What’s Trending in Biomanufacturing?

A recent analysis by BioPlan Associates outlines the major trends impacting biomanufacturing and related supply lines. From the impact of the COVID-19 pandemic to ways to increase biomanufacturing productivity to reductions in biomanufacturing footprints, what are the key developments impacting biomanufacturing and bio-outsourcing?

Inside biologic-based drug development and biomanufacturing

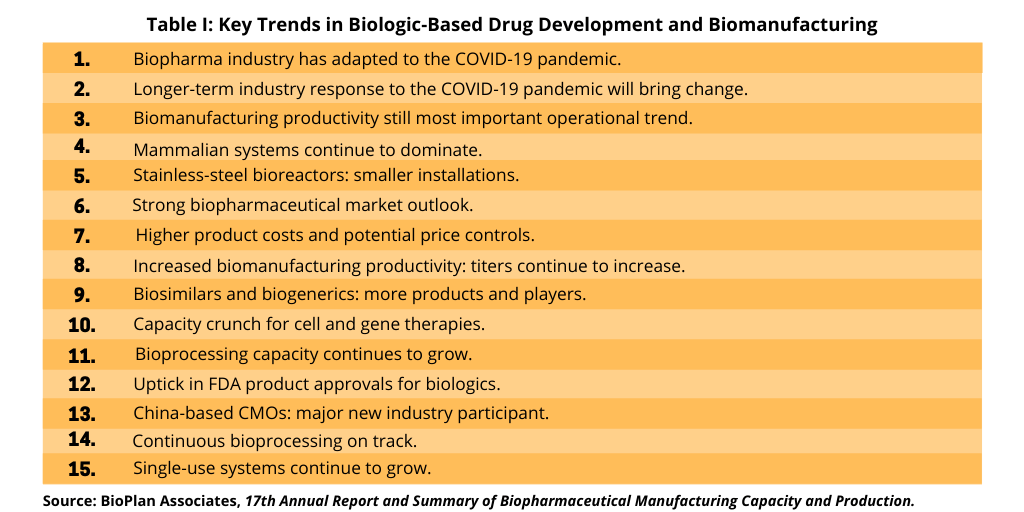

A recent analysis by BioPlan Associates, a Rockville, Maryland-based consultancy that provides strategic information and analysis of the biopharmaceutical and life-science industries, highlights major trends impacting biomanufacturing. Its report, the 17th Annual Report and Summary of Biopharmaceutical Manufacturing Capacity and Production, which was released earlier this year (April 2020), provides a detailed and comprehensive analysis of key trends on biologic-based drug development and biomanufacturing. The report is based on industry input from a survey of 130 executives from biopharmaceutical manufacturers and CMOs in 33 countries plus 150 industry vendors and direct suppliers of materials, services, and equipment to the biomanufacturing segment. Eric Langer, President and Managing Partner of BioPlan Associates, outlined 15 major trends from the report as highlighted in Table I and further explained below.

Biomanufacturing in the wake of COVID-19

The novel coronavirus (COVID-19) pandemic has had a impact on the global economy, but what has been the impact operationally on biomanufacturing, both in the short and long term?

“The operational aspects of the biopharmaceutical industry and its bioprocessing sector have rapidly pivoted and adapted to the COVID-19 pandemic,” said Langer “While many other industries continue to struggle with their adaptation to the pandemic, the biopharmaceutical industry and its manufacturing (bioprocessing) sector have, in most respects, already well adapted, with most expected major changes already implemented and working well (enough). The pandemic’s first wave had begun to stabilize in many regions (as of the summer 2020) and near-term responses to actually dealing with the pandemic have generally been effective. The most significant and long-term trends and effects on bioprocessing will be associated with the coming years—long worldwide recovery and related industry responses to pandemics not adaptation to the pandemic itself.”

One consequence of the COVID-19 pandemic has been the increase in biopharmaceutical R&D and biomanufacturing production/capacity being started or planned at many bioprocessing facilities/companies due to the pandemic. Langer points out that the pandemic response is mostly adding R&D and manufacturing to facilities, yet generally not halting other ongoing activities although many could be given lower priority. “For example, even smaller CMOs that are not involved in pandemic-related R&D or manufacturing are starting to see increased new projects and future demand as non-pandemic/biodefense projects are shifted from developers to CMOs, or from one CMO to another,” he says.

A longer-term result, according to the BioPlan study, is increased biomanufacturing outsourcing. Seventy percent of developer and supplier company executives cited increasing outsourcing when asked to identify the major long-term effects of the COVID-19 pandemic, followed by changes in the supply chain, with 60% of developers citing this, which included having more concerns and involvement with suppliers and securing second sources. Half of developers and nearly half of suppliers (46%) cited regionalization as a long-term consequence of the COVID-19 pandemic, referring to more biomanufacturing facilities, both by developers and suppliers, being located in more countries, often domestically. One problematic area cited by executives (50% of developers and 35% of suppliers) is a worsening of the supply crunch for single-use biomanufacturing components.

Biomanufacturing capacity: overall

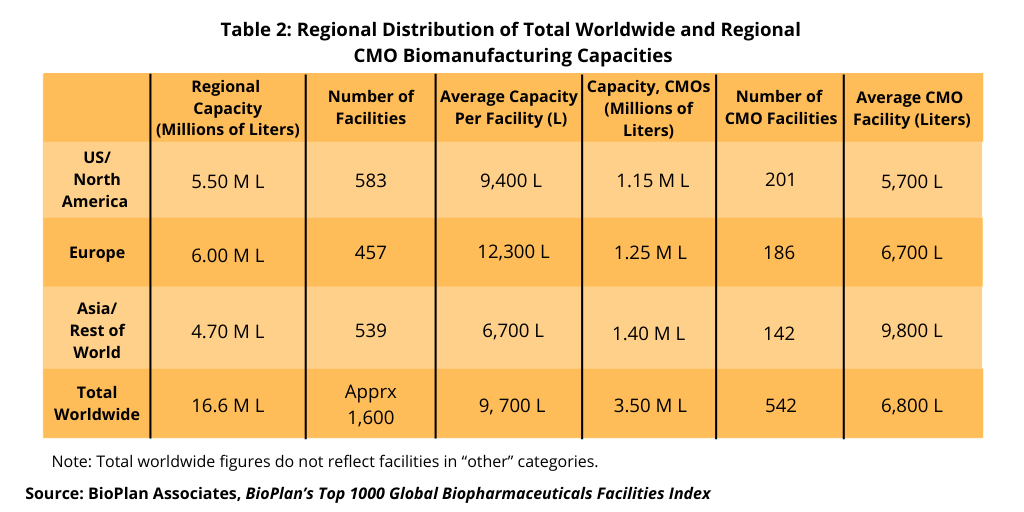

A separate BioPlan analysis, BioPlan’s Top 1000 Global Biopharmaceuticals Facilities Index, reports and ranks 1,625 biopharmaceutical manufacturing (bioprocessing) facilities worldwide in terms of known or estimated cumulative bioreactor capacity, onsite employment, number of products manufactured commercially and other facility and bioprocessing-related data. The source database now tracks 16.6 million liters of production capacity worldwide, including all major facilities for the manufacture of recombinant and non-recombinant biopharmaceuticals, vaccines, and blood/plasma-derived products. More than 70% or more than 11.6 million liters is estimated to be mammalian-based, primarily for commercial manufacturing of monoclonal antibodies (mAbs), and less than 30% or less than 5.0 million liters is estimated to be microbial or other non-mammalian capacity (e.g., plant and insect expression systems). A regional breakdown of worldwide bioprocessing capacity of CMOs is presented in Table 2.

Over 880 facilities worldwide now each have more than 1,000-L estimated bioprocessing capacity; over 1,110 facilities have more than 500-liter capacity, according to the BioPlan analysis. CMOs include some very large commercial manufacturing facilities, mostly in the US, offering contract bioprocessing services, with these tending to inflate the reported total capacity assigned to CMO tasks, notes the BioPlan analysis.

Langer explains that the majority of bioprocessing capacity worldwide continues to be held by a relatively small number of the largest facilities. For example, the total of more than 6.5 million liters reported for just the top 10 leading facilities comprises approximately 40.0% of the total estimated worldwide capacity. The 100 largest facilities have around two-thirds of worldwide capacity. The majority of the massive capacity held by the top leaders involves legacy stainless-steel facilities with bioreactor capacity of more than 10,000 liters. “’Relatively few such facilities are now being constructed in the US and Western Europe, with manufacturing in major market countries using single-use systems,” says Langer.

Biomanufacturing capacity: mammalian, microbial, and cell and gene therapies

Mammalian-cell biomanufacturing continues to dominate biomanufacturing operations, used by 77.2% of survey respondents, according to the BioPlan study. Mammalian expression systems (cell lines, vectors and associated genetic engineering) continue to be preferred over other options, e.g., microbial and plant systems, particularly for recombinant proteins and mAb production. Microbial fermentation accounts for 37.2% of biomanufacturing operations and newer modalities, cell and gene therapies, respectively accounted for 14.4% and 20.4%, according to the BioPlan study.

Results from the BioPlan study shows that most cellular and gene therapy facility manufacturing capacity remains skewed toward lower volumes. Among those involved in cellular or gene therapies, two-thirds (66.7%) of survey respondents report less than 500-liter total onsite bioreactor capacity. The BioPlan anaylsis shows that gene-therapy facilities generally have more capacity than cellular therapy facilities. “Most cellular therapy facilities are still working with fully individualized one-off products while viral vector manufacture for gene therapies is generally performed at larger scales and serving more patients per process run/batch and has even been scaled up by some facilities to use of 2,000-liter bioreactors,” notes Langer in commenting on the study’s results.

BioPlan has published data concerning current and future cellular/gene therapies manufacturing capacity needs, including projecting a current and worsening capacity crunch. The firm estimates that the current capacity shortfall in the cellular/gene therapy areas is 5x or 500%, meaning that 5x current capacity would be in use, if it were available, particularly if this were hirable CMO capacity, and the firm projects that this shortfall will increase. BioPlan studies also have shown that nearly 90% of cellular/gene therapy developers would prefer to manufacture using CMOs, but most are not finding the needed expertise, capacity and/or facilities among CMOs, or access due to long average wait times to get new projects started.

CMO and outsourcing trends

For its 2020 study, BioPlan asked biopharmaceutical developers to estimate the overall percentage of production they expect to outsource over the next five years. Generally, there has mostly been a continuing trend toward expecting more future outsourcing. Overall results still suggest a continuing trend toward future outsourcing of mammalian cell-culture biomanufacturing with 67.6% of respondents projecting some outsourcing by 2025, down slightly from 77.9% in 2019. For microbial fermentation systems, the percentage decreased to 64.3% in 2020, down from 77.5% in 2019. For cell or gene therapies, 88.2% expected some outsourcing by 2025, up from 77.0% in 2019.

For 2020, in particular, fill/finish operations and API biologics manufacturers were the two areas in which respondents said they planned to increase outsourcing. For fill/finish, 27.3% of biopharmaceutical developers planned to outsource compared to 19.7% in 2019. For API biologics manufacturing, 23.6% of biopharmaceutical developers plan to outsource compared to 21.2% in 2019. Also, on the drug-substance side, 9.1% of biopharmaceutical developers plan to outsource upstream process development, up from 8.0% in 2019.

Although outsourcing continues to increase, the rate of increase is slowing. “Recent survey data indicate the rate of growth in outsourcing has been slowing, and other studies have shown that growth in the use of CMOs for commercial manufacturing is tending to slow in the biopharmaceutical industry while increasing in the mainstream drugs industry,” says Langer. “…Overall, companies in the biopharmaceutical industry are now more carefully evaluating and weighing their out- vs. in-sourcing options, including assessing options from a longer-term perspective.”

In its 2020 study, BioPlan asked biopharmaceutical developers how their spending on outsourcing will change over the next 12 months in R&D or manufacturing. Based on these data, the firm estimates that, on average, budgets for outsourcing at individual facilities will remain relatively steady by a weighted average of 14.5% in 2020, compared to 10.3% in both 2019 and 2018. “These growth rates appear to show a weak trend of increases in outsourcing budgets,” said Langer, who indicated that 38.4% of respondents in 2020 indicated that their facility anticipates no change in outsourcing, a small increase from 30.7% in 2019.

An emerging trend in the CMO market is the rise of China as both a customer and potential supplier of biologics. As biopharmaceutical growth, including for biosmilars, increases globally, it is also increasing in China as well. “Biologics development and their commercial-scale manufacturing is relatively new in China; the country is just getting started,” says Langer. “Most product developers in China lack bioprocessing capacity, including early-stage manufacturing facilities, and/or their staff lack needed bioprocessing and regulatory knowledge and expertise, so use of CMOs is a necessity.”

BioPlan’s Top 1000 Global Biopharmaceutical Facilities Index now reports China has more than 1.5 million liters of bioprocessing capacity, about 9.2% of worldwide capacity, which now surpasses India (at 0.98 million liters) by over 50%.

Biomanufacturing productivity, facility design and bioreactor installations

BioPlan’s 17th Annual Report and Summary of Biopharmaceutical Manufacturing Capacity and Production highlights several key trends relating to biomanufacturing productivity, facility design, and bioreactor installations.

As in previous BioPlan studies, manufacturing productivity is cited by survey respondents as the single most important operational issue, and a trend continues to show incremental increases in bioprocessing productivity. The average titer for reported new commercial-scale mAb upstream bioprocessing in 2020 (based on the BioPlan study) is 3.53 g/L, and the average titer for reported new clinical-scale mAb upstream bioprocessing in 2020 is 3.96 g/L. Langer explains that average clinical-scale titers, produced at facilities typically applying process innovations, would be expected to be higher than commercial-scale processes at older facilities.

With respect to bioreactors, Langer explains that “besides fewer new stainless-steel bioreactors being installed, with more single-use facilities coming on line versus stainless-steel-based ones, a trend is continuing for reduction in volume of stainless-steel bioreactors in operation at facilities, as exemplified by the largest size stainless-steel bioreactor onsite.” In looking at the current and past BioPlan studies, there has been a trend for an overall decrease in the percent of respondents reporting their facilities having bioreactors greater than 2,000 liters, with 2,000 liters generally the current cut-off for use of single-use bioreactors. For comparison, the average reported size of the largest single-use bioreactor onsite was under 25% of the average largest-size onsite stainless-steel bioreactor, according to the BioPlan study. Single-use bioreactors now dominate use for R&D and early-phase clinical manufacturing, with an estimated 85% or more of preclinical and clinical bioprocessing using single-use systems.

Single-use equipment continues to make advances into biopharmaceutical manufacturing and is becoming increasingly common in most areas, particularly at pre-commercial scales (e.g., clinical, and preclinical) where single-use systems dominate stainless steel systems, especially upstream. BioPlan estimates that 85% or more of pre-commercial (R&D and clinical) product manufacturing now involves considerable, if not near total, single-use systems-based manufacturing.

With regard to process innovation, continuous bioprocessing—both in upstream and downstream operations—were the two areas cited the most needed by survey respondents in the BioPlan study. Upstream continuous bioprocessing/perfusion was cited by a total of 44.2% respondents and downstream continuous purification/chromatography was cited by 40.0% as areas in which they expect to evaluate/test in their facilities within the next year.

Biopharmaceutical product trends

The biopharmaceutical industry outlook is strong with several key indicators boding well for biologic-based drugs. Worldwide sales of biopharmaceuticals (therapeutics) are now over $300 billion. “Overall year-to-year industry revenue growth has been rather steady, with new product launches and increased sales of established products, including as products are approved for additional indications,” comments Langer. New and innovative biopharmaceutical product types continue the trend of increasing the number and diversity of types or classes of biopharmaceuticals, including new(er) technologies or product types including cellular and gene therapies, antibody-drug conjugates, live microbes as therapeutics, and RNAi therapies.

Overall, the Center for Drug Evaluation and Research and the Center for Biologics Evaluation and Research of the US Food and Drug Administration (FDA) approved 35 biopharmaceuticals in 2019. The great majority, 28 products, or 80%, have recombinantly manufactured active agents, according to the BioPlan analysis. Recombinant mAbs, including derived fragments, were the product class with the most approvals at 15 or 43% of all biopharmaceutical approvals. Seven (20%) non-mAb recombinant proteins received FDA approval. One gene therapy and no cellular therapies received approval. Ten biosimilars received approval. A total of 22 (63%) follow-on-type products, either biosimilars or equivalent 505(b)(2) generic drug approvals (for biologics), received FDA approval.

A current and future impact factor on biopharmaceutical growth is price controls, whether imposed directly by governments through admission of products to national formularies or through insurers requiring use of lower-cost generics and biosimilars.

Langer points out that costs of manufacturing continue to remain a small portion relative to sales prices/revenue. For example, a typical mAb product generally is estimated to have total costs for manufacturing in the 4-8% range of sales prices/revenue while most cellular and gene therapies generally have manufacturing costs about 2x higher, generally more than 10%.

Aside from innovator products, follow-on biologics (i.e., biosimilars, biogenerics, and biobetters) also represent an important product area. BioPlan’s Biosimilars/Biobetters Pipeline Directory now reports 1,099 biosimilars (including biogenerics) in development or marketed worldwide, with 588 now in clinical trials or marketed in one or more countries. There are also more than 560 biobetters in development or marketed worldwide, with 296 in clinical trials or marketed. Over 800 companies worldwide are involved in follow-on products (biosimilar, biobetters and biogenerics), including many new entrants in both developed and developing regions. Langer notes that CMOs in recent years have reported about a 15% increase in business attributed to biosimilars projects.

Further information on BioPlan Associates’ 17th Annual Report and Summary of Biopharmaceutical Manufacturing Capacity and Production, may be found here.