Raw Materials Outlook: A Macro View: GDP, Energy & Slowing Inflation

High energy costs and inflationary pressures had a major impact on raw materials supply post-pandemic, but what do key macroeconomic indicators now show? Will the moderate growth and slowing inflation seen in the first half of 2024 continue in the near term?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Is a soft landing in the making or not?

Inflation has been a significant vulnerability to global economic growth and business performance, and although the rate of inflation has slowed since peak levels seen post pandemic, it still remains high and poses headwinds to overall economic growth although there are some positive signs.

In its World Economic Outlook report, released earlier this month (July 2024), the International Monetary Fund projects an easing of the global inflation rate to 5.9% for the full-year 2024, down from 6.7% in 2023. Energy commodity prices are expected to fall by about 4.6% in 2024, which is less than projected in the IMF’s forecast made in April (April 2024), reflecting elevated oil prices from deep cuts by the Organization of the Petroleum Exporting Countries (OPEC), Russia, and other non-OPEC oil exporters, and reduced, but still present, price pressure from the Middle East conflict.

In advanced economies, the IMF’s revised forecast is for the pace of disinflation to slow in 2024 and 2025 as prices for services are expected to be more persistent and commodity prices higher. However, the gradual cooling of labor markets, together with an expected decline in energy prices, should bring headline inflation back to target by the end of 2025, according to the IMF analysis. Inflation is expected to remain higher in emerging markets and developing economies and to drop more slowly than in advanced economies. However, the IMF analysis notes that due to falling energy prices, inflation is already close to pre-pandemic levels for the median emerging markets and developing economies.

Although inflation rates are easing, inflation is still high relative to recent historical levels, and a key consideration is to what extent monetary policy will reflect an improvement in inflation if that trend continues. Elevated inflation raises the prospects of higher-for-even-longer interest rates, which in turn increases external, fiscal, and financial risks. Major central banks had increased interest rates in response to inflationary pressures, and a key variable going forward is whether the rate of inflation will continue to ease, and if so, will major central banks respond in kind by lowering interest rates. In its World Economic Outlook, the IMF projects that the monetary policy rates of major central banks are expected to decline in the second half of 2024, with divergence in the pace of normalization reflecting varied inflation circumstances.

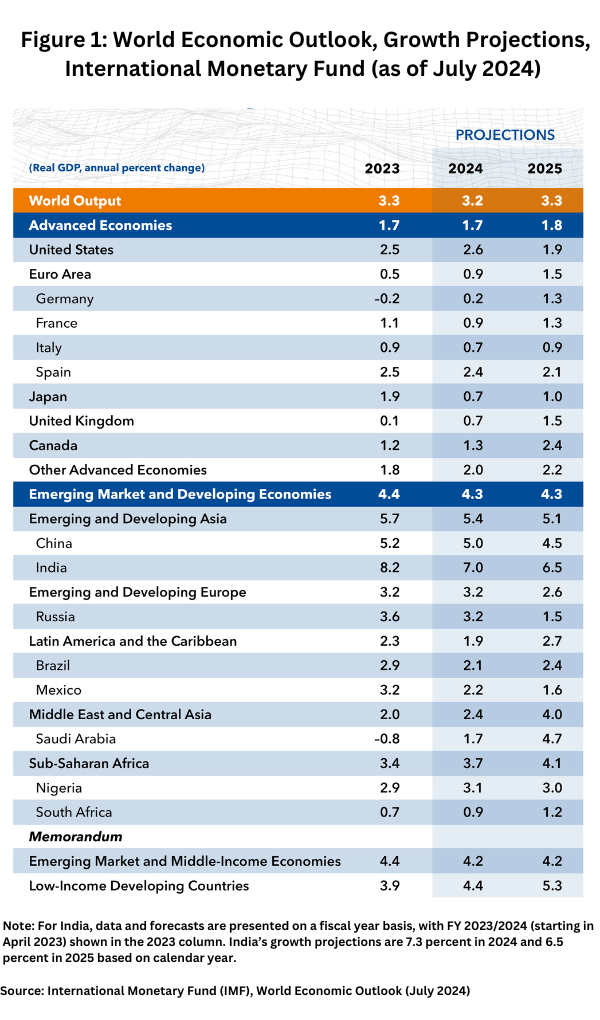

The impact on overall global economic growth is that the IMF projects that global growth in gross domestic product (GDP) to remain stable in the near term: 3.2% in 2024 and 3.3% in 2025, which largely remains unchanged from the IMF’s growth forecasts made in April (April 2024) (see Figure 1).

Among advanced economies, growth is expected to converge over the coming quarters. In the United States, the IMF revised its projected growth forecast downward to 2.6% for 2024 (0.1 percentage point lower than projected in April), reflecting the slower-than-expected start to the year. Growth is expected to slow to 1.9% in 2025 as the labor market cools and consumption moderates, with fiscal policy starting to tighten gradually. By the end of 2025, growth is projected to taper to potential, closing the positive output gap, according to the IMF analysis.

The IMF projections for the US economy were issued prior to the US government issuing advanced second-quarter 2024 estimates for the performance of the US economy, which performed better than expected. In the US, real GDP (referring to GDP adjusted for inflation) increased at an annual rate of 2.8% in the second quarter of 2024, according to advance estimates released on July 25, 2024, by the US Bureau of Economic Analysis. In the first quarter, real GDP increased 1.4%.

In the euro area, the IMF projects a modest uptick in economic performance in 2024. In line with the IMF’s projection made earlier this year in April 2024, a modest pickup of 0.9% is expected for 2024 (an upward revision of 0.1 percentage point), driven by stronger momentum in services and higher-than-expected net exports in the first half of the year; growth is projected to rise to 1.5% in 2025. This is underpinned by stronger consumption on the back of rising real wages as well as higher investment from easing financing conditions amid gradual monetary policy loosening this year. The IMF analysis, however, suggests that continued weaknesses in manufacturing suggest a more sluggish recovery in countries such as Germany.

In Japan, a strong wage settlement is expected to support a turnaround in private consumption starting in the second half of 2024, according to the IMF outlook. But the expectation for 2024 growth is revised downward by 0.2 percentage point, with the downward adjustment largely reflecting temporary supply disruptions and weak private investment in the first quarter of 2024.

The forecast for growth in emerging markets and developing economies is revised upward by the IMF from its April 2024 projections. The projected increase is powered by stronger activity in Asia, particularly China and India. For China, the growth forecast is revised upward to 5% in 2024, primarily due to a rebound in private consumption and strong exports in the first quarter of 2024. In 2025, GDP is projected to slow to 4.5%, and to continue to decelerate over the medium term to 3.3% by 2029, because of headwinds from an aging population and slowing productivity growth, according to the IMF analysis. The forecast for growth in India has also been revised upward, to 7.0% this year (2024), with the change reflecting carryover from upward revisions to growth in 2023 and improved prospects for private consumption, particularly in rural areas.