Mid-Year CDMO Review: COVID-19 Vaccine Manufacturing and M&A

What have been the key developments in 2021 thus far in the CDMO market? Increasing participation by CDMOs in COVID-19 vaccine manufacturing and robust mergers and acquisition activity have marked the first half of 2021. What are the implications, and what can be expected going forward?

CDMOs and COVID-19 vaccine manufacturing

The first half of 2021 has highlighted the indispensability of CDMOs in the bio/pharmaceutical industry. They have been vital to the successful launch of vaccines and therapies to combat the COVID-19 virus, and they have never been viewed as more valuable by the industry or by investors.

|

|

Jim Miller |

As the response to the COVID pandemic was taking shape, few CDMOs had experience in developing and manufacturing vaccines on a global scale. Vaccines were very much a niche business: a few CDMOs, such as Germany’s IDT Biologika, had established positions and some CDMOs had experience with seasonal vaccines, but that generally wasn’t an attractive business. Most major vaccine manufacturers, including Merck & Co, Sanofi, GlaxoSmithKline (GSK), and Pfizer, along with companies in emerging markets, such as the Serum Institute of India, did most of their development and manufacturing in-house.

In the first months of the pandemic, less than 10 CDMOs were known publicly to be working with bio/pharma companies and government agencies to develop and manufacture vaccines. Contracts were going to CDMOs that had specific technical experience, e.g., in mRNA manufacture, or that had capacity available or could expand capacity quickly, including Catalent, Lonza, and Grand River Aseptic Manufacturing. These contracts, however, were also going to companies with very limited experience and in some cases, just business plans. The initial vaccine launch was dependent on a handful of companies and facilities.

Today, as the vaccine rollout has gained speed, the demand for manufacturing capacity has ballooned, and the number of CDMOs known to be involved in supporting the six major Western vaccines has swelled (see Figure 1 at end of article). Many other CDMOs are thought to be involved but have not announced their customer relationships. CDMOs are engaged in making the vaccine active ingredients and key excipients, such as lipids, filling the vaccines into vials, packaging, and distribution. In addition, several large bio/pharma companies, including Merck & Co, Sanofi, and GSK, agreed to use their capacity to contract manufacture products for their erstwhile competitors after their own vaccines either failed or were delayed.

The demand for vaccine capacity has raised the profiles and status of many CDMOs that previously depended on older products and generics, including injectables, such as Fareva, Delpharm, Wockhardt, and Recipharm. Small drug-substance manufacturers have also benefitted, including Mabion, Celonic, and Wacker Biotech. Some companies, such as Rovi Contract Manufacturing, have scored both drug-substance and drug-product contracts.

Given the compressed and high stakes nature of the vaccine development and rollout efforts, it’s hardly a surprise that some developer–CDMO collaborations did not go well. The most high-profile problems have been at Emergent BioSolutions’ vaccine facility in Baltimore (not to be confused with Emergent’s injectables facility in the Camden area of Baltimore). No doubt because of its long relationship with Biomedical Advanced Research and Development Authority (BARDA) as a manufacturer of vaccines for the US military, Emergent had been one of the most active CDMOs in gaining contracts at the beginning of the pandemic, including deals with Johnson and Johnson and AstraZeneca. The Baltimore facility, however, ran into severe quality problems that resulted in Johnson and Johnson taking over the operation of the facility and AstraZeneca being forced to find an alternative supply source.

Potential implications of increased injectables capacity

While the world’s attention will be on ensuring the adequate supply of vaccines for the next several years, participants in and observers of the CDMO industry will increasingly be focused on the longer-term implications of the CDMO’s role in the pandemic response. A key question is what will happen with all of the injectables capacity that has been committed to or built for the pandemic response. Will governments maintain vaccine-preparedness programs that will pay for guaranteed manufacturing capacity for years into the future? Will it be absorbed as national supply-security initiatives forcibly repatriate more drug manufacture? Or will that capacity get dumped onto the commercial contract manufacturing market, with negative implications for pricing and profitability?

A second question relates to how the higher profile of previously lesser-known CDMOs could ultimately affect competitive dynamics in the CDMO industry. It’s likely that if they perform well as vaccine suppliers, their performance and supply relationships will give them access to more opportunities for higher-value products that would otherwise have gone to one of the very large CDMOs. Further, many small and mid-size injectable CDMOs are building new clinical and commercial capacity to fill a void left by the largest CDMOs, which need big projects to maintain injectable operations that now generate revenues of $1 billion or more. With the pipeline of injectable drugs growing rapidly and record levels of funding flowing to emerging bio/pharma companies, there is a growing need for capacity at the smaller project end of the market. While industry revenue may be getting more consolidated through mergers and acquisitions (M&A) (see article below), the number of industry participants is actually growing.

CDMO M&A remains robust

The other big CDMO story of the first half of 2021 has been M&A activity. CDMO M&A has been white hot as investors look to buy their way into the industry and incumbents seek to broaden and deepen their capabilities. There were 32 deals announced or closed during the first five months of 2021, including 19 acquisitions of companies, four acquisitions of business units divested by their parent companies, and nine facility acquisitions.

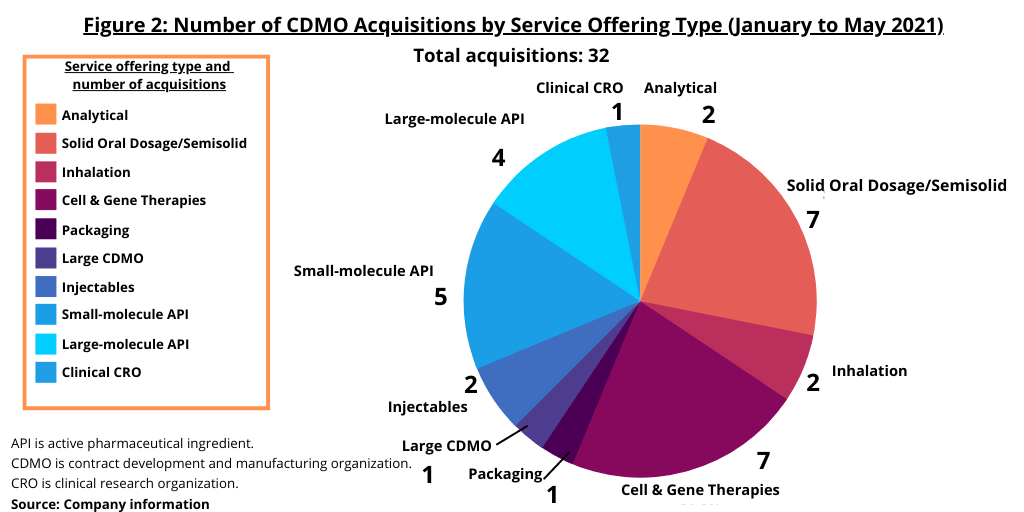

The biggest service categories among the 32 deals (see Figure 2) were gene and cell therapies with seven deals, and, somewhat surprisingly, providers of services for solid and semisolid/liquid products, which also accounted for seven transactions. There were five deals for small-molecule active pharmaceutical ingredient (API) businesses, and four for large-molecule manufacturing assets (see Figure 2).

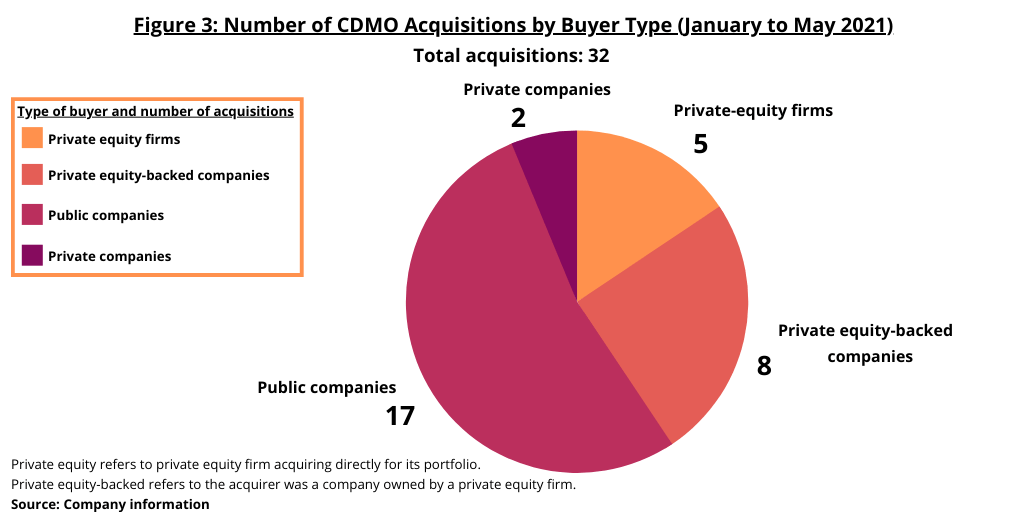

Among the buyers of CDMOs, public companies were the buyers in 17 of the transactions. Private equity (PE) firms acquired five companies (meaning the PE acquired the CDMO for its own portfolio) while PE-backed firms (meaning the acquirer was a company owned by a PE firm) did eight deals (see Figure 3). Five companies closed or announced multiple deals: the WuXi family of companies (WuXi AppTec, WuXi STA and WuXi Biologics) did four deals while three companies—Catalent, Charles River Laboratories, and Resilience—did three each; Thermo Fisher Scientific had two deals.

Divestiture has been a major theme in CDMO activity thus far this year, with nine facilities and four business units sold. Novasep sold its chromatography business unit to Sartorius, and its viral vector business to Thermo Fisher, boosting the latter’s gene- and cell-therapy business. Other facility divestitures by CDMOs included four solid and semisolid dose operations. Lonza sold off its liquid-filled hard capsule and softgel operations to NextPharma; Bora Pharmaceuticals gained a North American presence by buying GSK’s facility in Mississauga, Ontario, Canada. Fareva’s deal for Novartis’ injectables site in Unterach, Austria was its third injectables acquisition in four months and jumped it to one of the top spots in the injectable league tables.

Cell and gene therapies: a major source of CDMO M&A

Bulking up on cell- and gene-therapy assets has been another major theme. In addition to Thermo Fisher’s acquisition of the Novasep site, Catalent bolstered its cell- and gene-therapy business by acquiring the cell-therapy subsidiary of Promethera Biosciences. Charles River Laboratories acquired three companies (Retrogenix, Vigene, and Cognate Biosciences) to fortify its position in early development of cell and gene therapies. WuXi AppTec acquired Oxgene (Oxford Genetics), and Pharmaron acquired a biologics facility in Liverpool, UK, for its entry into cell and gene therapies.

Private equity and CDMO M&A

Private equity investors accounted for three of the biggest deals thus far this year (2021) with acquisitions that are making publicly traded CDMOs into private companies as outlined below.

EQT/Recipharm. EQT closed its $2.8-billion acquisition of Recipharm, which offers a broad range of conventional dose form development and manufacturing services. EQT already owned CDMOs Aldevron (plasmid DNA for viral vectors) and Fertin Pharma (specialty dose forms); it also owns SHL Medical, a leading developer and manufacturer of injectable delivery devices.

Clayton, Dubilier & Rice/UDG Healthcare. Clayton, Dubilier & Rice agreed to buy UDG Healthcare for $3.7 billion. UDG is the parent company of contract packager, Sharp (36% of operating profits), and strategic marketing services provider, Ashfield (64%). Sharp has had strong organic growth, driven in part by the COVID response while Ashfield has been built through an aggressive acquisition program.

Caryle Group/Vectura. Carlyle Group announced it will acquire inhalation CDMO Vectura for $1.35 billion. Vectura has been navigating a transition from a hybrid model of developing its own products and offering CDMO services to being a dedicated CDMO.

Largest deal thus far: Thermo Fisher Scientific/PPD

The really stunning deal of the year has been Thermo Fisher Scientific’s offer to acquire clinical research contractor, PPD, for $17.3 billion. PPD generated revenues of nearly $5 billion in the past 12 months from its offerings in clinical trial management and laboratory services, with an especially strong position as a strategic provider to major bio/pharma companies.

Thermo Fisher has already positioned itself as a provider of a broad range of services to the bio/pharma industry, including drug-product and drug-substance manufacturing, clinical supply services, cell- and gene-therapy manufacturing, laboratory instrumentation and consumables, and diagnostics; PPD’s clinical research capabilities will add to that. The company touted the acquisition as “a natural extension for Thermo Fisher” and said it plans to “invest in and connect the capabilities across the combined company.” The deal has several potential strategic benefits for Thermo Fisher, including:

- Expanding the range of services across which it can establish relationships with major bio/pharmaceutical companies.

- Enabling tighter integration between clinical trial operations and clinical trial supplies. Such integration could be advantageous as the industry moves to decentralized trials and direct-to-patient distribution.

- Boosting the laboratory services offering of Thermo Fisher’s bio/pharma manufacturing business.

The Thermo Fisher–PPD acquisition also represents another step up in the rivalry among the CDMO Big 4, which includes Catalent, Lonza, and the WuXi family of companies (which already provides clinical research services). As the companies jockey for industry leadership and a favored supplier position with global bio/pharma companies, we are likely to see more such blockbuster deals.

5

| Figure I: Select Examples of CDMOs with Publicly Announced Roles in COVID-19 Vaccine Manufacture | ||||||

| CDMO | Pfizer BioNtech |

Moderna | Johnson & Johnson | AstraZeneca | Novavax | CureVac |

| AGC Biologics | Vaccine substance | Vaccine substance | ||||

| Aldevron | Vaccine substance | |||||

| AMRI | Lipids | Fill-Finish | ||||

| Baxter BioPharma Solutions | Fill-Finish | Fill-Finish | ||||

| Catalent | Fill-Finish | Fill-Finish | Vaccine substance; Fill-Finish | |||

| Celonic | Vaccine substance; lipid nanoparticle formulation | |||||

| CordenPharma | lipids | |||||

| Delpharm | Fill-Finish | |||||

| Emergent Biosolutions | Vaccine substance | |||||

| Evonik | lipids | |||||

| Exelead | Vaccine precursor | |||||

| Fareva | Fill-Finish | |||||

| Fujifilm Diosynth Biotechnologies | Vaccine substance | |||||

| Grand River Aseptic Manufacturing | Fill-Finish | |||||

| Halix | Vaccine substance | |||||

| IDT Biologika | Vaccine substance | |||||

| Jubilant HollisterStier | Fill-Finish | |||||

| Lonza | Vaccine substance | |||||

| Mabion | Vaccine substance | |||||

| Oxford Biomedica | Vaccine substance | |||||

| PolyPeptide Group | Vaccine substance | |||||

| Recipharm | Fill-Finish | |||||

| Rentschler Biopharma | Vaccine substance | Vaccine substance | ||||

| Rovi | Vaccine substance; fill-finish |

|||||

| Samsung Biologics | Fill-Finish | |||||

| Serum Institute of India* | Manufacturing type not disclosed** | Vaccine substance; Fill-Finish | ||||

| Siegfried | Fill-Finish | Fill-Finish | ||||

| Thermo Fisher Scientific | Fill-Finish | Fill-Finish | ||||

| Wacker Biotech | Vaccine substance | |||||

| Wockhardt | Fill-Finish | |||||

|

Vaccine substance includes precursors, antigen, related materials, and/or adjuvants. * Also manufacturing the Russian Sputnik V vaccine in India. **The Serum Institute of India is partnered with AstraZeneca for the supply of AstraZeneca’s COVID-19 vaccine to the Indian government and to a large number of low- and middle-income countries. Note: MilliporeSigma increased lipid capacity and is supplying to undisclosed COVID-19 vaccine developers. Information compiled as of June 7, 2021. Source: Company information |

||||||

Editor’s Note: Figure I was updated to include additional manufacturing roles for select CDMOs.