Navigating the Supply-Chain Impacts of US Port Closings

The shutdown of ports on the US Gulf and East Coasts this week due to a labor strike had the potential for a major impact on the flow of US chemical shipments. With a strike now temporarily diverted, how would have chemical and pharma ingredient supply chains been affected?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Supply chains get a temporary reprieve

Global and US supply chains for chemicals and pharma ingredients got a reprieve late this week (Thursday October 3, 2024) when dockworkers at ports on the US Gulf and East Coasts agreed to suspend a strike, which had started on Tuesday (October 1, 2024), and had shut down these ports. The strike occurred due to a dispute over wage increases from the union representing dockworkers, the International Longshoremen’s Association, and port employers of the East and Gulf Coast longshore industry, represented by the United States Maritime Alliance. Both parties reached a tentative agreement on wages and dockworkers agreed to suspend their strike through January 15, 2025, as wage negotiations continue.

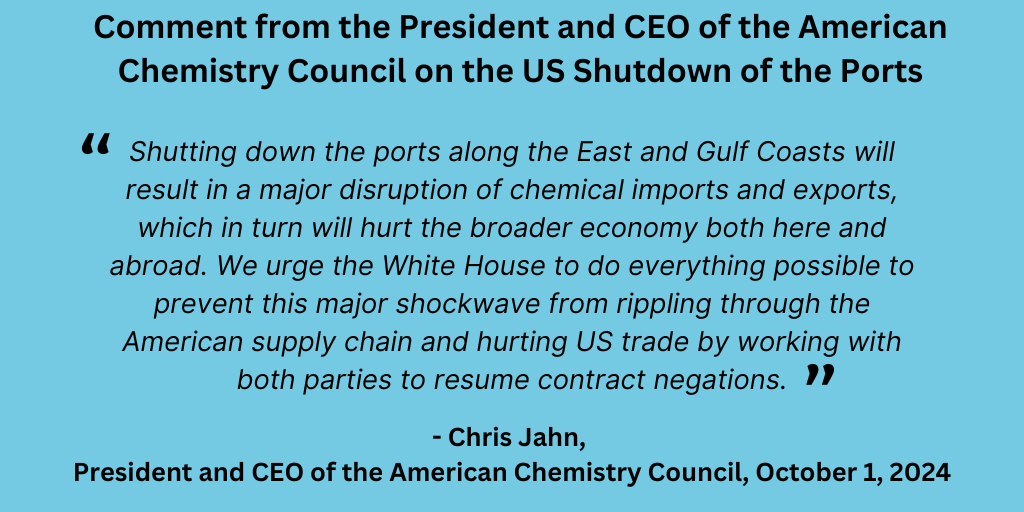

President and CEO

American Chemistry Council

The prospect of a lengthy strike was problematic for chemical shipments coming into and out of the US Gulf and East Coasts ports, which account for 90% of waterborne chemical shipments in the US. “The chemical industry is one of the country’s largest shippers across all modes of transportation, including marine shipments through our nation’s ports,” said Chris Jahn, President and CEO of the American Chemistry Council, which represents US-based chemical manufacturers. “The port strike is of particular concern to our industry since about 90% of the waterborne chemical shipments that move in and out of the U.S. flow through the East Coast and Gulf Coast ports.”

However, after dockworkers and port employers reached a tentative agreement late on Thursday October 3, 2024, a strike, which had closed the US Gulf and East Coast ports earlier this week, stopped as dockworkers agreed to continue working under their existing contract through January 15, 2025, as negotiations continue.

“The International Longshoremen’s Association and the United States Maritime Alliance, Ltd. have reached a tentative agreement on wages and have agreed to extend the Master Contract until January 15, 2025, to return to the bargaining table to negotiate all other outstanding issues,” said the International Longshoremen’s Association and the United States Maritime Alliance in an October 3, 2024, statement. “Effective immediately, all current job actions will cease,” and all work covered by the Master Contract will resume.” The master contract between the International Longshoremen’s Association and United States Maritime Alliance covers approximately 45,000 dockworkers at 36 ports from Maine to Texas.

The prospect of a lengthy strike was considered disruptive to the economy as a whole and to key industries, such as the chemical industry, and was a key focus for US government officials to avert a shutdown. “I want to applaud the International Longshoremen’s Association and the United States Maritime Alliance for coming together to reopen the East Coast and Gulf ports,” said President Joe Biden in an October 3, 2024, statement. “Today’s [October 3, 2024] tentative agreement on a record wage and an extension of the collective bargaining process represents critical progress towards a strong contract.”

US chemical shipments and its impact on supply chains

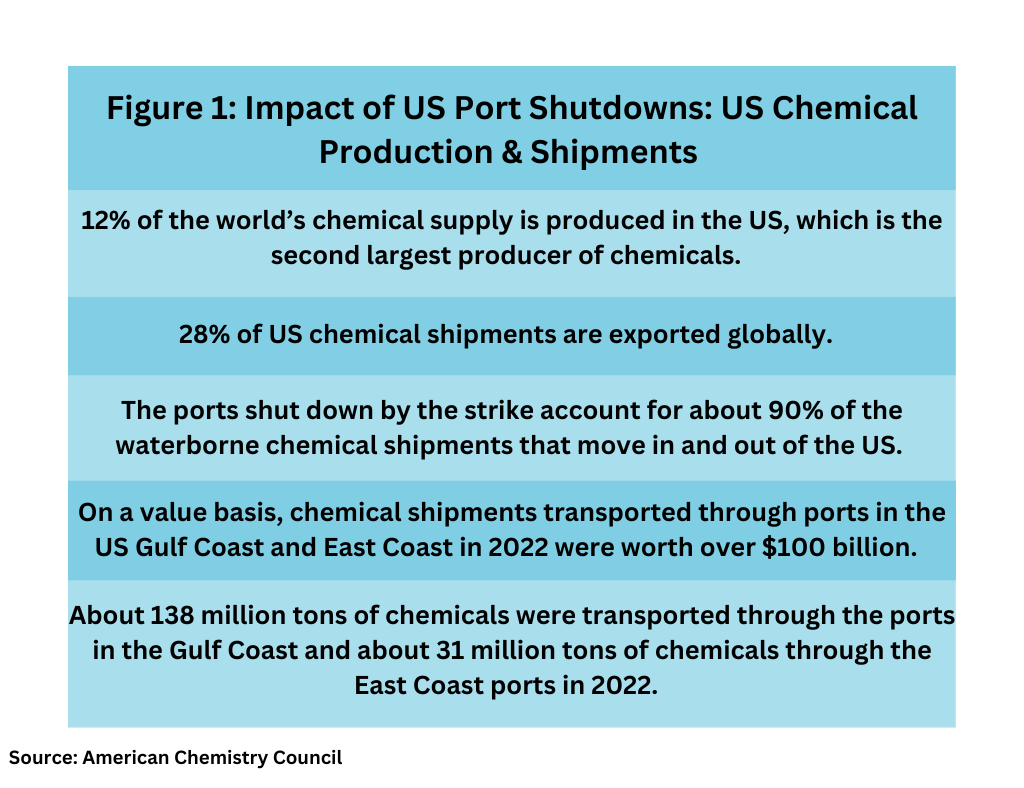

For the bio/pharma industry, a shutdown of US ports would have been problematic as it relates to the flow of chemicals used in the production of active pharmaceutical ingredients (APIs) and drug products. Looking at overall data of chemical shipments across all industries, about 12% of the world’s chemical supply is produced in the US, which is the second largest producer of chemicals, according to information from the American Chemistry Council, with 28% of US chemical shipments exported globally. The ports shut down by the strike account for about 90% of the waterborne chemical shipments that move in and out of the US. On a value basis, chemical shipments transported through ports in the US Gulf Coast and East Coast in 2022 were worth over $100 billion. About 138 million tons of chemicals were transported through the ports in the Gulf Coast and about 31 million tons of chemicals through the East Coast ports in 2022 (see Figure 1).

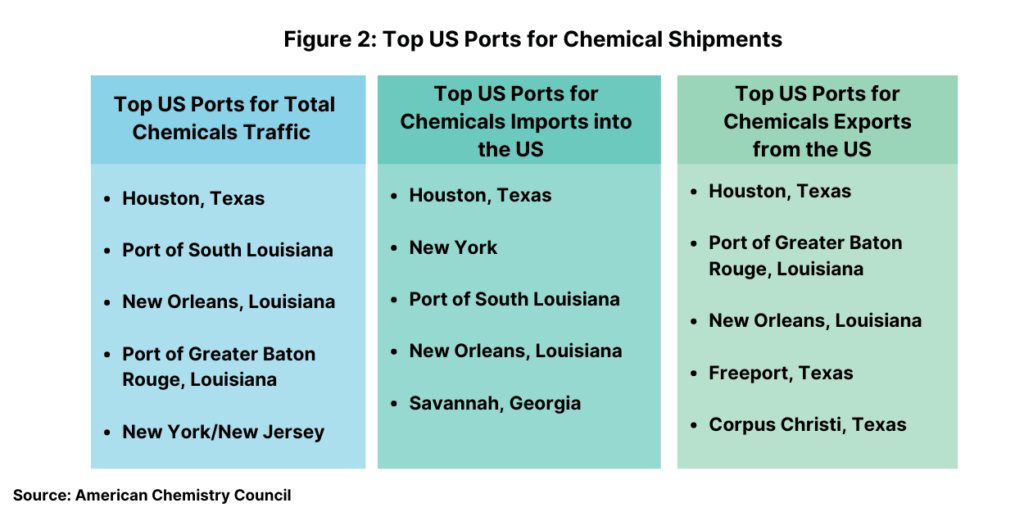

The ports on the US Gulf Coast, which include shipments from petrochemical and chemical manufacturers based in Texas and Louisiana, and East Coast ports in the US represent major channels for chemicals exported from and imported into the US (see Figure 2).

The Alliance for Chemical Distribution (formerly the National Association of Chemical Distributors), which represents multinational and US-based chemical distributors, had warned of the negative impact a strike would have on chemical supply chains. Ahead of the labor contract deadline of September 30, 2024, the Alliance for Chemical Distribution joined two letters —one on June 25, 2024, and the other on September 23, 2024, to the Biden Administration, both endorsed by over 150 shipping organizations, to urge the White House to get both sides to come to an agreement. It had also reached out to Congressional offices to raise concerns about the then looming strike and its economic impact. During an 11-day strike on the US West Coast in 2002, economic impact was estimated at $1 billion per day, according to information from the Alliance for Chemical Distribution.

Air freight is a common mode of transportation for APIs, but a disruption of transportation routes for other non-pharma products can disrupt supply chains for pharma ingredients. Either direct maritime shipping or diversion of non-pharma products from maritime routes affected by a potential shutdown of certain US ports can compete with other modes of transportation, such as trucking or air freight. For example, products can be re-routed using other modes of transportation or if shipments are diverted to alternate ports outside of ports affected by a shutdown, other modes of transportation have to be used to move products to the original destination points.

The US Department of Health and Human Services (HHS), which issued on statement on October 1, 2024, when the strike of US Gulf and East Coasts began said that its preliminary assessments indicated immediate impacts across medicines and medical devices should be limited. The HHS said it had met with trade associations, distributors, manufacturers, and other stakeholders on Monday September 30, 2024, to assess vulnerabilities and supply chain impacts. “In coordination with HHS and other Administration partners, FDA [US Food and Drug Administration] and ASPR [Administration for Strategic Preparedness and Response], have been in touch with trade associations, distributors, and manufacturers to limit impacts on consumers and assess vulnerabilities,” said HHS in its October 1, 2024, statement. “ASPR and FDA have and will continue working closely with HHS to quickly identify potential shortages of life-saving products impacted by a strike to determine the cause and work with manufacturers and distributors to address local, regional, and national needs as they arise.”