What’s on the Pharma Industry’s Radar for 2021?

COVID-19 will continue to be a defining issue for the pharmaceutical industry in 2021 as new vaccines and treatments enter the market. Across the broader industry, oncology drugs continue to be a major growth driver, the industry’s late-stage pipeline shows strong promise, and financing into the industry remains robust. What products and companies are on the radar for 2021?

Impact of COVID-19 on the pharma industry

COVID-19 will continue to be a defining issue for biopharmaceutical/pharmaceutical companies in 2021, according to a recent report by Evaluate Vantage using EvaluatePharma data. On one level, the COVID-19 pandemic initially had a negative impact on clinical development in 2020 as companies suspended or halted clinical trials as patient recruitment and access to clinical settings was limited. An analysis of clinical trial records shows that in April (April 2020), almost 160 commercially sponsored studies had been suspended for reasons related to COVID-19. By November (November 2020), that number had more than halved, and assuming vaccines continue to roll out in 2021, clinical development of non-COVID-19 treatments should improve further in 2021, according to the Evaluate Vantage report.

At the same time, the COVID-19 pandemic engendered new research and development in vaccines and treatments against COVID-19. Sales of COVID-19 vaccines are expected to reach between $10 billion to $15 billion in 2021 according to the Evaluate Vantage report, but how the leading COVID-19 vaccines will fare remains hard to gauge. In the US, two COVID-19 mRNA vaccines, respectively by BioNTech/Pfizer and Moderna, were the first COVID vaccines authorized for emergency use by the US Food and Drug Administration (FDA), respectively on December 11 and December 18, 2020. Later in December (December 2020), the European Medicines Agency granted conditional marketing authorization to Pfizer’s/BioNTech’s COVID-19 vaccine, and a decision for Moderna’s vatccine in the European Union (EU) is under review. Global regulatory reviews are ongoing for both vaccines with authorization granted to Pfizer’s/BioNTech’s vaccine in the UK, Canada, Mexico, Bahrain, and Saudi Arabia. In addition to the US, Moderna has received authorization for its COVID-19 vaccine in Canada and Israel, and in addition to the EU, authorizations are currently under review in Singapore, Switzerland and the UK. AstraZeneca and the University of Oxford received authorization for emergency supply for their COVID-19 vaccine in the UK late last month (December 2020) with global clinical trials ongoing. Johnson & Johnson is in late-stage development for its COVID-19 vaccine. Other leading companies with data from late-stage trials expected in 2021 further include: Novavax, Merck & Co., and Sanofi/GlaxoSmithKline.

With respect to COVID-19 treatments, Gilead Sciences’ Verlurky (remdesivir) was the first drug for treating COVID-19 that received full approval by the FDA. An antiviral, the drug was approved in October 2020 for treating COVID-19 requiring hospitalization in adult and pediatric patients 12 years of age and older and weighing at least 40 kilograms (about 88 pounds). Gilead had earlier received emergency use authorization by the FDA in May 2020. Veklury revenues were $873 million for the third quarter 2020, and consensus estimates project sales over $1 billion for 2021 although some downward pressure is possible, according to the Evaluate Vantage report.

Several other antiviral COVID drugs in development by the large pharmaceutical companies are highlighted in the Evaluate Vantage report. Merck & Co.’s molnupiravir was licensed by Merck from Ridgeback Biotherapeutics, a Miami, Florida-based biopharmaceutical company, in a deal that closed in July 2020. The drug, in Phase II/III development, is an orally bioavailable form of a ribonucleoside analog that inhibits the replication of multiple RNA viruses, including SARS-CoV-2, the virus that causes COVID-19. In October 2020, Roche formed a licensing pact ($350 million upfront plus milestones) with Altea Pharmaceuticals, a clinical-stage biopharmaceutical company, for the exclusive rights to research, develop, and distribute outside the US AT-527, an oral antiviral treatment for COVID-19 that is in Phase II development. Pfizer is developing PF-07304814, an oral antiviral in Phase I development that targets the 3CL protease, an enzyme that coronaviruses use to assemble themselves and multiply. Novartis formed a partnership with Molecular Partners, a clinical-stage biopharmaceutical company, in late October (October 2020) to develop two antivirals from Molecular Partners, MP0420 and MP0423, for treating COVID-19. Phase I clinical trials for MP0420 began in November 2020, and Molecular Partners will perform all remaining preclinical work for MP0423. Novartis will conduct Phase II and Phase III clinical trials, with Molecular Partners as the sponsor of these trials.

Monoclonal antibodies (mAbs) are another area of development for COVID-19 treatments. Two new mAb-based COVID-19 treatments that received emergency use authorization by the FDA and noted in the Evaluate Vantage report are Regeneron Pharmaceuticals’ antibody cocktail consisting of casirivimab and imdevimab for treating high-risk patients with mild-to-moderate disease and Eli Lilly and Company’s bamlanivimab for treating high-risk patients with mild-to-moderate disease.

For other mAb-based treatments, AstraZeneca is developing AZD7442, a long-acting antibody combination, which is in Phase III development. One trial is evaluating the safety and efficacy of AZD7442 to prevent infection for up to 12 months, and the second trial is evaluating post-exposure prophylaxis and pre-emptive treatment. In October 2020, the US government announced funding of approximately $486 million to support the development and supply of AZD7442. In addition, GlaxoSmithKline (GSK) and Vir Biotechnology, a South San Franciso-based biopharmaceutical company, are developing VIR-7831, now in Phase II/Phase III development. In April 2020, Vir and GSK entered into a collaboration to research and develop solutions for coronaviruses, including SARS-CoV-2, the virus that causes COVID-19.

The Evaluate Vantage report also notes other new drugs being developed to treat COVID-19 as well as already approved drugs for other indications being evaluated to treat COVID-19. Other novel drugs by the large pharma companies to treat COVID-19 include CD24Fc, a recombinant fusion protein to treat COVID-19 in Phase III development from Merck & Co. and OncoImmune, a clinical-stage biopharmaceutical company; Merck agreed to acquire OncoImmune in late November (November 2020). GSK is evaluating otilimab, an investigational anti-granulocyte macrophage colony-stimulating factor, which is being evaluated in Phase II trials to treat severe pulmonary COVID-19-related disease. Roche is evaluating in Phase II trials MSTT1041A (astegolimab) and UTTR1147A, in combination with standard of care, for treating patients hospitalized with severe COVID-19 pneumonia. Among already approved drugs being evaluated to treat COVID-19 are Lilly’s Olumiant (baricitinib), approved for treating rheumatoid arthritis, and now in Phase III development for treating hospitalized COVID-19 patients.In November 2020, the FDA granted emergency use authorization of baricitinib in combination with remdesivir in hospitalized adult and pediatric patients two years of age or older with suspected or laboratory confirmed COVID-19 who require supplemental oxygen, invasive mechanical ventilation, or extracorporeal membrane oxygenation (ECMO). Incyte is evaluating Jakafi (ruxolitinib) for the treatment of COVID-19-associated acute respiratory distress syndrome that requires mechanical ventilation.

Broader industry trends: new drug approvals

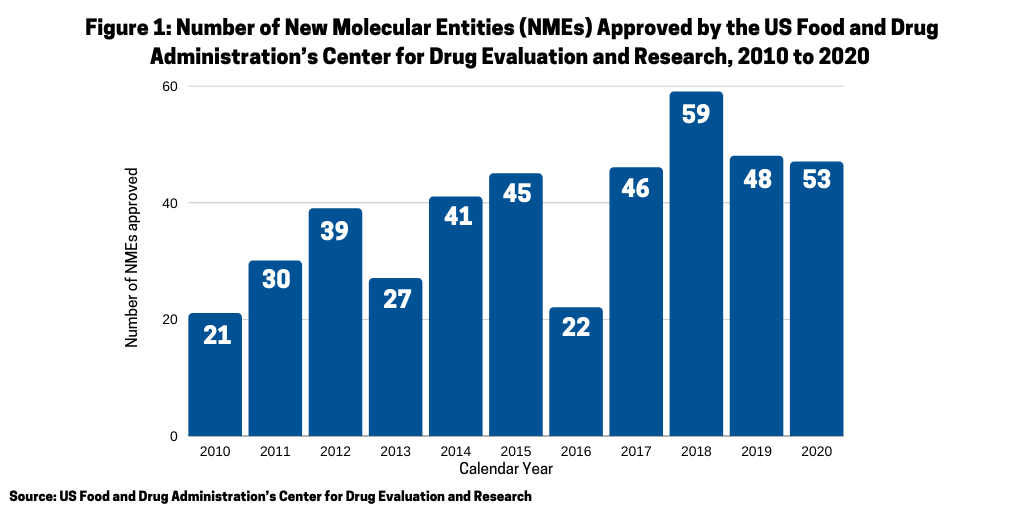

One of the questions arising in 2020 was whether the COVID-19 pandemic would have a negative impact on new drug approvals stemming from either companies’ suspending late-stage trials and/or regulatory agencies scaling back drug reviews. In looking at the number of new molecular entities (NMEs) approved in 2020 by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER), the answer seems to be no. In 2020, the FDA’s CDER approved 53 NMEs, which surpassed the 48 NMEs approved in 2019 (see Figure 1) and was the second highest level of NMEs approved over a 10-year period, except for 2018 when 59 NMEs were approved. Only one NME approved in 2020 was COVID-related: Gilead Sciences’ Verlurky (remdesivir).

Product growth in 2021

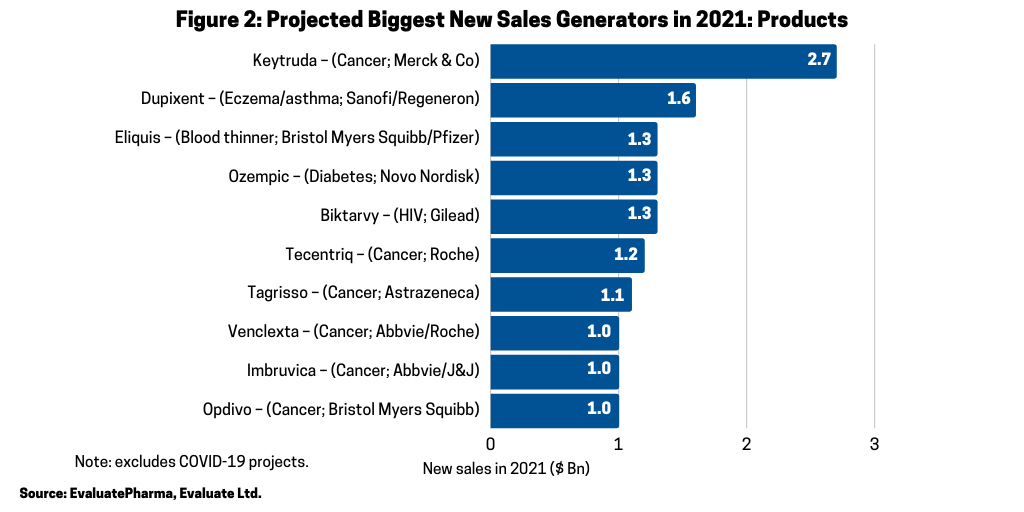

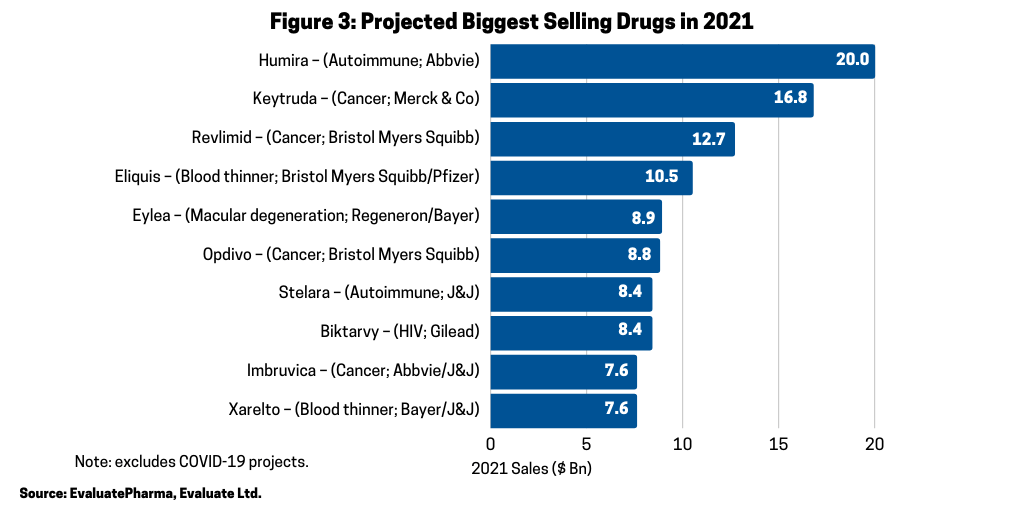

Across the broader industry, oncology continues to be a major driver of growth; six of the projected ten biggest new sales generators and four of the projected top ten best-selling products in 2021 are cancer drugs, according to the Evaluate Vantage report. Six of the 10 biggest new sales generators in 2021 (referring to increased sales projected for 2021) (see Figure 2) are treatments for various cancers, and three of these are anti-PD (L1) antibodies. Chief among them is Merck & Co.’s Keytruda (pembrolizumab), which is forecast to be the industry’s top-selling drug in 2023, taking the top spot from the current leading product, Abbvie’s Humira (adalimumab). Humira is approved to treat arthritis, plaque psoriasis, ankylosing spondylitis, Crohn’s disease, and ulcerative colitis, but faces near-term biosimilar competition. Keytruda is expected to add the most new sales in 2021, with $2.7 billion in growth and $16.8 billion in total sales.

In 2021, however, AbbVie’s Humira is projected to be the industry’s top-selling drug with Merck & Co.’s Keytruda forecast as the second top-selling drug in 2021 (see Figure 3). Including Keytruda, four of the top-selling drugs forecast in 2021 are oncology drugs (see Figure 3). The other projected top-selling drugs that are oncology drugs are Bristol-Myers Squibb’s (BMS) Revlimid (lenalidomide), gained from BMS’ $74-billion acquisition of Celgene in 2019; BMS’ Opdivo (nivolumab); and AbbVie’s and Johnson & Johnson’s Imbruvica (ibrutinib).

Companies’ sales growth in 2021

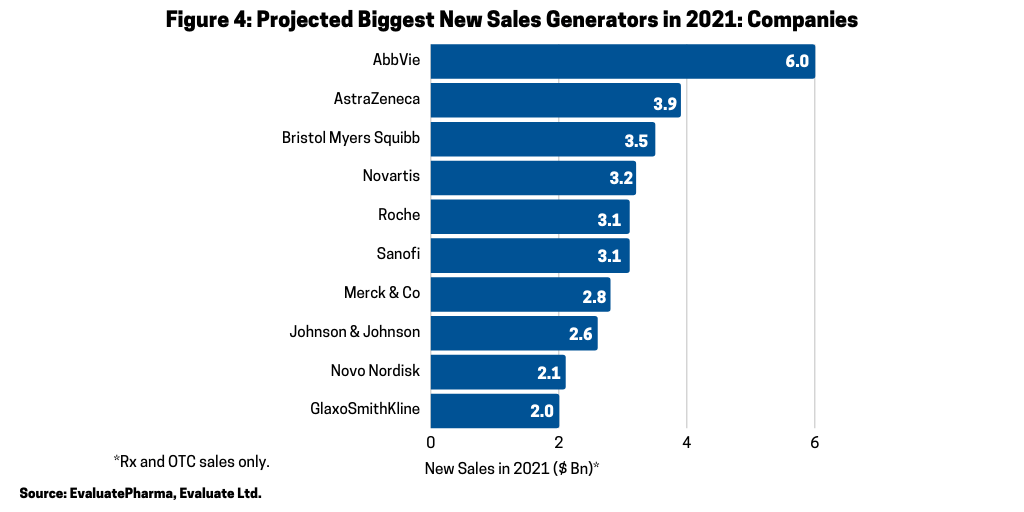

On a company basis, despite facing near-term biosimilar competition for Humira, AbbVie is projected to have the largest new sales gains in 2021, led by new immunotherapies, Rinvoq (upadacitinib) for treating moderately to severely active rheumatoid arthritis and Skyrizi (risankizumab-rzaa) for treating moderate-to-severe plaque psoriasis, according to the Evaluate Vantage report. Figure 4 outlines the top 10 new sales generators by company with AbbVie projected to lead the way in 2021 with sales gains of $6 billion, followed by AstraZeneca (+ $3.9 billion), Bristol-Myers Squibb (+ $3.5 billion), Novartis (+ $3.2 billion), Sanofi (+ $3.1 billion) and Roche (+ $3.1 billion).

AstraZeneca and BMS have cancer franchises in particular to boost their new sales in 2021. BMS will see sales gains from Revlimid in 2021 (although it faces near-term generic competition), and AstraZeneca is projected to realize sales gains in 2020 from its cancer drugs: Tagrisso (osimertinib), Imfinzi (durvalumab), and Lynparza (olaparib). Novartis is looking to a mix of therapy areas for its new sales, from immunotherapy to cardiology to rare diseases. Its gene therapy, Zolgensma (onasemnogene abeparvovec-xioi), approved for treating spinal muscular atrophy, a rare neuromuscular disease, is expected to become a blockbuster in 2021 with projected sales of $1.5 billion. Sanofi will rely heavily on Dupixent (dupilumab), approved for treating eczema, asthma and nasal polyps that result in chronic sinusitis, for new sales growth in 2021.

Industry’s late-stage pipeline and potential blockbusters

New drug approvals from the FDA are also expected to generate significant value in 2021 with 10 drugs projected to launch in 2021 with potential blockbuster status by 2026, according to the Evaluate Vantage report. Table I at the end of the article outlines the top 10 blockbuster contenders to be launched in 2021 and projected to achieve blockbuster status by 2026.

Biogen’s and Eisai’s aducanumab, a drug to treat Alzheimer’s disease, is the biggest potential launch in 2021 with $4.8 billion in forecast sales in 2026; however, the FDA’s decision on whether to approve the drug is an important upcoming event in 2021. In November (November 2020), an advisory committee of the FDA voted to reject approval of aducanumab, citing that the drug failed to demonstrate efficacy and more research is needed. FDA advisory committee recommendations are non-binding although they have historically been taken by the full FDA when considering a drug for approval. Aducanumab is an amyloid beta-targeting antibody that has shown in clinical trials to remove amyloid beta in the brain and slow clinical decline in patients with mild cognitive impairment due to Alzheimer’s disease and mild Alzheimer’s disease dementia. The FDA is scheduled to make its decision no later than March 7, 2021. The drug is also under review in the European Union and Japan. Biogen licensed aducanumab from Neurimmune, a Swiss biopharmaceutical company, under a collaborative development and license agreement. Since October 2017, Biogen and Eisai have collaborated on the development and commercialization of aducanumab globally.

Overall, the industry’s late-stage pipeline has a combined net present value for the top 10 R&D projects of nearly $60 billion. Of these top 10 R&D projects, Lilly’s tirzepatide maintains its ranking as the most highly valued R&D project, with a net present value of $12.7 billion. Other top 10 R&D projects (based on net present value) from the large pharmaceutical companies include: BMS’ deucravacitinib, a Tyk2 inhibitor for treating psoriasis and other autoimmune conditions, with a net present value of $6.0 billion; Amgen’s sotorasib, a Kras G12C inhibitor for treating lung cancer, with a net present value of $4.7 billion; Amgen’s/AstraZeneca’s tezepelumab, an anti-TSLP mAb for treating severe asthma with a net present value of $4.1 billion; and Johnson & Johnson’s and Genmab’s amivantamab, an anti-EGFR and cMet bispecific antibody for treating lung cancer, with a net present value of $3.1 billion.

Table I: Projected Biggest Product Launches in 2021 with Potential Blockbuster Status Based on 2026 Estimated Worldwide Sales

| Product | Product Type/Indication | Company | 2026 Estimated Worldwide Sales |

| Aducanumab | Anti-beta amyloid mAb for Alzheimer’s disease | Biogen/Eisai | $4.8 Bn |

| Efgartigimod | Anti-FcRn mAb for IgG-mediated autoimmune diseases | Argenx | $2.5 Bn |

| Mavacamten | Cardiac myosin inhibitor for cardiomyopathy | Bristol-Myers Squibb | $2.0 Bn* |

| Bimekizumab | Anti IL-17A&F mAb for psoriasis | UCB | $1.6 Bn |

| TransCon hGH | Long-acting human growth hormone | Ascendis Pharma | $1.5 Bn |

| Idecabtagene vicleucel (ide-cel) | Anti-BCMA Car-T therapy for myeloma | Bristol Myers Squibb/bluebird bio | $1.5 Bn |

| AXS-05 | NMDA receptor antagonist for treating depression | Axsome Therapeutics | $1.2 Bn |

| Avacopan | Complement factor C5a inhibitor for vasculitis | ChemoCentryx/Vifor Pharma | $1.2 Bn |

| Voclosporin | Calcineurin inhibitor for lupus nephritis | Aurinia Pharmaceuticals | $1.1 Bn |

| Abrocitinib | JAK-1 inhibitor for atopic dermatitis | Pfizer | $1.0 Bn |

Bn is billion; mAb is monoclonal antibody.

* Forecasts from analysts covering Myokardia, ahead of BMS buyout. Decision on BMS’ liso-cel (2026 estimated sales of $1.2 billon) could also come in 2021, delayed from 2020.

Listing excludes COVID-19 products.

Source: EvaluatePharma, Evaluate Ltd