Rising Energy & Raw Materials Costs: When Is Relief Coming?

Inflationary pressures, in the form of higher energy, raw materials, and shipping costs, have tightened margins across all industries, including the bio/pharma industry. When will relief be on the way?

Global growth hampered by inflation

A key variable in the near term for the performance of all industries, including the bio/pharmaceutical industry, will be the impact of higher energy, raw materials, and shipping costs, which rose in 2021 as countries recover from the COVID-19 pandemic, demand for products and services increased, and geopolitical uncertainty looms following Russia’s invasion of Ukraine.

The International Monetary Fund (IMF) projects global growth of 3.6% in both 2022 and 2023, compared to 6.1% growth in 2021. In advanced economies, growth is projected at 3.3% in 2022 and 2.4% in 2023, down from 5.2 % growth in 2021.This reflects the direct impact of the war on Ukraine and sanctions on Russia, with both countries projected to experience steep contractions. This year’s growth outlook for the European Union was revised downward due to the indirect effects of the war, with growth projected for the Euro Area at 2.8% in 2022 and 2.3% in 2023, down from growth of 5.3% in 2021.

Moreover, inflation is curbing growth prospects globally. “Inflation has become a clear and present danger for many countries,” said IMF in an analysis provided on April 27, 2022. “Even prior to the war, it surged on the back of soaring commodity prices and supply-demand imbalances. Many central banks, such as the Federal Reserve, had already moved toward tightening monetary policy. War-related disruptions amplify those pressures. We now project inflation will remain elevated for much longer. In the United States and some European countries, it has reached its highest level in more than 40 years, in the context of tight labor markets.”

Energy costs an important factor

For the bio/pharmaceutical industry, rising energy costs affect not only the costs for energy consumed for heat, power, and electricity generation to run operations and transport products and materials, but also impact the costs of raw materials, intermediates, and other materials used to make active pharmaceutical ingredients (APIs) and ultimately the final drug product. Energy, when used as a feedstock, is an important determinant of cost in producing the chemicals used in API production, whether raw materials, solvents, reagents, intermediates, and other chemical inputs. When energy costs rise, it places pricing pressure on chemical inputs as well as on costs for overall energy consumption.

US energy outlook

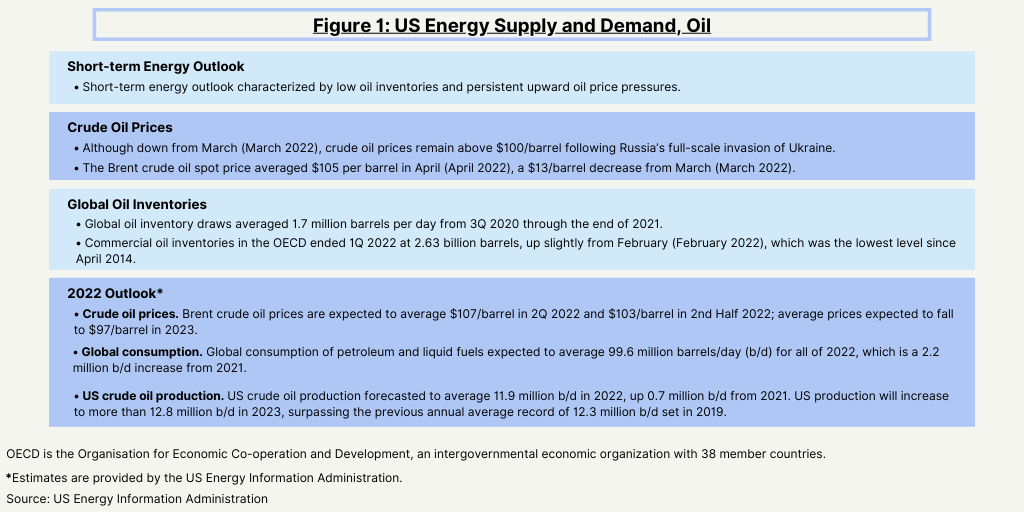

In the US, the short-term energy outlook is characterized by low oil inventories and persistent upward oil price pressures (see Figure 1), according to a recent analysis by the US Energy Information Administration (EIA), a US federal agency. Based on its macroeconomic forecasts from several sources, it projects that US gross domestic product will grow by 3.1% in both 2022 and 2023, following growth of 5.7% in 2021. It points to a wide range of potential macroeconomic outcomes that could significantly affect US energy markets in 2022/2023. Major factors driving energy supply uncertainty include how sanctions affect Russia’s oil production, the production decisions of OPEC+, and the rate at which US oil and natural gas producers increase drilling.

The EIA’s short-term outlook points to crude oil prices remaining above $100/barrel following Russia’s full-scale invasion of Ukraine with sanctions on Russia and other independent corporate actions contributing to falling oil production in Russia and continuing to create significant market uncertainties about the potential for further oil supply disruptions. These events occurred against a backdrop of low oil inventories and persistent upward oil price pressures. Global oil inventory draws averaged 1.7 million barrels per day (b/d) from the third quarter of 2020 through the end of 2021. The EIA estimates that commercial oil inventories in the countries comprising the Organisation for Economic Co-operation and Development (OECD) ended the first quarter of 2022 at 2.63 billion barrels, up slightly from February (February 2022), which was the lowest level since April 2014.

The EIA expects the Brent crude oil price in the US will average $107/barrel in 2Q22 and $103/barrel in the second half of 2022 and the average price to fall to $97/barrel in 2023. However, the EIA says this price forecast is highly uncertain.

“Actual price outcomes will largely depend on the degree to which existing sanctions imposed on Russia, any potential future sanctions, and independent corporate actions that affect Russia’s oil production or the sale of Russia’s oil in the global market,” said the EIA in its analysis. The EIA completed its short-term outlook on May 5, 2022, and, therefore, it does not include an EU ban on oil imports from Russia. Such bans, it says would likely contribute to tighter oil balances and higher oil prices than its current forecast. In addition, the degree to which other oil producers respond to current oil prices and the effects of macroeconomic developments might have on global oil demand will be important for oil price formation in the coming months. Because oil inventories are currently low, the EIA expects downward oil price pressures will be limited and market conditions will exist for significant price volatility.

EU also facing uncertainty

At the same time the European Union (EU) has faced similar macroeconomic uncertainty caused by inflationary pressures further attenuated by the geopolitical uncertainty and effects of Russia’s invasion of Ukraine. Even before Russia’s invasion of Ukraine in February (February 2022), the EU was already feeling the impact of inflationary pressures, particularly for energy.

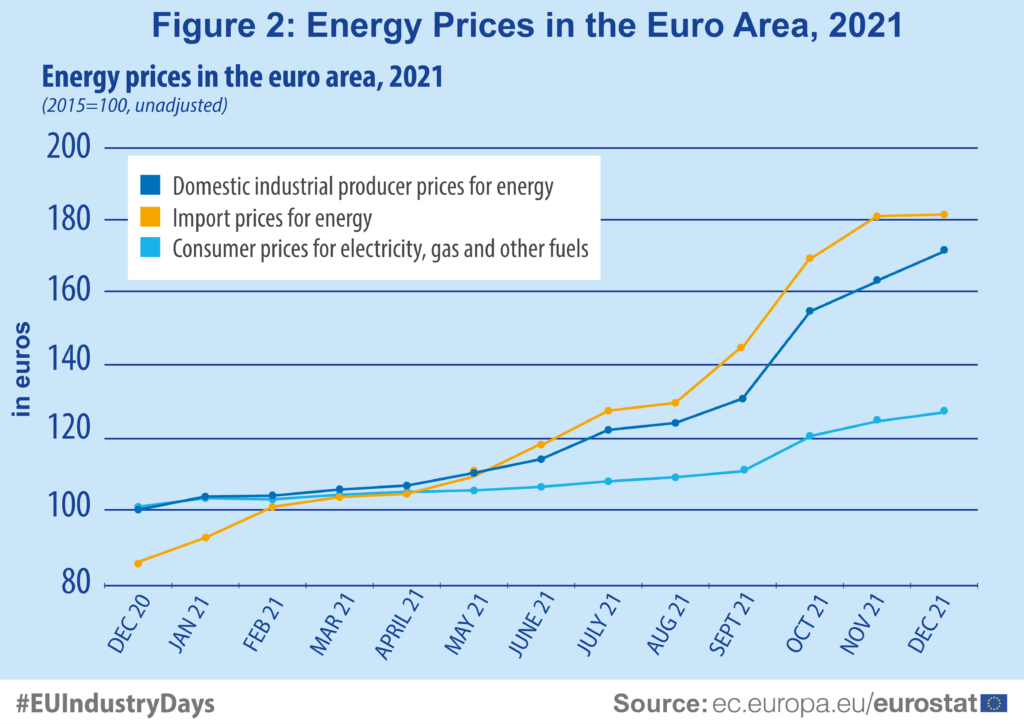

Between December 2020 and December 2021, the import price for energy in the euro area more than doubled (115%) (see Figure 2). The domestic producer prices for energy increased by almost three quarters (73%). This development is in sharp contrast to the relative price stability for energy import prices between 2010 and 2019 (in 2020, prices dropped by 31%) and the relatively low annual increase of domestic producer prices for energy of 0.9% between 2010 and 2019 (in 2020, energy producer prices fell by almost 10%). This recent development is quite unprecedented. Energy import prices, while rather volatile, did not change by more than around 30% during a year in the past; domestic producer prices did not change by more than around 10% per year. Consumer prices for electricity, gas and other fuels increased by 25% between December 2020 and December 2021.

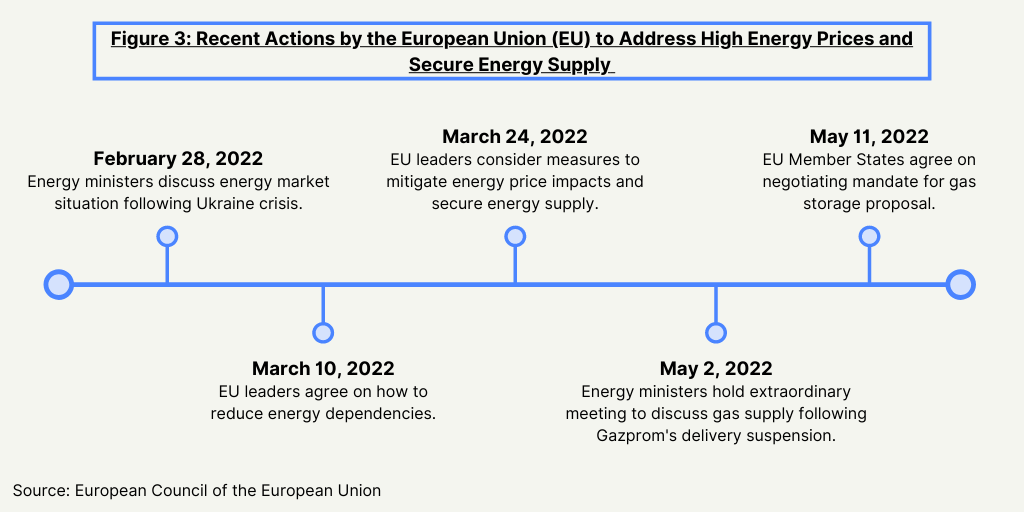

EU officials have moved forward on addressing energy prices and energy security in the EU beginning in 2021 while also deciding in March (March 2022) to eliminate energy imports from Russia as a result of Russia’s invasion into Ukraine, a move that has further affected the energy markets, causing new increases of energy prices and concerns over the EU’s ability to secure its energy supply. Russia was c the main provider of crude oil, natural gas, and solid fossil fuels for the EU. Europe depended on Russia for about 40% of its natural gas needs. In 2019, close to one third of extra-EU imports of crude oil came from Russia (27%). Despite the role of Russia on EU energy market, the EU decided to take action against Russia to end the EU’s dependence on Russian energy given Russia’s invasion into Ukraine. In March 2022, at an informal meeting of heads of state or governments in March 2022, EU leaders agreed to phase out the EU dependency on Russian fossil fuels and has since taken further action (see Figure 3).

In late March (March 2022), The European Council, discussed proposals by the European Commission to address the energy situation in three main ways: (1) a legislative proposal on minimum gas storage obligations; (2) options for temporary market intervention in the short term to limit price increases; and (3) its readiness to create a task force for common gas purchases. EU leaders urged the European Council and the European Commission to reach out to energy stakeholders to discuss if and how the concrete short-term options presented by the European Commission would contribute to reducing the gas price and address its effect on electricity markets. They also tasked the European Council to take forward work on the proposal on the EU’s gas storage policy and discussed voluntary common purchases of fuel.

Earlier this month (May 2, 2022), EU energy ministers held an extraordinary meeting to discuss the EU’s level of preparedness and measures to be undertaken in the event of a supply crisis, following Gazprom’s recent suspension of gas deliveries to some EU member states. Gazprom is a Russian majority state-owned multinational energy corporation. Earlier this week (May 11, 2022), EU member states reached a mandate for negotiations with the European Parliament on the European Commission’s proposal on gas storage. In order to improve the EU’s security of energy supply, the proposal aims to ensure that gas storage capacities in the EU are filled before winter and can be shared between member states.

While various factors have contributed to high energy prices in Europe, a main driver is the surge in the price of natural gas, which has been mainly caused by a tight global liquefied natural gas (LNG) market. The rise in natural gas prices worldwide is a result of the surge in global demand, notably in Asia, as it and other countries emerge from the COVID-19 pandemic. This has led to lower volumes of LNG imports into Europe with demand outpacing supply, with the recent move by Gazprom further pressuring supply.

For now, the near-term geopolitical uncertainty in the EU and related impacts on energy markets will continue and it has yet to be seen when such pressures will be eased.