The Year in Review: The Top 10 News Developments from 2022

Escalating energy and raw materials costs was the number one story in the bio/pharmaceutical industry in 2022, but what other news was noteworthy in deal-making, expansions, and industry performance. DCAT Value Chain Insights provides its Top 10 News Stories of 2022.

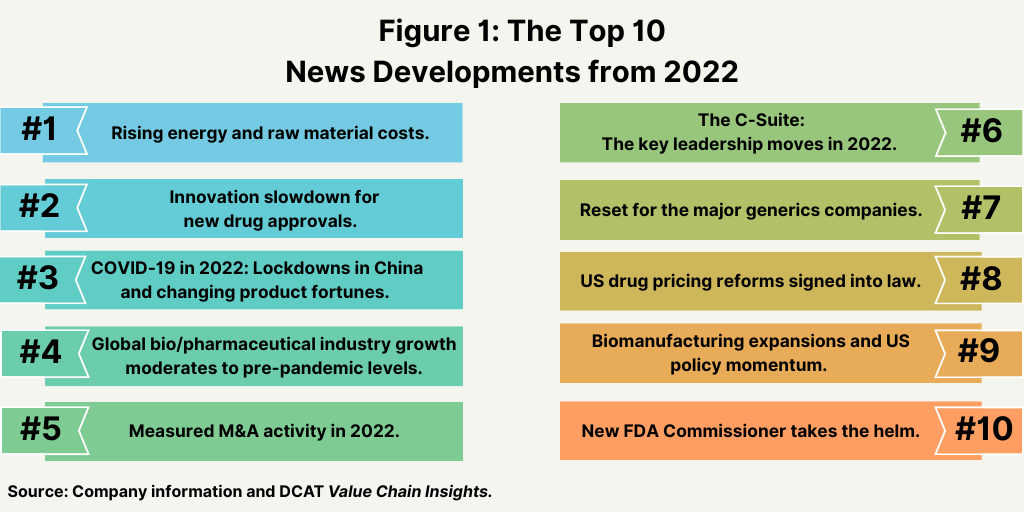

As we near the end of 2022, what have been the key news developments in the bio/pharmaceutical industry in 2022? DCAT Value Chain Insights editorial team ranked what it considered the most important developments impacting the bio/pharmaceutical industry as a whole and across the bio/pharmaceutical manufacturing value chain (see Figure 1).

Rising energy and raw material costs. Without question, inflationary pressures—in the form of escalating energy and raw material costs—represented the most significant news development in 2022. The bio/pharmaceutical industry was not alone in dealing with higher costs in 2022 as the global economy and markets faced strong inflationary pressures in 2022. As the global economy emerged from the pandemic, markets responded to increased demand, and with that, came supply challenges to meet that demand on a production, transportation, and overall supply-chain level, which contributed to rising costs. That situation, later combined with the volatility in energy markets, particularly in Europe, stemming from the war in Ukraine and the European Union’s (EU) policy moves and actions to decrease its reliance on the supply of natural gas from Russia resulted in shifts in supply-demand fundamentals for energy, impacting not only production and transportation costs, but the chemicals manufacturing value chain, in the form of higher feedstock costs and resulting impact on commodity and downstream chemicals.

This situation has had direct impact on the bio/pharmaceutical and allied industries, particularly in Europe. As a case in point, two industry groups, Medicines for Europe, which represents generics and biosimilars companies and manufacturers in Europe, and the European Chemical Industry Council (Cefic), which represents European chemical manufacturers, both issued calls to action to EU authorities to address the inflationary pressures in energy, raw materials, and transportation, and the negative impact on bio/pharmaceutical and chemical production.

EU authorities have taken action to reduce the EU’s dependence of Russian gas, which had accounted for 40% of natural gas supply to Europe prior to Russia’s invasion into Ukraine in February (February 2022), to reach levels of about 14% as of September (September 2022). It also has put into place natural gas storage requirements and coordinated gas demand reduction in the EU to address energy supply and cost issues. To address recent dramatic price rises in electricity, it has taken measures to help reduce the cost of electricity for consumers (both businesses and households), and measures to redistribute the energy sector’s surplus revenues to final customers. These measures are in particular response to address the energy issues for the upcoming winter, but industry groups say that more action is needed to address both short-term and longer term needs.

Last month (November 2022), Medicines for Europe, underscored that the continuing inflationary pressures in Europe require reforms in EU pharmaceutical legislation to address security of supply for medicines and access to medicines. It notes that high inflation across Europe (+ 9%) and steep rises in the price of energy and raw materials (estimated at between +50 and 160%) and transportation (up to +500%) are significantly increasing costs for manufacturers, impacting the feasibility of continuing production, and when combined with reimbursement and pricing policies for generic drugs limit price flexibility to reflect these higher costs. To address these issues, Medicines for Europe is calling on EU officials to do the following: (1) develop policies to encourage generic and biosimilar medicines use to broaden patient access; (2) tackle the impact of inflation on the security of essential medicine supplies with smart procurement guidelines for medicines; (3) allow the off-patent medicines industry access to EU funds for manufacturing investments; and (4) optimize the regulatory system to improve access to medicine and to benefit from efficiency gains made from increased digitalization.

For its part, Cefic is calling on the European Commission and EU member states to immediately design and implement closely coordinated pan-European measures to limit the impact of energy prices vis-à-vis competing economies, increase energy supply, and incentivize reductions in energy consumption, which target the upcoming winter and prepare for 2023 and beyond.

Innovation slowdown for new drug approvals. New product development is a measure of strength for any industry, and for the bio/pharmaceutical industry one measure of the industry’s health and level of product innovation is the number of new drug approvals. Although not following a strictly chronological path, examining the pace of approvals of new molecular entities (NMEs) and new therapeutic biological products is an important measure of product innovation in the bio/pharmaceutical industry. As of December 1, 2022, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) has approved 31 NMEs and new therapeutic biological products thus far in 2022, well below the pace set in 2021, in which 46 NMEs had been approved by early December en route to a total of 50 new drug approvals (NMEs and new therapeutic biological products) in the full-year 2021. A similar strong pace on new drug approvals by FDA’s CDER was seen in 2020, when 47 new drugs were approved in early December en route to a total of 53 NMEs approved for the full-year 2020. The 53 new drug approved in 2020 represented the second highest level of approvals in the past decade, except for 2018 when 59 new drugs were approved.

COVID-19 in 2022: Lockdowns in China and changing product fortunes. Although on a global basis, the COVID-19 pandemic eased in 2022, it still continues to present challenges globally and in the bio/pharmaceutical industry specifically. The emergence of variants, such as the Omicron variant, has obligated the industry to adapt vaccines and treatments to address these variants. At the same time, an uptick of COVID-19 cases in China, for example, has led the government there to implement a zero-COVID policy, forcing lockdowns in select regions of the country impacting production and supply.

The COVID-19 lockdowns in China, prompted by a rise of cases related to Omicron variants, and the country’s strict zero-COVID-19 policy, remain a concern and risk for the country and the potential for ensuing impact on businesses and industrial production. In September (September 2022), Chengdu, the capital of southwestern China’s Sichuan Province, was locked down after COVID cases were detected, becoming the largest Chinese metropolis hit with curbs since Shanghai’s lockdown in April and May of this year (2022).

Although the COVID-19 restrictions in Shanghai was eased later in June (June 2022), such situations are impactful to global supply chains. China is an important source of raw materials, intermediates, and active pharmaceutical ingredients (APIs), particularly APIs for the generics market. There are over 3,000 APIs companies worldwide, of which China accounts for 48% and India 19%, according to a recent analysis by the Chemical Pharmaceutical Generic Association, which represents Italian manufacturers of active ingredients and intermediates for the generics market. A well-chronicled and continuing trend over the past decades is the increasing shifting of API manufacturing from the highly regulated markets (US, EU) toward low-cost Asian countries, particularly China and India. For example, 80% of API import volume for the EU comes from five countries: China (which accounts for 45%), India, the US, the UK, and Indonesia, according to a recent analysis by the European Commission.

Global bio/pharmaceutical industry growth moderates to pre-pandemic levels. After reaching growth of 12% in 2021, in large measure due to COVID-19 products, the US bio/pharma market, the largest national market in the global bio/pharmaceutical market, is projected to see growth moderate to pre-pandemic levels. Spending on medicines in the US, at estimated net manufacturer prices, reached $407 billion in 2021, up 12.1% over 2020, as COVID-19 vaccines and therapeutics became widely available and added $29 billion in related spending, according to a report by the IQVIA Institute for Human Data Science. In 2021, the non-COVID medicines market in the US grew more slowly, at only 4.9%, with growth tempered from the growing impact of biosimilars, which increased significantly, offsetting increased use of branded medicines.

While spending growth slowed in 2020 to less than 1%, from a combination of impacts on volume and spending on newly launched medicines, the pandemic impact was reduced in 2021. Net spending in the past five years (2017–2021) grew at a compound annual growth rate (CAGR) of 4.6%, including for COVID-19 products, but only 3.1% for all other medicines, reflecting a slowing trend without these new treatments. Medicine spending in the US grew $82 billion over the past five years (2017–2021), with COVID-19 products contributing $29 billion. In the prior five-year period (2016–2020), US medicine spending increased by 4.3%. Although health services utilization returned to pre-pandemic levels by the end of 2021, it has yet to make up for the pandemic-induced backlog in missed patient visits, screenings and diagnostics, elective procedures, and new prescription starts, according to the IQVIA Institute report. However, prescription drug use in the US reached a record level of 194 billion daily doses in 2021 as new prescription starts for both chronic and acute care recovered from the slowdown recorded in 2020. Spending on medicines in the US is expected to return to pre-pandemic growth trend lines by 2023 despite year-to-year fluctuations and incremental spending on COVID-19 vaccines and therapeutics. The IQVIA Institute projects a compound average annual growth rate of 2.1% (range of 1-4%) for the US market through 2026, which is comparable to pre-pandemic levels, and total US market size in 2026 of about $450 billion on a net manufacturer price basis.

The C-Suite: The key leadership moves in 2022. One of the most noteworthy leadership changes among the large pharma companies in 2022 was the appointment of Christopher A. Viehbacher, former CEO of Sanofi and most recently co-founder of Gurnet Point Capital, a healthcare investment fund, as President and CEO and a member of the Board of Directors, effective November 14, 2022. Viehbacher succeeded Michel Vounatsos, who announced in May 2022 that he would be stepping down as CEO.

Vounatsos, who had led Biogen since 2017, announced in May (May 2022) that he would step down as CEO following lower-than-expected results and diminished prospects for its Alzheimer’s drug, Aduhelm (aducanumab), once touted as a potential blockbuster. The company also announced in May (May 2022) that it would implement a $500-million cost-reduction program, which involves substantially eliminating the commercial infrastructure for the drug. The $500 million is in addition to further cost-reductions announced by the company in last December (December 2021) to bring its total annualized cost-savings to $1 billion.

In other changing of the guard, late last month (November 2022). Teva announced that it had appointed Richard Francis, former CEO of Sandoz, and current CEO of Purespring Therapeutics and Forcefield Therapeutics, as Teva’s President and CEO, effective January 1, 2023. Francis will succeed Kåre Schultz, currently Teva’s CEO, who will retire, effective December 31, 2022.

Schultz has been Teva’s CEO since 2017 and he came on board to lead a major restructuring plan, which was announced in late 2017. The plan addressed declining revenue from its generics business, large debt caused by its $40.5-billion acquisition of Allergan’s generics business in 2016, and declining revenue from its number one specialty innovator product at the time, Copaxone (glatiramer acetate) for treating multiple sclerosis, which faced its own generic-drug competition. Schultz was hired to turn the company around. He has overseen the company’s restructuring and developed the ensuing strategy of further diversifying in innovator drugs and optimizing the company’s generics portfolio by rationalizing the company’s generics product portfolio and moving it away from less profitable areas to more value-added products, such as complex generics, biosimilars, and other products with a higher barrier to market entry.

Also, In a planned move, Johnson and Johnson ( J&J) announced Joaquin Duato, J&J’s current CEO, will assume the additional position of Chairman, effective in January 2023. Mr. Duato succeeds Alex Gorsky, who will step down from his role as Executive Chairman following a brief transitional period. The move is part of a previously announced succession plan following J&J’s decision in November 2021 to split the company into two separate, stand-alone, publicly traded companies, one focused on pharmaceuticals and medical devices, and the other on consumer health.

Mr. Duato has served as J&J’s CEO and a member of the Board of Directors since January 3, 2022. Prior to that time, he held senior leadership positions over his 30-plus year career with the company across multiple business sectors, geographics and functions. As J&J’s CEO, he leads a global workforce of 135,000 employees in pharmaceuticals, med-tech, and consumer health. Previously, he served as the Vice Chairman of J&J’s Executive Committee, where he provided strategic direction for the Pharmaceutical and Consumer Health sectors and oversaw both Information Technology and the Global Supply Chain.

Mr. Gorsky was named CEO and Chairman of J&J in 2012 and has a had a three-decade-plus career with the company, beginning as a sales representative with Janssen Pharmaceutica in 1988. Over the next three decades, he advanced through positions of increasing responsibility in sales, marketing, and management, culminating in being named CEO and Chairman in 2012.

Last November (November 2021), J&J announced its plan to split the company into two separate, stand-alone, publicly traded companies, one focused on pharmaceuticals and medical devices (Johnson & Johnson) and the other on consumer health (Kenvue as the name for planned new consumer healthcare company). J&J is targeting completion of the planned separation in 18 to 24 months from its initial announcement made in November 2021.

Reset for the major generics companies. Three of themajor generic-drug companies (Teva, Viatris, and Sandoz) are undergoing resets are the companies continue to address cost pressures and margin pressure.

A key move by the major generics companies is Novartis’ plan to spin off Sandoz, its generics and biosmilars business, into a new publicly traded stand-alone company, a move announced by the company in late August (August 2022). The decision follows its previous announcement in October 2021, in which Novartis announced a strategic review of Sandoz. The stand-alone Sandoz would be headquartered in Switzerland and be listed on the SIX Swiss Exchange, with an American Depositary Receipt program in the US. The Sandoz spin-off transaction is expected to be completed in the second half of 2023.

At the same time, Viatris is proceeding with what it calls a “reshaping plan,” which includes restructuring and divestments of non-core assets to improve the company’s financial position. Late last month (November 2022), it completed its divestment of its biosimilars assets to Biocon Biologics, a Bangalore, India-based biosimilars company and subsidiary of Biocon Ltd., in a $3.35-billion deal. The move is part of an overall plan by Viatris to achieve $9 billion in pre-tax proceeds through the Biocon Biologics transaction and the divestment of other non-core assets. Viatris is retaining 12.9% stake in Biocon Biologics, to still keep a position in biosimlars.In 2009, Biocon formed an alliance with Mylan, Viatris’ predecessor, to develop monoclonal antibody biosimilars. In 2013, the partnership was expanded to include insulin biosimilars. Viatris was formed in 2020 through the merger of Mylan and Upjohn, Pfizer’s off-patent branded and generic established medicines business.

Viatris expects to use the net proceeds from the $2-billion cash payment from the Biocon biosimilars transaction to do the following: (1) pay down additional short-term debt and accelerate its progress toward $6.5 billion of its Phase 1 debt-reduction plan; (2) in combination with cash on hand, fund two pending acquisitions of ophthalmology drug companies (Oyster Point Pharma and Famy Life Sciences) for a combined total of between $700 million and $750 million, to establish an ophthalmology franchise as a new revenue source; and (3) execute on its previously announced share buyback authorization in 2023.

For its part, Teva will see a change of the guard as an ex-Sandoz executive will take the helm of the company in January (January 2023). Teva Pharmaceutical Industries has appointed Richard Francis, former CEO of Sandoz, and current CEO of Purespring Therapeutics and Forcefield Therapeutics, as Teva’s President and CEO, effective January 1, 2023. Francis will succeed Kåre Schultz, currently Teva’s CEO, who will retire, effective December 31, 2022.

Schultz has been Teva’s CEO since 2017 and he came on board to lead a major restructuring plan, which was announced in late 2017. The plan addressed declining revenue from its generics business, large debt caused by its $40.5-billion acquisition of Allergan’s generics business in 2016, and declining revenue from its number one specialty innovator product at the time, Copaxone (glatiramer acetate) for treating multiple sclerosis, which faced its own generic-drug competition. Schultz was hired to turn the company around. He has overseen the company’s restructuring and developed the ensuing strategy of further diversifying in innovator drugs and optimizing the company’s generics portfolio by rationalizing the company’s generics product portfolio and moving it away from less profitable areas to more value-added products, such as complex generics, biosimilars, and other products with a higher barrier to market entry.

Francis is an Operating Partner at Syncona, which focuses on founding, building and funding healthcare companies and the CEO of two Syncona’s portfolio companies: Purespring Therapeutics, a London-based gene-therapy company, and Forcefield Therapeutics, a London-based bio/pharmaceutical company focused on cardiovascular disease. Prior to that, he spent five years as CEO of Sandoz and a member of the Novartis Executive Team. Prior to his role at Sandoz, he was a senior executive at Biogen for 13 years, where he held several senior roles, including leading the US business.

US drug pricing reforms signed into law. After a multi-year policy debate, drug pricing reforms in the US became a reality when President Joe Biden in August (August 2022) signed into law a major climate, tax, and healthcare bill, “The Inflation Reduction Act of 2022,” which included measures to address the cost of prescription drugs in the US.

Among the most noteworthy reforms is that the new law requires and authorizes, for the first time ever, for the US government, through the Department of Health and Human Services (HHS) to negotiate prices for certain prescription drugs under Medicare, the US federal health insurance program for people 65 or older. The measure applies to drugs under Medicare Part D, which covers most outpatient prescription drugs from pharmacies and other pharmacy providers, and Medicare Part B, which applies to prescription drugs administered in a physician’s office or clinical/hospital outpatient setting.

The bio/pharmaceutical industry has largely criticized the new law Industry groups, such as the Pharmaceutical Research and Manufacturers of America, which represents the large, innovator pharma companies, and the Biotechnology Innovation Organization, which represents the biotechnology industry, say the new law gives the government unchecked authority in setting drug pricing and does not sufficiently address the larger issue of affordability for prescription drugs while creating a chilling effect on research and development and product innovation,

The new law, however, does have limits and made certain appeasements to those concerns. It limits the number and type of drugs eligible to be negotiated under the drug-pricing plan. For example, the plan applies only to: “high-cost” drugs defined by levels of Medicare spending; “older” drugs, defined on the basis of the number of years from when a drug was approved by the US Food and Drug Administration (FDA); drugs without generic-drug and biosimilar competition; smaller biotech drugs; and orphan drugs. Under the plan, the HHS Secretary would select a specified number of drugs from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part D spending and from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part B spending over a given 12-month period. It would limit the number of eligible drugs for negotiations to 10 Medicare Part D drugs in 2026, 15 Medicare Part D drugs in 2027, 15 Medicare Part B and D drugs in 2028, and 20 Medicare Part B and D drugs in 2029 and thereafter. The law also limits the drug-pricing negotiation plan to drugs covered under Medicare and does not include products covered under private insurance. It is sets a spending cap for prescription drugs for individuals under Medicare.

Biomanufacturing expansions and US policy momentum. Biomanufacturing continues to be an active investment by both bio/pharmaceutical companies and CDMOs/CMOs, but biomanufacturing took a major leap on a national policy level, when in September (September 2022), President Joe Biden issued an executive order to launch the National Biotechnology and Biomanufacturing Initiative. The executive order outlines key policy goals in biomanufacturing and biotechnology in support of further developing what the Administration calls the “bioeconomy.” Key objectives are to: (1) bolster and coordinate federal investment in R&D for biotechnology and biomanufacturing; (2) foster a biological data ecosystem that advances biotechnology and biomanufacturing innovation; (3) improve and expand domestic biomanufacturing production capacity and processes while also increasing piloting and prototyping efforts in biotechnology and biomanufacturing to accelerate the translation of basic research results into practice; and (4) train and support a diverse, skilled workforce to advance biotechnology and biomanufacturing.

New FDA Commissioner takes the helm. In 2022, the US Food and Drug Administration (FDA) saw a new leader take helm, when Dr. Robert Califf took over as FDA Commissioner in February (February 2022). This is Dr. Califf’s second time serving as FDA Commissioner. He previously served as FDA Commissioner from 2016-2017 and as Deputy Commissioner for Medical Products and Tobacco at FDA from 2015-2016. He returned to the FDA after most recently serving as a Professor of Medicine at the Duke University School of Medicine, where he previously served as Vice Chancellor and founded the Duke Clinical Research Institute. He also was a Senior Advisor for Google Health and Verily Life Sciences, the life-sciences arm of Alphabet, the parent company of Google. Overall, he has nearly 40 years of experience as a doctor and researcher and is recognized for his expertise in clinical trial research, health disparities, healthcare quality, and cardiovascular medicine.

Calliff was nominated by President Joe Biden to be FDA Commissioner to fill the position vacated by Dr. Janet Woodcock, who stepped down as Acting FDA Commissioner. She was named Acting FDA Commissioner on January 20, 2021, and due to a statutory limit to how long a Senate-confirmed position can be filled by an Acting official, she either had to be named to the position on a permanent basis or step down by mid-November 2021. President Biden nominated Dr. Califf to serve as permanent FDA Commissioner.

In office for less than one year, Califf has outlined several key strategic priorities for the FDA on an overall agency level. These priorities include: (1) the need for improved information, data-management systems, and evidence generation to enable more efficient and effective decision-making and regulatory oversight by the FDA; (2) increased authority to support the agency’s oversight of industry supply chain chains to mitigate product shortages as well as increased resources, such as information technology support and increased digitalization tools to do so; (3) countering the growing dissemination of misinformation and disinformation about science, medicine, and the FDA, which arose in particular during the COVID-19 pandemic; and (4) the need to work more closely with companies in the form of increased communications and interactions to facilitate new product development and production innovation.