Pharma Company on the Move: The New AbbVie

Following AbbVie’s $63-billion acquisition of Allergan, which closed earlier this month (May 2020), the new AbbVie, reflecting the combined companies, has projected revenues of $50 billion. DCAT Value Chain Insights examines the key products, both pipeline contenders and established products, for the new AbbVie and its combined manufacturing network.

Inside the deal

AbbVie’s $63-billion acquisition of Allergan, which was first announced in June 2019 and closed earlier this month (May 2020), positions AbbVie as it faces near-term biosimilars competition for its top-selling drug, Humira (adalimumab), a drug to treat autoimmune diseases in multiple indications. Humira had 2019 sales of approximately $19.2 billion, which accounted for 58% of AbbVie’s 2019 total revenues of $33.27 billion.

On a patent basis, the US composition of matter patent for Humira expired in December 2016, and the equivalent European Union (EU) patent expired in the majority of EU countries in October 2018. In the US, non-composition of matter patents covering adalimumab expire no earlier than 2022. AbbVie has entered into settlement and license agreements with several adalimumab biosimilar manufacturers under which license agreements in the US will begin in 2023; the license in Europe began in 2018.

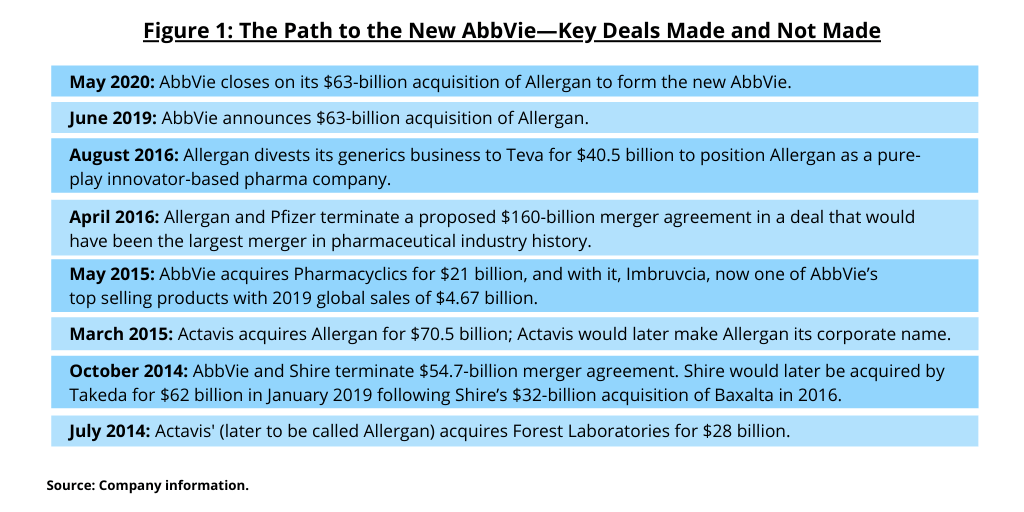

Facing biosimilar competition for Humira, AbbVie over the past several years has made acquisitions or tried to make acquisitions to diversify its product portfolio with near-term biosimilars competition for Humira (see Figure 1 ). Chief among them was its $21-billion acquisition of Pharmacyclics, a Silicon Valley, California-based company developing small-molecule medicines for the treatment of cancers and immune-mediated diseases. That deal, which was completed in 2015, provided AbbVie with Imbruvica (ibrutinib), co-developed with Johnson & Johnson, and now one of AbbVie’s top-selling products with 2019 global sales of $4.67 billion. The small-molecule drug binds permanently to a protein, Bruton’s tyrosine kinase, that is important in B cells and is used to treat B cell cancers, such as mantle cell lymphoma, chronic lymphocytic leukemia, and Waldenström’s macroglobulinemia.

Both Allergan and AbbVie had previously been involved in recent mega mergers that did not come to fruition and which were both called off due to uncertainty at the time of US policy for corporate inversions, a practice by which a US-based multinational company restructures so that the US parent is replaced by a foreign corporation as a means to achieve a lower tax rate. The potential of lower corporate tax rates was part of the rationale for Pfizer’s proposed $160-billion merger with Dublin, Ireland-headquartered Allergan in 2015, and in AbbVie’s proposed $55-billion acquisition of Jersey, UK-incorporated Shire in 2014. In 2016, Pfizer called off its proposed $160-billion merger with Allergan, which would have been the largest merger in the history of the pharmaceutical industry, and AbbVie called off its merger with Shire in 2014; Shire was later acquired by Takeda for $63 billion in a deal completed in January 2019 (see Figure 1 ).

Allergan’s path to now becoming part of AbbVie also involved several large-scale acquisitions to transform the company to be an innovator-based pharmaceutical company as opposed to generally a generics company. In 2015, Actavis, primarily a generic-drug manufacturer, acquired Allergan for $70.5 billion; Actavis would later make Allergan its corporate name. In 2014, Actavis (later to be called Allergan) began its strategy with product diversification to innovator drugs with the $28-billion acquisition of Forest Laboratories. Allergan, later in 2016, divested its generics business (the former Actavis generics business) to Teva for $40.5 billion to position Allergan as a pure-play innovator-based pharma company (see Figure 1).

Inside the new AbbVie

Following the acquisition of Allergan, the growth portfolios of AbbVie (ex-Humira) and Allergan have estimated combined revenues of $30 billion for the full-year 2020, and overall combined revenues are approximately $50 billion. The combined company has several key therapeutic areas: immunology, oncology, neuroscience, eye care, virology, women’s health and gastroenterology, in addition to products and services across Allergan’s aesthetics portfolio.

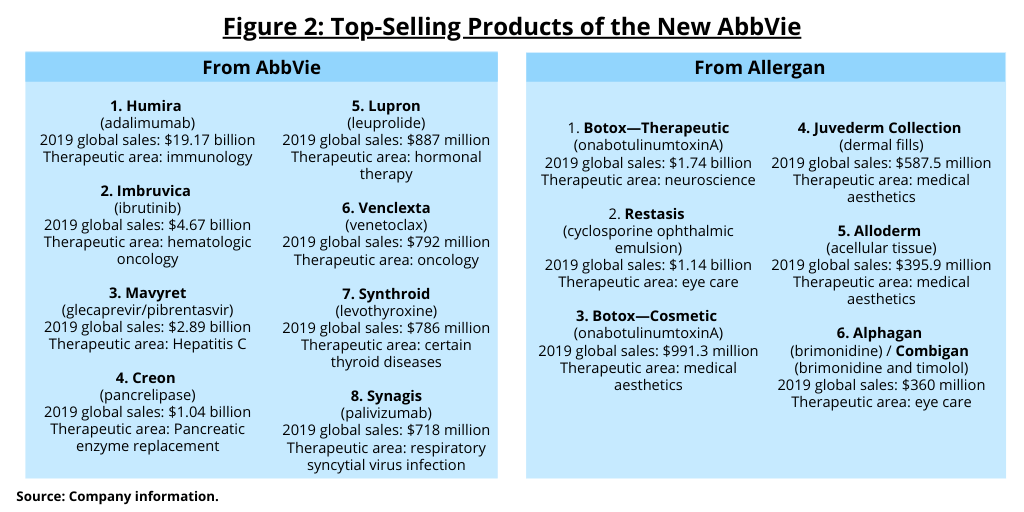

Figure 2 outlines the top-selling products of AbbVie and Allergan based on 2019 sales. Aside from Humira, which represents the mainstay of AbbVie’s current revenues, AbbVie has three other blockbuster drugs (defined as drugs with sales of $1 billion or more): Imbruvica (ibrutinib) with 2019 global sales of $4.67 billion to treat certain hematologic oncologic disorders; Mavyret (glecaprevir/pibrentasvir), a drug to treat hepatitis C, with 2019 global sales of $2.89 billion; and Creon (pancrelipase), a pancreatic enzyme replacement therapy with 2019 global sales of $1.04 billion.

For its part, Allergan has two blockbuster drugs: Restasis (cyclosporine ophthalmic emulsion), a drug to treat dry eyes with 2019 sales of $1.14 billion, but which faces generic competition, and Botox (onabotulinumtoxinA), approved for both medical and aesthetic uses and Allergan’s top-selling product with 2019 global sales for both uses of $2.73 billion.

Key to AbbVie going forward is further product diversification outside of Humira, gained not only through its acquisition of Allergan, but also by advancing recent product launches and pipeline products. In the immunology therapeutic space where Humira resides, key for AbbVie will be Skyrizi (risankizumab), which is indicated for the treatment of moderate-to-severe plaque psoriasis, and Rinvoq (upadacitinib), approved for moderate-to severe-active rheumatoid arthritis. Net revenues for Skyrizi were $355 million in 2019 following the April 2019 regulatory approvals for the treatment of moderate-to-severe plaque psoriasis. Net revenues for Rinvoq were $47 million in 2019 following the August 2019 FDA approval for the treatment of moderate-to-severe rheumatoid arthritis. AbbVie is advancing further indications for these drugs and projects $10-billion-plus in incremental risk-adjusted sales by 2025.

In its hematological oncology franchise in addition to Imbruvica, another recently launched drug with high potential is Venclexta (venetoclax), a drug to treat hematological malignancies, which some analysts have projected peak sales of $3 billion with patent protection lasting into the 2030s. The hematological oncology franchise for AbbVie is more than $4 billion currently on the strength of Imbruvica, and the company projects that its hematological oncology franchise may contribute $9 billion-plus in incremental risk-adjusted sales by 2025.

Another strong future product for AbbVie is Orilissa (elagolix) for treating endometriosis and uterine fibroids with projected $2 billion-plus in incremental risk-adjusted sales by 2025. Overall, on a pipeline basis, AbbVie’s pipeline (as of December 31, 2019) includes approximately 60 compounds or indications in clinical development individually or under collaboration or license agreements and is focused on immunology, oncology and neuroscience along with targeted investments in cystic fibrosis and women’s health. Of these programs, approximately 30 are in mid- and late-stage development as of December 31, 2019.

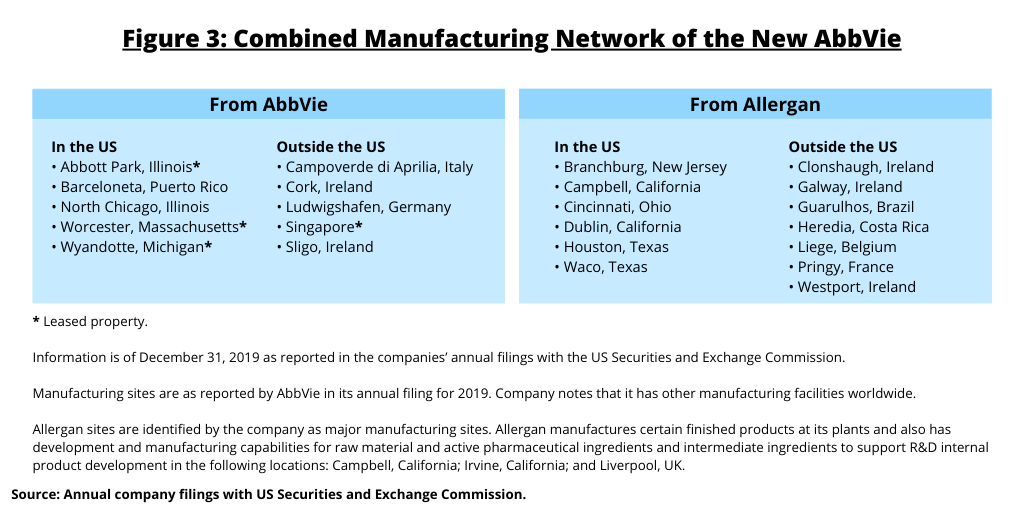

On the manufacturing front, the combined manufacturing network of the new AbbVie has facilities in the US (including Puerto Rico), Europe, Asia and Central and South America (see Figure 3).