Pharma Industry Outlook: The Challenges and Opportunities

At DCAT Week 2022, Graham Lewis, IQVIA, provided a market outlook for the global bio/pharma industry: the growth opportunities and challenges. What is projected for the near term?

After responding to the COVID-19 pandemic for the past two years, the global bio/pharmaceutical industry is now facing a “new normal” in 2023 that will require changes in commercial strategy and execution. Growth prospects are being impacted by several key issues: current healthcare expenditures not being sustainable in real terms, lower net sales resulting largely from discounting in the US market, an upcoming patent cliff resulting in increased generic-drug and biosimilar incursion, and a changing healthcare landscape in the patient–physician–payer environment. Those were some key takeaways from Graham Lewis, Vice President of Global Pharma Strategy, IQVIA, who provided a market overview at the Pharma Industry Outlook program at DCAT Week 2022, the flagship event of the Drug, Chemical & Associated Technologies Association (DCAT), which was held March 21–24, 2022.

Impact on COVID-19: what it means going forward

A key issue shaping growth prospects in the global bio/pharma market will be national healthcare budgets and financing as governments face pressures not only in their own healthcare spending but also from competing national priorities as geopolitical conditions evolve.

IQVIA’s Lewis pointed to signs of budgetary tensions within healthcare budgets and between competing expenditure sectors. Despite achieving high rates of COVID-19 vaccination (more than 50% globally and more than 65% in developed countries), governments continue to incur direct and indirect costs from spiking COVID-19 infections, which are putting further pressure on national healthcare budgets. Between 2021 and 2026, IQVIA estimates $250 billion in global COVID-19 incremental spending on vaccines alone.

Countries will not only face pressure from their healthcare budgets but also from other national priorities. “Healthcare budgets are expected to be constrained, and in the light of recent events, further pressure is expected as countries announce increases in defense budgets, and also in clawing back the educational deficit caused by COVID-19,” Lewis said.

At the same time, the COVID-19 pandemic has caused a huge increase in patient backlogs stemming from a reduction in screening and diagnoses on a massive scale, which has also resulted in significant numbers of patients being diagnosed at later stages of disease. To illustrate, Lewis pointed to some statistics from the US healthcare market. In the first half of 2021, there was a 270 million diagnostics gap in the US, reflecting a 10.7% decrease in diagnostic visits. The confluence of all these issues—the continued impact of COVID-19 and increased patient backlogs—is adding considerable pressure to healthcare budgets and will distort pharmaceutical markets until 2024, said Lewis.

Global bio/pharma market performance

Despite these pressures, global pharma sales (excluding vaccines), measured at ex-manufacturers’ prices, were above expectations in 2021 in every region, both on a value and volume basis. Overall, global pharma sales increased 8% in value and 4% in volume in 2021, according to IQVIA information.

In most regions, growth approximated to the average of 8%. The exception was Latin America, which grew by 20% (as measured at ex-manufacturers’ prices in US dollars).

Overall, the global pharma market is projected to reach $1.7 trillion in 2025, excluding vaccines (at constant dollar, ex-manufacturers’ prices), with the US and China representing more than 50% of the global market.

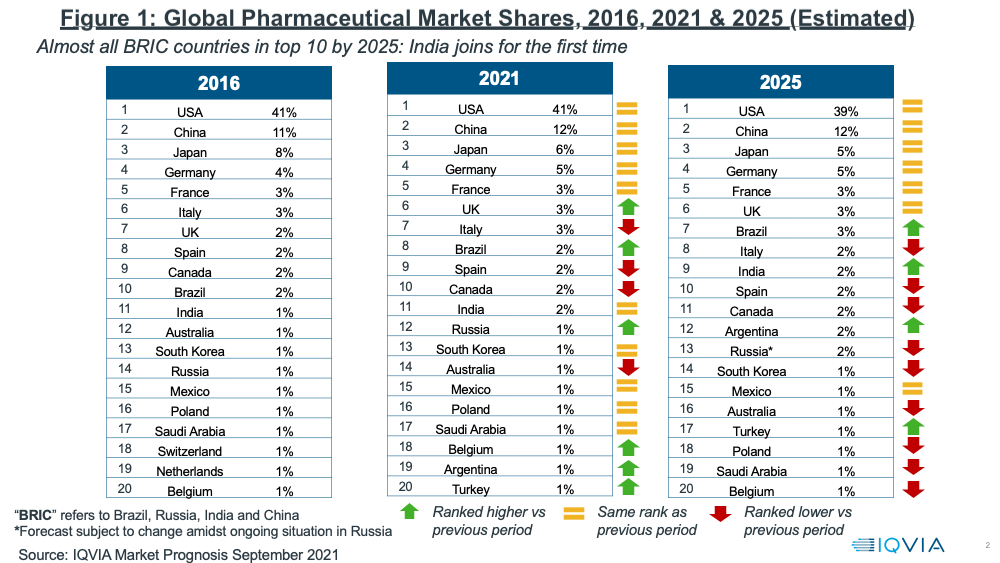

Lewis noted that a key change projected in 2025 is the rise of India to one of the top 10 countries in the global pharma industry, surpassing Canada, which drops outside the top 10 to number 11. In addition to China, India joins another BRIC country, Brazil, which rises to number seven in the global market in 2025, up from number eight in 2021. China retains its position as the number two ranked market. Japan, the EU 4 (France, Germany, Italy, and Spain), and the UK round out the other top 10 pharma markets both in 2021 and projected for 2025 (see Figure 1).

Growth prospects in key therapeutic areas

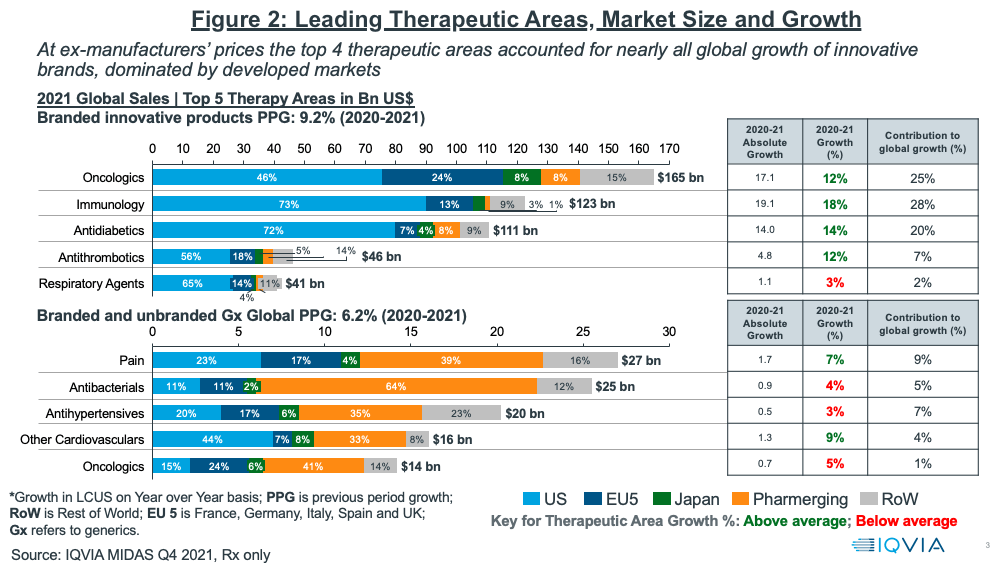

In looking at growth prospects on a therapeutic area basis, oncology continues to be the leading sector, both on an absolute level and growth basis (see Figure 2). Oncology and three other therapeutic areas (immunology, anti-diabetics, and anti-thrombotics) accounted for nearly all of global growth of innovative brands in 2020–2021, which was dominated by developed markets (as measured at ex-manufacturers’ prices). Combined, these four therapeutic areas accounted for 80% of the growth in innovative brands. Growing rebates, especially in the US, however, has been and will be a major challenge to growth in net sales. This is particularly noticeable in diabetes, where estimates suggest average rebates are above 50%.

For branded and unbranded generics, the top four therapeutics areas in 2020–2021 were pain management, anti-bacterials, anti-hypertensives, and other cardiovascular medicines. Combined, these four areas accounted for 25% of the growth in generics (see Figure 2).

Key trends going forward: a changing healthcare landscape

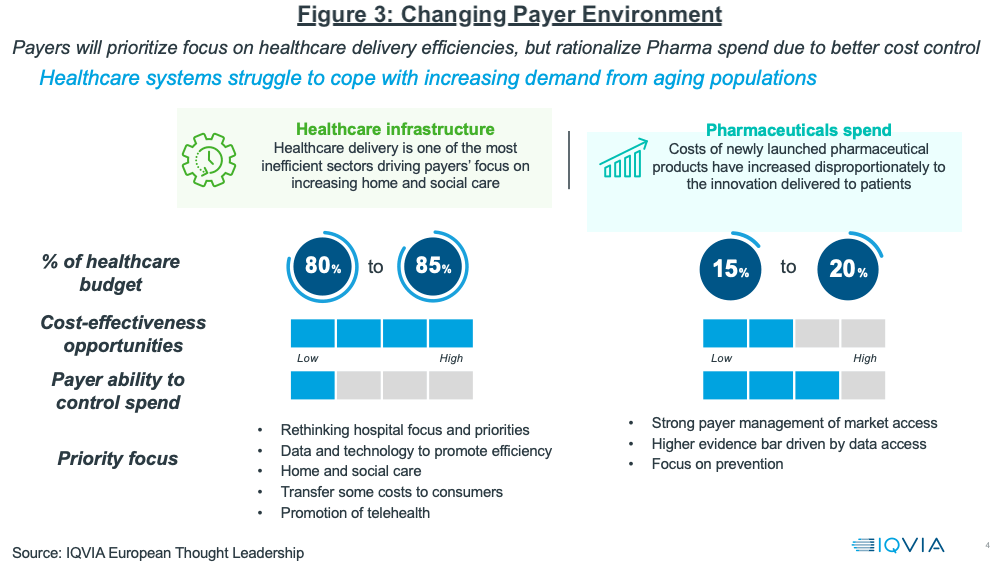

Growth prospects in developed markets will continue to be influenced by a changing healthcare landscape, noted Lewis. Payers will prioritize their focus on healthcare delivery efficiencies, but rationalize pharma spending to achieve better cost control. Figure 3 outlines the key issues at play, ultimately resulting in more payer influence in pharma spending levels. Payer management of pharmaceuticals is expected to increase with stricter market access and pricing pressure, and some healthcare costs and responsibility for healthcare will be redirected to consumers.

In the US, Lewis explained that market access is becoming increasingly restrictive, pointing to several noteworthy trends: a 4x increase in the number of drug exclusions among key payers and increases in

formulary exclusions, even for oncology, once a protected class, with approximately 60 excluded products in 2021. In Europe, Lewis noted that payers are expected to promote generics and biosimilars more aggressively as healthcare cost containment remains a key issue.

Generics and the upcoming patent cliff

A focus on healthcare cost containment from both payers and national governments bodes well for generics, but that sector continues to face competitive pressures, Lewis noted. “Generic sales are growing slowly while fragmenting competition disrupts return on investment,” he explained. On a value basis, the global generics market in 2021 was $305 billion, according to IQVIA estimates, up from a 2016 level of $265 billion. The developed markets of the US, Japan, the EU 4 (France, Germany, Italy, and Spain), and the UK, accounted for a combined 46% of the $305-billion global generics market in 2021.

The generics sector, always highly cost competitive, continues to see pricing pressures, particularly in the US. Lewis noted that Indian manufacturers have gained significant share of the US market since 2016, driven by a lower cost base that has allowed for aggressive price discounting. Prices have declined by more than 30% since 2016.

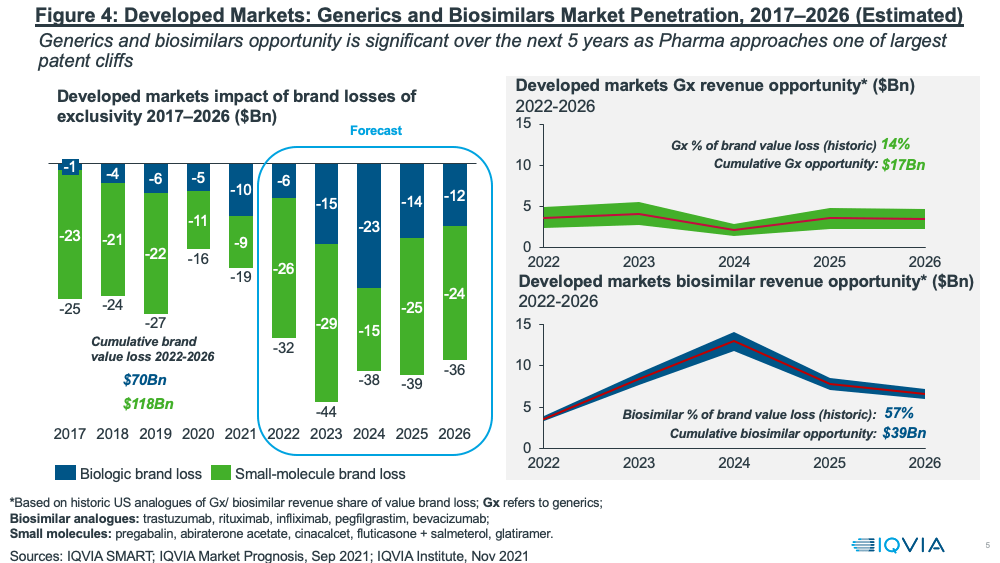

Despite these pressures, the near-term fortunes of the generics and biosimilars sector will largely rest on one of the largest patent cliffs upcoming over the next five years (2022–2026) with a cumulative brand loss by innovators of $188 billion (see Figure 4). The resulting revenue opportunities for the generics and biosimilar sectors are significant: $17 billion for generics and $39 billion for biosimilars for the period 2022–2026, according to IQVIA estimates.

Implications for the bio/pharma industry in the near term

Looking forward, the bio/pharma industry will need to build from 2021 as it seeks to respond to a changing healthcare environment, one that will seek to create new customer/patient engagement models, including through increased digitalization to achieve that better engagement.

There are major opportunities for innovative products as healthcare management seeks more predictable and cost-effective solutions. Pipelines, especially in oncology, autoimmune, and central nervous system (CNS) drugs, are very strong. Significant opportunities though have arisen as a direct consequence of COVID-19. In particular, healthcare management is reviewing its strategies regarding how hospital systems can focus more efficiently by looking for medicines and diagnostics that can be delivered effectively in the ambulant environment. Simpler dosing modalities offer a big opportunity in this regard, especially in biologics.

While the performance of the top 15 Pharma companies was strong in 2021, product-launch sales trajectories of non-COVID-19 products in 2020-2021 were significantly below historic averages. Significant falls in diagnoses and in new and brand prescriptions, as well as constrained engagements between healthcare professionals and Pharma, all contributed to less than predicted sales from most new launches. Next year (2023) will see an upsurge in the utilization of the many new innovative products that have been made available during the COVID-19 pandemic, noted Lewis.

Going forward, redefining customer engagement is a top priority for Pharma as customer preferences vary significantly, which will involve increased digitalization and data usage to achieve that engagement and define those preferences. At the same time, Pharma will have to align its R&D more closely with healthcare priorities as the industry and governments address healthcare budget priorities, COVID exhaustion, and patient backlogs, Lewis concluded.