Pharma Pulse: Top-Selling Small Molecules & Biologics

How do small molecules and biologics rank among the projected top-selling products for 2022? Which products will be the greatest new sales generators? A look at the projections and products.

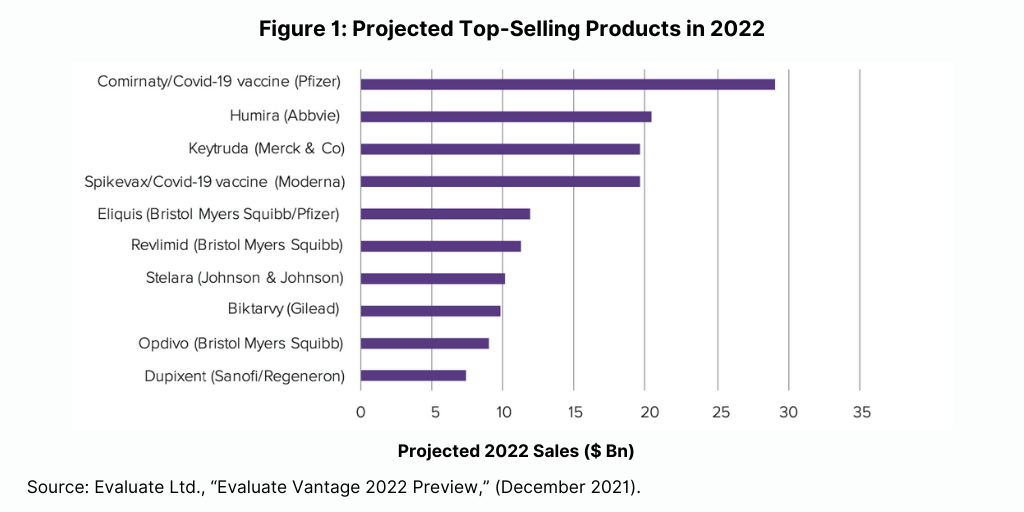

Projected top-selling drugs in 2022

A recent analysis by Evaluate Ltd, Evaluate Vantage 2022 Preview, highlights the 10 top-selling products for 2022 (see Figure 1). Of these 10 products, seven are biologics, and three are small molecules.

As might be expected on top of the list is Comirnaty, Pfizer’s/BioNTech’s mRNA COVID-19 vaccine. Moderna’s mRNA COVID-19 vaccine, Spikevax, also is projected to be one of the top-selling products of 2022.

In addition to these two vaccines, five biologic-based drugs are projected to be among the top-selling products. These include what had been the industry’s top-selling product prior to Pfizer’s/BioNTech’s COVID-19 vaccine, AbbVie’s Humira (adalimumab) for treating arthritis, plaque psoriasis, ankylosing spondylitis, Crohn’s disease, and ulcerative colitis. Two immuno-oncology drugs are also among the projected top selling drugs: Merck & Co.’s Keytruda (pembrolizumab) and Bristol-Myers Squibb’s Opdivo (nivolumab). The two other top-selling biologics projected for 2022 are Johnson & Johnson’s Stelara (ustekinumab) for treating plaque psoriasis and psoriatic arthritis and Sanofi’s and Regeneron’s Dupixent (dupilumab) for treating eczema, asthma, and nasal polyps that result in chronic sinusitis.

Three small-molecule drugs are among the 10 top-selling products projected for 2022. These include two drugs by Bristol-Myers Squibb: Revlimid (lenalidomide) for treating myelodysplastic syndrome, multiple myeloma, and mantle cell lymphoma and Eliquis (apixaban), an anticoagulant, which BMS is partnered with Pfizer. The other top-selling small-molecule drug projected for 2022 is Gilead Sciences’ combination drug for treating HIV, Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide).

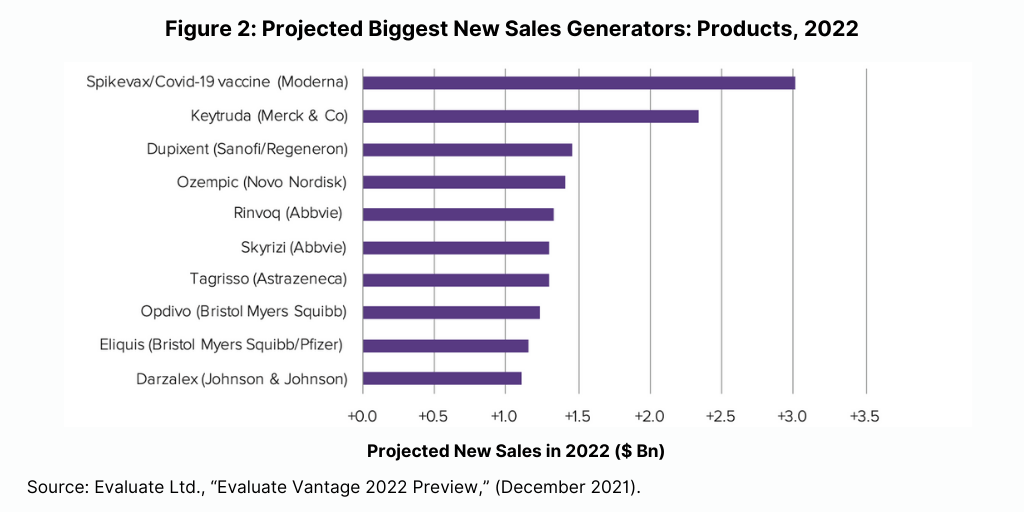

The Evaluate Vantage analysis also looked at which drugs would be the biggest new sales generators projected for 2022 (see Figure 2). Among the 10 top new sales generators projected for 2022, meaning those products that will generate the greatest new sales in 2022 over the prior year, biologic-based drugs again dominate. Seven of the top new sales generators projected for 2022 are biologics, and three are small molecules.

Moderna’s COVID vaccine is the top new sales generator in 2022, and six other biologics are in the top 10. These include several of the top-selling products projected for 2022 based on absolute sales: Merck & Co.’s Keytruda (pembrolizumab), Bristol-Myers Squibb’ Opdivo, and Sanofi’s/Regeneron Pharmaceuticals’ Dupixent. Other biologics projected to generate the greatest new sales in 2022 are: Novo Nordisk’s Ozempic (nivolumab) for treating Type II diabetes; AbbVie’s/Boehringer Ingelheim’s Skyrizi (risankizumab) for treating moderate-to-severe plaque psoriasis and psoriatic arthritis; and Johnson & Johnson’s Darzalex (daratumumab) for treating multiple myeloma (see Figure 2).

The top new sales generators that are small molecules include: AbbVie’s Rinvoq (upadacitinib) for treating rheumatoid arthritis, psoriatic arthritis, and atopic dermatitis (eczema); AstraZeneca’s Tagrisso (osimertinib) for treating non-small cell lung cancer; and Bristol-Myers Squibb’s/Pfizer’s Eliquis (apixaban), the anticoagulant also projected as one of the top-selling products for 2022 in absolute terms (see Figure 2).

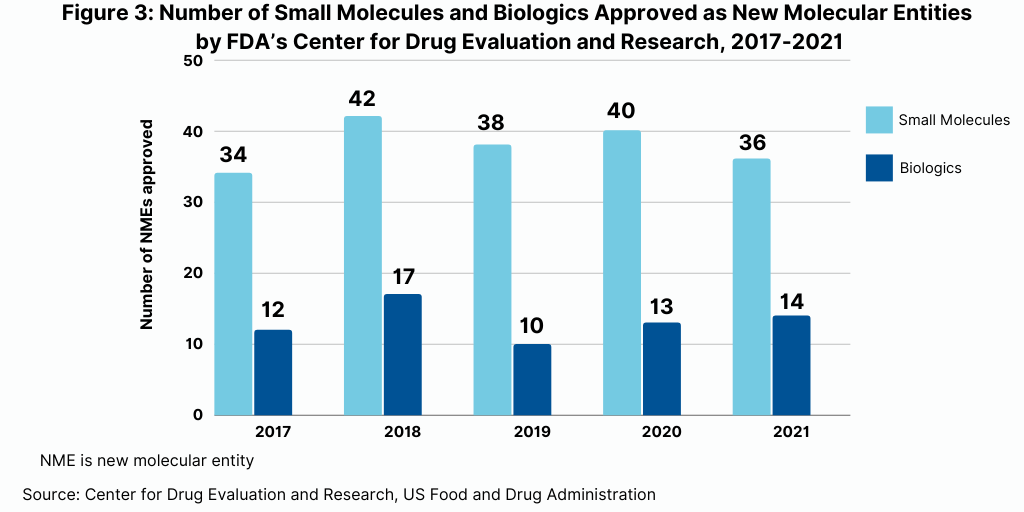

New drug approvals: small molecules and biologics

Although biologics lead among the top-selling products and new sales generators projected for 2022, small molecules continue to dominate in new drug approvals (see Figure 3). Of the 50 new molecular entities approved by the US Food and Drug Administration’s Center for Drug Evaluation and Research in 2021, 36, or 72%, were small molecules, and 14, or 28%, were biologics. This continues a recent trend of having approximately three-fourths of NME approvals be small molecules. In 2020, 75% or 40 of the 53 NMEs were small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71% and 74% in 2017.