Ranking the Top 25 Supply Chains: Who Made the Mark?

Supply-chain resiliency and agility are characteristics of companies ranked with the top supply chains according to a recent analysis and ranking by The Gartner Group of the Top 25 supply chains in 2021. Four bio/pharma companies made the Top 25. Who are they, and what other companies made the Top 25 and why?

Gartner Group of the Top 25 supply chains in 2021. Four bio/pharma companies made the Top 25. Who are they, and what other companies made the Top 25 and why?

The Top 25 Supply Chains

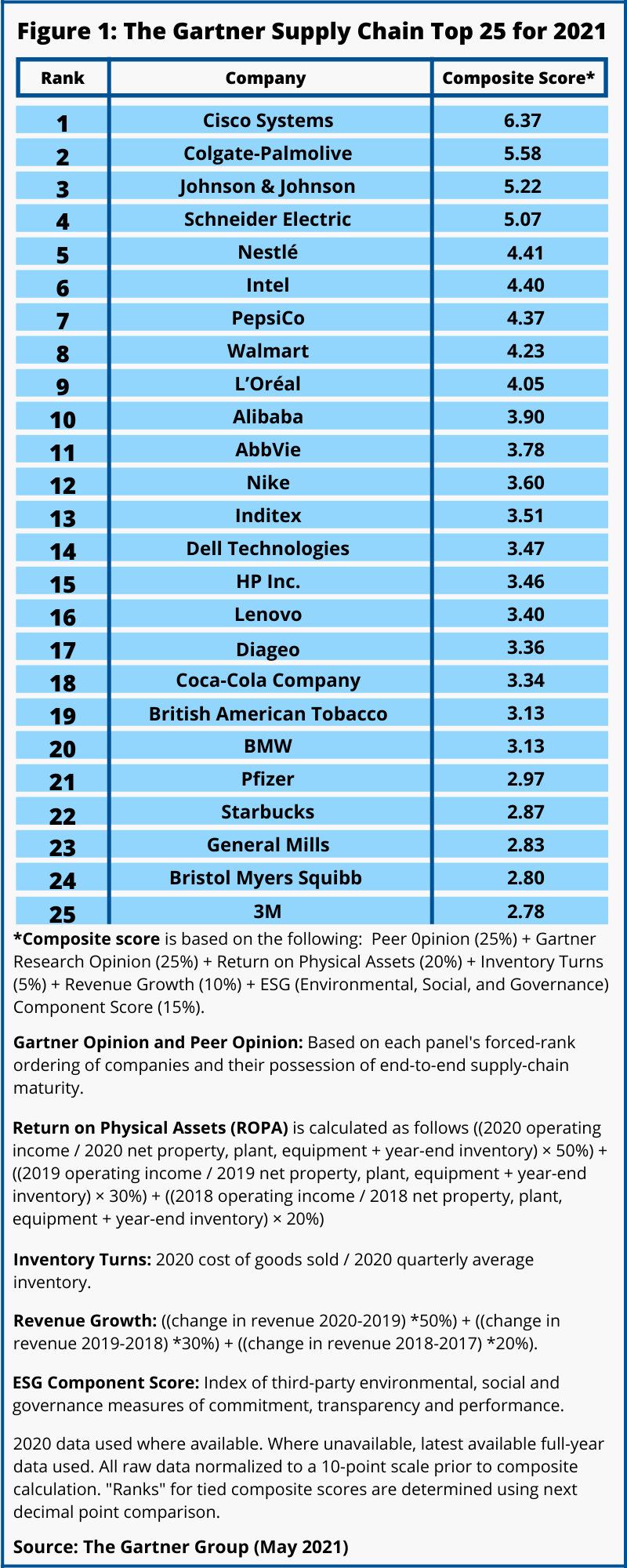

Supply chains are always a crucial part of companies’ operations and business performance, but the COVID-19 pandemic has created challenges further underscoring how important effective supply chains are. That was a key point highlighted by The Gartner Group, a research and advisory group, in putting together its annual Top 25 supply chain rankings for 2021 (see Figure 1).

“In our 17th edition of the Supply Chain Top 25 we saw organizations continuing to deal with the effects of COVID-19 on their businesses,” said Mike Griswold, Vice President Team Manager with Gartner’s Supply Chain Practice, in commenting on the rankings. “Therefore, resiliency and agility capabilities became essential to survival. Our ranking highlights companies that possess these strategies and other differentiating capabilities.”

Cisco Systems scored the top spot in the ranking for the second consecutive year, followed by Colgate-Palmolive, Johnson & Johnson (J&J), Schneider Electric, and Nestlé (see Figure 1). Four new companies joined the 2021 list: Dell Technologies, Pfizer, General Mills, and Bristol Myers Squibb (BMS). In all, four bio/pharmaceutical companies made the top 25 rankings: J&J (number 3), AbbVie (number 11), Pfizer (number 21), and BMS (number 24).

Gartner’s Supply Chain Top 25 ranking comprises two main components: business performance and opinion. Business performance in the form of public financial and ESG (environmental, social, governance) data provides a view into how companies have performed in the past while the opinion component evaluates future potential and reflects leadership in the supply-chain community. These two components are combined into a total composite score (the detailed methodology for how the component score is calculated is outlined in the notes in Figure 1. In compiling the rankings, Gartner analysts derive a list of companies from a combination of the Fortune Global 500 and the Forbes Global 2000. In an effort to maintain the list of companies evaluated at a manageable level, a general annual revenue threshold of $12 billion was applied.

Cisco ranks number one and others in The Master Class

Cisco’s supply chain was ranked number one in 2021, a position it also held in 2020. “Strong revenue growth, strength in environmental, social and governance (ESG) initiatives, and recognition of leadership in the community opinion polls drove Cisco to the top spot for the second consecutive year,” said Gartner’s Griswold. “Cisco’s agility helped them prioritize video conferencing and critical infrastructure capabilities for hospitals and vaccine research.”

To recognize sustained supply-chain excellence, Gartner introduced the “Masters” category in 2015. To be considered Masters, companies must have attained top-five composite scores for at least seven out of the last 10 years. All of 2020’ Masters—Amazon, Apple, Procter & Gamble, McDonald’s, and Unilever—qualified for the category in 2021.

“During times of disruption, these companies continue to lead by example and provide advanced lessons for the supply-chain community,” Griswold added. “The Supply Chain Top 25 offer a platform for insights, learning, debate and contributions to the rising influence of supply-chain practices on the global economy.”

Three key characteristics of the Top 25 Supply Chains

For 2021, the Top 25 and Masters companies shared three key characteristics, according to the Gartner analysis: (1) integrated-purpose-driven organizations; (2) customer-driven business transformation; and (3) digital-first supply chains, as outlined below.

Integrated, purpose-driven organizations. In 2020, many of the supply chains in Gartner’s top 25 ranking not only showed operational strength and supply-chain resiliency but are also moving forward with environmental, social, and governance initiatives that are integrated into their organizations. “A maturity differentiator among purpose-driven organizations is that those further along in the journey are not simply supporting a varied list of ‘green’ initiatives and people-related programs,” according to Gartner’s analysis. “Instead, they integrated these into a larger strategy alongside commercial partners. Some are even leveraging product marketing budgets to fund this work and integrating it into brand messages, instead of treating environmental, social, and corporate governance (ESG) investments as a purely operational cost.”

Customer-driven business transformation. Along with intermittent supply disruptions and larger-than-normal demand swings, the pandemic has driven an accelerated level of business model transformation across industries which required supply chains to be highly adaptive, according to Gartner’s analysis. “Many changes were driven by an outsized uptick in products and services delivered direct to customers and patients, instead of through more traditional, centralized locations such as physical stores and medical facilities,” Griswold said.

Digital-first supply chains. A Gartner survey of board of directors, taken late in 2020, showed that nearly 70% of companies accelerated their digital roadmaps during the pandemic. “Some leading supply chains have reached a point in their transformation journey where they consider themselves ‘digital first’ in the use of technology to enable more seamless customer experiences and more automated and insightful decisions in supply and product management, at scale,” according to the Gartner analysis.

The Gartner analysis emphasizes that digital transformation would not be possible without the right talent. It points to leading companies conducting formal skills assessment and strategic workforce planning. Artificial intelligence, machine learning, and Big Data analysis are the most common capabilities, and most are simultaneously recruiting and developing these skills in their organizations, according to the analysis. The study points to several advanced supply-chain organizations running digital literacy and dexterity programs to enable employees to better understand and exploit digital business opportunities.

“Leaders must position new digital technologies as a means for employees to stop spending time on manual, non-value-added activities, so they can focus on providing value for their customers,” Gartner’s Griswold emphasized.