The Pharma Pulse: Product Innovation & Emerging Pharma

New product development is the lifeblood of any industry. Smaller bio/pharmaceutical companies are accounting for an increasingly larger portion of new products as measured by recent new molecular entity approvals. Which companies are making the mark? DCAT Value Chain Insights takes an inside look.

R&D productivity declines among large bio/pharma companies

The rise in product innovation from smaller companies comes as R&D productivity from larger bio/pharmaceutical companies declines. An analysis by Deloitte and Global Data, which tracked the late-stage pipelines (Phase III or Phase II with breakthrough therapy designation) of 12 large bio/pharmaceutical companies over a 10-year period beginning in 2010 and an additional cohort of four specialty bio/pharmaceutical companies over five years, showed a decline in returns on R&D investments (1). While individual companies may have had short-term successes, rising R&D costs and lower returns on investments present a challenge. In looking at the study’s original cohort of 12 large bio/pharmaceutical companies, R&D returns have declined each year since 2010, from 10.1% in 2010 to only 1.9% in 2018 and 1.8% in 2019, the most recent available data. Although the extension cohort of four specialty bio/pharmaceutical companies showed better R&D returns, they still show recent declines from 9.3% in 2018 to 6.2% in 2019. At the same time, forecast peak sales per asset for the large bio/pharmaceutical companies have almost halved since 2010, when they were $816 million to $376 million in 2019.

At the same time, externally sourced product innovation has become increasingly important for large bio/pharmaceutical companies. In 2010, close to half of the study’s original 12 large bio/pharmaceutical companies’ pipelines were sourced through external innovation, which historically launches at a rate higher than the industry’s benchmark. In 2018 and 2019, more than 50% of the late-stage pipelines of both cohorts of the study—the 12 large bio/pharmaceutical companies and the additional four specialty bio/pharmaceutical companies—were sourced externally.

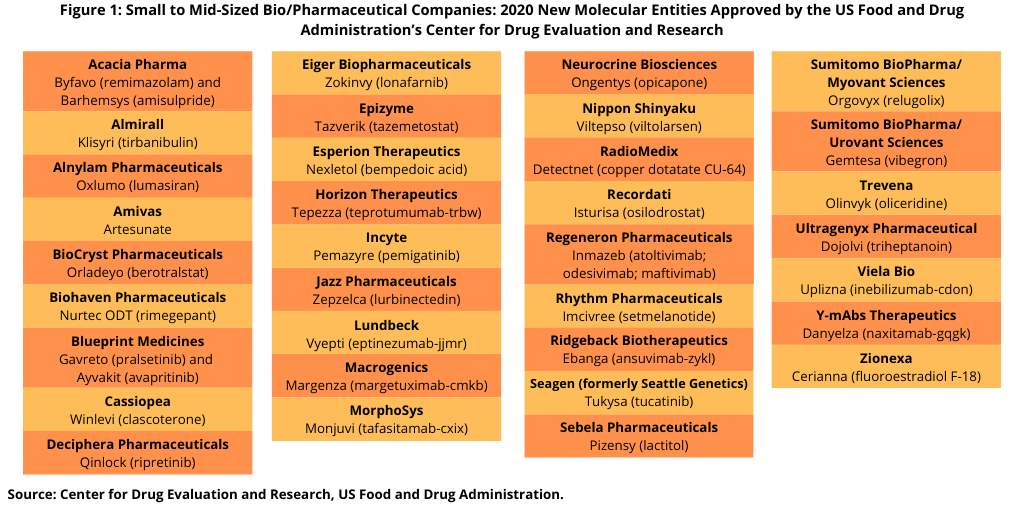

New molecular entity approvals and smaller bio/pharma companies

The importance of smaller bio/pharmaceutical companies in new product development is evident by recent trends in new drug approvals. Taking last year (2020) as an example, of the 53 new molecular entities (NMEs) approved in 2020 by the US Food and Drug Administration’s Center for Drug Evaluation and Research, 36, or 68%, were from small to mid-sized bio/pharmaceutical companies. For purposes of this analysis, the large bio/pharmaceutical companies were defined as those companies among the top 26 companies based on 2019 pharmaceutical revenues (2) and not included in this evaluation. Figure 1 outlines those drug approvals and Table I at the end of the article outlines all 53 NMEs approved in 2020.

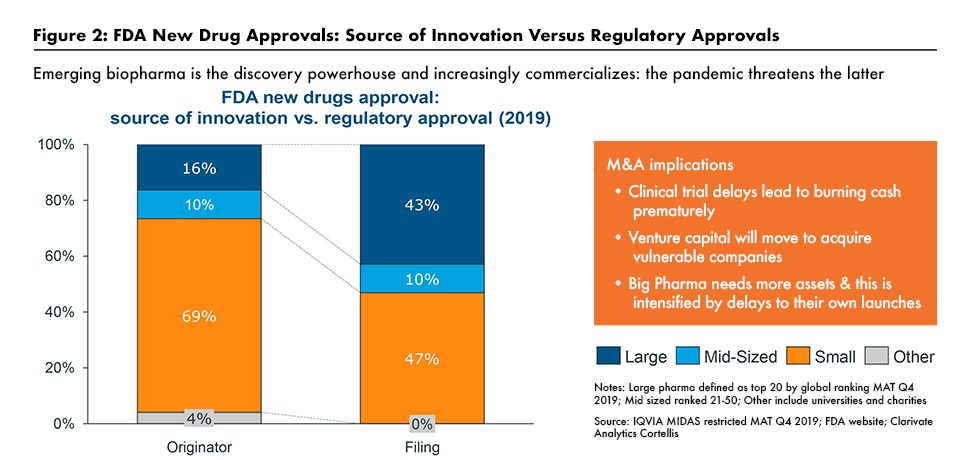

The increased role of smaller bio/pharmaceutical companies was also underscored in a June 2020 webinar hosted by the Drug, Chemical & Associated Technologies Association (DCAT) and featuring Graham Lewis, Vice President, Global Pharma Strategy, IQVIA. He pointed out that emerging bio/pharmaceutical companies are increasingly intent at commercializing their own products rather than just being a source of external innovation for larger companies (3) (see Figure 2).

Financing into the bio/pharma industry

Recent financing trends are a promising sign that smaller companies will continue to be the source of product innovation. The bio/pharmaceutical industry as a whole (both large and small companies) had a favorable year in 2020 on a financing basis, due in part to the COVID-19 pandemic as investors saw uptick in the sector. The top 600 bio/pharmaceutical companies added $487 billion in market capitalization in 2020, according to the Evaluate Vantage Pharma, Biotech & Medtech 2020 in Review report, and the industry saw an unprecedented amount of cash flow into the sector. Drug developers raised a record-breaking $12.7 billion via initial public offerings in 2020, which was more than twice the total raised in 2019. The average amount raised ($167 million) nearly doubled, and 55 companies raised more than $100 million and 35 of these bringing in more than $200 million. Private companies also broke records, with $20 billion invested by venture financers, which eclipsed the boom year of 2018 although the total number of financing rounds was lower than in prior years, according to the analysis. The average financing per round in 2020 was nearly $45 million, almost $10 million higher than the average in 2019.

References

1. Ten Years from Measuring the Return from Pharma Innovation, Deloitte Center for Health Solutions and GlobalData (2019).

2. M. Christel, “Pharm Exec’s Top 50 Companies in 2020,” Pharmaceutical Executive, June 1, 2020, Volume 40, Issue 6.

3. J. Miller, “Pandemic Complicates an Already Challenging Outlook for the Global Pharma Industry,” DCAT Value Chain Insights, July 15, 2020.

| Table 1: New Molecular Entities Approved in 2020 by the US Food and Drug Administration’s Center for Drug Evaluation and Research | ||

| Company | Proprietary Name (active ingredient); NDA or BLA | Indication |

| Acacia Pharma | Byfavo (remimazolam); NDA | Sedation |

| Acacia Pharma | Barhemsys (amisulpride); NDA | To prevent nausea and vomiting after surgery |

| Almirall | Klisyri (tirbanibulin); NDA | Actinic keratosis of the face or scalp |

| Alnylam Pharmaceuticals | Oxlumo (lumasiran); NDA | Hyperoxaluria type 1, a rare genetic disease leading to kidney disorders. |

| Amivas | artesunate; NDA | Severe malaria |

| AstraZeneca | Koselugo (selumetinib); NDA | Neurofibromatosis Type 1, a genetic disorder of the nervous system causing tumors to grow on nerves |

| Bayer Healthcare | Lampit (nifurtimox); NDA | Chagas disease in certain pediatric patients younger than age 18 |

| BioCryst Pharmaceuticals | Orladeyo (berotralstat); NDA | Hereditary angioedema |

| Biohaven Pharmaceuticals | Nurtec ODT (rimegepant); NDA | Migraines |

| Blueprint Medicines | Gavreto (pralsetinib); NDA | Non-small lung cancer |

| Blueprint Medicines | Ayvakit (avapritinib); NDA | Unresectable or metastatic gastrointestinal stromal tumor (GIST) |

| Bristol-Myers Squibb/Celgene | Zeposia (ozanimod); NDA | Relapsing forms of multiple sclerosis |

| Cassiopea | Winlevi (clascoterone); NDA | Acne |

| Deciphera Pharmaceuticals | Qinlock (ripretinib); NDA | Advanced gastrointestinal-stromal tumors |

| Dr. Reddy’s Laboratories | Xeglyze (abametapir); NDA | Head lice |

| Eiger Biopharmaceuticals | Zokinvy (lonafarnib); NDA | Rare conditions related to premature aging |

| Eli Lilly and Company/Avid Radiopharmaceuticals | Tauvid (flortaucipir F-18); NDA | Diagnostic agent for patients with Alzheimer’s disease |

| Eli Lilly and Company/Loxo Oncology | Retevmo (selpercatinib); NDA | Certain lung and thyroid cancers |

| Epizyme | Tazverik (tazemetostat); NDA | Epithelioid sarcoma |

| Esperion Therapeutics | Nexletol (bempedoic acid); NDA | Adults with heterozygous familial hypercholesterolemia or established atherosclerotic cardiovascular disease who require additional lowering of LDL-C |

| Gilead Sciences | Veklury (remdesivir); NDA | Adult and pediatric patients 12 years of age and older and weighing at least 40 kg for treating COVID-19 requiring hospitalization. |

| Gilead Sciences/Immunomedics | Trodelvy (sacituzumab govitecan-hziy); BLA | Adult patients with metastatic triple-negative breast cancer who received at least two prior therapies for metastatic disease |

| GlaxoSmithKline | Blenrep (belantamab mafodotin-blmf); BLA | Certain type of multiple myeloma |

| Horizon Therapeutics | Tepezza (teprotumumab-trbw); BLA | Thyroid eye disease |

| Incyte | Pemazyre (pemigatinib); NDA | Cholangiocarcinoma, a rare form of cancer that forms in bile ducts |

| Jazz Pharmaceuticals | Zepzelca (lurbinectedin); NDA | Metastatic small cell lung cancer |

| Lundbeck | Vyepti (eptinezumab-jjmr); BLA | Preventive treatment of migraine in adults |

| Macrogenics | Margenza (margetuximab-cmkb); BLA | HER2+ breast cancer |

| MorphoSys | Monjuvi (tafasitamab-cxix); BLA | Relapsed or refractory diffuse large B-cell lymphoma |

| Neurocrine Biosciences | Ongentys (opicapone); NDA | Parkinson’s disease “off” episodes |

| Nippon Shinyaku | Viltepso (viltolarsen); NDA | Duchenne muscular dystrophy |

| Novartis | Tabrecta (capmatinib); NDA | Certain form of non-small cell lung cancer |

| Novo Nordisk | Sogroya (somapacitan-beco); BLA | Human growth hormone |

| Otsuka | Inqovi (cedazuridine; decitabine); NDA | Adult patients with myelodysplastic syndromes and chronic myelomonocytic leukemia |

| RadioMedix | Detectnet (copper dotatate CU-64); NDA | Detection of certain types of neuroendocrine tumors |

| Recordati | Isturisa (osilodrostat); NDA | Adults with Cushing’s disease who either cannot undergo pituitary gland surgery or have undergone the surgery but still have the disease |

| Regeneron Pharmaceuticals | Inmazeb (atoltivimab; odesivimab; maftivimab); BLA | Ebola virus |

| Rhythm Pharmaceuticals | Imcivree (setmelanotide); NDA | Obesity and the control of hunger associated with pro-opiomelanocortin deficiency, a rare disorder that causes severe obesity that begins at an early age |

| Ridgeback Biotherapeutics | Ebanga (ansuvimab-zykl); BLA | Ebola virus |

| Roche’s Genentech | Enspryng (satralizumab); BLA | Neuromyelitis optica spectrum disorder |

| Roche’s Genentech | Evrysdi (risdiplam); NDA | Spinal muscular atrophy |

| Sanofi | Sarclisa (isatuximab-irfc); BLA | Multiple myeloma under certain conditions |

| Seagen (formerly Seattle Genetics) | Tukysa (tucatinib); NDA | Advanced unresectable or metastatic HER2-positive breast cancer |

| Sebela Pharmaceuticals | Pizensy (lactitol); NDA | Chronic idiopathic constipation in adults |

| Sumitomo BioPharma/Myovant Sciences | Orgovyx (relugolix); NDA | Advanced prostate cancer |

| Sumitomo BioPharma/Urovant Sciences | Gemtesa (vibegron); NDA | Overactive bladder |

| Trevena | Olinvyk (oliceridine); NDA | Management of acute pain |

| Ultragenyx Pharmaceutical | Dojolvi (triheptanoin); NDA | Molecularly long-chain fatty acid oxidation disorders |

| University of California Los Angeles and the University of California, San Francisco | Gallium 68 PSMA-11 (Gallium 68 PSMA-11); NDA | Detection and localization of prostate cancer |

| Viela Bio | Uplizna (inebilizumab-cdon); BLA | Neuromyelitis optica spectrum disorder |

| ViiV Healthcare | Rukobia (fostemsavir tromethamine); NDA | HIV |

| Y-mAbs Therapeutics | Danyelza (naxitamab-gqgk); BLA | High-risk refractory or relapsed neuroblastoma |

| Zionexa | Cerianna (fluoroestradiol F-18); NDA | Diagnostic imaging agent for certain patients with breast cancer |

|

||