President Biden Calls for Review of US Drug Supply Chain

Supply-chain vulnerabilities exposed during the COVID-19 pandemic as well as those existing pre-pandemic were behind an executive order signed by President Joe Biden late last month (February 2021) to require a 100-day supply-chain review of four product areas, including pharmaceuticals and ingredients, as well as longer-term sectorial reviews.

Short-term review of US drug supply chain

President Joe Biden’s executive order issued on February 24, 2021 puts into an action a review of the US drug supply chain, both a short-term review and a longer-term sectorial assessment.

”The United States needs resilient, diverse, and secure supply chains to ensure our economic prosperity and national security,” said the President’s executive order issued on February 24, 2021, in outlining the rationale and policy goals behind the order. “Pandemics and other biological threats, cyber-attacks, climate shocks and extreme weather events, terrorist attacks, geopolitical and economic competition, and other conditions can reduce critical manufacturing capacity and the availability and integrity of critical goods, products, and services. Resilient American supply chains will revitalize and rebuild domestic manufacturing capacity, maintain America’s competitive edge in research and development, and create well-paying jobs. They will also support small businesses, promote prosperity, advance the fight against climate change, and encourage economic growth in communities of color and economically distressed areas.”

The first part of the executive order is a 100-day review, which is intended to identify near-term steps the Administration can take, including with Congress, to address vulnerabilities in supply chains. In addition to pharmaceuticals and ingredients, the other product areas for the 100-day supply-chain review are semiconductors, key minerals and materials, such as rare-earth metals, and advanced batteries, such as those used in electric vehicles.

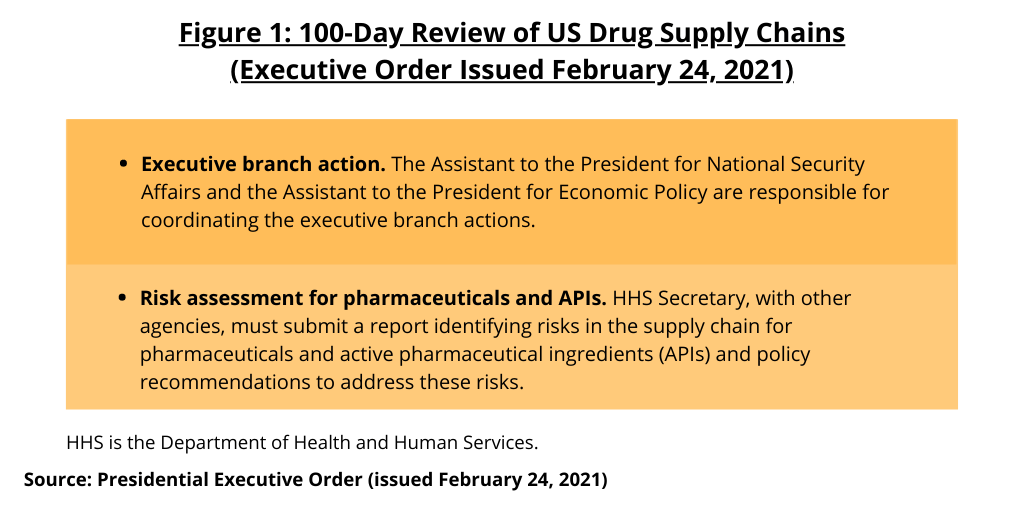

Under the executive order, for pharmaceuticals, the Secretary of Health of Health and Human Services, with other agencies, must submit a report identifying risks in the supply chain for pharmaceuticals and active pharmaceutical ingredients (APIs) and policy recommendations to address these risks (see Figure 1). Overall, the Assistant to the President for National Security Affairs (APNSA) and the Assistant to the President for Economic Policy (APEP) are to coordinate the executive branch actions necessary to implement the order.

Longer-term sectorial supply-chain assessments

In addition, the executive order directs year-long reviews for six sectors, which includes the public health and biological preparedness industrial base. The other sectors are: the defense industrial base; the information and communications technology industrial base; the energy sector industrial base; the transportation industrial base; and supply chains for agricultural commodities and food production.

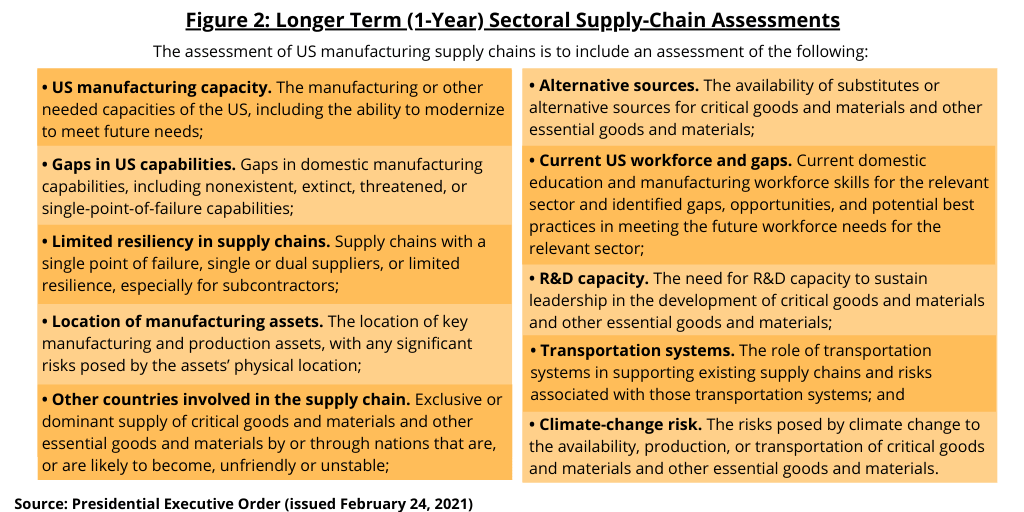

These sectoral reviews direct federal agencies and departments to review a variety of risks to supply chains and industrial bases (see Figure 2). Within 1 year of the date of executive order issued on February 24, 2021, the specified heads of agencies in these six sectors, which includes pharmaceuticals, are required to submit reports to the President, through the APNSA and the APEP. These reviews must identify critical goods and materials within supply chains, the manufacturing or other capabilities needed to produce those materials, as well as a variety of vulnerabilities created by failure to develop domestic capabilities. Federal agencies and departments are also directed to identify locations of key manufacturing and production assets, the availability of substitutes or alternative sources for critical goods, the state of workforce skills and identified gaps for all sectors, and the role of transportation systems in supporting supply chains and industrial bases. Additional details required in this assessment of US manufacturing supply chains are outlined below.

- US manufacturing capacity. The manufacturing or other needed capacities of the US, including the ability to modernize to meet future needs;

- Gaps in US capabilities. Gaps in domestic manufacturing capabilities, including nonexistent, extinct, threatened, or single-point-of-failure capabilities;

- Limited resiliency in supply chains. Supply chains with a single point of failure, single or dual suppliers, or limited resilience, especially for subcontractors;

- Location of manufacturing assets. The location of key manufacturing and production assets, with any significant risks posed by the assets’ physical location;

- Other countries involved in the supply chain. Exclusive or dominant supply of critical goods and materials and other essential goods and materials by or through nations that are, or are likely to become, unfriendly or unstable;

- Alternative sources. The availability of substitutes or alternative sources for critical goods and materials and other essential goods and materials;

- Current US workforce and gaps. Current domestic education and manufacturing workforce skills for the relevant sector and identified gaps, opportunities, and potential best practices in meeting the future workforce needs for the relevant sector;

- R&D capacity. The need for R&D capacity to sustain leadership in the development of critical goods and materials and other essential goods and materials;

- Transportation systems. The role of transportation systems in supporting existing supply chains and risks associated with those transportation systems; and

- Climate-change risk. The risks posed by climate change to the availability, production, or transportation of critical goods and materials and other essential goods and materials.

In addition, the supply-chain assessments also are to include whether there are possible avenues for international engagement with US allies and partners for the critical goods and materials and other essential goods and materials identified in the review of the given sector’s supply chain. In addition, the assessment should identify the primary causes of risks for any aspect of the relevant industrial base and supply chains assessed as vulnerable. The assessment should include a prioritization of the critical goods and materials and other essential goods and materials, including digital products for the purpose of identifying options and policy recommendations. The prioritization is to be based on statutory or regulatory requirements, importance to national security, emergency preparedness, and US policy.

Agencies are directed to make specific policy recommendations to address risks as well as proposals for new research and development (R&D) activities (see Figure 3). The executive order specifies that the policy recommendations for ensuring a resilient supply chain for a given sector should evaluate the following:

- Reshoring. Sustainably reshoring supply chains and developing domestic supplies;

- Alternative supply chains. Cooperating with allies and partners to identify alternative supply chains;

- Redundancy. Building redundancy into domestic supply chains;

- Stockpiles. Ensuring and enlarging stockpiles;

- Workforce. Developing workforce capabilities;

- Financing. Enhancing access to financing;

- R&D capacity. Expanding R&D to broaden supply chains;

- Digital-products risks. Addressing risks due to vulnerabilities in digital products relied on by supply chains;

- Climate-change risks. Addressing risks posed by climate change, and any other recommendations;

- US government support and policy. Any executive, legislative, regulatory, policy changes and any other actions needed to strengthen capabilities; and

- Other US government efforts. Proposals for improving the US government-wide effort to strengthen supply chains.

Going forward, after this initial 1-year view of supply chains, the executive order specifies that the US government also plans to conduct regular, ongoing reviews of supply-chain resilience, including a quadrennial review process.

Industry feedback

Industry feedback on the new executive order comes from the Association for Accessible Medicines (AAM), which represents generic-drug and biosimilar manufacturers, which “strongly” supports the executive order. “The Executive Order is a prudent, considered approach to fully understanding the scope and capacity of current U.S. pharmaceutical manufacturing while identifying specific vulnerabilities that can be targeted for resolution both immediately with the COVID-19 pandemic and longer-term as the country prepares for future public health challenges,” said the AAM in a February 25, 2021 statement. “The US government plays a critical role in encouraging the conditions that support domestic manufacturing of essential medicines. AAM believes that additional incentives, such as those included in our Blueprint for Enhancing the Security of the US Pharmaceutical Supply Chain, will be necessary as the US seeks to increase its role in the global pharmaceutical supply chain.”

Last April (April 2020), the AAM issued its Blueprint for Enhancing the Security of the US Pharmaceutical Supply Chain, which included a proposal for re-shoring drug manufacturing of designated essential medicines in the US through various measures, such as providing tax incentives, grants, and volume guarantees to incentivize drug manufacturers and make re-shoring drug manufacturing economically feasible.

Looking ahead

It has yet to be seen what will emerge from the supply-chain reviews directed by this most recent executive order. In late January (January 2021), President Biden also issued an executive order to strengthen certain requirements that goods, materials, and products purchased by the US federal government be manufactured in the US. That executive order applies only to federal procurement of goods, materials, and products, so for the pharmaceutical industry, the direct impact of that order thus far would apply only to those products purchased by federal agencies of the US government.

Under the previous Administration, there were several executive orders to increase US-based drug manufacturing for essential drugs. In 2020, President Donald Trump issued an executive order that set forth the policy goals and authorization by certain federal departments and agencies, including the US Department of Health and Human Services and the US Food and Drug Administration, to increase US-based production and federal procurement of essential medicines, medical countermeasures, and critical inputs and to limit federal procurement for such products to be made in the US. The HHS/FDA was charged to identify a list of essential medicines, medical countermeasures, and critical inputs (inclusive of active pharmaceutical ingredients [APIs]) that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage forms. The FDA issued such a list, subject to public comment, compromised of 223 drugs and biological products, primarily generic drugs.

What measures the Biden Administration may take or not as it specifically relates to pharmaceuticals and US-based drug manufacturing is a key policy issue to continue to watch for as both the short-term and longer-term supply-chain assessments are made per the February 2021 executive order.