The CDMO/CMO Report: Strong Growth Drives Contract ADC Market

Double-digit growth is projected for the contract market for antibody drug conjugates (ADCs). Increased investment by both large bio/pharma companies and smaller ADC innovators is fueling demand for for high-potency manufacturing and conjugation services. Which companies lead the charge?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Contract ADC market growth

High-potency manufacturing continues to be an active area of investment for CDMOs/CMOs Part of that investment is driven by strong growth in the market for antibody drug conjugates (ADCs) as both large and smaller bio/pharmaceutical candidates advance their pipelines in this area with oncology being the leading therapeutic area driving this growth.

Several key acquisitions by the large bio/pharmaceutical companies of smaller bio/pharmaceutical companies specializing in ADCs underscore the strong interest in this field. Key recent deals include Pfizer’s $43-billion acquisition in late 2023 of Seagen, a Bothwell, Washington-based bio/pharmaceutical company, one of the few companies with approved ADCs on the market and with several key pipeline contenders, AbbVie’s $10-billion acquisition in February (February 2024) of ImmunoGen, a Waltham, Massachusetts-based bio/pharmaceutical company, and Johnson & Johnson’s $2-billion acquisition in March (March 2024) of Ambrx Biopharma, a San Diego-based bio/pharmaceutical company. In terms of drug-development partnership deals, key recent deals include Merck & Co.’s and Daiichi Sanyko’s $22-billion global licensing and commercialization pact for three ADC candidates, announced in October 2023, and Daiichi Sankyo’s $6-billion partnership with AstraZeneca in ADCs, announced in 2020.

ADCs are composed of both biologic and small-molecule components and consist of a small-molecule compound (for oncology applications, typically a cytotoxic compound) linked to a monoclonal antibody. For CDMOs/CMOs specializing in high-potency manufacturing, the manufacture of an ADC requires specialized conditions under high-containment to produce the cytotoxic small-molecule compound and conjugation capabilities to link the small-molecule compound to the monoclonal antibody.

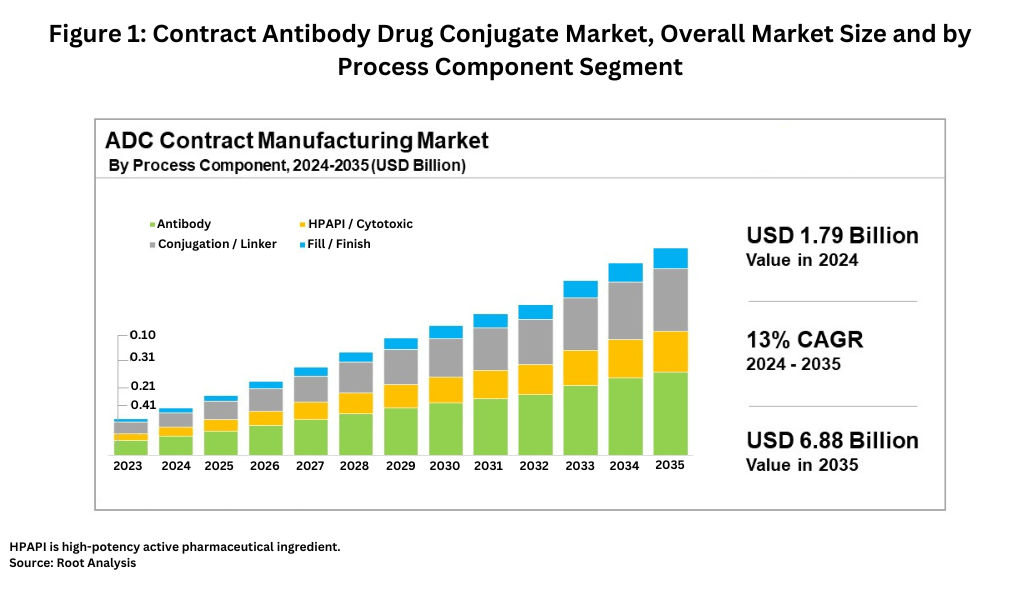

The global ADC contract manufacturing market is estimated at $1.79 billion in 2024 and is expected to grow at a compound annual growth rate of 13% to reach approximately $6.87 billion by 2035, according to a recent market study by Root Analysis, a business research and consulting firm serving the bio/pharmaceutical industry. Based on process component, the contract ADC market is divided into four major segments: the antibody, high-potency active pharmaceutical ingredient (HPAPI)/cytotoxic payload, conjugation/linker, and fill–finish of the final drug product. The antibody component of the market represents the largest share, accounting for approximately 40% of the contract ADC market, followed by the conjugation/linker segment at 30%, the HPAPI/cytotoxic payload segment at 20%, and the fill–finish segment at 10%, according to the Root Analysis study. Figure 1 outlines the market size, growth rates, and segments for the contract ADC market.

Bio/pharmaceutical M&A for ADCs surge

Pfizer’s $43-billion acquisition of Seagen last December (December 2023) was not only the high-mark among recent ADC deals but also was the largest acquisition in the industry in 2023. Seagen’s portfolio includes four approved medicines that are indicated across solid tumors and hematologic malignancies, including three ADCs: Adcetris (brentuximab vedotin), Padcev (enfortumab vedotin), and Tivdak (tisotumab vedotin). The company also commercializes Tukysa (tucatinib), which was approved in 2023 for treating certain types of colorectal cancer in combination with trastuzumab. Clinical development programs are ongoing for each of these medicines for potential new tumor types or expanded indications in earlier lines of therapy, with catalysts expected annually through 2027.

Overall, 15 ADC-related mergers and acquisitions (M&A) relating to ADCs have occurred in the past five years (2019-2023), according to a recent analysis on the ADC market by Clarivate, a business intelligence firm. Seven of these, or nearly 50%, occurred in 2023 alone.

Completed ADC-related M&A thus far in 2024 (as of mid-April 2024) include AbbVie’s $10-billion acquisition of Immunogen, which netted Amgen Immunogen’s commercial ADC, Elahere (mirvetuximab soravtansine-gynx), for treating platinum-resistant ovarian cancer. ImmunoGen’s pipeline includes a Phase I asset, IMGN-151, an anti-FRα ADC for treating ovarian cancer with the potential for expansion into other solid tumor indications. Pivekimab sunirine, currently in Phase II, is an anti-CD123 ADC targeting blastic plasmacytoid dendritic cell neoplasm (BPDCN), a rare blood cancer, which was granted FDA breakthrough therapy designation for treating relapsed/refractory BPDCN.

Also completed in 2024 was J&J’s $2-billion acquisition of Ambrx Biopharma, which gave J&J several clinical and preclinical ADC programs in multiple cancer indications, including ARX517, an ADC for treating prostate cancer, ARX788, an ADC for treating breast cancer, and ARX305, an ADC for treating renal-cell carcinoma.

Another key ADC-related M&A was the $1.8-billion acquisition by Genmab, a Copenhagen-based bio/pharmaceutical company, of ProfoundBio (Suzhou) Co. Ltd.

ADC-related deal-making also on the rise

Aside from outright acquisitions, an escalation in the number and value of partnering deals among bio/pharma companies in ADCs is also a positive sign for the contract ADC market. The Clarivate analysis shows that 33 disclosed blockbuster deals (defined as deals with a value of $1 billion or more) in the past five years (2019-2023) represent a significant jump in activity and valuation in the ADC field (see Figure 2).

Overall, oncology continues to be the leading focus for ADC-related deal-making activity. Over the past 10 years (2014-2023), oncology leads all ADC-related deals in both volume and value, accounting for 392 deals with a projected total valuation of $206 billion, according to the Clarivate analysis. In comparison, the next largest therapeutic sector in ADC-related deal-making is in infectious diseases with nine deals with a projected value of approximately $806 million.

One of the key deals was a $22-billion global development and commercialization agreement between Merck & Co. and Daiichi Sanyko in ADCs, announced last October (October 2023), for three of Daiichi Sankyo’s ADC oncology drug candidates: patritumab deruxtecan, ifinatamab deruxtecan, and raludotatug deruxtecan. Under the deal, Merck agreed to pay Daiichi Sankyo a $4-billion upfront payment in addition to $1.5 billion in continuation payments over the next 24 months (as reported in October 2023), and potential additional payments of up to $16.5 billion contingent upon the achievement of future sales milestones, for a total potential consideration of up to $22 billion. In aggregate, the three programs have multi-billion dollar worldwide commercial revenue potential for each company in the mid-2030s timeline, according to information from Merck in announcing the deal last October. The companies will jointly develop and potentially commercialize these ADC candidates worldwide, except in Japan, where Daiichi Sankyo will maintain exclusive rights. Daiichi Sankyo is solely responsible for manufacturing and supply.

The companies had a setback for one of these three ADC candidates, patritumab deruxtecan, when the US Food and Drug Administration (FDA) issued a Complete Response Letter (CRL) last month (June 2024) for the companies’ biologics license application for the drug due to findings pertaining to an inspection of a third-party manufacturing facility. The CRL did not identify any issues with the efficacy or safety data submitted. The companies said that they will work with FDA and its third-party manufacturer to resolve the issues.

Merck’s partnership with Daiichi Sankyo followed Merck’s $9.5-billion license and collaboration agreement, formed in 2022, with Kelun-Biotech, a bio/pharma company based based in Chengdu, Sichuan Province, China, to develop seven investigational preclinical ADCs to treat cancer. That deal came in at number one in terms of deal value in 2022 and second for the last five years (2019-2023), according to the Clarivate analysis. All of the top ADC deals over the past five years were in oncology.

Daiichi Sankyo is also partnered with AstraZeneca in a $6-billion ADC deal, formed in 2020, to develop and commercialize datopotamab deruxtecan, Daiichi Sankyo’s proprietary trophoblast cell-surface antigen 2 (TROP2)-directed ADC for treating several multiple tumor types, including breast and lung cancer. The drug is under regulatory review in the US for treating a certain form of breast cancer, with an expected Prescription Drug User Fee Act review date of January 29, 2025. In March (March 2024), the European Medicines Agency (EMA) validated two marketing authorization applications for the drug, respectively, to treat certain forms of breast and lung cancer. The validations begin the scientific review process by the EMA’s Committee for Medicinal Products for Human Use. Clarivate projects the ADC as a potential blockbuster (defined as sales of $1 billion or more) with expected sales of $2.70 billion for breast cancer and non-small-cell lung cancer indications combined by 2029, according to Clarivate’s Drugs to Watch 2024 report.

Already in 2024 (as of April 12, 2024), 32 ADC-related deals have been announced or completed, according to the Clarivate analysis. The largest disclosed deals (of more than $500 million) have been between:

• Bristol-Myers Squibb and Systimmune, a Redmond, Washington-based bio/pharma company, for a projected $8.4 billion to co-develop and co-commercialize Systimmune’s BL-B01D1 in the US for treating metastatic or unresectable non-small-cell lung cancer;

• Merck KGaA. and Caris Discovery, the therapeutic research arm of Caris Life Sciences, an Irvine, Texas-based molecular science and technology company, for a projected $1.4 billion to identify targets and develop ADCs for cancer worldwide;

• Roche and MediLink Therapeutics, a Suzhou, China-based bio/pharma company, for a projected $1 billion to develop, manufacture, and commercialize MediLink Therapeutics’ YL-211 against solid tumors worldwide; and

• Ispen, a Paris-based bio/pharma company, and Sutro Biopharma, a South San Francisco, California-based bio/pharma company, for a projected $899 million to develop and commercialize Sutro Biopharma’s STRO-003 for treating solid tumors.

ADC market: clinical development

On a development basis, the Clarivate analysis estimates that there are more than 1,200 active clinical trials for ADCs, the majority of which have occurred over the past five years. Although cancer drugs have been the focus of most ADC research activity to date, 13 non-oncology ADC assets are being evaluated in clinical trials that started in the last five years, according to the Clarivate data. These trials cover the following indications: age-related macular degeneration (AMD), AL amyloidosis, Crohn’s disease, diabetic macular edema. Duchenne muscular dystrophy, influenza, kidney disease, rheumatoid arthritis, nonalcoholic steatohepatitis (NASH, a liver disease), scleroderma, familial amyotrophic lateral sclerosis, and hepatitis B virus infection. Of these, an ADC, KSI-501, for treating AMD, by Kodiak Sciences, a Palo Alto, California-based bio/pharma company, is the furthest along in development, with a Phase III trial slated to start in June 2024, according to the Clarivate analysis.

ADC companies under the radar

In its analysis, Clarivate also highlighted seven lesser-known companies specializing in ADCs to watch, which show promise either in terms of their pipeline assets or ADC-related technologies. A brief roundup of these companies is provided below.

Adcendo ApS (Frederiksberg, Denmark) develops ADCs targeting the uPARAP receptor, which is highly expressed in various mesenchymal and epithelial cancers. Adcendo aims to replace conventional chemotherapy with targeted, personalized treatments that have fewer side effects.

Araris Biotech AG (AU, Zurich, Switzerland) is a spin-off company from the research institutes of the Paul Scherrer Institute and ETH Zurich, has proprietary conjugation technology and linker-payload platforms that can accommodates various drug-load combinations without altering the antibody’s pharmacokinetic profile, aiming to create more efficacious and less toxic ADC cancer treatments.

GO Therapeutics (Natick, Massachusetts) uses advances in glycoproteomics to develop antibody-based therapies against clean glycoprotein cancer targets. Its platform-based approach uses selectively targeted O-glycoproteins for multiple cancer types.

Heidelberg Pharma AG (Munich, Germany) has a proprietary technology (ATAC) that uses amanitin-based compounds as the ADC payload. As the first to use amanitin for cancer therapies. Heidelberg Pharma’s approach targets RNA polymerase II to induce apoptosis (cell death) to develop drugs with potentially improved therapeutic indices and fewer side effects.

Pheon Therapeutics (Cambridge, Massachusetts) focuses on extending the benefits of ADCs through novel oncology targets and proprietary linker-payload technologies. Its development strategy focuses on a novel target that is broadly overexpressed in multiple solid tumor types. Pheon’s lead program for solid tumors, PHN-010, is set to enter the clinical stage in 2024.

Tallac Therapeutics (Burlingame, California) uses ADC technology with novel oligonucleotide payloads to create antibody-oligonucleotide conjugates (AOCs). Its TRAAC platform uses a potent Toll-like receptor agonist for targeted immune activation within the tumor microenvironment with potentially less toxicity and more durable therapeutic profiles for treating solid tumors.

Tubulis (Planegg, Germany) has a proprietary technology (Tub-tag) and P5 conjugation platforms to provide more targeted delivery of the ADCs, stabilize the linker, and minimize offsite toxicities. Tubulis’ lead candidates, TUB-040 and TUB-030, target specific antigens in ovarian, lung, and other solid tumors.