Pharma Company on the Move: Alnylam Pharmaceuticals

Buoyed by $2 billion in funding by the private equity firm, Blackstone, a $1-billion partnering deal with Regeneron Pharmaceuticals, and potential gains from a possible blockbuster anti-cholesterol drug it has licensed to Novartis, Alnylam Pharmaceuticals is advancing its portfolio of RNAi medicines. What are the products, drug candidates, and deals leading the company’s way?

Inside Alnylam Pharmaceuticals

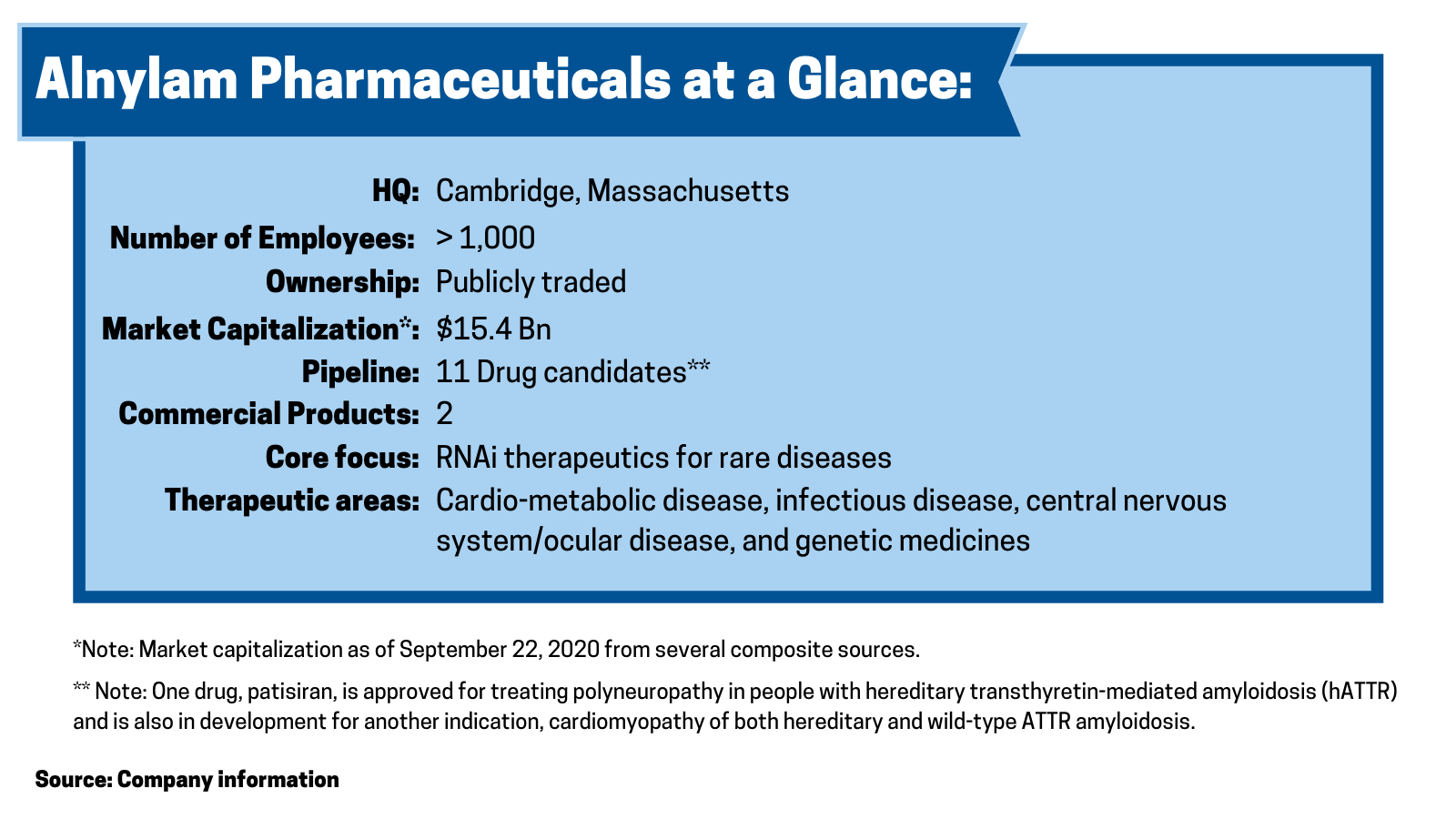

Alnylam Pharmaceuticals, a Cambridge, Massachusetts-based biopharmaceutical company focused on RNA interference (RNAi) therapeutics for rare diseases, has made significant moves thus far in 2020 and in 2019 to advance its portfolio of pipeline products.

Chief among its recent moves is a collaboration with Blackstone Life Sciences, a private investment firm, under which Blackstone will provide up to $2 billion to support Alnylam’s advancement of RNAi medicines. The deal was announced earlier this year (April 2020), and the companies closed on the R&D funding component of the deal ($150 million) in August (August 2020).

The deal is anchored by Blackstone’s purchase of 50% of the royalties owed to Alnylam on global sales of inclisiran, an investigational RNAi therapeutic for treating hypercholesterolemia (high cholesterol) currently under review by the US Food and Drug Administration. Inclisiran, which was originally developed by Alnylam, was subsequently added to Novartis’ pipeline via Novartis’ $9.7-billion acquisition of The Medicines Company earlier this year (January 2020). Novartis has global rights to develop, manufacture, and commercialize inclisiran under a license and collaboration agreement with Alnylam.

Inclisiran is a twice-a-year, subcutaneously injected RNAi therapeutic for treating familial hypercholesterolaemia, an inherited disorder that results in high levels of low-density lipoprotein cholesterol. It is slated by some analysts as a potential blockbuster. Projected 2024 sales, based on market entry in 2020, are $1.16 billion, according to a recent analysis (February 2020) by Clarivate Analytics’ Cortellis.

In December 2019, The Medicines Company submitted a new drug application for inclisiran to the FDA for use in secondary prevention patients with atherosclerotic cardiovascular disease and familial hypercholesterolaemia. Inclisiran is a PCSK9 (proprotein convertase subtilisin/kexin type 9) inhibitor. It would compete against PCSK9-targeting antibodies, such as Sanofi’s and Regeneron Pharmaceuticals’ Praluent (alirocumab) and Amgen’s Repatha (evolocumab) as well as other cholesterol-lowering drugs such as statins.

Inclisiran is the key piece of Blackstone’s $2-billion investment in Alnylam, which includes $1 billion in committed payments, which includes Blackstone’s acquisition of 50% of Alnylam’s royalties and commercial milestones for inclisiran. The $2-billion deal also includes: (1) up to $750 million in a first-lien senior secured term loan led by GSO Capital Partners, Blackstone’s credit platform; (2) up to $150 million from Blackstone Life Sciences for the development of Alnylam’s cardiometabolic programs, vutrisiran and ALN AGT, to be established based upon a non-binding letter of intent; and (3) a $100-million purchase of Alnylam common stock.

In August (August 2020), Blackstone and Alynlam closed on the $150-million R&D funding component of the deal for the development of Alnylam’s cardiometabolic disease programs, vutrisiran and ALN-AGT, two of 11 investigational drugs under clinical development by the company. The investment includes up to $70 million to support an ongoing Phase III study of vutrisiran in ATTR amyloidosis patients with cardiomyopathy, and up to $80 million to support Phase II and Phase III development of ALN-AGT, in development for the treatment of hypertension.

Other deals

Alynlam is also partnered with other pharma companies to advance its pipeline. A key deal, formed last year (2019), is a global, strategic collaboration, worth up to $1 billion, with Regeneron Pharmaceuticals, a Tarrytown, New York biopharmaceutical company, to discover, develop, and commercialize RNAi therapeutics for disease targets expressed in the eye and central nervous system (CNS) in addition to a select number of targets expressed in the liver. The pact builds on previous collaborations between the companies, formed in 2018, to identify RNAi therapeutics for nonalcoholic steatohepatitis (NASH) and potentially other related diseases.

Under the deal, Alnylam will work exclusively with Regeneron to discover RNAi therapeutics for eye and CNS diseases. Regeneron will lead development and commercialization for all programs targeting eye diseases, with Alnylam entitled to potential milestone and royalty payments. The companies will jointly advance and alternate leadership on CNS programs, with the lead party retaining global development and commercial responsibility. For CNS programs, both companies will have the option at candidate selection to participate equally in potential future profits of programs led by the other party.

With the deal, Regeneron agreed to make a $400-million upfront payment to Alnylam and to purchase $400 million of Alnylam equity. Alnylam is eligible to receive up to an additional $200 million in milestone payments upon achievement of certain criteria during early clinical development for the eye and CNS programs. The companies plan to advance programs directed to 30 targets and introduce many into clinical development during the initial five-year discovery period, which includes an option to extend. For each program, Regeneron will provide Alnylam with $2.5 million in funding at program initiation and an additional $2.5 million at lead candidate identification, translating to the potential for approximately $30 million in annual discovery funding to Alnylam.

Last year (2019), Alnylam announced that it was concluding the research and product option phase of a 2014 RNAi therapeutics alliance in rare genetic diseases with Sanofi. With that, Sanofi obtained the rights for global development and commercialization to fitusiran, an investigational RNAi therapeutic, as well as patisiran and vutrisiran. As part of their agreement, Alnylam will advance an additional investigational asset in an undisclosed rare genetic disease through the end of investigational new drug (IND)-enabling studies. Sanofi will be responsible for any potential further development or commercialization of such asset. If this product is approved, Alnylam will be eligible to receive tiered double-digit royalties on its global net sales.

Alnylam is also partnered with Vir Biotechnology, a San Francisco-based biopharmaceutical company. The companies formed a collaboration in 2018 with respect to Alnylam’s hepatic infectious disease pipeline. The companies also partnered earlier this year (2020) to develop VIR-2703, an investigational RNAi therapeutic targeting the genome of SARS-CoV-2, the virus that causes COVID-19 with plans to advance VIR-2703 as an inhalational formulation for the potential treatment and/or prevention of COVID-19.

Products and pipeline

Alnylam has two commercial products. Onpattro (patisiran) is FDA-approved for treating polyneuropathy in people with hereditary transthyretin-mediated amyloidosis (hATTR) and is also in development for another indication, cardiomyopathy of both hereditary and wild-type ATTR amyloidosis. Givlaari (givosiran) is approved for treating adult patients with acute hepatic porphyria, a genetic disorder resulting in the buildup of toxic porphyrin molecules, which are formed during the production of heme, which helps bind oxygen in the blood. Onpattro posted second-quarter 2020 revenues of $66.5 million, and Givlaari posted second-quarter 2020 revenues of $11.0 million.

Including the development of patisiran for an additional indication, the company has 11 drug candidates in clinical development. One, inclisiran, as previously discussed as part of a licensing deal with Novartis and a financing pact with Blackstone, is under review by the FDA. Three drug candidates are in late-stage development: patisiran, which as previously mentioned is approved and being developed for a second indication; vutrisiran for treating ATTR amyloidosis; and fitusiran, a drug it is partnered with Sanofi for treating hemophilia A or B with and without inhibitors. The balance of its pipeline is in early-stage development.