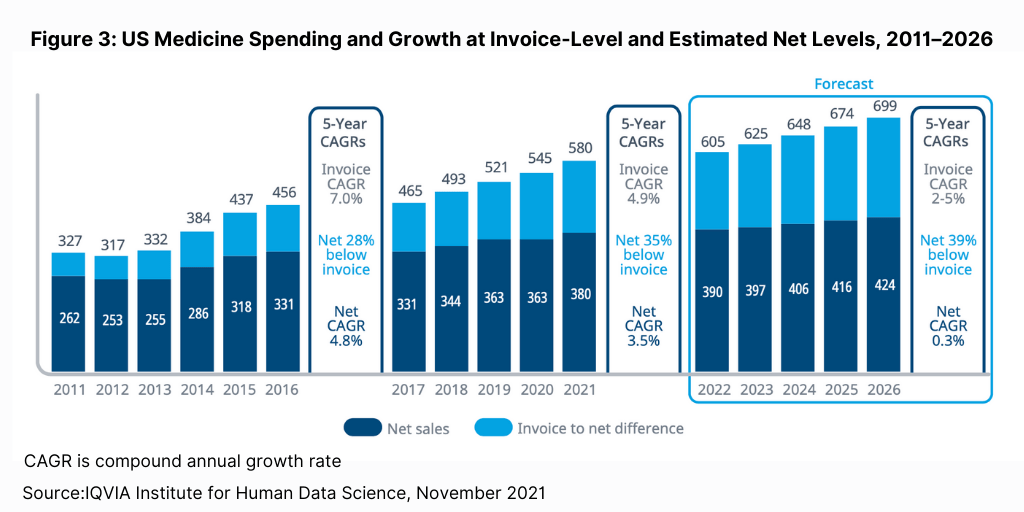

The US, the industry’s largest national market, will see slowing growth on a net-price basis. On a net- price basis, the US market is forecast to grow at a CAGR of 0-3% over the next five years (2022 to 2026), which is down from earlier net-price levels: 3.5% CAGR from 2017 to 2021 and 4.8% CAGR from 2011 to 2016 (see Figure 3), according to the IQVIA Institute analysis. Historically high numbers of new products will contribute $114 billion in spending over the next five years (2022 to 2026), up from $93 billion over the last five years, but representing a smaller share of the market. The largest drivers of the slowing growth rate are reduced price growth for brands and the increased impact of brand losses of exclusivity, including biosimilars, which more than doubles to $141 billion over the next five years compared to $57 billion in the prior five years.

Figure 3 outlines historical growth in US medicines spending at invoice levels and estimated net-invoice levels from 2011 to 2026. Off-invoice discounts and rebates include statutory discounts and rebates for the government, negotiated rebates by pharmacy benefit managers and insurers, discounts negotiated by purchasers, and coupons used by patients. In total, these off-invoice discounts and rebates result in spending that was estimated at 35% lower than invoice levels in 2021 and is projected to be 39% lower than invoice levels in 2026.

Spending on medicines in the US at invoice prices is expected to increase by $119 billion through 2026, very similar to the $124 billion increase over the past five years, according to the IQVIA Institute analysis. The largest driver of growth will be increased usage of existing protected branded products, which are expected to add $149 billion in spending over the next five years (2022 to 2026), much higher than the $89 billion increase from 2016 to 2021 for products more than two years after their launch up until their loss of exclusivity. Overall medicines spending at invoice prices in the US is expected to reach nearly $700 billion by 2026, even as off-invoice discounts and rebates are expected to reach 39% and net spending increases of only $44 billion over the next five years.

Other developed markets: Europe and Japan

Medicines spending in the top five European markets (France, Germany, Italy, Spain, and the UK) is expected to increase at a CAGR of between 3% and 6%, or $51 billion, over the next five years (2022 to 2026), up from $44 billion in the past five years but with large shifts in the drivers of growth, according to the IQVIA Institute analysis. New brands were the largest driver of growth from 2016 to 2021 and are expected to continue in the next five years (2022 to 2026) but will be hampered by lingering effects of the pandemic on marketing operations and reimbursement decisions.

Generics, including biosimilars, are expected to add $15 billion in growth over the next five years (2022 to 2026), about the same as in the past five years despite a larger impact of losses of exclusivity as volume gains will be offset by price deflation. The impact of losses of exclusivity (LOE) in the five largest European markets (Germany, France, Italy, Spain, and the UK) is expected to triple over the next five years (2022 to 2026). More than half of the impact is expected to be from biologics, which will account for $19.4 billion of the $33.3 billion total impact of LOE. The major impact will be in 2023 and 2024 with patent expiry of ranibizumab (Roche’s Lucentis) in 2022 and ustekinumab (Johnson & Johnson’s Stelara) in 2024. Small-molecule LOE is expected to double in terms of impact on brands in the next five years even as they have been a smaller share of overall impact.

Japan, the third-largest global market, is projected to have flat-to-declining medicines spending, including the likely shift from biennial to annual price revisions, which started with off-cycle price cuts in 2021, according to the IQVIA Institute analysis. Current pricing policies that reward innovative patent-protected brands are expected to continue, coinciding with the ongoing shift to generics for older medicines.

Spending growth in Japan is expected to maintain a consistent –2% to 1% growth rate over the next five years (2022 to 2026) as COVID-19 recovery continues and long-term trends affecting long-listed brands continue. While 2020 had the impact of being a price-cut year on top of the pandemic, the more muted rebound in 2021 included an off-cycle price-cut as well as the lingering effects of the pandemic on the market, according to the IQVIA Institute analysis.

The largest impact expected in the forecast period (2022 to 2026) is the –12% CAGR growth for long-listed products, which are expected to continue to face above average price cuts and to increase to annual frequency although the government’s policy has not been announced, according to the IQVIA Institute analysis. Long-listed products in Japan have declined from 27% of spending in 2011 to 13% in 2021 and are expected to drop to 7% by 2026.

Emerging market growth

Growth in “pharmerging markets,” defined by IQVIA as the most promising emerging market countries for medicines spending, will be moderate compared to historical levels. In pharmerging markets, absolute growth will be led by China, which is expected to grow at a rate of between 2.5% and 5.5% and add more than $30 billion in annual spending by 2026, driven by greater uptake and use of new original medicines, according to the IQVIA Institute analysis. Medicines spending in China has risen from $68 billion in 2011 to $169 billion in 2021, dipping to $158 billion in 2020 due to COVID-19, on a constant US dollars basis.

Over the past five years, spending growth in China was driven by original branded products, most often from multinational companies, which grew at an average of 13.1% per year to reach 28% of spending in 2021, up from 20% five years earlier. Over the next five years (2022 to 2026), government policies to update the national reimbursement drug list annually is contributing to a greater share of new original medicines being reimbursed, resulting in higher levels of spending, though these are generally subject to lower negotiated net prices, according to the IQVIA Institute analysis.

Over the next five years (2022 to 2026), original brands will grow by more than 10% per year while other types of products will grow at less than 3%, contributing to the overall growth rate slowing to between 2% and 5%. By 2026, medicines spending in China is projected to exceed $205 billion, an increase of more than $35 billion in the next five years.

Growth in biologics

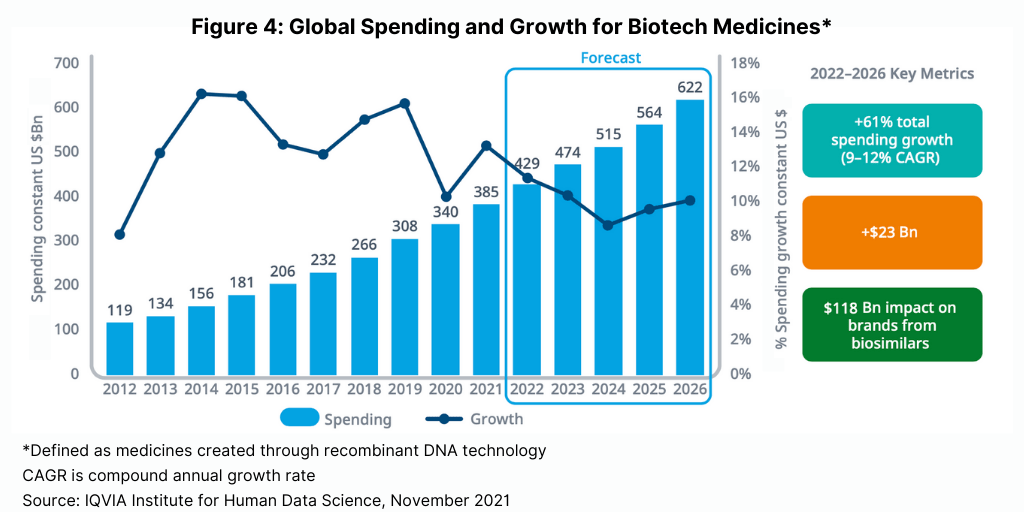

Global spending on biotech drugs, defined as those created through recombinant DNA technology, are expected to reach $620 billion by 2026, representing more than one-third of global medicines spending, according to the IQVIA Institute analysis. Biotech drugs will see a 61% aggregate increase over the next five years (2022 to 2026) with a CAGR of between 9% and 12%, adding $237 billion globally (see Figure 4). This growth will occur despite brand losses of $118 billion due to biosimilars in the forecast period (2022 to 2026). Spending growth is expected to slow significantly in the next five years from the impact of key biosimilars, especially in developed markets, but will remain robust through the continued flow of new medicines.

Innovator drugs versus generics and biosimilars

In looking at overall medicines spending trends, new brands in developed markets through 2026 are projected to increase in absolute spending to $196 billion, up more than 20% over the past five years, according to the IQVIA Institute analysis. The projected level of spending on new brands through 2026 continues a historically high period of spending on novel medicines and represents recovery from the impact of the pandemic. New active substances launches are also projected to continue at higher levels than seen in the past decade, with an average of between 54 and 63 per year, totaling between 290 and 315 for the next five years (2022 to 2026).

The two leading global therapy areas—oncology and immunology—are forecast to grow through 2026, respectively, at a CAGR of between 9% and 12% and 6% and 9% through 2026, lifted by significant increases in new treatments and medicine use and offset by the impact of biosimilars, according to the IQVIA Institute analysis. Oncology is projected to add 100 new treatments over five years, contributing to an increase in spending of $119 billion to a total of more than $300 billion in 2026. Immunology medicines growth is projected to slow to between 6% and 9% in the forecast period (2022 to 2026) from a CAGR of 16.9% seen over the past five years as biosimilars provide lower-cost treatments and offset growth from volume and drug launches. In addition, many new therapies are expected in neurology, including novel migraine therapies, potential treatments for rare neurological diseases, and potential therapies for Alzheimer’s and Parkinson’s diseases, according to the IQVIA Institute analysis.

At the same time, on a global basis, the impact of exclusivity losses will increase to $188 billion over the next five years (2022 to 2026), mostly due to the availability of biosimilars, which will have greater impact in some countries than small molecules. The cumulative incremental savings in the years 2022-2026 from new biosimilars will reach an estimated $215 billion.