Supply-Chain Digitalization: Change Is Here

How will digital technologies, such as AI, blockchain, and predictive analytics, change the way business is conducted between Bio/Pharma companies and suppliers? A DCAT Week program has the answers.

Increased supply-chain digitalization is coming

The value of advancing digital technologies such as artificial intelligence (AI), blockchain, predictive analytics, has taken on greater importance as the Bio/Pharma industry, along with other industries, grapple with supply-chain challenges that emerged during the pandemic and that continue today. The pandemic not only exposed supply-chain vulnerabilities but also has caused companies to re-evaluate their supply chains and address existing inefficiencies and ways to improve supply-chain performance.

Consider this. “Digital-first” supply chains was cited as one of the top three characteristics by the Gartner Group, a research and advisory group, in putting together its annual rankings of the Top 25 Supply Chains in 2021. An integrated-purpose-driven organizations and customer-driven business transformation were the other two.

A Gartner survey of board of directors, taken late in 2020, showed that nearly 70% of companies accelerated their digital roadmaps during the pandemic. “Some leading supply chains have reached a point in their transformation journey where they consider themselves ‘digital first’ in the use of technology to enable more seamless customer experiences and more automated and insightful decisions in supply and product management, at scale,” according to the Gartner analysis.

The Gartner analysis emphasizes that digital transformation would not be possible without the right talent. It points to leading companies conducting formal skills assessment and strategic workforce planning. AI, machine learning, and Big Data analysis are the most common capabilities, and most are simultaneously recruiting and developing these skills in their organizations, according to the analysis. The study points to several advanced supply-chain organizations running digital literacy and dexterity programs to enable employees to better understand and exploit digital business opportunities.

“Leaders must position new digital technologies as a means for employees to stop spending time on manual, non-value-added activities, so they can focus on providing value for their customers,” said Mike Griswold, Vice President and Team Manager with Gartner’s Supply Chain Practice, in commenting on the rankings when released in August 2021.

A Pulse Survey, conducted by the management-consulting firm, PwC, of more than 650 executives last month (January 2022) asked what they see as the most significant issues in their growth strategy; 60% said that digital transformation is their most important growth driver. Almost a third (32%) of executives foresee continued supply-chain disruptions, which are leading companies to evaluate alternative sourcing strategies, from policy shifts to opportunities to digitize supply chains.

Associate Dean and Professor

Eli Broad College of Business, Michigan State University

Impact on the Bio/Pharma supply chain

Although it is clear that supply-chain digitalization is here to stay and will continue to advance, how does that impact how business is conducted between customers and suppliers in the Bio/Pharma supply chain? For those engaged in sourcing, procurement, and supply management at Bio/Pharma companies and their business counterparts on the supply side, what may be next? What is the impact on day-to-day operations, project management, and supply-chain practices among Bio/Pharma companies and CMDOs/CMOs/suppliers, and in turn, how may job functions evolve?

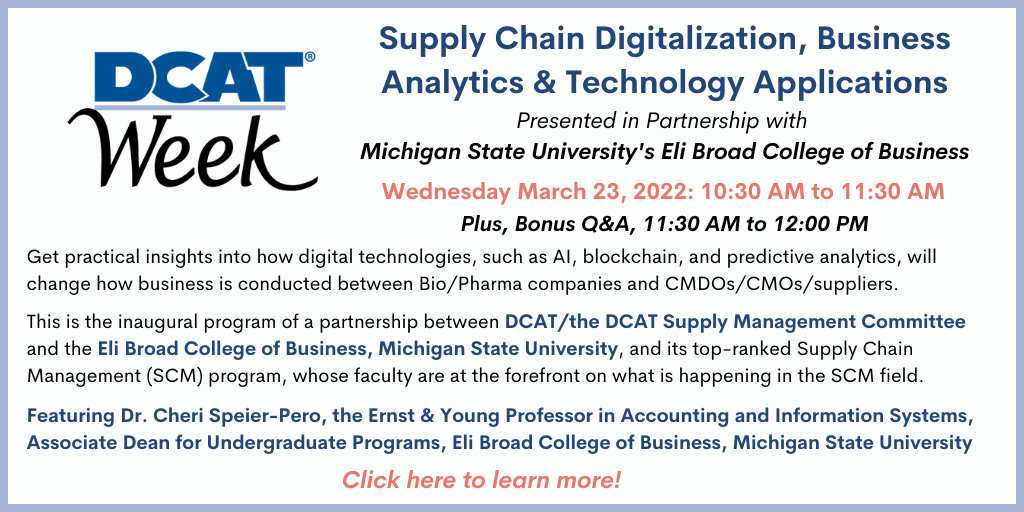

A special DCAT Week program, Supply Chain Digitalization, Business Analytics & Technology Applications on Wednesday March 23 from 10:30 to 11:30 AM, will provide answers. The program will give practical insights on how companies are using digital technologies, such as AI, blockchain, and predictive analytics, now and in the near term, and with that, how expectations between customers and suppliers are evolving.

This is the inaugural program of a partnership between DCAT/the DCAT Supply Management Committee and the Eli Broad College of Business, Michigan State University (MSU), and its top-ranked Supply Chain Management (SCM) program. The faculty members in MSU’s Department of Supply Chain Management are thought leaders in the SCM field and are on the forefront of what is happening in SCM across all industries.

Dr. Cheri Speier-Pero, the Ernst & Young Professor in Accounting and Information Systems, and Associate Dean for Undergraduate Programs, Eli Broad College of Business, Michigan State University, will lead an interactive program, including a bonus 30-minute Q&A, to provide answers to your most pressing questions. The Q&A session will be recorded and provided to program registrants via email post the program.

For information on the DCAT Week program, Supply Chain Digitalization, Business Analytics & Technology Applications, including how to register, may be found here.