New Drug Approvals in 2022: Making the Mark

There were 37 new molecular entities and therapeutic biologics approved in 2022 by the FDA, significantly down from the 50 new drugs approved in 2021. What were the winners in small molecules and biologics and among large and small companies?

New drug approvals in 2022

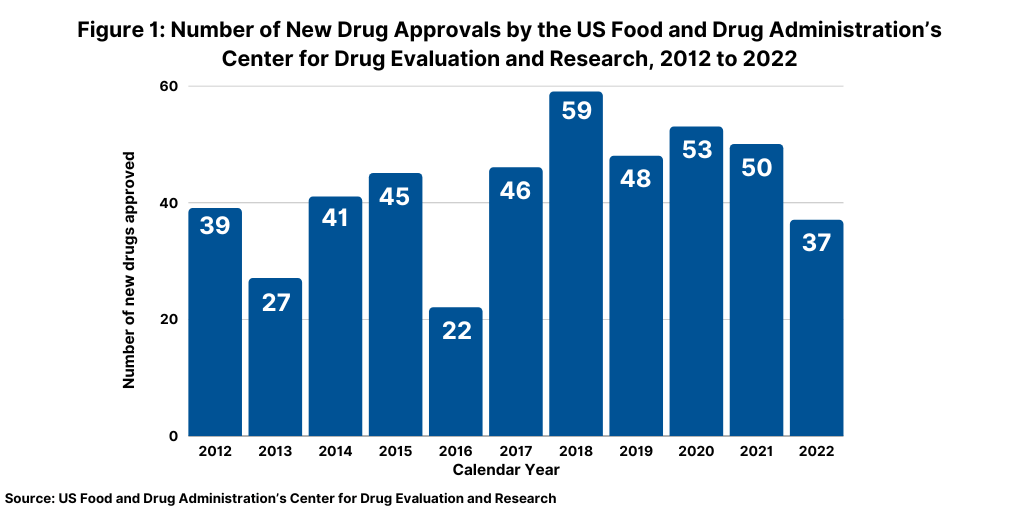

The number of new drug approvals is an important measure of new product innovation in the bio/pharma industry, and the results from 2022 show a downturn from recent trends. The US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 37 new drugs in 2022, significantly down from the 50 new drugs approved in 2021 and the 53 new drugs approved in 2020 (see Figure 1). The new drug approvals include both new molecular entities and new therapeutic biologics approved by the FDA’s CDER and does not include vaccines, allergenic products, blood and blood products, plasma derivatives, cellular and gene therapy products, or other products approved by the FDA’s Center for Biologics Evaluation and Research.

The 37 new drug approvals, in fact, represent a recent low for new drug approvals over the last decade. Only 2018 and 2013 had lower levels of new drug approvals, with 22 new drug approvals in 2018 and 27 in 2013 (see Figure 1). Table I at the end of the article lists all new drug approvals in 2022.

Small molecules versus biologics

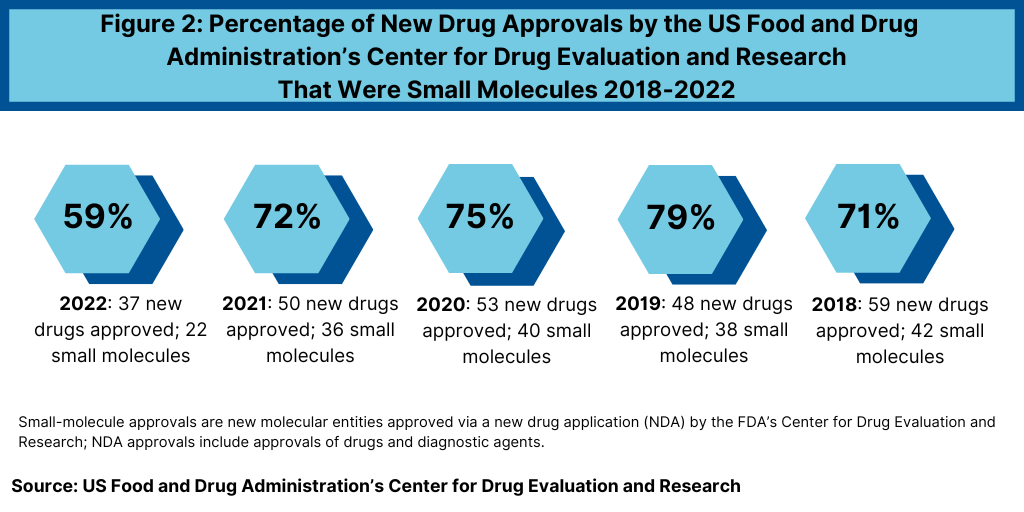

Another important development in 2022 was the reduced share of small molecules in new drug approvals. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules, also significantly down from recent years—when small molecules accounted for approximately three-fourths of new drugs approvals (see Figure 2). In 2022, 22 of the 37 new drug approvals were small molecules, representing 59% of new drug approvals. In comparison, between 2018 and 2021, small molecules averaged 74% of new drug approvals (see Figure 2). In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, 79% in 2019, and 71% in 2018 (see Figure 2).

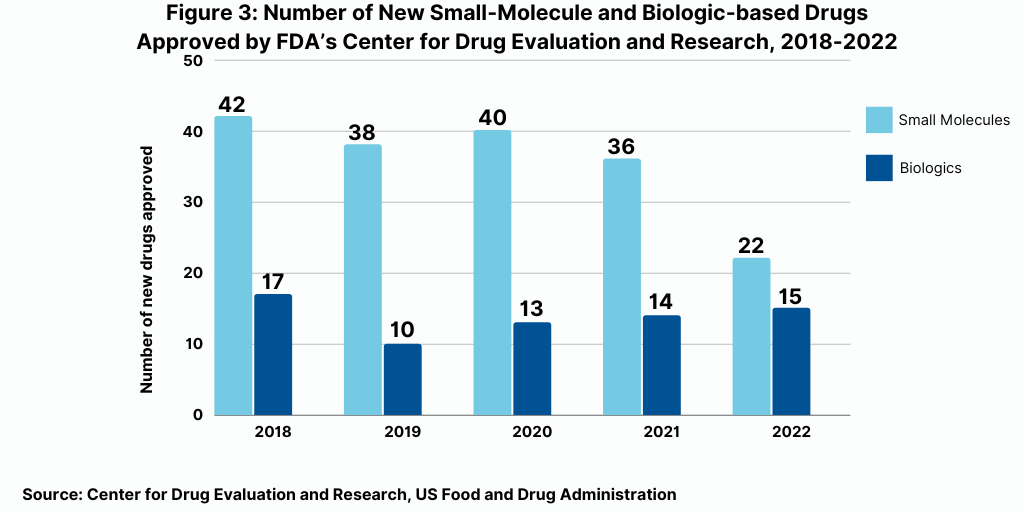

The decrease in small molecules’ share of new drug approvals is largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, the FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics, with the 15 new biologic drug approvals representing a recent high (see Figure 3). The 15 new biologic drug approvals in 2022 was only recently eclipsed by the 17 new biologic drug approvals in 2018 and surpassed recent new biologic drug approvals of 14 in 2021, 13 in 2020, and 10 in 2019 (see Figure 3).

New drug approvals in 2022; large versus small companies

Continuing a trend, the large bio/pharmaceutical companies’ share of new drug approvals was surpassed by mid to small-sized bio/pharmaceutical companies. Although the number of new drug approvals does not reflect the market potential of a given drug, it is an important measure of product innovation, and continuing a recent trend, smaller bio/pharmaceutical companies are outpacing product innovation of the larger companies.

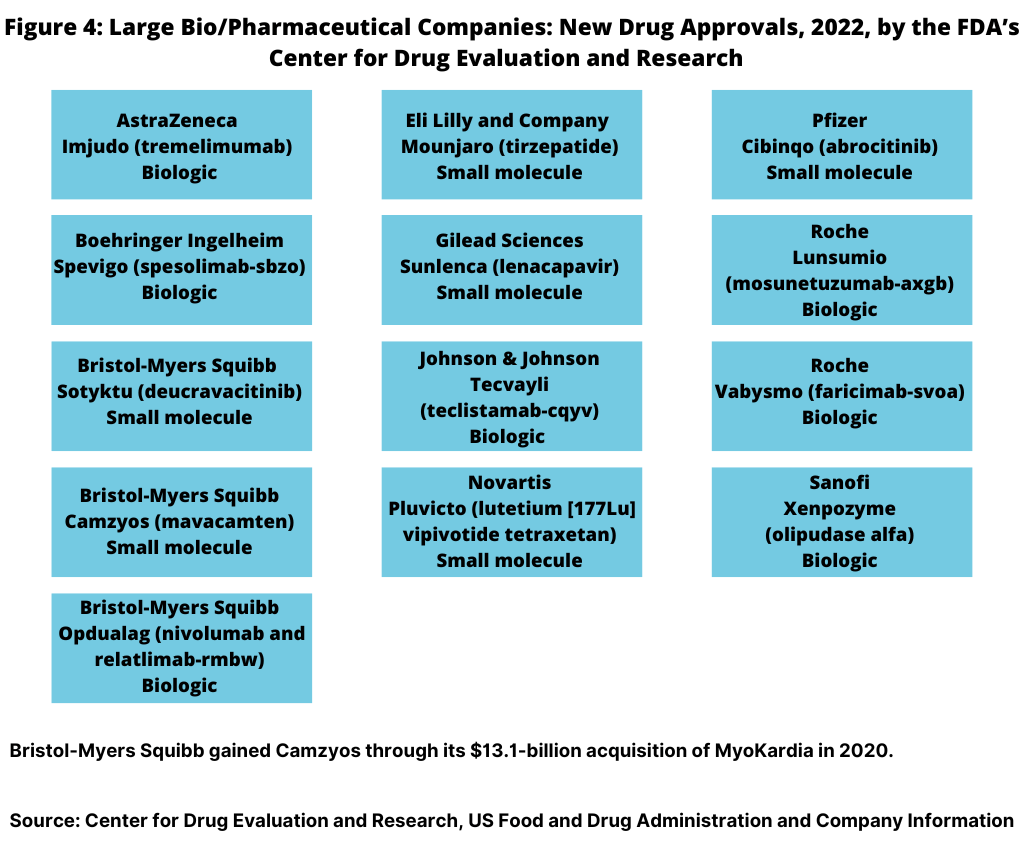

In 2022, 13, or 35%, of the new drug approvals were from the large bio/pharmaceutical companies (see Figure 4). Bristol-Myers Squibb (BMS) led all companies with three new drug approvals, followed by Roche with two new drug approvals. Eight large bio/pharmaceutical companies each had one new drug approval: AstraZeneca, Boehringer Ingelheim, Eli Lilly and Company, Gilead Sciences, Johnson & Johnson, Novartis, Pfizer, and Sanofi (see Figure 4).

BMS received approval for two small-molecule drugs: Sotyktu (deucravacitinib) to treat moderate-to-severe plaque psoriasis and for Camzyos (mavacamten) to treat certain classes of obstructIive hypertrophic cardiomyopathy, a disease in which the heart muscle becomes thickened. BMS gained Camzyos through its $13.1-billion acquisition of MyoKardia in 2020. BMS also received approval for a new biologic, Opdualag (nivolumab and relatlimab-rmbw), for treating unresectable or metastatic melanoma.

Roche received approval for two biologics in 2022: Lunsumio (mosunetuzumab-axgb) for treating relapsed or refractory follicular lymphoma, a type of non-Hodgkin lymphoma, and for Vabysmo (faricimab-svoa) for treating neovascular (wet) aged-related macular degeneration and diabetic macular edema.

AstraZeneca, Boehringer Ingelheim, Johnson & Johnson (J&J), and Sanofi each had one new biologic drug approval, and Lilly, Gilead Sciences, Novartis, and Pfizer each had one small-molecule drug approval (see Figure 4).

On the biologics side, AstraZeneca received approval for Imjudo (tremelimumab) for treating unresectable hepatocellular carcinoma (liver cancer). Boehringer Ingelheim got the nod for Spevigo (spesolimab-sbzo) for treating generalized pustular psoriasis flares. J&J received approval for Tecvayli (teclistamab-cqyv) for treating relasped or refractory multiple myeloma among adults who have received at least four specific lines of therapy. Sanofi received approval for Xenpozyme (olipudase alfa) for treating acid sphingomyelinase deficiency, a rare genetic disease that causes premature death (see Figure 4).

On the small-molecule side, Lilly received approval for Mounjaro (tirzepatide) to improve blood sugar control in adults with Type 2 diabetes. Gilead Sciences got the nod for Sunlenca (lenacapavir) to treat HIV-1 in patients whose HIV infections cannot be successfully treated with other available treatments. Novartis received approval for Pluvicto (lutetium (177Lu) vipivotide tetraxetan), a radiopharmaceutical to treat prostate cancer. Pfizer received approval for Cibinqo (abrocitinib) to treat refractory, moderate-to-severe atopic dermatitis (eczema) (see Figure 4).

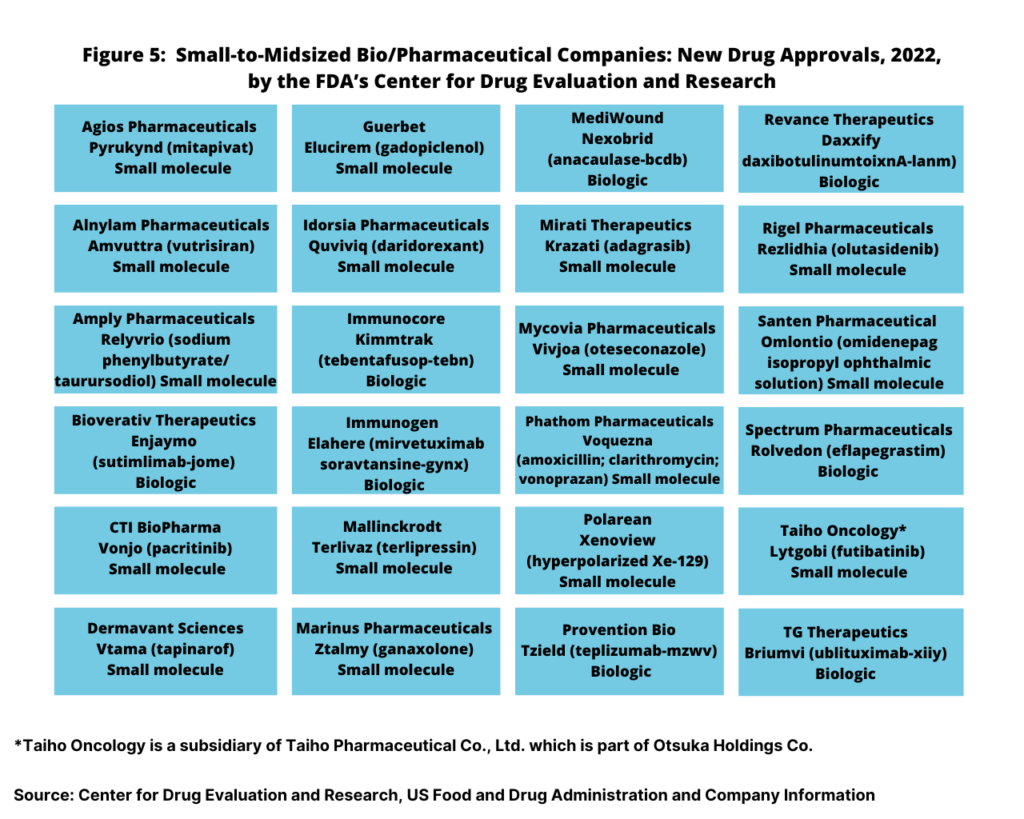

With the large bio/pharma companies accounting for only13, or 35% of the new drug approvals in 2022, small to mid-sized bio/pharma companies accounted for 24 or 65% of new drug approvals (see Figure 5). Small to mid-sized companies accounted for 16 small-molecule new drug approvals and for eight new biologic drug approvals.

Small-molecule drug approvals were from Agios Pharmaceuticals, Alnylam Pharmaceuticals, Amply Pharmaceuticals, CTI BioPharma, Dermavant Sciences, Guerbet, Idorsia, Mallinckrodt, Marinus Pharmaceuticals, Mirati Therapeutics, Mycovia Pharmaceuticals, Phathom Pharmaceuticals, Polarean, Rigel Pharmaceuticals, Santen Pharmaceutical, and Taiho Oncology. On the biologics side, new drug approvals were from Bioverativ Therapeutics, Immunogen, Immunocore, MediWound, Provention Bio, Revance Therapeutics, Spectrum Pharmaceuticals, and TG Therapeutics (see Figure 5).

Table I below lists all new drug approvals in 2022 from the FDA’s CDER.

Table I: New Drug Approvals, 2022, by the Center for Drug Evaluation and Research, US Food and Drug Administration. Approved as New Drug Applications (NDA) and Biologic License Applications (BLA).

| Company | Brand Name (active ingredient); NDA or BLA | Indication |

| Agios Pharmaceuticals | Pyrukynd (mitapivat); NDA | Hemolytic anemia in pyruvate kinase deficiency, an inherited red-blood cell enzyme disorder. |

| Alnylam Pharmaceuticals | Amvuttra (vutrisiran); NDA | Polyneuropathy of hereditary transthyretin-mediated amyloidosis, a rare inherited disease |

| Amply Pharmaceuticals | Relyvrio (sodium phenylbutyrate /taurursodiol); NDA | Amyotrophic lateral sclerosis (i.e., Lou Gehrig’s disease) |

| AstraZeneca | Imjudo (tremelimumab); BLA | Unresectable hepatocellular carcinoma (liver cancer) |

| Bioverativ Therapeutics | Enjaymo (sutimlimab-jome); BLA | To decrease the need for red blood cell transfusion due to hemolysis in cold agglutinin disease. |

| Boehringer Ingelheim | Spevigo (spesolimab-sbzo); BLA | Generalized pustular psoriasis flares. |

| Bristol-Myers Squibb | Sotyktu (deucravacitinib); NDA | Moderate-to-severe plaque psoriasis |

| Bristol-Myers Squibb (mavacamten) | Camzyos (mavacamten); NDA | Certain classes of obstructive hypertrophic cardiomyopathy. |

| Bristol-Myers Squibb | Opdualag (nivolumab and relatlimab-rmbw); BLA | Unresectable or metastatic melanoma. |

| CTI BioPharma | Vonjo (pacritinib); NDA | Intermediate or high-risk primary or secondary myelofibrosis, a rare form of a bone marrow disorder, |

| Dermavant Sciences | Vtama (tapinarof); NDA | Plaque psoriasis. |

| Eli Lilly and Company | Mounjaro (tirzepatide); NDA | To improve blood sugar control in adults with Type 2 diabetes as an addition to diet and exercise. |

| Gilead Sciences | Sunlenca (lenacapavir); NDA | HIV-1, in patients whose HIV infections cannot be successfully treated with other available treatments. |

| Guerbet | Elucirem (gadopiclenol); NDA | A contrast agent to detect and visualize lesions, together with MRI, with abnormal vascularity in the central nervous system and the body. |

| Idorsia | Quviviq (daridorexant); NDA | Insomnia |

| Immunocore | Kimmtrak (tebentafusp-tebn); BLA | Unresectable or metastatic uveal melanoma |

| Immunogen | Elahere (mirvetuximab soravtansine-gynx); BLA | Recurrent ovarian cancer that is resistant to platinum therapy. |

| Johnson & Johnson | Tecvayli (teclistamab-cqyv); BLA | Relapsed or refractory multiple myeloma among adults who have received at least four specific lines of therapy |

| Mallinckrodt | Terlivaz (terlipressin); NDA | To improve kidney function in adults with hepatorenal syndrome with rapid reduction in kidney function |

| Marinus Pharmaceuticals | Ztalmy (ganaxolone); NDA | Seizures in cyclin-dependent kinase-like 5 deficiency disorder |

| MediWound | Nexobrid (anacaulase-bcdb); BLA | To remove eschar in adults with deep partial thickness or full thickness thermal burns |

| Mirati Therapeutics | Krazati (adagrasib); NDA | Treating KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer in adults who have received at least one prior systemic therapy. |

| Mycovia Pharmaceuticals | Vivjoa (oteseconazole); NDA | To reduce the incidence of recurrent vulvovaginal candidiasis. |

| Novartis | Pluvicto (lutetium [177Lu] vipivotide tetraxetan); NDA | Prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer following other therapies. |

| Pfizer | Cibinqo (abrocitinib); NDA | Refractory, moderate-to-severe atopic dermatitis (eczema). |

| Phathom Pharmaceuticals | Voquezna (vonoprazan, amoxicillin, and clarithromycin); NDA | Helicobacter pylori infection. |

| Polarean | Xenoview (hyperpolarized Xe-129); NDA | To evaluate pulmonary function and imaging. |

| Provention Bio | Tzield (teplizumab-mzwv); BLA | To delay the onset of Stage 3 Type 1 diabetes in adults and pediatric patients 8 years and older. |

| Revance Therapeutics | Daxxify daxibotulinumtoixnA-lanm); BLA | Moderate-to-severe glabellar lines associated with corrugator and/or procerus muscle activity |

| Rigel Pharmaceuticals. | Rezlidhia (olutasidenib); NDA | Relapsed or refractory acute myeloid leukemia with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation. |

| Roche | Lunsumio (mosunetuzumab-axgb); BLA | Relapsed or refractory follicular lymphoma, a type of non-Hodgkin lymphoma |

| Roche | Vabysmo (faricimab-svoa); BLA | Neovascular (wet) aged-related macular degeneration and diabetic macular edema. |

| Sanofi | Xenpozyme (olipudase alfa); BLA | Acid sphingomyelinase deficiency, a rare genetic disease that causes premature death. |

| Santen Pharmaceutical | Omlontio (omidenepag isopropyl ophthalmic solution); NDA | To reduce elevated intraocular pressure in patients with open‑angle glaucoma or ocular hypertension. |

| Spectrum Pharmaceuticals | Rolvedon (eflapegrastim); BLA | To decrease the incidence of infection in patients with non-myeloid malignancies receiving myelosuppressive anti-cancer drugs associated with clinically significant incidence of febrile neutropenia. |

| Taiho Oncology* | Lytgobi (futibatinib); NDA | Intrahepatic cholangiocarcinoma (bile duct cancer) harboring fibroblast growth factor receptor 2 (FGFR2) gene fusions or other rearrangements. |

| TG Therapeutics | Briumvi (ublituximab-xiiy); BLA | Relapsing forms of multiple sclerosis |

Taiho Oncology is a subsidiary of Taiho Pharmaceutical Co., Ltd. which is part of Otsuka Holdings Co., Ltd.

Source: Center for Drug Evaluation and Research, US Food and Drug Administration and Company Information