Orphan Drugs: Bearing Revenue Gains or Not?

Orphan drugs, defined in the US as a drug to treat less than 200,000 patients, have accounted for more than 40% of new drug approvals by the FDA over the past several years, but are they producing the revenue gains pharma companies are seeking or are they too niche? DCAT Value Chain Insights takes an inside look.

Inside new drug approvals and drug-development trends for orphan drugs

Orphan drugs are defined as prescription medicines developed for rare diseases and conditions, which, in the US, affect fewer than 200,000 people, or, in the European Union, affect 5 per 10,000 people or fewer. The share of new drug approvals worldwide for rare diseases doubled from 29% of all approvals in 2010 to a recent high of 58% in 2018, according to a 2019 analysis by the Tufts Center for Drug Development.

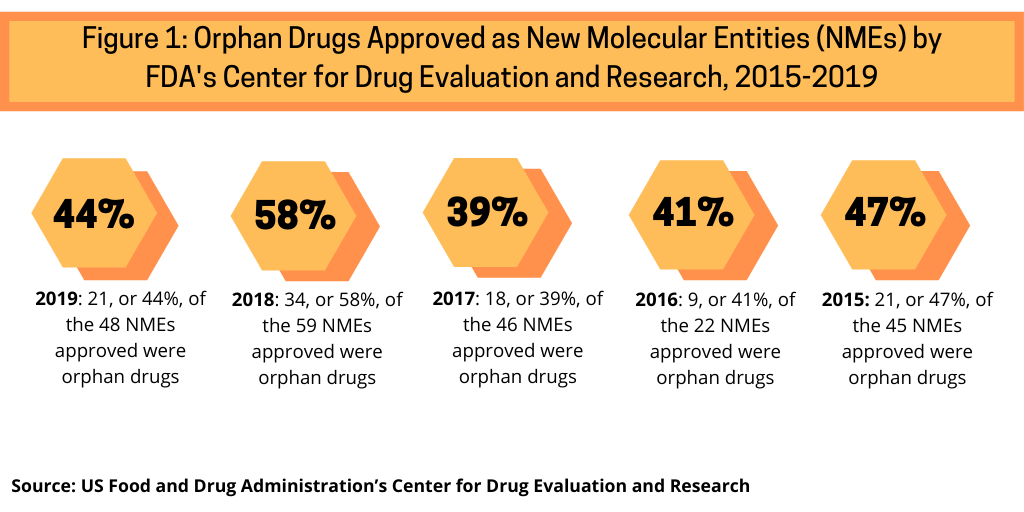

In examining approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Research and Evaluation (CDER) from 2015 to 2019 shows the increasing share of orphan drug approvals in recent NME approvals (see Figure 1). Between 2015 and 2019, orphan drug approvals accounted for between 39% and 58% of NME approvals by the FDA’s CDER. In 2019, orphan drugs accounted for 44%, or 21 of the 48 NMEs approved by the FDA’s CDER. In 2018, orphan drugs accounted for 58%, or 34 of the 59 NMEs approved by the FDA, which represented a recent high. Between 2015 and 2017, orphan drugs NME approvals averaged 42% of NME approvals by the FDA’s CDER, which amounted to 39% of NME approvals in 2017, 41% in 2016, and 47% in 2015. In the five-year period between 2015 and 2019, which includes the high mark of orphan drug approvals in 2018, orphan drugs have accounted for 46% of NME approvals by FDA’s CDER (see Figure 1).

These trends point to an important development in the pharmaceutical market: rare disease drug approval rates in the US are now approaching non-rare drug approval rates, according to the Tufts Center for Drug Development study. Orphan drugs, however, present both opportunities and challenges for pharmaceutical companies looking to develop these types of drugs.

Although a niche market, orphan drugs provide pharmaceutical companies certain incentives to develop these drugs. The Orphan Drug Act, which was enacted in the US in 1983, provides special status to a drug or biological product to treat a rare disease or condition. Orphan designation qualifies the sponsor of the drug for various development incentives, including tax credits for qualified clinical testing, certain exemptions from prescription-drug user fees, and incentives for market exclusivity.

There, are however, challenges in orphan drug development. “Our research on rare disease development programs suggests that sponsor companies are encountering unprecedented operating challenges in this area,” said Kenneth Getz, Associate Professor and Director of Sponsored Research at the Tufts Center for Drug Development, who led the analysis, in commenting on the 2019 study. “Smaller market opportunities and longer development cycle times—driven in large part by difficulties identifying investigators and recruiting rare-disease patients—will necessitate increased use of data and analytics and more flexible and mobile clinical trial models.”

The study by the Tufts Center for Drug Development outlines some of the challenges in orphan-drug development. Clinical through approval phase durations for rare-disease drug development on average take four years longer than those for non-rare diseases. Phase I clinical trials for rare diseases, on average, engaged six times the number of investigative sites to recruit a quarter of the number of patients, compared with those for non-rare diseases.

“Clinical trials for rare diseases have lower drop-out rates, compared to those for non-rare diseases, said Getz in commenting on the 2019 study. “However, finding and enrolling study volunteers is extremely difficult. Benchmark data from recent clinical trials show that, in addition to long study start-up and enrollment periods, screen and randomization failure rates are much higher in studies among rare-disease patients.”

Inside the market for orphan drugs

Despite the challenges in rare-disease drug development, both the large pharmaceutical companies and smaller pharmaceutical companies continue to target orphan drugs as part of their pipeline and commercialization strategies. Several of the pharmaceutical majors have made acquisitions to bolster their positions in the rare-disease sector, which includes both drugs and more recently cell and gene therapies.

Key recent deals include Roche’s $4.3-billion acquisition of Spark Therapeutics, a gene-therapy company, which was completed in December 2019. With the acquisition of Spark, Roche gains a commercial gene therapy, Luxturna (voretigene neparvovec-rzyl), a one-time gene-therapy product indicated for treating biallelic RPE65 mutation-associated retinal dystrophy, a rare form of inherited vision loss.

Bristol-Myers Squibb’s (BMS) $74-billion acquisition of Celgene, a deal completed in November 2019, also netted BMS certain rare-disease assets, which included two top-selling drugs of Celgene with rare-disease indications and two rare-disease drugs approved by the FDA in 2019. Revlimid (lenalidomide), which had 2018 global sales of $9.685 billion, and Pomalyst (pomalidomide), which had 2018 global sales of $2.040 billion, both have orphan-drug designations in multiple myeloma. BMS also gained two pipeline rare-disease therapies, with some analysts projecting blockbuster status by 2024: lisocabtagene maraleucel (liso-cel), an autologous anti-CD19 chimeric antigen receptor (CAR) T‑cell immunotherapy for treating relapsed or refractory large B-cell lymphoma (LBCL) after at least two prior therapies, and idecabtagene vicleucel (ide-cel), a CAR T therapy for treating relapsed and refractory multiple myeloma. BMS also gained bb2121, an anti-B-cell maturation antigen (BCMA) CAR T-cell therapy for multiple myeloma in which Celgene was developing with blueprint bio and which has been designated by the FDA for orphan-drug status.

Rare diseases iarealso one of four targeted therapeutic areas for Takeda, a position it strengthened with its $62-billion acquisition of Shire, a deal that was completed in January 2019. With the acquisition of Shire, Takeda gained a position in rare diseases, an area that Shire strengthened through its $32-billion acquisition in 2016 of Baxalta, the biopharmaceutical company spun off from Baxter Healthcare. Across therapy areas, rare diseases represented Shire’s main strategic focus. In 2017, its Rare Disease Division accounted for approximately $11 billion in revenues or approximately 72% of the company’s total revenues. Seventy percent (70%) of Shire’s clinical programs were focused on rare diseases based on its 2017 filings.

In 2018, Novartis acquired AveXis, a gene-therapy company, for $8.7 billion, and with the acquisition, Zolgensma (onasemnogene abeparvovec-xioi) for treating pediatric patients less than two years of age, with spinal muscular atrophy, a rare neuromuscular disorder, with bi-allelic mutations in the SMN1 gene.

In 2017, Johnson & Johnson (J&J) acquired the Swiss pharmaceutical company, Actelion, for approximately $30 billion, which provided J&J with a position in rare diseases, including products for treating pulmonary arterial hypertension (PAH), a rare, progressive disorder characterized by high blood pressure in the arteries of the lung. Pulmonary hypertension is now one segment in J&J’s pharmaceutical business and accounted for sales of $2.6 billion in 2019. Orphan drugs for treating PAH gained in that acquisition were Tracleer (bosentan) with 2019 sales of $341 million; Opsumit (macitentan) with 2019 sales of $1.3 billion; and Uptravi (selexipag) with 2019 sales of $819 million.

J&J is also partnered with AbbVie for a key rare-disease drug, Imbruvica (ibrutinib), a small-molecule drug that binds permanently to a protein, Bruton’s tyrosine kinase, which is important in B cells. It is used to treat B-cell cancers, including mantle cell lymphoma, chronic lymphocytic leukemia, and Waldenström’s macroglobulinemia. J&J initially partnered with Pharmacyclics for the development of Imbruvica, and AbbVie acquired Pharmacylics in 2015 for $21 billion. In 2019, J&J posted 2019 sales of $3.4 billion for Imbruvica, and AbbVie posted 2019 revenues of $4.7 billion.

Market outlook for orphan drugs

A recent analysis by Evaluate Ltd., the Orphan Drug Report 2019, shows strong growth for the orphan drug market, which it defines as those products with orphan-drug designations in the US, Europe, or Japan. It projects worldwide orphan-drug sales to total $242 billion in 2024 with a compound annual growth rate of orphan drugs between 2018 and 2024 of 12.3%, which represents approximately double the growth rate of that of the non-orphan drug market. It projects that orphan drugs will represent one-fifth (20.3%) of worldwide prescription-drug sales by 2024. The orphan drug pipeline is anticipated to contribute $187.7 billion in sales by 2024, which represents 35% of the combined forecast for all pipeline products.

Orphan-drug NMEs and market penetration

An important measure of the market performance of orphan drugs is to look at the market penetration of recent NMEs approved as orphan drugs. Based on 2018 sales, five NMEs approved by the FDA’s CDER between 2015 and 2018 reached sales of $500 million or more (see Table I). These products include: AstraZeneca’s Tagrisso (osimertinib) for treating metastatic non-small-cell lung cancer; Biogen’s Spinraza (nusinersen) for treating spinal muscular atrophy in pediatric and adult patients; J&J’s Darzalex (daratumumab) for treating multiple myeloma; Vertex Pharmaceuticals’ Symdeko (tezacaftor; ivacaftor) for treating cystic fibrosis in patients age 12 and older; and Roche’s Alecensa (alectinib) for treating anaplastic lymphoma kinase-positive metastatic non-small-cell lung cancer.

| Table I: Orphan Drugs FDA-Approved as New Molecular Entities in 2015-2018, with 2018 Sales of $500 Million or More |

||||

|

Company |

Drug Brand Name (active ingredient) |

Indication |

2018 Sales |

Year of Approval |

| AstraZeneca | Tagrisso (osimertinib) | Metastatic non-small-cell lung cancer | $1.9 billion | 2015 |

| Biogen | Spinraza (nusinersen) | Spinal muscular atrophy in pediatric and adult patients | $1.7 billion | 2016 |

| Johnson & Johnson’s Janssen | Darzalex (daratumumab) | Multiple myeloma | $1.2 billion | 2015 |

| Vertex Pharmaceuticals | Symdeko (tezacaftor; ivacaftor) | Cystic fibrosis in patients age 12 and older | $769 million | 2018 |

| Roche | Alecensa (alectinib) | Anaplastic lymphoma kinase- positive metastatic non-small- cell lung cancer | CHF 637 million ($648 million) | 2015 |

|

Source: US Food and Drug Administration’s Center for Drug Evaluation and Research and company information |

||||

,