The Bio/Pharma Industry’s Watchlist for 2023

What are the top 10 items on the bio/pharma industry’s watchlist for 2023? To continued inflationary pressures, a looming global recession, to moderating global bio/pharma industry growth, DCAT Value Chain Insights examines what is on the industry’s radar.

The bio/pharma industry’s watchlist for 2023

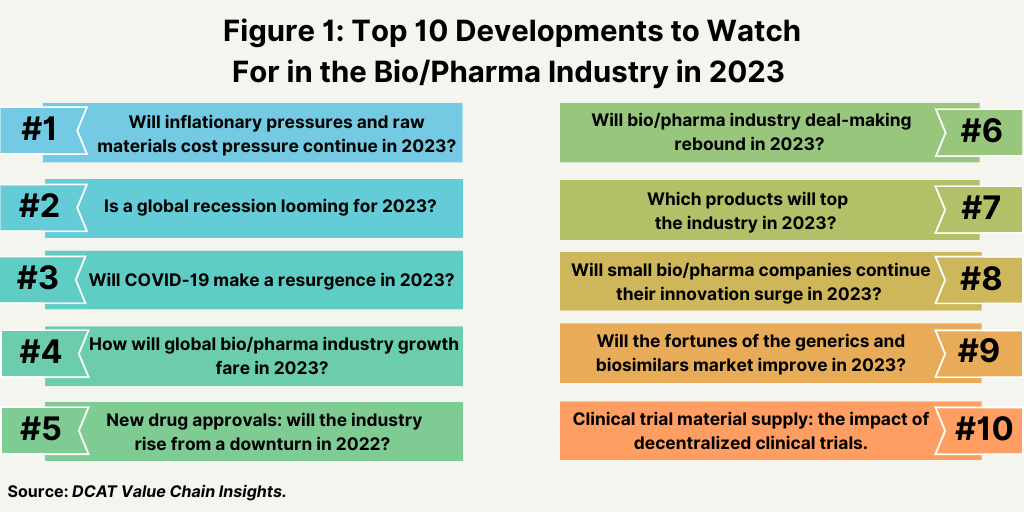

So what are the top issues for the industry in 2023? Figure 1 highlights the key developments to watch for in 2023

Inflationary pressures and raw materials cost pressure. Without question, inflationary pressures—in the form of escalating energy and raw material costs—represented the most significant news development in 2022, and the key question for 2023 is will there be relief. The bio/pharmaceutical industry was not alone in dealing with higher costs in 2022 as the global economy and markets faced strong inflationary pressures in 2022. As the global economy emerged from the pandemic, markets responded to increased demand, and with that, came supply challenges to meet that demand on a production, transportation, and overall supply-chain level, which contributed to rising costs. That situation, later combined with the volatility in energy markets, particularly in Europe, stemming from the war in Ukraine and the European Union’s (EU) policy moves and actions to decrease its reliance on the supply of natural gas from Russia resulted in shifts in supply-demand fundamentals for energy. This not only affected production and transportation costs, but the chemicals manufacturing value chain, in the form of higher feedstock costs and the resulting negative impact on commodity and downstream chemicals.

This situation has had direct impact on the bio/pharmaceutical and allied industries, particularly in Europe and a key question is how energy markets in Europe will fare this winter and in 2023. Two industry groups, Medicines for Europe, which represents generics and biosimilars companies and manufacturers in Europe, and the European Chemical Industry Council (Cefic), which represents European chemical manufacturers, both issued calls to action to European authorities to address the inflationary pressures in energy, raw materials, and transportation, and the negative impact on bio/pharmaceutical and chemical production.

EU authorities have taken action to reduce the EU’s dependence of Russian gas, which had accounted for 40% of natural gas supply to Europe prior to Russia’s invasion into Ukraine in February (February 2022), to reach levels of about 14% as of September (September 2022). It also has put into place natural gas storage requirements and coordinated gas demand reductions in the EU to address energy supply and cost issues. To address dramatic price rises in electricity, it has taken measures to help reduce the cost of electricity for consumers (both businesses and households), and measures to redistribute the energy sector’s surplus revenues to final customers. These measures are in particular response to address the energy issues for this winter, but industry groups say that more action is needed to address both short-term and longer term needs. How the energy picture will unfold in Europe and the resulting impact on raw materials costs is the number one item on the industry’s watchlist for 2023.

Looming global recession in play or not. Many economists point to a looming global recession in 2023 as governments use monetary policy in the form of higher interest rates to curb inflation but to a negative impact of slowing economy growth. This situation, along with other factors, such as ongoing supply-chain issues on a global basis, COVID-19 pressures in China, continued inflationary pressures, and geopolitical uncertainty also weigh on the performance of the global economy.

The Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva said recently that 2023 will be tougher than previous year for most of the global economy as the United States, the European Union, and China experience slowing growth. She says said that in 2023, one-third of the world’s economies are expected to be in recession. She made her comments on the CBS news program, Face the Nation, on January 1, 2023.

Last October (October 2022), the IMF downgraded its outlook for the global economy in 2023 based on the effects of the war in Ukraine, global inflation that requires interest rate hikes, and a slowdown in China. The IMF lowered its growth forecast for 2023 for the global economy to 2.7%, which represents the weakest growth profile since 2001 except for the global financial crisis of 2008/2009 and the acute phase of the COVID-19 pandemic. The IMF forecast reflects significant slowdowns for the largest economies that occurred in 2022: a US contraction in gross domestic product (GDP) growth in the first half of 2022, a euro area contraction in the second half of 2022, and prolonged COVID-19 outbreaks and lockdowns in China with a growing property sector crisis. About one-third of the world economy faces two consecutive quarters of negative growth, the definition of a recession. On a positive note, the global inflation rate is expected to decline to 6.5% in 2023 and to 4.1% by 2024 after reaching 4.7% in 2021 and 8.8% in 2022.

In the US, some economists say the US may avoid recession and experience a so-called “slowcession” referring to slowing growth but not two consecutive quarters of negative growth, which is a condition of a recession. Moody’s Analytics baseline outlook calls for a recession-free 2023 in the US but with slowing growth with expectations that inflationary pressures continue to steadily moderate.

While the bio/pharma industry is historically not as affected by the cyclicality of the economy as other industries, such as automotive, housing, and retail, a downturn in the economy can have an impact in the form of reduced healthcare spending by governments or individuals affected by a downturn in employment and access to healthcare. How the global economy fares in 2023 will be a key point to watch for in 2023.

COVID-19: is a resurgence in the making? Although on a global basis, the COVID-19 pandemic eased in 2022, it still continues to present challenges globally and in the bio/pharmaceutical industry specifically. The emergence of variants, such as the Omicron variant, has obligated the industry to adapt vaccines and treatments to address these variants. At the same time, an uptick of COVID-19 cases in China led the government there to implement a zero-COVID policy, forcing lockdowns in select regions of the country, which impacted production and supply for products, including pharmaceuticals and direct materials. While the national government in China has eased those restrictions, it also has come with a recent resurgence in COVID-19 cases in China. The extent of a COVID-19 resurgence in China remains unclear as international bodies, including the World Health Organization (WHO), seek to get more information and data from the country. In late December (December 2022), high-level officials from China’s National Health Commission and the National Disease Control and Prevention Administration briefed WHO on China’s evolving strategy and actions in the areas of epidemiology, monitoring of variants, vaccination, clinical care, communication and R&D. WHO stressed the importance of monitoring and the timely publication of data to help China and the global community to formulate accurate risk assessments and to inform effective responses.

Also at play globally is the emergence of a new Omicron subvariant, XBB.1.5, which in the US now accounts for about 41% of new COVID-19 infections as reported by the US Centers for Disease Control and Prevention. Over the month of December (December 2022), the percentage of new COVID-19 infections in the US caused by XBB.1.5 rose from an estimated 4% to 41%. XBB.1.5, which was first detected in the US, has spread to at least 29 countries and is the most transmissible form of the Omicron variant to date, according to information from WHO. WHO said it does not have any data on severity yet, or a clinical assessment of the impact of the XBB.1.5 subvariant although increased transmissibility is always an issue to watch. Additionally, it is expected that new variants of concern will continue to emerge and that health monitoring will be important to evaluate any potential negative impacts.

Bio/pharmaceutical industry growth in 2023. A key indicator for global bio/pharma industry performance in 2023 is the US bio/pharma market, which accounts for approximately 40% of the global market. After reaching growth of 12% in 2021, in large measure due to COVID-19 products, growth in the US bio/pharma market has and is expected to continue to moderate to pre-pandemic levels. Spending on medicines in the US, at net manufacturer prices, reached $407 billion in 2021, up 12.1% over 2020, as COVID-19 vaccines and therapeutics became widely available and added $29 billion in related spending, according to the IQVIA Institute for Human Data Science. In 2021, the non-COVID medicines market in the US grew more slowly, at only 4.9%, with growth tempered from the growing impact of biosimilars, which increased significantly, offsetting increased use of branded medicines.

While spending growth slowed in 2020 to less than 1%, from a combination of impacts on volume and spending on newly launched medicines, the pandemic impact was reduced in 2021. US net spending over the five-year period of 2017–2021 grew at a compound annual growth rate (CAGR) of 4.6%, including for COVID-19 products, but only 3.1% for all other medicines, reflecting a slowing trend without these new treatments. Medicine spending in the US grew $82 billion over the five-year period of 2017–2021, with COVID-19 products contributing $29 billion. In the prior five-year period (2016–2020), US medicine spending increased by 4.3%. Prescription drug use in the US reached a record level of 194 billion daily doses in 2021 as new prescription starts for both chronic and acute care recovered from the slowdown recorded in 2020. Spending on medicines in the US is expected to return to pre-pandemic growth trend lines by 2023 despite year-to-year fluctuations and incremental spending on COVID-19 vaccines and therapeutics. The IQVIA Institute projects a CAGR of 2.1% (range of 1-4%) for the US market through 2026, which is comparable to pre-pandemic levels, and total US market size in 2026 of about $450 billion on a net manufacturer price basis.

New drug approvals in 2023. A key question for 2023 is whether the bio/pharma industry will rebound from a downturn in new drug approvals in 2022. The number of new drug approvals is an important measure of new product innovation in the bio/pharma industry, and the results from 2022 show a downturn from recent trends. The US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 37 new drugs in 2022, significantly down from the 50 new drugs approved in 2021 and the 53 new drugs approved in 2020. The new drug approvals include both new molecular entities and new therapeutic biologics approved by the FDA’s CDER and does not include vaccines, allergenic products, blood and blood products, plasma derivatives, cellular and gene therapy products, or other products approved by the FDA’s Center for Biologics Evaluation and Research. The 37 new drug approvals, in fact, represent a recent low for new drug approvals over the last decade; only 2018 and 2013 had lower levels of new drug approvals, with 22 new drug approvals in 2018 and 27 in 2013.

A rebound or not for bio/pharma industry deal-making in 2023. Last year (2022) saw a decline in bio/pharmaceutical industry deal-making comparative to 2021, and so the key question is what will happen in 2023. In 2022, the value of pharma and biotech mergers and acquisitions (M&A) tallied to $158.5 billion, a 41% decrease in deal value comparative to 2021, according to a PwC analysis. The number of deals in 2022 was 258, a decrease of 30% compared to 2021. Amgen’s pending $28-billion acquisition of Horizon Therapeutics, a company focused on rare diseases, was the largest deal in 2022. The deal was announced in early December (December 2022). Pfizer’s $11.6-billion acquisition of Biohaven Pharmaceuticals, a New Haven, Connecticut-based bio/pharmaceutical company focused on the treatment of migraines, was one of the largest acquisitions in 2022 aside from Amgen’s pending $28-billion acquisition of Horizon Therapeutics. In 2023, PwC expects M&A to more closely resemble prior years with a total deal value in the $225 billion to $275 billion range across all subsectors. Ample corporate cash, the need to continue to invest to address medium-term pipeline gaps and the resetting of biotech valuations will provide the backdrop for an active year, according to the PwC analysis.

Small bio/pharma companies’ innovation surge in 2023. A key development to watch for in 2023 is whether small bio/pharma companies will continue to lead in product innovation. In 2022, small to mid-sized bio/pharma companies accounted for 24, or 65%, of new drug approvals. This continues multi-year trends that show a surge by smaller companies in new product development.

Consider these numbers from a recent report by the IQVIA Institute for Human Data Science. Emerging Bio/pharma companies are responsible for a record 65% of the molecules in the industry’s R&D pipeline without a larger company involved, up from less than 50% in 2016 and 34% in 2001. The number of products filed with the US Food and Drug Administration (FDA) by Emerging Bio/pharma companies has grown four-fold over the last decade and now accounts for 42% of products filed with the FDA, up from 11% in 2012. A significant portion of oncology drug development, the largest therapeutic sector in the bio/pharma industry, comes from Emerging Bio/pharma companies, with oncology representing 39% of the Emerging Bio/pharma pipeline and more than 1,500 oncology products in development.

The fortunes of the generics and biosimilars market in 2023. The near-term fortunes of the generics and biosimilars sector will largely rest on one of the largest patent cliffs over the five-year period (2022–2026) with a cumulative brand loss by innovators of $188 billion in developed markets, according to IQVIA estimates. The resulting revenue opportunities for the generics and biosimilar sectors are significant: $17 billion for generics and $39 billion for biosimilars for the period 2022–2026, according to IQVIA estimates.

Also in play in 2023 is how the strategies of three of the major generic-drug companies (Teva, Viatris, and Sandoz) will fare as they implement resets to address continuing cost pressures and margin erosion.

A key move in 2023 will be Novartis’ plan to spin off Sandoz, its generics and biosmilars business, into a new publicly traded stand-alone company, a move announced by the company in late August (August 2022). The decision followed its previous announcement in October 2021, in which Novartis announced a strategic review of Sandoz. The stand-alone Sandoz would be headquartered in Switzerland and be listed on the SIX Swiss Exchange, with an American Depositary Receipt program in the US. The Sandoz spin-off transaction is expected to be completed in the second half of 2023.

At the same time, Viatris is proceeding with what it calls a “reshaping plan,” which includes restructuring and divestments of non-core assets to improve the company’s financial position. A key move in 2022 was completing, in November 2022, its divestment of its biosimilars assets to Biocon Biologics, a Bangalore, India-based biosimilars company and subsidiary of Biocon Ltd., in a $3.35-billion deal. The move is part of an overall plan by Viatris to achieve $9 billion in pre-tax proceeds through the Biocon Biologics transaction and the divestment of other non-core assets. Viatris is retaining a 12.9% stake in Biocon Biologics to still keep a position in biosimlars. In 2009, Biocon formed an alliance with Mylan, Viatris’ predecessor, to develop monoclonal antibody biosimilars. In 2013, the partnership was expanded to include insulin biosimilars. Viatris was formed in 2020 through the merger of Mylan and Upjohn, Pfizer’s off-patent branded and generic established medicines business.

Viatris expects to use the net proceeds from the $2-billion cash payment from the Biocon biosimilars transaction to do the following: (1) pay down additional short-term debt and accelerate its progress toward $6.5 billion of its Phase 1 debt-reduction plan; (2) in combination with cash on hand, fund two recent acquisitions of ophthalmology drug companies (Oyster Point Pharma and Famy Life Sciences) for a combined total of $750 million, to establish an ophthalmology franchise as a new revenue source; and (3) execute on its previously announced share buyback authorization in 2023.

For its part, Teva will proceed with a change of the guard as an ex-Sandoz executive took the helm of the company on January 1, 2023. Richard Francis, former CEO of Sandoz, and former CEO of Purespring Therapeutics and Forcefield Therapeutics, became Teva’s President and CEO. He succeeded Kåre Schultz, formerly Teva’s CEO, who retired, effective December 31, 2022.

Schultz had been Teva’s CEO since 2017 and he came on board to lead a major restructuring plan, which was announced in late 2017. The plan addressed declining revenue from its generics business, large debt caused by its $40.5-billion acquisition of Allergan’s generics business in 2016, and declining revenue from its number one specialty innovator product at the time, Copaxone (glatiramer acetate) for treating multiple sclerosis, which faced its own generic-drug competition. Schultz was hired to turn the company around. He oversaw the company’s restructuring and developed the ensuing strategy of further diversifying in innovator drugs and optimizing the company’s generics portfolio by rationalizing the company’s generics product portfolio and moving it away from less profitable areas to more value-added products, such as complex generics, biosimilars, and other products with a higher barrier to market entry.

Clinical trial material supply: the impact of decentralized clinical trials. One continuing development to watch for in 2023 is the rise of decentralized clinical trials (DCTs). One of the consequences of the COVID-19 pandemic was the increase in DCTs due to limitations in conducting onsite trails in traditional clinical settings. Though it became a practice of necessity due to the pandemic, a key question for 2023 and beyond is whether DCTs will continue to make inroads.

A recent analysis by the IQVIA Institute of Human Data Science looked at this question. In the analysis, decentralized trials were assessed against 14 metrics across three categories (productivity, quality, and trial delivery), to determine how a DCT approach compared to traditional study models. The analysis found that sponsors can achieve faster, less expensive, and more engaging trials using DCT-driven protocols. Specifically, the findings show substantial reductions in timelines for Final Protocol to First Patient In (FPI), timelines for FPI to Last Patient In, Screen Failure Rate, as well as protocol deviations. The analysis highlights that, while different trials experienced varying levels of benefits from a DCT approach, making decentralized models part of a clinical research strategy from the outset can lead to significant returns.

For bio/pharma companies and their suppliers, a shift to more DCTs will also change supply lines for clinical trial materials to at-home or other site delivery. Advances and increased use in DCTs will continue to be an important trend to watch for in 2023.