US Drug Pricing Reforms: Gov’t Releases Negotiated Prices for 10 Drugs

In an historic first, the US government has released the prices negotiated with the industry of the first 10 drugs selected under the the Medicare Drug Price Negotiation Program. The negotiated prices, which will go into effect in January 2026, represent the first slate of drugs targeted for price negotiations under the Inflation Reduction Act. Which products are affected?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

New drug-pricing measures in the US

This week (August 14, 2024), the White House released the negotiated drug prices between the US government and the industry over the first 10 drugs selected under Medicare Drug Price Negotiation Program, which was authorized under the Inflation Reduction Act (IRA), a major climate, tax, and healthcare bill that was signed into law in 2022 and which included drug-pricing measures in the US. A key provision under the new law is that for the first time ever, the US government, through the Department of Health and Human Services (HHS), was authorized and required to negotiate prices for certain prescription drugs under Medicare, the US federal health insurance program for people 65 or older. The process for implementing the new law began last year (2023), and the first negotiated prices are set go into effect in 2026.

Table I (see end of article) identifies the 10 drugs for which prices were negotiated and the reductions in pricing agreed to between the US government and participating companies of those 10 drugs. The price reductions ranged between 38% and 79% of the list price based on a 30-day supply of the drug. The 10 drugs for which prices were negotiated were: AbbVie’s/Johnson & Johnson’s Imbruvica (ibrutinib); Amgen’s Enbrel (etanercept); AstraZeneca’s Farxiga (dapagliflozin); Boehringer Ingelheim’s/Eli Lilly and Company’s Jardiance (empagliflozin); Bristol-Myers Squibb’s/Pfizer’s Eliquis (apixaban); Johnson & Johnson’s Stelara (ustekinumab) and Xarelto (rivaroxaban); Merck & Co.’s Januvia (sitagliptin); Novartis’ Entresto (sacubitril/valsartan); and various formats for insulin apart, a short-acting insulin from Novo Nordisk, Fiasp, Fiasp FlexTouch, Fiasp PenFill, NovoLog, NovoLog FlexPen, and NovoLog PenFill.

How were the drugs for price negotiation were chosen

The drug-pricing measures under the Inflation Reduction Act apply to select drugs under Medicare Part D, which covers most outpatient prescription drugs from pharmacies and other pharmacy providers, and Medicare Part B, which applies to prescription drugs administered in a physician’s office or clinical/hospital outpatient setting. The Medicare Drug Price Negotiation Program limits the number of drugs to be selected for price negotiations. Under the drug-price negotiation program, the HHS Secretary is authorized and required to select a specified number of drugs from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part D spending and from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part B spending over a given 12-month period. It would limit the number of eligible drugs for negotiations to 10 Medicare Part D drugs in 2026, 15 Medicare Part D drugs in 2027, 15 Medicare Part B and D drugs in 2028, and 20 Medicare Part B and D drugs in 2029 and thereafter. In all, over the next several years, the US government will negotiate prices for up to 60 drugs covered under Medicare Part D and Part B, and up to an additional 20 drugs every year after that.

In addition, the program also limits the type of drugs eligible to be negotiated under the drug-pricing plan. For example, the plan applies only to “high-cost” drugs defined by levels of Medicare spending, “older” drugs, defined on the basis of the number of years from when a drug was approved by the US Food and Drug Administration (FDA), and drugs without generic-drug and biosimilar competition. Also certain drugs, such as orphan drugs and plasma-derived products, are excluded from the negotiation process.

Specifically, under the Medicare Drug Price Negotiation Program, “negotiation-eligible” drugs include brand-name drugs but would exclude the following types of drugs:

- Drugs that have a generic or biosimilar available;

- Small-molecule drugs with less than nine years from their approval date by FDA and biologic-based drugs with less than 13 years from their licensure date by FDA;

- Certain “small biotech drugs,” defined as drugs that account for no more than 1% of Medicare spending for all drugs from all manufacturers and that account for at least 80% of total 2021 Medicare spending for all drugs from a given manufacturer (this exclusion applies only in 2026, 2027, and 2028);

- Drugs that accounted for less than $200 million in Medicare spending in 2021;Drugs with an orphan-drug designation as the only-FDA approved indication; and

- Plasma-derived products

A maximum fair price for those drugs subject to negotiation in a given year would be determined through several criteria. The upper limit of a negotiated price would be equal to the lower of three possible conditions: (1) the drug’s enrollment-weighted negotiated price (net of price concessions) for a Medicare Part D drug; (2) the average sales price of a Medicare Part B drug; or (3) a percentage of the non-federal average manufacturer price (referring to the average price wholesalers pay manufacturers to distribute their drugs to non-federal purchasers) based on FDA approval dates. For this condition, that percentage would be 75% for small-molecule drugs with more than nine years but less than 12 years beyond FDA approval, 65% for drugs with between 12 and 16 years beyond FDA approval, and 40% for drugs with more than 16 years beyond FDA approval.

The negotiation process

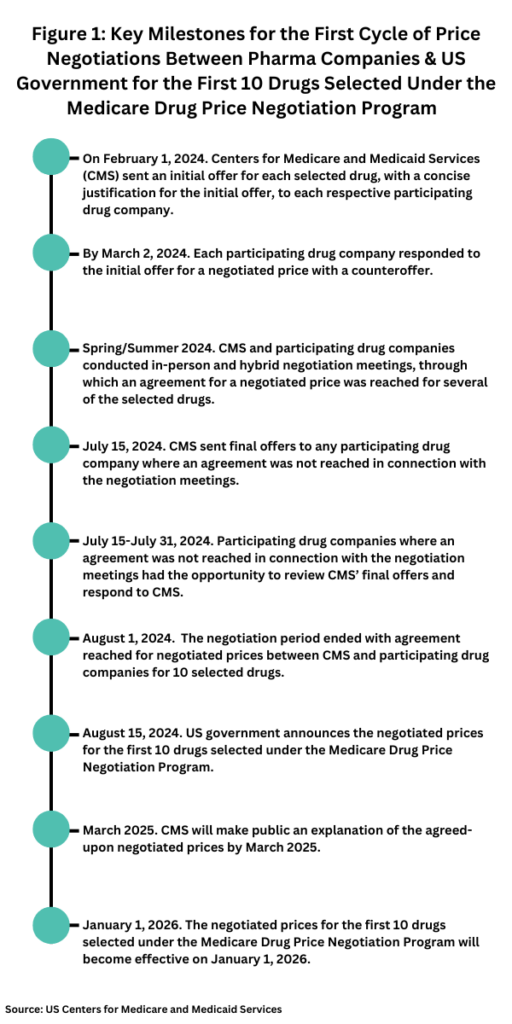

Based on those criteria, the HHS announced the 10 drugs selected for the first cycle of Medicare drug price negotiation last August (August 2023), and last October (October 2023), the HHS announced that the drug companies of all 10 selected drugs agreed to participate in negotiations with Medicare. The negotiation process, through the Centers for Medicare and Medicaid Services (CMS), the federal agency within the HHS that administers the Medicare program, began in February of this year (2024), with CMS providing the participating companies an initial offer for each selected drug with a justification for the initial offer. That step initiated the negotiation process (see timeline, Figure 1), which culminated in the US government publicly releasing the negotiated prices for the first 10 drugs selected under the Medicare Drug Price Negotiation Program this week (August 14, 2024). Going forward, CMS will make public an explanation of the agreed-upon negotiated prices by March 2025, and the negotiated prices for these first 10 drugs go into effect on January 1, 2026.

Industry response

As a whole, the industry has been critical of the drug-pricing measures authorized under the Inflation Reduction Act. The Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies, has raised concerns over a lack of transparency and accountability in the process and the overall dampening effect of drug-pricing measures on product innovation.

Last year (2023), PhRMA, the National Infusion Center Association, and the Global Colon Cancer Association, filed a complaint in a federal district court in Texas asserting the price-setting provisions in the Inflation Reduction Act were unconstitutional as they relate to separation of powers and due process. PhRMA had argued that Congress had impermissibly delegated broad authority to the HHS to set prices within Medicare with no meaningful constraints on the agency’s exercise of this new price-setting authority and that the price-setting measures lack transparency and do not adequately involve stakeholder input from drug manufacturers, in conflict with due-process protection.

In the public policy arena, PhRMA further contends that the drug-pricing measures also do not achieve the desired goal of lowering drug prices as the measures do not take into account the role that third-parties, insurance companies and pharmacy benefit managers, have in setting drug prices. “The administration is using the IRA’s [Inflation Reduction Act] price-setting scheme to drive political headlines, but patients will be disappointed when they find out what it means for them,” said Steve Ubl, PhRMA’s President and CEO, in an August 14, 2024, statement, in commenting on the release on the negotiated prices for the first 10 drugs subject to price negotiations. “There are no assurances patients will see lower out-of-pocket costs because the law did nothing to rein in abuses by insurance companies and PBMs [pharmacy benefit managers] who ultimately decide what medicines are covered and what patients pay at the pharmacy.”

In June (June 2024), PhRMA released the results of a study it had commissioned to examine the impact of the Medicare Drug Price Negotiation Program on Medicare Part D beneficiary out-of-pocket costs. The analysis showed that 3.5 million Part D patients taking medicines subject to the Medicare Drug Price Negotiation Program could see higher out-of-pocket costs in 2026 as a direct result of the Inflation Reduction Act’s drug-pricing provisions. The full analysis may be found here.

In addition, PhRMA has raised concerns over the negative impact that the drug-pricing measures would have on research and development in the industry. “The IRA [Inflation Reduction Act] also fundamentally alters the incentives for medicine development,” said PhRMA’s Ubl in his August 14, 2024, statement. “Companies are already changing their research programs as a result of the law, and experts predict this will result in fewer treatments for cancer, mental health, rare diseases, and other conditions. Medicine development is a long and complex process, and the negative implications of these changes will not be fully realized for decades to come.”

PhRMA also has taken issue with fines for drug manufacturers that do not participate in the price-negotiation process. Under the drug-pricing measures, drug manufacturers would face financial penalties for non-compliance in the form of an excise tax that would be imposed for not negotiating prices with the HHS Secretary. That excise tax would start at 65% of the drug’s prior-year sales and increase by 10% each quarter, up to 95%. The excise tax would be suspended if a drug manufacturer decides not to have that drug covered under Medicare or Medicaid. A civil monetary penalty would also be imposed on drug manufacturers not offering the agreed maximum fair price; that penalty would be up to 10 times the difference between the price charged and the negotiated price.

PhRMA says that this formula for calculating fines would practically result in bio/pharmaceutical companies paying a real tax of up to 1,900% (not 95%) on the total sales revenue of the medicine selected for price setting. In addition, PhRMA says that although price-setting measures apply only to drugs under Medicare, if companies were to withdraw drugs from Medicare programs, the withdrawal process is long and that a practical consequence may be that other drugs, not just ones specifically withdrawn, would be removed from the program. “Watch all their medicines get withdrawn from Medicare (Parts B and D) and Medicaid [the US healthcare program for low-income individuals], not just the medicine selected for price-setting,” said PhRMA in its August 14, 2024, release. “Even if manufacturers were to consider this option, it’s not up to them; CMS gets to decide. A manufacturer-initiated withdrawal would take 11 to 23 months to take effect, during which period the manufacturer would be required to disclose proprietary information and ‘agree’ with CMS’ actions.”

Table I: Prices Negotiated by US Government & Pharma Companies for the First 10 Drugs Selected Under the Medicare Drug Price Negotiation Program, Effective 2026

| Company | Drug Name (active ingredient) | Commonly Treated Conditions | Drug List Price in 2023 for 30-day Supply | Negotiated Price for 2026 for 30-Day Supply | Amount of Price Reduction & % Change of List Price vs. Negotiated Price |

| AbbVie/ Johnson & Johnson | Imbruvica (ibrutinib) | Certain blood cancers | $14,934 | $9,319 | $5,615 (-38%) |

| Amgen | Enbrel (etanercept) | Rheumatoid arthritis; psoriasis; psoriatic arthritis | $7,106 | $2,355 | $4,751 (-67%) |

| AstraZeneca | Farxiga (dapagliflozin) | Diabetes; heart failure; chronic kidney disease | $556 | $178.50 | $377.50 (68%) |

| Boehringer Ingelheim/Eli Lilly and Company | Jardiance (empagliflozin) | Diabetes; heart failure; chronic kidney disease | $573 $197 | $197 | $376 (-66%) |

| Bristol-Myers Squibb/Pfizer | Eliquis (apixaban) | Prevention & treatment of blood clots | $521 | $231 | $290 (-56%) |

| Johnson & Johnson | Stelara (ustekinumab) | Psoriasis; psoriatic arthritis; Crohn’s disease; ulcerative colitis | $13,836 | $4,695 | $9,141 (-66%) |

| Johnson & Johnson | Xarelto (rivaroxaban) | Prevention & treatment of blood clots; Reduction of risk for patients with coronary or peripheral artery disease | $517 | $197 | $320 (-62%) |

| Merck & Co. | Januvia (sitagliptin) | Type 2 diabetes | $527 | $113 | $414 (-79%) |

| Novartis | Entresto (sacubitril/valsartan) | Chronic heart failure | $628 | $295 | $333 (-53%) |

| Novo Nordisk | Fiasp; Fiasp FlexTouch; Fiasp PenFill; NovoLog; NovoLog FlexPen; NovoLog PenFill (all, products, insulin aspart) | Diabetes | $495 | $119 | $376 (-76%) |