President Signs Executive Orders on Drug Pricing

Reforming drug pricing in the US has emerged again with the signing of executive orders by President Trump late last week. What do the executive orders require, and what is the impact on the pharmaceutical industry?

Drug-pricing reform re-surfaces

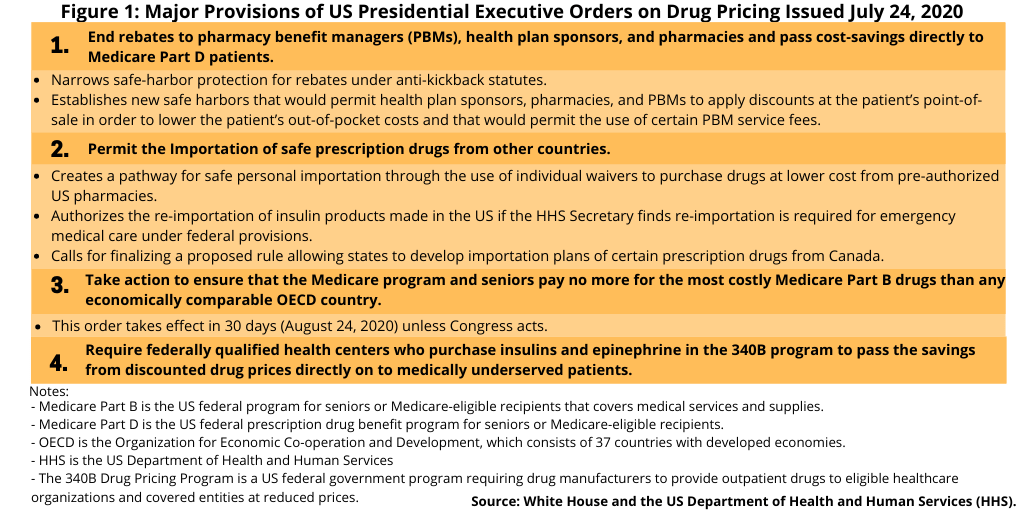

Drug-pricing reforms in the US, which has been on the policy agenda in both the White House and Congress, re-surfaced late last week (July 24, 2020) with President Donald Trump signing several executive orders (see Figure 1), which include limiting the use or rebates and linking drug pricing in the US to international pricing. The latter measure received strong criticism from the pharmaceutical industry, which says such actions would deter innovation.

Drug-pricing reform has been on the policy agenda with both a plan from the White House and several legislative proposals, but has recently taken a back seat to the government response to the novel coronavirus (COVID-19) pandemic. In May 2018, the Trump Administration and the US Department of Health and Human Services (HHS) put forth a plan, a Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs, which laid out four strategies: boosting competition, enhancing negotiation, creating incentives for lower list prices, and bringing down out-of-pocket costs. Congress, too, has taken some action with the introduction of legislation although no legislation has been passed by both houses of Congress. Perhaps the most prominent bill is the Elijah E. Cummings Lower Drug Costs Now Act (H.R.3), which was passed by the US House of Representatives in December 2019. The bill, which has been referred to the Senate, where it still sits, would establish a fair price negotiation program, put in protections from excessive price increases under the Medicare program (the US federal healthcare program for people over the age of 65), and establish an out-of-pocket maximum for enrollees of Medicare Part D (the prescription drug program under Medicare).

The executive orders signed earlier this month (July 2020) bring elements of both the Administration’s earlier blueprint and Congressional proposals, along with some new measures, into the policy wheel although specific actionable elements need to be further defined. Key measures (see Figure 1) include: (1) ending rebates to pharmacy benefit managers (PBMs), health plan sponsors, and pharmacies and pass cost-savings directly to Medicare Part D patients; (2) taking action to ensure that the costs of Medicare Part B drugs (i.e, prescription drugs covered under Medicare B, which covers medical services and suppliers, include non-outpatient drugs administered in a clinical setting, such as a doctor’s office or hospital) are economically comparable to drug prices from countries in the Organization for Economic Co-operation and Development (OECD); (3) putting into place measures for the safe importation of certain prescription drugs from other countries, including Canada; and (4) requiring federally qualified health centers that purchase insulins and epinephrine in the 340B program (a US federal government program requiring drug manufacturers to provide outpatient drugs to eligible healthcare organizations and covered entities at reduced prices) and pass the savings from discounted drug prices directly on to patients.

Of these measures, perhaps the one that has drawn the sharpest rebuke from the industry is the one linking US drug pricing to international drug pricing. This executive order, which would take effect in 30 days (August 24, 2020) unless Congress acts, did not provide details on how that would occur but only specified that the Administration would take action to ensure that the cost of Medicare Part B drugs (drugs administered in a clinical setting) be no more than drugs in other OECD countries (the OECD consists of 37 developed countries).

This executive order, although not specifying further details other than authorizing the HHS to take necessary action, re-visits a proposal made earlier by the Trump Administration in 2018 that called for the costs of Medicare Part B drugs be based on the prices paid in other advanced industrial countries through the establishment of an international price index. This index would be used as the basis to determine the costs for drugs covered under Medicare Part B, which covers medical services and supplies, and therefore would include non-outpatient drugs, meaning drugs administered in a doctor’s office or hospital.

Industry feedback

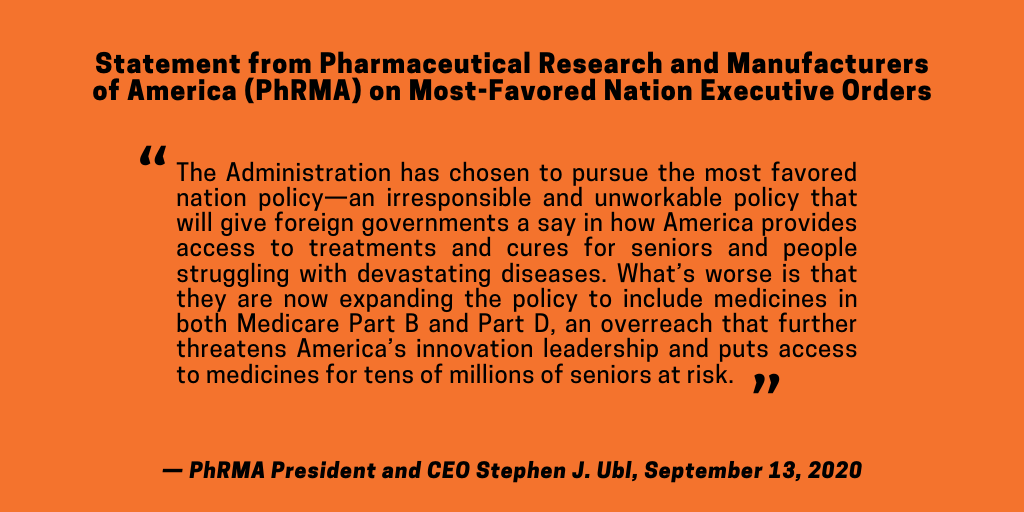

Linking US drug pricing to international drug prices is a measure strongly opposed by the pharmaceutical industry. “…[I]n the middle of a global pandemic, when nearly 145,000 Americans have lost their lives and millions of others have suffered untold economic hardships, this administration has decided to pursue a radical and dangerous policy to set prices based on rates paid in countries that he has labeled as socialist, which will harm patients today and into the future,” said Pharmaceutical Research and Manufacturers of America (PhRMA) President and CEO Stephen J. Ubl in a July 24, 2020 statement. PhRMA is the US-based trade association representing innovator, research-based pharmaceutical companies.

Pharmaceutical industry officials also say the President’s executive orders and move for drug-pricing reform would have a negative impact on innovation, and in light of the COVID-19 pandemic, comes at a time when innovation is of particular importance. “The research-based biopharmaceutical industry has been working around the clock to develop therapeutics and vaccines to treat and prevent COVID-19,” PhRMA’s Ubl said in his statement. “The administration’s proposal today [July 24, 2020] is a reckless distraction that impedes our ability to respond to the current pandemic – and those we could face in the future. It jeopardizes American leadership that rewards risk-taking and innovation and threatens the hope of patients who need better treatments and cures.”

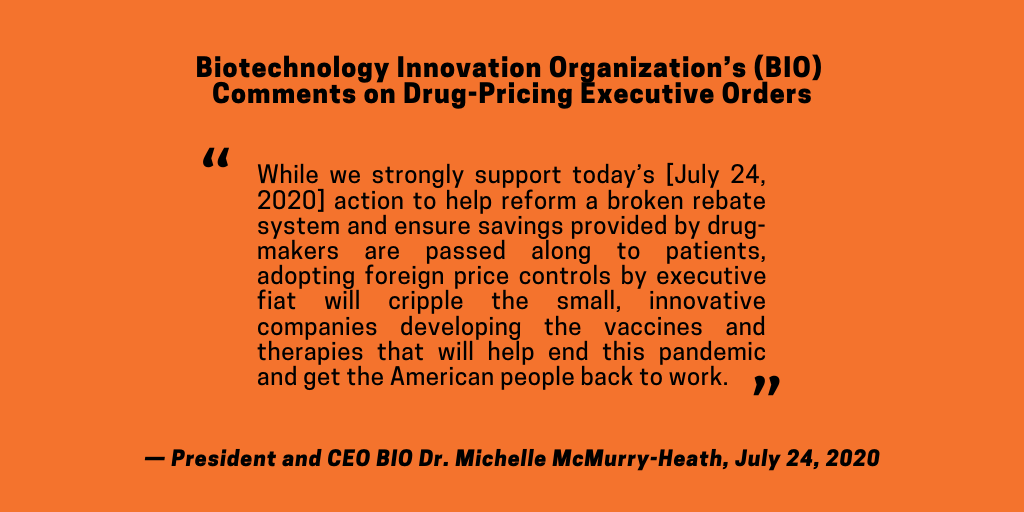

The negative impact on innovation and also the timing and manner in which the executive orders were issued was also criticized by the Biotechnology Innovation Organization (BIO), which is the US-based trade association representing the biotechnology industry, including biopharmaceutical companies. “While we strongly support today’s [July 24, 2020] action to help reform a broken rebate system and ensure savings provided by drug-makers are passed along to patients, adopting foreign price controls by executive fiat will cripple the small, innovative companies developing the vaccines and therapies that will help end this pandemic and get the American people back to work,” said Dr. Michelle McMurry-Heath, President and CEO, BIO, in a July 24, 2020 statement. She raised these and other concerns in a letter to President Trump, which urged the President to abandon any further implementation of the executive order imposing foreign price controls.

Other measures in the executive orders

A set of measures in another executive order would allow for the safe importation of prescription drugs from other countries, including Canada (see Figure 1). This executive order authorizes the HHS to do the following: (1) create a pathway for safe personal importation through the use of individual waivers to purchase drugs at lower cost from pre-authorized US pharmacies; (2) permit the re-importation of insulin products made in the US if the HHS Secretary finds re-importation is required for emergency medical care under federal provisions; and (3) finalize a proposed rule allowing states to develop importation plans of certain prescription drugs from Canada.

This executive order builds on measures announced by the Trump Administration late last year (2019). In December 2019, the Administration, the HHS, and the US Food and Drug Administration (FDA) issued a notice of proposed rulemaking (NPRM) that, if finalized, would allow for the importation of certain prescription drugs from Canada. In addition, the Administration announced the availability of a new draft guidance that describes procedures that drug manufacturers can follow to facilitate importation of prescription drugs, including biological products, that are FDA-approved, manufactured abroad, authorized for sale in any foreign country, and originally intended for sale in that foreign country.

Measures to facilitate drug importation are viewed as a means to increase drug competition and, therefore, potentially resulting in lower drug pricing in the US. “One way to minimize international disparities in price is to increase the trade of prescription drugs between nations with lower prices and those with persistently higher ones,” said President Trump in his executive order. “Over time, reducing trade barriers and increasing the exchange of drugs will likely result in lower prices for the country that is paying more for drugs. For example, in the European Union, a market characterized by price controls and significant barriers to entry, the parallel trade of drugs has existed for decades and has been estimated to reduce the price of certain drugs by up to 20%. Accordingly, my Administration supports the goal of safe importation of prescription drugs.”

Last year (July 2019), the FDA announced the Safe Importation Action Plan, which outlines two potential pathways that would lay the foundation for the safe importation of certain drugs originally intended for foreign markets. The first pathway, via the rule-making process, would authorize demonstration projects to allow importation of drugs from Canada and would include conditions to ensure the importation poses no additional risk to the public’s health and safety. Under the second pathway, manufacturers could import versions of FDA-approved drug products that they sell in foreign countries that are the same as the US versions. Under this pathway, manufacturers would use a new National Drug Code for those products, thereby potentially allowing them to offer a lower price than what their current distribution contracts require.

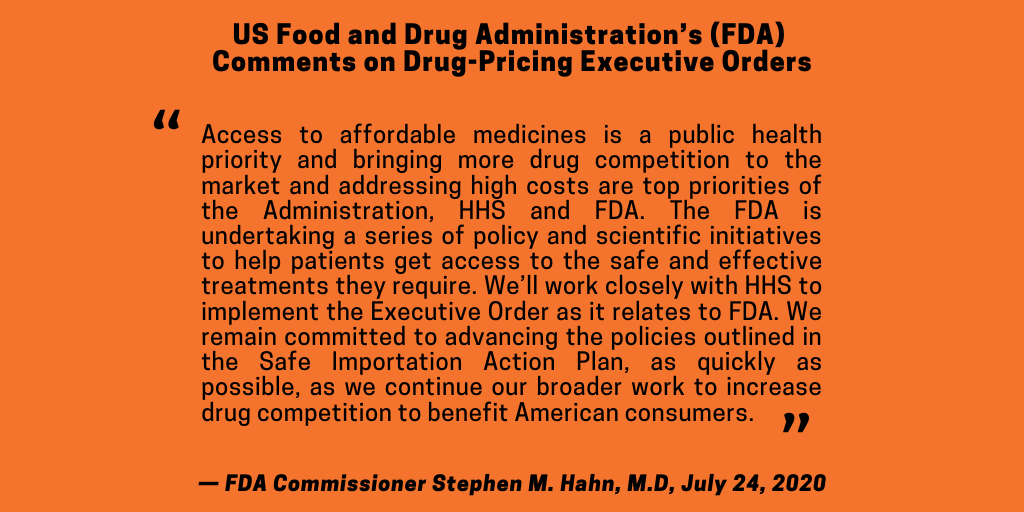

FDA Commissioner Stephen Hahn said that the agency supports the Administration’s recent executive order and the role of the FDA in implementing safe drug-importation measures. “The FDA is undertaking a series of policy and scientific initiatives to help patients get access to the safe and effective treatments they require. We’ll work closely with HHS to implement the Executive Order as it relates to FDA,” said Hahn in a July 24, 2020 statement. “We remain committed to advancing the policies outlined in the Safe Importation Action Plan as quickly as possible as we continue our broader work to increase drug competition to benefit American consumers.”

The other important policy move in the executive orders relates to removing safe-harbor provisions for drug rebates. An executive order directs the HHS to narrow safe-harbor protection for rebates for drugs under Medicare Part D (the US federal prescription drug benefit for people 65 or older) under anti-kickback statutes. It also authorizes the HHS to establish new safe harbors that would require health plan sponsors, pharmacies, and pharmacy benefit mangers (PBM) to apply discounts at the patient’s point-of-sale in order to lower the patient’s out-of-pocket costs and would permit the use of certain PBM service fees.

Reforming the rebate system has been an area of policy consensus among the pharmaceutical industry, Congress, and the Trump Administration as a means to reduce out-of-pocket costs through prescriptions filled both through private insurance and government programs, such as Medicare Part D, the US federal prescription-drug plan for people aged 65 or older. In Congressional testimony last year (2019), industry executives pointed to problems in the current system in which they say rebates and discounts for prescription drugs that drug manufacturers provide to PBMs and insurance companies are not passed onto consumers, thereby resulting in high out-of-pocket costs. The aim of this executive order is to respond to higher drug prices due to what the Administration calls “a complex mix of payers and negotiators that often separates the consumer from the manufacturer in the drug-purchasing process.”