Mid-Year Review: New Drug Approvals

At the halfway point in 2021, how are approvals of new molecular entities (NMEs) by the FDA progressing, and how does it compare to prior years? What NMEs have been approved, and what was the mix between small molecules and biologics? And, are large bio/pharma companies or smaller companies winning the innovation race?

Approvals of new molecular entities thus far in 2021

Although not following a strictly chronological path, examining the pace of approvals of new molecular entities (NMEs) is an important measure of product innovation in the bio/pharmaceutical industry. At the halfway point of 2021 (as of June 28, 2021), the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) had approved 26 NMEs, which kept pace with full-year 2020, in which 53 NMEs were approved. The 53 NMEs approved in 2020 was the second highest level of NMEs approved in the past decade, except for 2018 when 59 NMEs were approved. Table I at end of article outlines the 26 NMEs approved thus far in 2021 (as of June 28, 2021).

Small molecules versus biologics

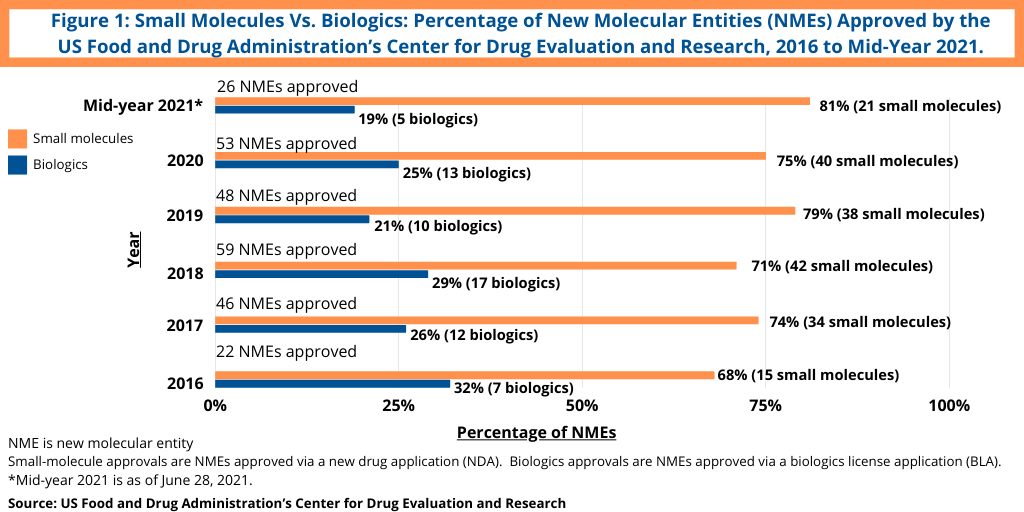

Continuing a trend, small-molecule drugs have thus far dominated NME approvals in 2021. Of the 26 NMEs approved as of the mid-point of 2021 (as of June 28, 2021), 81%, or 21 drugs, were small molecules, and 19%, or five, were biologic-based drugs (see Figure 1). These levels continue a five-year trend between 2016 and 2020 in which small molecules averaged 73% of NME approvals. In 2020, 75% or 40 of the 53 NMEs approved in 2020 were small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71% and 74% in 2017. Table I at end of article identifies small molecules approved in 2021 thus far in 2021 (approved as new drug applications) and biologics (approved as biologics license applications).

Large bio/pharmaceutical companies and NME approvals

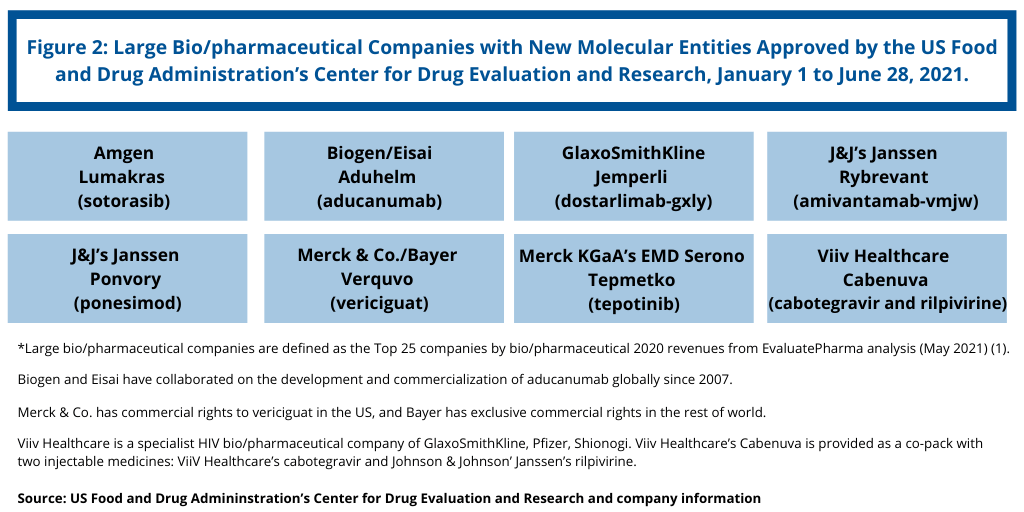

NME approvals are one measure of innovation and new product development in the bio/pharma industry. So how has the innovation bar fared between the large bio/pharmaceutical companies and small and mid-size companies thus far in 2021? Figure 2 outlines NME approvals by the large bio/pharmaceutical companies, defined for this analysis as those companies among the top 25 companies based on 2020 bio/pharmaceutical revenues (1). Using that as a criterion, the large bio/pharmaceutical companies accounted for eight, or only 31%, of the NME approvals thus far in 2021 (see Figure 2). That level was compatible with NME approvals in 2020, when the large bio/pharmaceutical companies accounted for 15, or 28%, of NME approvals in 2020 (2).

One of the noteworthy NME approvals among the large bio/pharmaceutical companies thus far in 2021 is Biogen’s and Eisai’s Aduhelm (aducanumab), a biologic-based drug for treating Alzheimer’s disease. It is the first new treatment approved by the FDA for Alzheimer’s since 2003 and is the first therapy that targets the fundamental pathophysiology of the disease, according to the FDA. The drug has been slated by some analysts as a potential blockbuster.

In a recent analysis, EvaluatePharma identified Biogen’s and Eisai’s aducanumab as the biggest potential launch in 2021 with $4.8 billion in forecast sales in 2026 (3). Aducanumab is an amyloid beta-targeting antibody that was shown in clinical trials to remove amyloid beta in the brain and slow clinical decline in patients with mild cognitive impairment due to Alzheimer’s disease and mild Alzheimer’s disease dementia.

Biogen licensed aducanumab from Neurimmune, Zurich, Switzerland-based biopharmaceutical company. Since 2017, Biogen and Eisai have collaborated on the development and commercialization of aducanumab globally.

The FDA granted accelerated approval of aducanumab earlier this month (June 2021). In an atypical move, the FDA granted approval despite the recommendation by a FDA advisory committee, made in November (November 2020), to reject approval of aducanumab, citing that the drug failed to demonstrate efficacy and that more research was needed.

Among the other large bio/pharmaceutical companies with NME approvals thus far in 2021, Johnson & Johnson’s (J&J) Janssen and GlaxoSmithKline (GSK) each scored two NME approvals. J&J’s Janssen received approval for its biologic-based drug, Rybrevant (amivantamab-vmjw), for treating non-small-cell lung cancer with certain mutations (epidermal growth factor receptor exon 20 insertion mutations). J&J’s Janssen also received approval for its small-molecule drug, Ponvory (ponesimod), for treating relapsing forms of multiple sclerosis.

GSK received approval for its biologic-based drug, Jemperli (dostarlimab-gxly), for treating recurrent or advanced mismatch repair deficient (dMMR) endometrial cancer. Viiv Healthcare received approval for Cabenuva (cabotegravir and rilpivirine), a drug to treat HIV. Viiv Healthcare is a specialist HIV bio/pharmaceutical company of GlaxoSmithKline, Pfizer, and Shionogi. Viiv Healthcare’s Cabenuva is provided as a co-pack with two injectable medicines: ViiV Healthcare’s cabotegravir and Johnson & Johnson’ Janssen’s rilpivirine.

Amgen, Merck & Co./Bayer, and Merck KGaA’s EMD Serono each had one NME approval thus far in 2021. Amgen received approval for its small-molecule drug, Lumakras (sotorasib), for treating advanced non-small cell lung cancer with the KRAS G12C genetic mutation as determined by an FDA-approved test, in patients who have received at least one prior systemic therapy.

Merck & Co. received approval for its small-molecule drug, Verquvo (vericiguat), for treating chronic heart failure. Specifically, the drug was approved to reduce the risk of cardiovascular death and heart failure hospitalization following hospitalization for heart failure or need for outpatient intravenous diuretics in adults with symptomatic chronic heart failure and ejection fraction less than 45%. Merck & Co. has commercial rights to vericiguat in the US, and Bayer has exclusive commercial rights in the rest of world. The companies shared equally the costs of development of vericiguat.

Merck KGaA’s EMD Serono received approval for its small-molecule drug, Tepmetko (tepotinib), indicated to treat metastatic non-small-cell lung cancer with a specific mutation (mesenchymalepithelial transition exon 14 skipping alterations).

Small and mid-sized bio/pharmaceutical companies and NME approvals

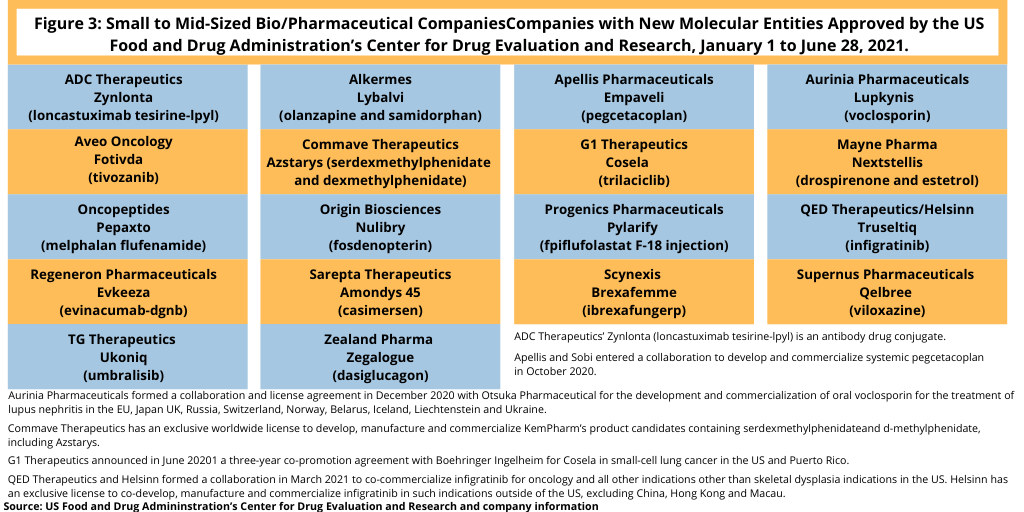

As they did in 2020, small and mid-sized companies have led the innovation race with 18 NME approvals, or 69%, of the NMEs approved by the FDA thus far in 2021 (see Figure 3). This level is on par with full-year 2020 NME approvals when small and mid-sized bio/pharmaceutical companies accounted for 38 NME approvals, or 72% of NME approvals in 2020.

Among the NME approvals by small to mid-sized companies thus far in 2021, one drug cited by analysts with blockbuster potential is voclosporin, a small-molecule drug for treating lupus nephritis, a complication of the autoimmune disease, systemic lupus erythematosus, by Aurinia Pharmaceuticals, a Victoria, British Columbia, Canada-based company. A recent analysis by EvaluatePharma projects 2026 estimated global sales of $1.1 billion (3). In December 2020, Aurinia Pharmaceuticals formed a collaboration and license agreement with Otsuka Pharmaceutical for the development and commercialization of oral voclosporin for the treatment of lupus nephritis in the European Union, Japan, as well as in the UK, Russia, Switzerland, Norway, Belarus, Iceland, Liechtenstein and Ukraine. Earlier this month (June 2021), Otsuka filed an initial marketing authorization application for voclosporin for the treatment of lupus nephritis with the European Medicines Agency.

BridgeBio Pharma, a Palo Alto-based bio/pharmaceutical company with a focus on developing medicines for genetic diseases and cancer, received two NME approvals thus far in 2021 through two of its affiliates: QED Therapeutics and Origin Biosciences.

QED Therapeutics and its licensing partner, Helsinn, a Lugano, Switzerland-based bio/pharmaceutical company and CDMO, gained FDA approval for Truseltiq (infigratinib) for treating previously treated locally advanced or metastatic cholangiocarcinoma (bile duct cancer) with a FGFR2 fusion or rearrangement. BridgeBio and Helsinn are jointly responsible for commercialization activities in the US and will share US profits and losses on an equal basis for infigratinib in oncology and all other indications other than skeletal dysplasia indications. Helsinn has exclusive commercialization rights on infigratinib outside of the US, excluding China, Hong Kong and Macau. Under a global collaboration and licensing agreement between the companies formed earlier this year (March 2021), BridgeBio is eligible for tiered royalties as a percentage of adjusted net sales and payments totaling up to approximately $2.45 billion.

BridgeBio’s Origin Biosciences received FDA approval for Nulibry (fosdenopterin) for treating molybdenum cofactor deficiency Type A, an ultra-rare genetic disorder in infants resulting in severe and largely irreversible neurological injury with high mortality rates.

This year (2021) also has seen the approval of an antibody drug conjugate, Zynlonta (loncastuximab tesirine-lpyl), by Lausanne, Switzerland-based ADC Therapeutics. The drug was approved for treating relapsed or refractory large B-cell lymphoma in adults after certain conditions. Figure 3 lists NME approvals by small to mid-sized companies in 2021 (as of June 28, 2021), and Table I at end of article lists all NME approvals thus far in 2021.

The rise in product innovation from smaller companies comes as R&D productivity from larger bio/pharmaceutical companies declines. An analysis by Deloitte and Global Data, which tracked the late-stage pipelines (Phase III or Phase II with breakthrough therapy designation) of 12 large bio/pharmaceutical companies over a 10-year period beginning in 2010 and an additional cohort of four specialty bio/pharmaceutical companies over five years, showed a decline in returns on R&D investments (4, 5). While individual companies may have had short-term successes, rising R&D costs and lower returns on investments present a challenge. In looking at the study’s original cohort of 12 large bio/pharmaceutical companies, R&D returns have declined each year since 2010, from 10.1% in 2010 to only 1.9% in 2018 and 1.8% in 2019, the most recent available data. Although the extension cohort of four specialty bio/pharmaceutical companies showed better R&D returns, they still show recent declines from 9.3% in 2018 to 6.2% in 2019. At the same time, forecast peak sales per asset for the large bio/pharmaceutical companies have almost halved since 2010, when they were $816 million to $376 million in 2019.

References

1. M. Christel, “Pharm Exec’s Top 50 Companies in 2021,” Pharmaceutical Executive, June 9, 2021, Volume 41, Issue 6.

2. P. Van Arnum, “New Drug Approvals in 2020: Which Drugs Made the Mark?,” DCAT Value Chain Insights, January 20, 2021.

3. P. Van Arnum, “Blockbuster Watch: Small Molecules and Biologics,” DCAT Value Chain Insights. March 3, 2021.

4. P. Van Arnum, “The Pharma Pulse: Product Innovation & Emerging Pharma, DCAT Value Chain Insights, April 28, 2001.

5. “Ten Years from Measuring the Return from Pharma Innovation,” Deloitte Center for Health Solutions and GlobalData (2019).

| Table I: 2021 New Molecular Entities Approved by the US Food and Drug Administration’s Center for Drug Evaluation and Research as of June 28, 2021. | ||

| Company | Proprietary Name (active ingredient); NDA or BLA | Indication |

| ADC Therapeutics | Zynlonta (loncastuximab tesirine-lpyl); BLA | Certain types of relapsed or refractory large B-cell lymphoma |

| Alkermes | Lybalvi (olanzapine and samidorphan); NDA | Schizophrenia in adults and certain aspects of bipolar I disorder in adults |

| Amgen | Lumakras (sotorasib); NDA | Non-small cell lung cancer with the KRAS G12C genetic mutation |

| Apellis Pharmaceuticals | Empaveli (pegcetacoplan); NDA | Paroxysmal nocturnal hemoglobinuria, a rare blood disorder |

| Aurinia Pharmaceuticals | Lupkynis (voclosporin); NDA | Lupus nephritis |

| Aveo Oncology | Fotivda (tivozanib); NDA | Relapsed or refractory advanced renal cell carcinoma |

| Biogen/Eisai | Aduhelm (aducanumab); BLA | Alzheimer’s disease |

| Commave Therapeutics | Azstarys (serdexmethylphenidate and dexmethylphenidate); NDA | Attention deficit hyperactivity disorder |

| G1 Therapeutics | Cosela (trilaciclib); NDA | Chemotherapy-induced myelosuppression in adult patients with small-cell lung cancer |

| GlaxoSmithKline | Jemperli (dostarlimab-gxly); BLA | Recurrent or advanced mismatch repair deficient (dMMR) endometrial cancer |

| Johnson & Johnson’s Janssen | Rybrevant (amivantamab-vmjw); BLA | Non-small-cell lung cancer with epidermal growth factor receptor exon 20 insertion mutations |

| Johnson & Johnson’s Janssen | Ponvory (ponesimod); NDA | Relapsing forms of multiple sclerosis |

| Mayne Pharma | Nextstellis (drospirenone and estetrol); NDA | Contraceptive |

| Merck & Co./Bayer | Verquvo (vericiguat); NDA | Chronic heart failure |

| Merck KGaA’s EMD Serono | Tepmetko (tepotinib); NDA | Metastatic non-small-cell lung cancer) with mesenchymalepithelial transition exon 14 skipping alterations |

| Oncopeptides | Pepaxto (melphalan flufenamide); NDA | Relapsed or refractory multiple myeloma |

| Origin Biosciences | Nulibry (fosdenopterin); NDA | To reduce the risk of death caused by molybdenum cofactor deficiency Type A, a rare, genetic metabolic disorder in infants causing seizures, brain injury and death |

| Progenics Pharmaceuticals | Pylarify (piflufolastat F-18 injection); NDA | Positron emission tomography imaging of prostate-specific membrane antigen-positive lesions in men with prostate cancer |

| QED Therapeutics/Helsinn | Truseltiq (infigratinib); NDA | Cholangiocarcinoma (bile duct cancer) under certain disease criteria |

| Regeneron Pharmaceuticals | Evkeeza (evinacumab-dgnb); BLA | Homozygous familial hypercholesterolemia, a rare condition marked by elevated circulating levels of low-density lipoprotein cholesterol (LDL-C) |

| Sarepta Therapeutics | Amondys 45 (casimersen); NDA | Duchenne muscular dystrophy with a confirmed mutation amenable to exon 45 skipping, a rare genetic disorder characterized by progressive muscle deterioration and weakness |

| Scynexis | Brexafemme (ibrexafungerp); NDA | Vulvovaginal candidiasis |

| Supernus Pharmaceuticals | Qelbree (viloxazine); NDA | Attention deficit hyperactivity disorder in patients 6 to 17 years of age |

| TG Therapeutics | Ukoniq (umbralisib); NDA | Marginal zone lymphoma and follicular lymphoma |

| Viiv Healthcare | Cabenuva (cabotegravir and rilpivirine); NDA | HIV |

| Zealand Pharma | Zegalogue (dasiglucagon); NDA | Severe hypoglycemia |

|

NDA is new drug application; BLA is biologics license application. ADC Therapeutics’ Zynlonta (loncastuximab tesirine-lpyl) is an antibody drug conjugate. Apellis and Sobi entered a collaboration to develop and commercialize systemic pegcetacoplan in October 2020. The companies have global co-development rights for systemic pegcetacoplan. Apellis has exclusive US commercialization rights for systemic pegcetacoplan and retains worldwide commercial rights for ophthalmological pegcetacoplan, including for geographic atrophy. Sobi has exclusive ex-US commercialization rights for systemic pegcetacoplan. Aurinia Pharmaceuticals formed a collaboration and license agreement in December 2020 with Otsuka Pharmaceutical for the development and commercialization of oral voclosporin for the treatment of lupus nephritis in the European Union, Japan, as well as in the UK, Russia, Switzerland, Norway, Belarus, Iceland, Liechtenstein and Ukraine. Biogen licensed aducanumab from Neurimmune, a Zurich, Switzerland-based bio/pharmaceutical company. Since 2017, Biogen and Eisai have collaborated on the development and commercialization of aducanumab globally. Commave Therapeutics has an exclusive worldwide license to develop, manufacture and commercialize KemPharm’s product candidates containing serdexmethylphenidateand d-methylphenidate including Azstarys. G1 Therapeutics announced in June 20201 a three-year co-promotion agreement with Boehringer Ingelheim for Cosela in small-cell lung cancer in the US and Puerto Rico. GlaxoSmithKline acquired Tesaro in 2019; AnaptysBio discovered dostarlimab and licensed it to Tesaro. Merck & Co. has commercial rights to vericiguat in the US, and Bayer has exclusive commercial rights in the rest of world. The companies share equally the costs of development of vericiguat. QED Therapeutics and Helsinn formed a collaboration in March 2021 to co-commercialize infigratinib for oncology and all other indications other than skeletal dysplasia indications in the US and equally share profits. Helsinn has an exclusive license to co-develop, manufacture and commercialize infigratinib in such indications outside of the US, excluding China, Hong Kong and Macau. Viiv Healthcare is a specialist HIV bio/pharmaceutical company of GlaxoSmithKline, Pfizer, and Shionogi. Viiv Healthcare’s Cabenuva is provided as a co-pack with two injectable medicines: ViiV Healthcare’s cabotegravir and Johnson & Johnson’ Janssen’s rilpivirine. Source: Center for Drug Evaluation and Research, US Food and Drug Administration and company information |

||