Tracking Biologics: What’s in Store for 2021?

Which biologics are slated for the strongest sales growth in 2021, and how do they compare with sales growth for small-molecule drugs? What biologics were approved as new molecular entities in 2020, and which drugs are slated for future blockbuster potential? DCAT Value Chain Insights takes an inside look.

Biologics and new drug approvals

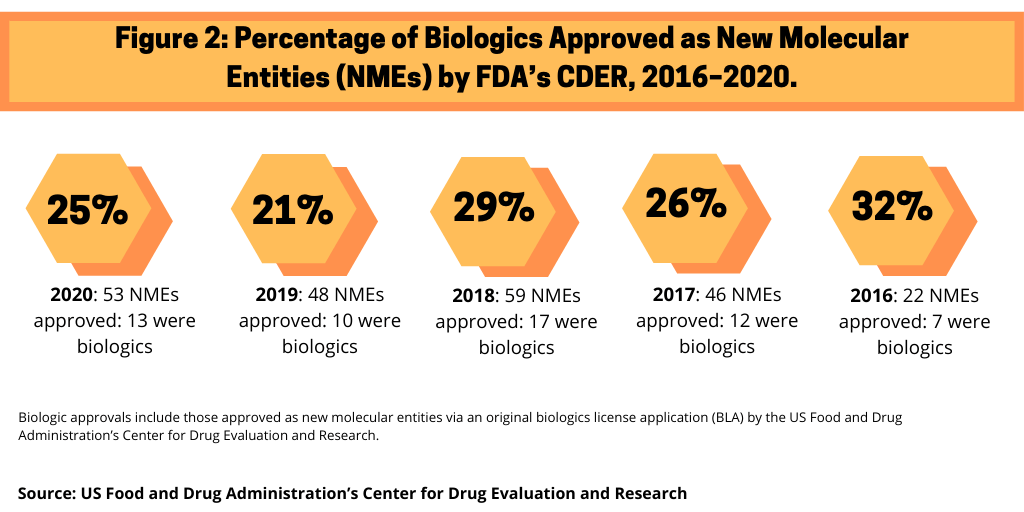

In 2020, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 53 new molecular entities (NMEs), of which 13, or 25%, were biologics. This level of biologic NME approvals is consistent with recent years (see Figure 1). In 2019, 21% of NME approvals by CDER were biologics, 29% in 2018, 26% in 2017, and 32% in 2016, when only 22 NMEs were approved.

Among the 13 biologic NME approvals in 2020, large pharmaceutical companies accounted for five biologic NME approvals, or 38% of biologic NME approvals, with Gilead Sciences, GlaxoSmithKline (GSK), Novo Nordisk, Roche, and Sanofi each having one biologic NME approval (see Table I).

| Table 1: Biologics Approved as New Molecular Entities in 2020 by the FDA’s Center for Drug Evaluation and Research | ||

| Company | Proprietary Name (active ingredient); BLA | Indication |

| Gilead Sciences/Immunomedics | Trodelvy (sacituzumab govitecan-hziy); BLA | Adult patients with metastatic triple-negative breast cancer who received at least two prior therapies for metastatic disease |

| GlaxoSmithKline | Blenrep (belantamab mafodotin-blmf); BLA | Certain type of multiple myeloma |

| Horizon Therapeutics | Tepezza (teprotumumab-trbw); BLA | Thyroid eye disease |

| Lundbeck | Vyepti (eptinezumab-jjmr); BLA | Preventive treatment of migraine in adults |

| Macrogenics | Margenza (margetuximab-cmkb); BLA | HER2+ breast cancer |

| MorphoSys | Monjuvi (tafasitamab-cxix); BLA | Relapsed or refractory diffuse large B-cell lymphoma |

| Novo Nordisk | Sogroya (somapacitan-beco); BLA | Human growth hormone |

| Regeneron Pharmaceuticals | Inmazeb (atoltivimab; odesivimab; maftivimab); BLA | Ebola virus |

| Ridgeback Biotherapeutics | Ebanga (ansuvimab-zykl); BLA | Ebola virus |

| Roche’s Genentech | Enspryng (satralizumab); BLA | Neuromyelitis optica spectrum disorder |

| Sanofi | Sarclisa (isatuximab-irfc); BLA | Multiple myeloma under certain conditions |

| Viela Bio | Uplizna (inebilizumab-cdon); BLA | Neuromyelitis optica spectrum disorder |

| Y-mAbs Therapeutics | Danyelza (naxitamab-gqgk); BLA | High-risk refractory or relapsed neuroblastoma |

|

BLA is biologics license application. Gilead Sciences acquired Immunomedics in October 2020. Source: US Food and Drug Administration’s Center for Drug Evaluation and Research |

||

Gilead Sciences received approval for Trodelvy (sacituzumab govitecan-hziy), an antibody drug conjugate (ADC) for treating metastatic triple-negative breast cancer in adult patients who received at least two prior therapies for metastatic disease. Gilead gained Trodelvy through its $21-billion acquisition of Immunomedics, a Morris Plains, New Jersey-based biopharmaceutical company, which was completed in October 2020. GSK received approval for Blenrep (belantamab mafodotin-blmf), an ADC and rare disease drug for treating multiple myeloma in patients receiving certain prior treatments,

Novo Nordisk received approval for Sogroya (somapacitan-beco), human growth hormone. Roche received approval for a biologic rare disease drug: Enspryng (satralizumab) for treating neuromyelitis optica spectrum disorder, a chronic disorder of the brain and spinal cord dominated by inflammation of the optic nerve and inflammation of the spinal cord. Sanofi received approval for Sarclisa (isatuximab-irfc), for treating multiple myeloma in combination with pomalidomide and dexamethasone to treat adults who have received at least two prior therapies, including lenalidomide and a proteasome inhibitor (see Table I).

Biologics’ product growth in 2021

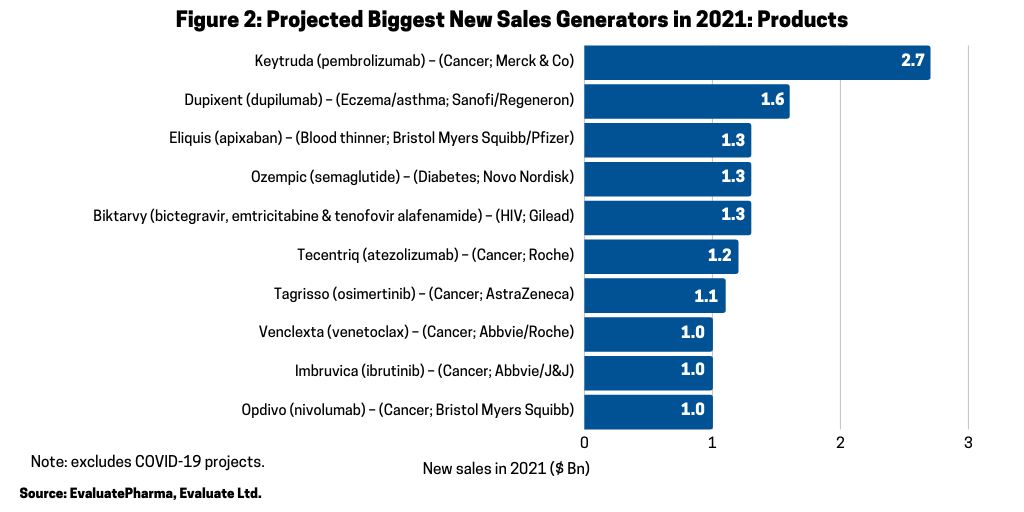

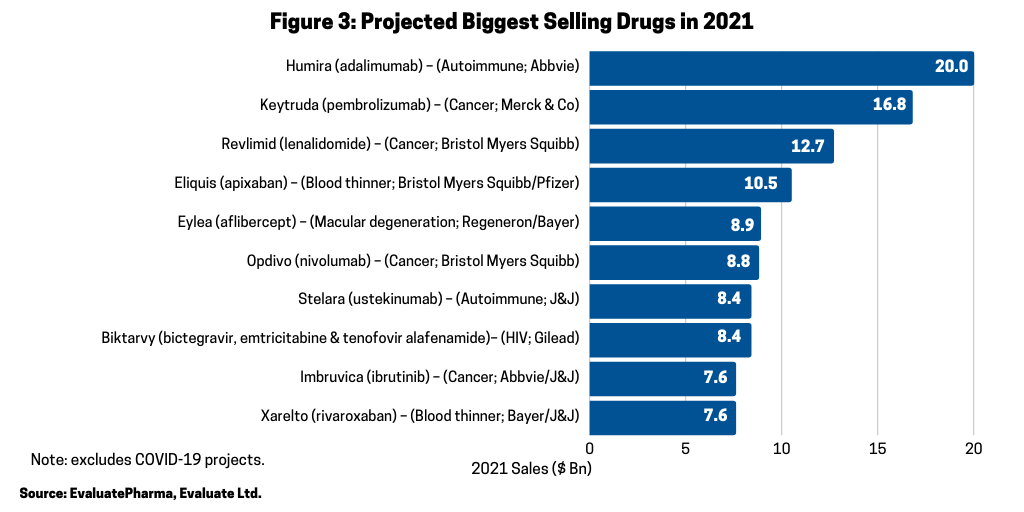

In looking at the 10 biggest new sales generators projected for 2021 (referring to increased products sales projected for 2021), according to a recent report by Evaluate Vantage using EvaluatePharma data, four of the top 10 projected largest new sales generators are biologics (see Figure 2). Leading the way is Merck & Co.’s Keytruda (pembrolizumab), approved for treating multiple cancers, which is forecast to be the industry’s top-selling drug in 2023, taking the top spot from the current leading product, also, a biologic, Abbvie’s Humira (adalimumab). Humira is approved to treat arthritis, plaque psoriasis, ankylosing spondylitis, Crohn’s disease, and ulcerative colitis, but faces near-term biosimilar competition. Keytruda is expected to add the most new sales in 2021, with $2.7 billion in growth (see Figure 2) and $16.8 billion in total sales (see Figure 3).

In addition to Merck & Co.’s Keytruda (pembrolizumab), three other biologic-based drugs are projected to generate the largest sales gain in 2020: Sanofi’s Dupixent (dupilumab), which is approved for treating eczema, asthma, and nasal polyps that result in chronic sinusitis; Roche’s Tecentriq (atezolizumab), which is approved to treat multiple cancers; and Bristol-Myers Squibb Opdivo (nivolumab) (see Figure 2).

Among the top 10 selling drugs projected for 2021, five are biologics (see Figure 3). In 2021, AbbVie’s Humira (adalimumab) is projected to be the industry’s top-selling drug with Merck & Co.’s Keytruda forecast as the second top-selling drug in 2021 (see Figure 3). The other projected top-selling drugs in 2021 that are biologics are: Bayer’s/Regeneron Pharmaceuticals’ Eylea (aflibercept), an eye-care drug for treating macular degeneration, macular edema, and diabetic retinopathy; Bristol-Myers Squibb’s Opdivo (nivolumab) for treating multiple cancers; and Johnson & Johnson’s Stelara (ustekinumab) for treating various autoimmune diseases, including Crohn’s disease, ulcerative colitis, psoriasis. and psoriatic arthritis (see Figure 3).

Biologics and potential blockbusters

New drug approvals from the FDA are also expected to generate significant value in 2021 with 10 drugs projected to launch in 2021 with potential blockbuster status by 2026, according to the Evaluate Vantage report. Table 2 at the end of the article outlines the top 10 blockbuster contenders to be launched in 2021 and projected to achieve blockbuster status by 2026. Of these 10 projected blockbusters, five are biologics: Biogen’s and Eisai’s aducanumab; Argenx’s efgartigimod, an antibody fragment; UCB’s bimekizumab; Ascendis Pharma’s TransCon hGH (long-acting human growth hormone); and Bristol Myers Squibb’s/bluebird bio’s decabtagene vicleucel (ide-cel) (see Table II at the end of the article).

Biogen’s and Eisai’s aducanumab, a drug to treat Alzheimer’s disease, is the biggest potential launch in 2021 with $4.8 billion in forecast sales in 2026; however, the FDA’s decision on whether to approve the drug is an important upcoming event in 2021. In November (November 2020), an advisory committee of the FDA voted to reject approval of aducanumab, citing that the drug failed to demonstrate efficacy and more research is needed. FDA advisory committee recommendations are non-binding although they have historically been taken into consideration by the full FDA when considering a drug for approval. Aducanumab is an amyloid beta-targeting antibody that has shown in clinical trials to remove amyloid beta in the brain and slow clinical decline in patients with mild cognitive impairment due to Alzheimer’s disease and mild Alzheimer’s disease dementia. The FDA is scheduled to make its decision no later than March 7, 2021. The drug is also under review in the European Union and Japan. Biogen licensed aducanumab from Neurimmune, a Swiss biopharmaceutical company, under a collaborative development and license agreement. Since October 2017, Biogen and Eisai have collaborated on the development and commercialization of aducanumab globally.

Table II: Projected Biggest Product Launches in 2021 with Potential Blockbuster Status Based on 2026 Estimated Worldwide Sales

| Product; molecule type | Product Type/Indication | Company | 2026 Estimated Worldwide Sales |

| Aducanumab; biologic | Anti-beta amyloid mAb for Alzheimer’s disease | Biogen/Eisai | $4.8 Bn |

| Efgartigimod; biologic | Anti-FcRn mAb for IgG-mediated autoimmune diseases | Argenx | $2.5 Bn |

| Mavacamten; small molecule | Cardiac myosin inhibitor for cardiomyopathy | Bristol-Myers Squibb | $2.0 Bn* |

| Bimekizumab; biologic | Anti IL-17A&F mAb for psoriasis | UCB | $1.6 Bn |

| TransCon hGH; biologic | Long-acting human growth hormone | Ascendis Pharma | $1.5 Bn |

| Idecabtagene vicleucel (ide-cel); biologic | Anti-BCMA Car-T therapy for myeloma | Bristol Myers Squibb/bluebird bio | $1.5 Bn |

| AXS-05; small molecule | NMDA receptor antagonist for treating depression | Axsome Therapeutics | $1.2 Bn |

| Avacopan; small molecule | Complement factor C5a inhibitor for vasculitis | ChemoCentryx/Vifor Pharma | $1.2 Bn |

| Voclosporin; small molecule | Calcineurin inhibitor for lupus nephritis | Aurinia Pharmaceuticals | $1.1 Bn |

| Abrocitinib; small molecule | JAK-1 inhibitor for atopic dermatitis | Pfizer | $1.0 Bn |

Bn is billion; mAb is monoclonal antibody.

* Forecasts from analysts covering Myokardia, ahead of BMS buyout. Decision on BMS’ liso-cel (2026 estimated sales of $1.2 billon) could also come in 2021, delayed from 2020.

Listing excludes COVID-19 products.

Source: EvaluatePharma, Evaluate Ltd and company information