The Global Bio/Pharma Market: Where’s the Growth?

The global bio/pharma market is projected to reach $1.6 trillion by 2025. What’s the outlook for the US, Europe, other markets and key product areas?

Global growth projections

The outlook for the global bio/pharmaceutical industry through 2025 shows moderate growth overall, but flat-to-moderate growth in the US, the largest national market, increased biosimilars and generic competition in Europe, and slowing growth in major emerging markets such as China.

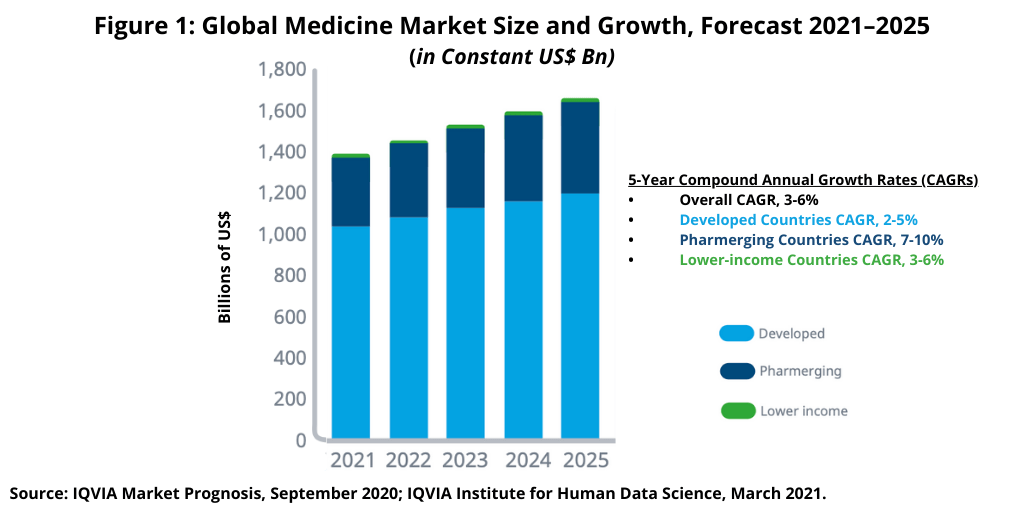

Global spending on medicines—using invoice price levels—is expected to grow at a compound annual growth rate (CAGR) of 3%–6% through 2025 to reach about $1.6 trillion by 2025, excluding spending of COVID-19 vaccines, according to a 2021 analysis by the IQVIA Institute for Human Data Science (1). The pre-pandemic drivers of medicine use and spending remain significant drivers of the outlook. Figure 1 outlines the growth prospects in developed countries (defined as those countries with upper-middle or high incomes), “pharmerging” countries (defined as the most promising emerging market countries for medicines spending), and lower-income countries, which represent only a small fraction of global spending on medicines.

In developed countries, the adoption of new treatments, offset by patent lifecycles and competition from generics and biosimilars, is expected to continue as the main factor influencing medicines spending and growth. Medicines spending in developed countries is expected to grow 2%–5% from 2021 through 2025, similar by comparison to the past five years (2016–2020). Pharmerging countries will see slowing growth and volume declines across many markets with an overall CAGR in the forecast period (2021–2025) of 7%–10%, according to the IQVIA Institute analysis (1).

US faces historically slow growth

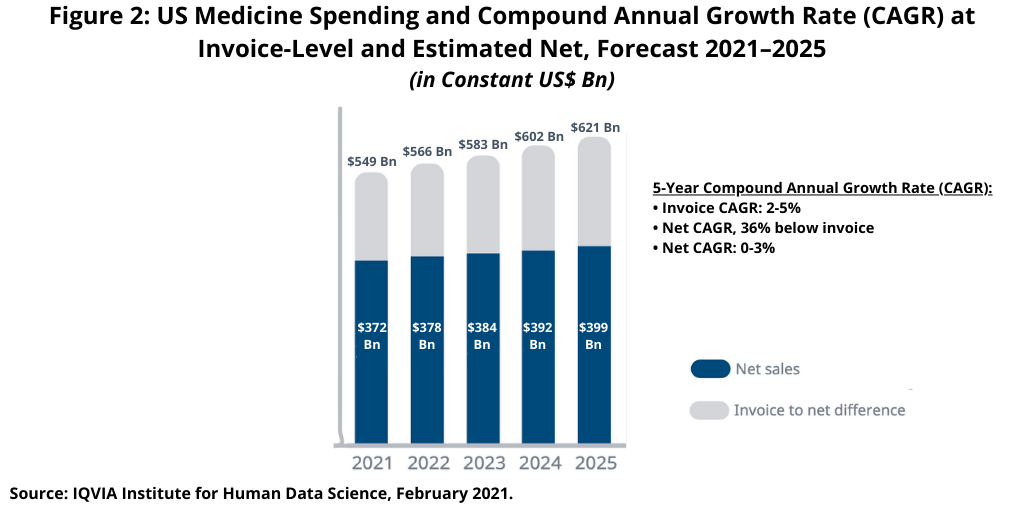

In the US, the largest national market in the global bio/pharma market, with an approximate 40% share, will see flat to low single-digit growth (0%–3%) at net levels from 2021 to 2025 (see Figure 2) as rising off-invoice discounts and rebates are expected to slow spending growth over time. The US payer environment includes a range of stakeholders who receive off-invoice discounts and rebates, including statutory discounts and rebates for the government, negotiated rebates by pharmacy benefit managers and insurers, discounts negotiated by purchasers, and coupons used by patients. In total, these off-invoice discounts and rebates result in spending that was estimated to be 31% lower than the invoice level in 2020 and is projected to be 36% lower than the invoice level in 2025. In addition to discounts and rebates, ongoing market dynamics around the use of medicines, the adoption of newer treatments, the impact of patent expiries, and new competition from generics or biosimilars will all contribute to historically slow market growth in the US for the next five years (2021–2025), according to the IQVIA Institute analysis (1).

The US spending forecast reflects an increasing gap between invoice level spending and manufacturer net revenues. Total net spending on medicines in the US is expected to reach between $380 billion and $400 billion in 2025, up from $359 billion in 2020, reflecting a CAGR of 0–3%, according to an IQVIA Institute analysis on medicines spending in the US (2). New brand spending in the US is projected to be higher than the last five years (2016–2020) with a projected $133 billion of new drug spending over the next five years (2021–2025) (2). In the US, losses of exclusivity will result in $128 billion of lower brand spending through 2025 with $39 billion from branded biologics (2).

Europe’s growth remains in line with historical levels

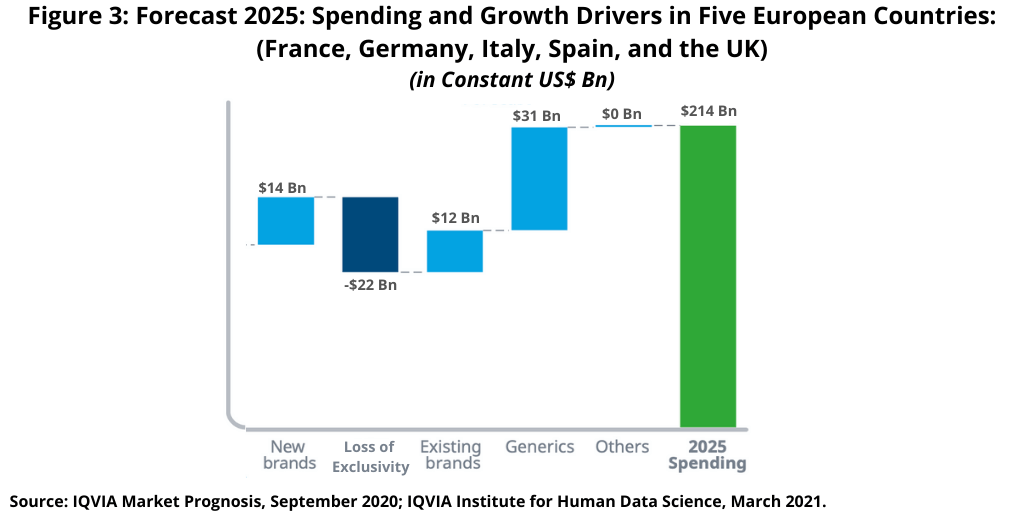

Medicines spending in the top five European markets (France, Italy, Germany, Spain, and the UK) is expected to increase by $35 billion over the next five years (2021–2025), the same increase as in the past five years (2016–2020) but with large shifts in the drivers of growth (see Figure 3). While new brands were the largest driver of growth in the prior five years (2016–2020), they are expected to contribute less in the next five years (2021–2025). Innovation had been expected to be significantly stronger in the next five years (2021–2025), but adoption of newer medicines will be slowed by the disruptions to industry promotional activity from the pandemic and greater scrutiny of the value of new medicines in the form of health technology assessments, according to the IQVIA Institute analysis (1).

Instead, generics, including biosimilars, are expected to add more than $31 billion in growth over the next five years (2021–2025) in Europe’s five largest markets, more than double the contribution in the past five years (2016–2020) as a range of patent expiries and the maturation of biosimilars contribute to lower spending overall (see Figure 3).

China’s growth slows and product mix shifts

In pharmerging markets, growth will be led by China, which is expected to accelerate post-COVID driven by greater uptake and use of new original medicines. China’s growth remains the largest driver among pharmerging countries and is being led by a shift in the types of products used, with greater spending on new medicines to a degree compared to very common traditional Chinese medicines. Medicine spending in China rose from $56 billion in 2010 to $138 billion in 2019 and dipped to $134 billion in 2020 due to COVID, according to the IQVIA Institute analysis (1). Over the past five years (2016–2020), spending growth was driven by original branded products, most often from multinational companies, which grew at an average of 12.3% per year to reach 28% of spending in 2020, up from 20% five years earlier. Over the next five years (2021–2025), government policies to update the national reimbursement drug list more frequently are contributing to a greater share of new original medicines being reimbursed, thereby resulting in higher levels of spending. Over the next five years (2021–2025), original brands and generics will each grow by more than 9% per year while other types of products will grow at less than half that rate. By 2025, China is projected to exceed $170 billion in medicines spending, an increase of almost $50 billion in the next five years (2021–2025). Overall, medicines spending in China is expected to grow at a CAGR of 4.5%–7.5% through 2025 to reach between $170 billion and $200 billion.

Developed markets versus pharmerging markets and by product type

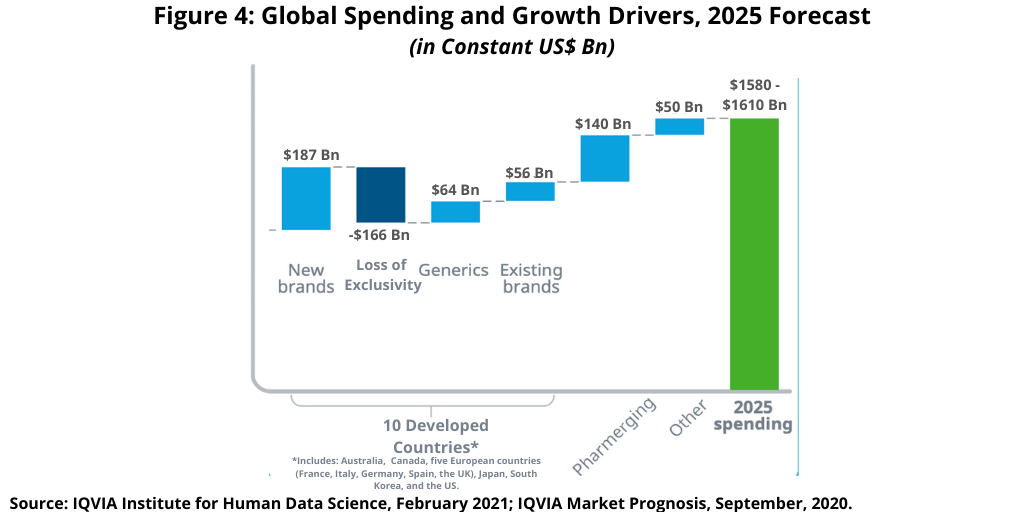

Overall, spending across major pharmerging markets is expected to grow at a 7%–10% CAGR through 2025, driven by the largest countries—China, Brazil, India, and Russia—but generally outperformed by smaller pharmerging markets, which are growing at a rate of 8.5%–11.5% over the same period, according to the IQVIA Institute analysis (1). In the next five years (2021–2025), global medicines spending will increase by nearly $350 billion to reach nearly $1.6 trillion in 2025, with most of the increase from developed countries despite their lower rates of growth.

Figure 4 breaks down the increase in global medicines spending by product type. Global medicines spending continues to increase, mostly driven by new medicines, which are projected to increase to $187 billion over the next five years (2021–2025) compared to $196 billion over the past five years (2016–2020), according to the IQVIA Institute analysis (1). Losses of exclusivity are expected to be significantly higher through 2025, estimated at $166 billion, than the past five years (2016–2020), contributing to overall slowing growth. The contribution of generic-drug spending growth is typically muted as volume increases are offset by price deflation, but the influx and maturation of biosimilars, particularly in the US, is expected to result in higher absolute growth. Pharmerging growth is expected to accelerate through 2025 and provide for an increase of nearly $140 billion in global medicines spending (1).

Rising share of specialty medicines

Spending on specialty medicines has been increasing as a share of medicines spending in higher-income countries, such as the 10 largest developed countries and in other high- and upper-middle-income countries, where they reached shares of global medicines spending of 47% and 37%, respectively, in 2020, up from 24% and 21% 10 years earlier, according to the IQVIA Institute analysis (1). Globally, specialty medicines are projected to represent 45% of global medicines spending by 2025, with more than half of the spending on these products in major developed markets. Specialty medicines are those which treat chronic, complex, and rare diseases, and while they have a range of characteristics, including the complexity of disease management or distribution, the most commonly noted attribute is that they are more expensive than other more traditional medicines.

Leading therapeutic areas

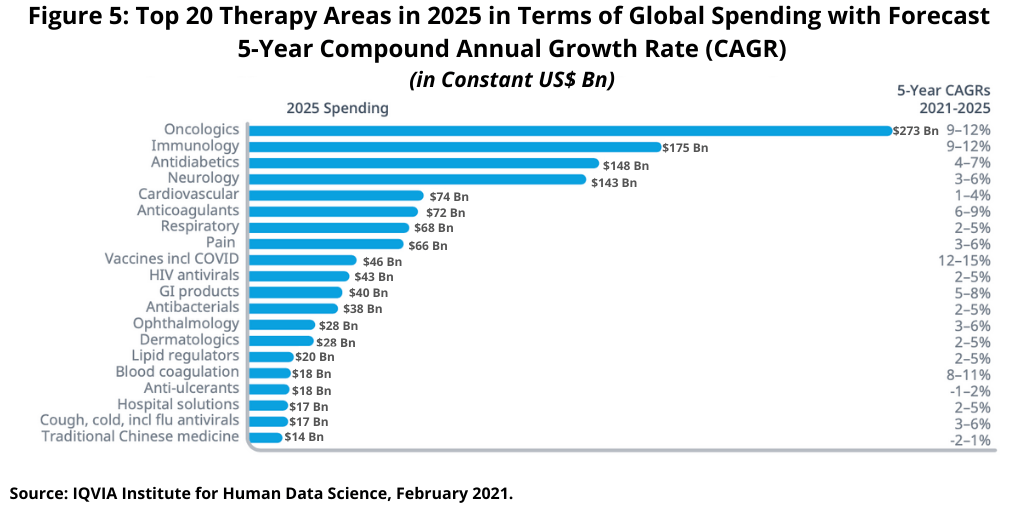

On a therapeutic-area basis, the two leading global therapy areas—oncology and immunology—are forecast to grow at a CAGR of 9%–12% through 2025, lifted by significant increases in new treatments and medicine use (see Figure 5), according to the IQVIA Institute analysis (1). Oncology is projected to add 100 new treatments over five years, contributing to an increase in spending of more than $100 billion to a total of more than $260 billion in 2025.

Emerging bio/pharma companies (defined as those companies with an estimated annual R&D expenditure of less than $200 million) represent two-thirds of the industry’s oncology late-stage pipeline and almost 80% of the early-stage pipeline, according to an IQVIA Institute analysis of global oncology medicines trends (3). The total number of new drugs in the oncology drug pipeline reached almost 3,500 in 2020, up 75% since 2015. In 2020, about 500 products were in late-stage development for rare cancers, similar to the number in late-stage development for larger population cancers, according to the IQVIA Institute analysis (3). Targeted small molecules and biologics include many of the newest immuno-oncology treatments, checkpoint inhibitors, kinase inhibitors, and treatments linked to various biomarkers. The IQVIA Institute analysis shows that oncology research has a small, but important, focus on next-generation biotherapeutics, which include a range of cell and gene therapies, products made by gene editing, and RNAi therapies (3).

Growth in the immunology sector, the second largest therapeutic sector, is projected to slow from the 17.3% CAGR over the past five years (2016–2020) as biosimilars bring lower-cost treatments and offset growth from volume and drug launches. The immunology sector, which includes autoimmune therapies for rheumatoid arthritis, ulcerative colitis, Crohn’s disease, psoriasis, and related conditions as well as a new range of autoimmune dermatology conditions, will see growth of 9%–12% in the forecast period of 2021–2025, including the expected negative impact by biosimilars (1).

Diabetes medicines, the third largest therapy area globally, is expected to reach nearly $150 billion in global medicines spending by 2025 and grow at a CAGR of 4%–7%—although this sector is heavily discounted, which could cause spending to be lower, according to the IQVIA Institute analysis (1). Neurology, the fourth largest therapeutic sector, is expected to grow at a CAGR of 3%–6% to more than $140 billion by 2025. This sector includes much higher growth subsegments as a range of rare neurological diseases have had new treatments approved research as well as potentially new treatments for large population diseases, such as Alzheimer’s or Parkinson’s (1). Figure 5 outlines the growth rates and medicines spending for the top 20 therapeutic areas.

References

1. IQVIA Institute for Human Data Science, Global Medicine Spending and Usage Trends: Outlook to 2025, April 2021.

2. IQVIA Institute for Human Data Science, The Use of Medicines in the U.S.: Spending and Usage Trends and Outlook to 2025, May 2021.

3. IQVIA Institute for Human Data Science, Global Oncology Trends 2021: Outlook to 2025, June 2021.