Pharma Industry Faces Slower Growth, Changing Business Models

Graham Lewis, Vice President of Global Pharma Strategy, IQVIA, presented a challenging vision for drug companies at DCAT Week ’19 as the industry faces slowing global growth, evolving innovation strategies, and a more difficult US market, the largest global market, stemming from increased generics competition and pricing pressures.

The next 10 years will be a challenging period for the global pharmaceutical industry. Global biopharma companies will face increasing pressures on their top and bottom lines at a time when they will need to make fundamental changes in their business models. Broad changes in the healthcare industry demand investments in new skills and technologies.

That’s the message delivered by Graham Lewis, IQVIA’s Vice President of Global Pharma Strategy, who spoke at the DCAT Week ‘19 Pharma Industry Outlook education program, held on March 18 in New York. Lewis’ presentation kicked off DCAT Week with illuminating and thought-provoking insights into broad pharma industry trends.

|

|

Graham Lewis |

Slowing growth will define the immediate operating environment of pharmaceutical executives. Lewis expects the global pharmaceutical industry to grow at just 2-3% annually at net prices (after discounts, rebates, etc.) through 2022; that’s just half the rate of growth the industry experienced in the previous five-year period. The major driver of that slower growth is the increasingly difficult conditions in the US market as major products lose patent protection, and public and private payers ratchet up efforts to control prices and utilization.

Primary care therapies lead the way down

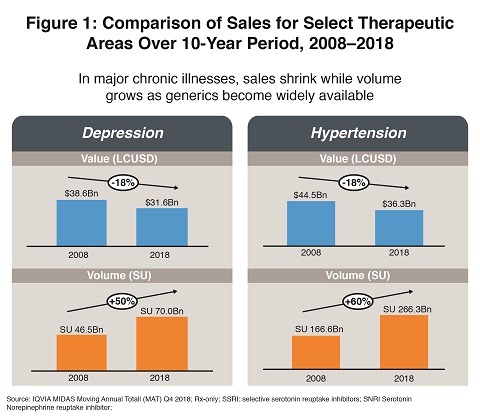

The downward pressure on prices in the US is especially severe for drugs that treat chronic illnesses affecting large populations, including diabetes, hypertension and depression. Branded and generic drugs for these diseases are experiencing sharp declines in revenues even as unit volumes continue to rise. Lewis expects the patent-protected branded drug sector in the US to experience overall price increases of no more than 3% annually for the next five years while generic drugs are unlikely to get any relief from the steady price erosion they have suffered in recent years. Even new molecular entities are not immune from these pricing pressures. Lewis showed that newly introduced products are sometimes priced below existing therapies and sponsors are employing novel strategies in order to gain market share. Figure 1 illustrates the competitive pricing pressures at play.

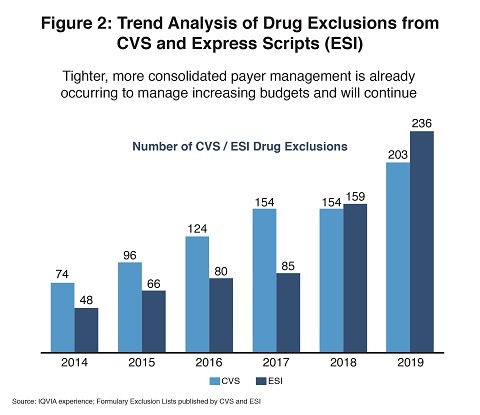

Public and private efforts to control drug prices are gaining considerable traction in the US. According to Lewis, patent-protected products are already selling at a 44% discount from their list prices, and generics are sold at 64% below list price. Consolidated payer management is already occurring to manage increasing budgets and will continue (see Figure 2) .

In the public sphere, the US Department of Health and Human Services (HHS), which administers the Medicare program, is proposing to eliminate the safe-harbor protection granted to drug companies for the rebates they pay to pharmacy benefit managers (PBMs). The proposed rule changes would allow discounts to be passed through directly to Medicare beneficiaries. The PBM’s trade association is fighting the changes, but some pharma organizations are supporting them.

Global opportunities limited

IQVIA’s Lewis doesn’t see much relief coming from markets outside the US. Europe, where governments are often the principal payers, has been experiencing slow growth for a number of years and won’t be doing better than the US. Japan, which is undergoing a shift in prescribing preferences from branded to generic drugs, will only grow at 1% annually. The most promising emerging countries which Lewis refers to as the “pharmerging” markets, are experiencing faster growth than the mature markets, but even in those countries, drugs that serve large populations are experiencing revenue declines despite growth in unit volumes. Further, the major global pharmaceutical companies have struggled to compete effectively against local and regional players.

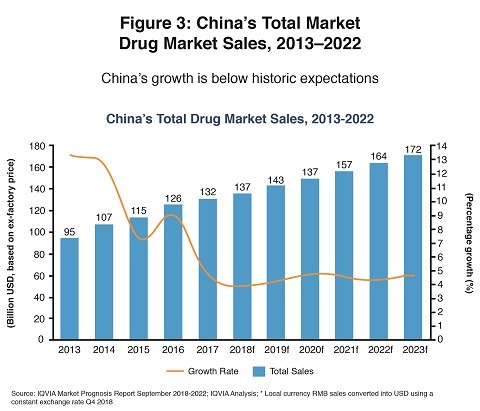

The one pharmerging market that shows promise is, not surprisingly, China. Lewis expects the pharmaceutical market in China likely to grow at 4-5% annually which, while nearly half of its growth in the past five years, is still faster than most major countries. Chinese authorities have increased their approvals of innovative medicines in recent years, and Chinese patients should especially benefit from greater access to oncology treatments. In addition, global biopharma companies have continued to invest in China, with varying degrees of success. Figure 3 shows recent and forecasted pharmaceutical growth in China.

Growing dominance of specialty drugs

The principal bright spot for the biopharma industry is specialty pharmaceuticals. These are generally drugs with well-defined but smaller populations, often targeted at narrow indications (e.g., orphan drugs), and often accompanied by a companion diagnostic or having a known biomarker. Specialty drugs include high-priced products, such as biologics and gene/cell therapies, and for expensive-to-treat indications, such as cancer, autoimmune diseases and rare diseases.

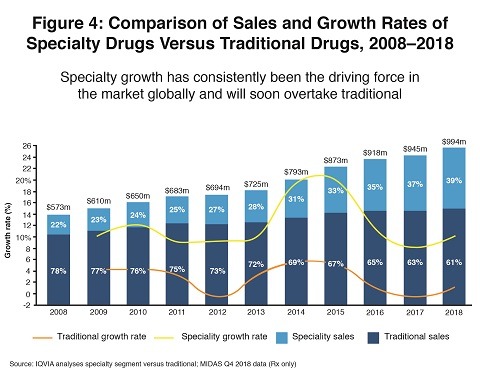

Specialty drugs are the most rapidly growing segment of the biopharma industry, according to Lewis, especially in mature markets. They will account for 50% of industry revenues in the US and Europe by 2023 (nearly doubling their share in just 10 years), and 40% in Japan, but only 20% in the pharmerging countries. Figure 4 shows increasing market share for specialty drugs in the global pharmaceutical market.

While specialty drugs hold great promise for the industry, they come with significant challenges. Unit volumes of these drugs are small, especially for orphan drugs, and the technologies for producing them are often new and highly specialized. Without the large populations and manufacturing scale economies of traditional pharmaceuticals, specialty drugs have to be priced at high levels. Some specialty pharmaceuticals have been approved after just a single Phase II trial, thanks to the US Food and Drug Administration’s breakthrough drug and other fast-track initiatives. This raises the risk that some of these drugs could be withdrawn from the market once broader experience is gained.

Filling the R&D gap is getting harder

The picture of the near-term outlook painted by Lewis will be challenging for everyone involved in the pharmaceutical industry, but it could be especially difficult for the large global biopharma companies which, by the nature of their size, have the most to lose. The pressure on their top-line revenue growth is likely to continue, but it comes at a time when it has become harder for them to discover, develop, and introduce significant new products. Lewis showed that research and development (R&D) productivity at global bio/pharma companies, as measured by revenues generated per dollar spent on R&D, has been falling for almost 15 years. And, he noted, the new products that are being introduced are on average generating less revenue than in the past.

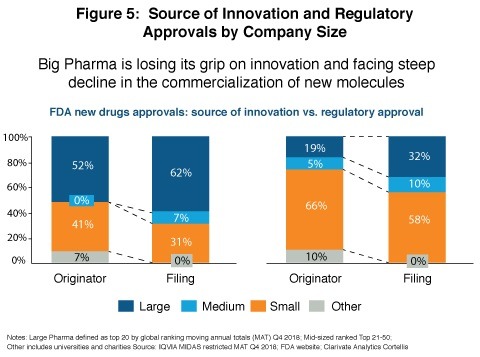

Traditionally, global biopharma companies have plugged the R&D gap by using their strong balance sheets to in-license or acquire promising candidates and companies. But today, small and mid-size pharma are more likely to hold onto their specialty pharmaceutical candidates right through to commercialization, rather than out-license them. That’s because external funding is readily available, and the targeted nature of specialty drugs makes their clinical development and marketing much less expensive. Lewis shared data that showed how dramatic the shift in balance of power has been (see Figure 5) :

- Large Pharma discovered themselves 52% of the pipelines in 2011 but just 19% in 2018 while small and mid-size pharmaceutical companies’ share grew from 41% to 71%; and

- Large Pharma commercialized 62% of newly approved drugs in 2011, but just 32% in 2018; small and mid-sized pharma companies’ share jumped from 38% to 68%.

The challenge of the near future

The pharmaceutical industry’s problems are coming at a time when the broader healthcare universe in which it operates is undergoing radical change. As Lewis explained at the beginning of his presentation, the enormous strides of the last 20 years in telecommunications networking, data collection and analysis, and artificial intelligence are finally being brought to bear on the enormous challenges facing the healthcare system, especially the high cost of treating an aging population that suffers from more chronic illnesses. Health systems and entrepreneurs are developing new delivery models that leverage the ability of mobile devices to continuously monitor a patient’s condition and compliance and deliver care in a more integrated fashion. Technology to bank and analyze enormous amounts of data is enabling more efficient drug discovery, more precise diagnoses, personalized care plans, and payment models based on patient outcomes.

In this changing healthcare environment, biopharmaceutical companies can no longer operate in isolation. They will have to work in cooperation with experts in communication technologies and advanced analytics. Real-world data and evidence will need to be at the core of clinical development and successful commercialization.

A key take-way is that biopharma companies will need to invest in these new skills while simultaneously maintaining their scientific core and the pipeline of new products. As Lewis noted in his conclusion, that will be a challenge unlike any faced by the pharmaceutical industry throughout its history.