Market Watch: Cell and Gene Therapies, Niche But Growing

Cell and gene therapies are a niche, but growing part of the bio/pharma industry. DCAT Value Chain Insights looks at key market activity: number of developers, commercial products, pipelines, and financing trends. Where does the industry stand, and what’s the potential?

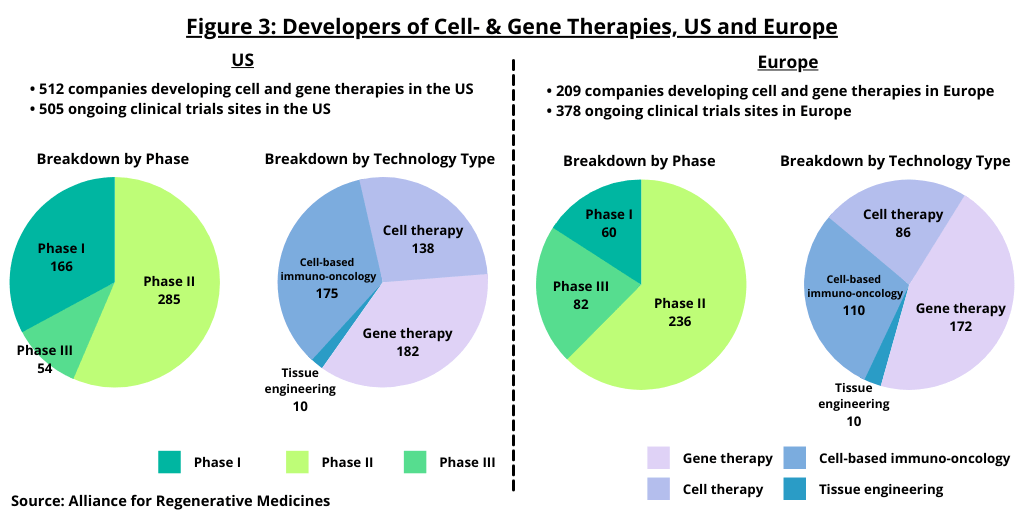

Financing trends

One measure of the health of a given sector is to look at the financing trends in that sector. The regenerative medicine and advanced therapies sector raised a record $19.9 billion in funding in 2020 (see Figure 1), up 50% from the $9.8 billion raised in 2019 and exceeding the the previous record of $13.5 billion set in 2018, according to information from the Alliance for Regenerative Medicine (ARM), an international advocacy organization for regenerative medicines and advanced therapies. The $19.9 billion raised in 2020 included more than 50 deals with at least $100 million raised from five deal types: (1) initial public offerings; (2) follow-on offerings; (3) venture capital; (4) partnerships; and (5) private placements.

Publicly traded regenerative-medicine companies saw an approximate 44% increase in performance in 2020, eclipsing the NASDAQ Biotech Index, which increased by 23%, according to the ARM analysis. Initial and follow-on public offerings, totaling $3.7 billion and $6.0 billion, respectively, (see Figure 1) surpassed those in previous years, according to the ARM analysis. In total, 14 developers went public in 2020, compared to six in 2019 and 12 in 2018. Of these 14 initial public offerings (IPOs) in 2020, 11 of them raised $100 million or more.

The largest IPOs in 2020 were from Legend Biotech, a Somerset, New Jersey-based company developing cell therapies for oncology and other indications, with $487 million raised; AlloVir, a Cambridge, Massachusetts-based clinical-stage cell-therapy company, with $317 million raised; and Nkarta, a South San Francisco, California-based company focused on developing allogeneic natural killer cell therapies for cancer, with $290 million raised.

Six other companies raised $200 million or more through an IPO in 2020. These companies were: Passage Bio, a Philadelphia-based company developing gene therapies for rare monogenic central nervous system disorders ($248 million raised); Akouos, a Boston-based company developing gene therapies for hearing disorders ($244 million); Generation Bio, a Cambridge, Massachusetts company developing non-viral gene therapies ($230 million); Poseida Therapeutics, a San Diego-based cell- and gene-therapy company ($224 million); and Beam Therapeutics, a Cambridge, Massachusetts-based company with a platform for gene editing and delivery technologies for precision genetic medicines ($207 million).

Three companies raised between $100 million and $200 million in 2020. They were: Taysha Gene Therapeutics, a Dallas, Texas-based company developing gene therapies for monogenic central nervous system diseases ($181 million); Freeline Therapeutics, a Stevenage, UK-based gene-therapy company ($159 million); and Immunotech Biopharma, a Beijing-based developer of T cell immunotherapies ($142 million).

In terms of private financing, venture-capital financing accounted for $5.6 billion in 2020 (see Figure 1), which exceeded the $4.1 billion record set in 2019, according to the ARM analysis. Partnerships with bio/pharmaceutical companies were another large source of funding in 2020, with partnerships accounting for $3.0 billion (based on upfront payments). Key partnerships from 2020 include a $350-million upfront agreement (plus up to $2.37 billion in potential milestones) between Biogen and Sangamo Therapeutics, a Brisbane, California-based genomic medicine company, to develop gene-regulation therapies using zinc finger proteins for neurodegenerative disorders; and a $100-million upfront deal (plus up to $3 billion in potential milestone payments) between Johnson & Johnson’s Janssen and Fate Therapeutics, a San Diego-based bio/pharmaceutical company, to develop cell-based immunotherapies for hematologic and solid tumors.

Number of developers

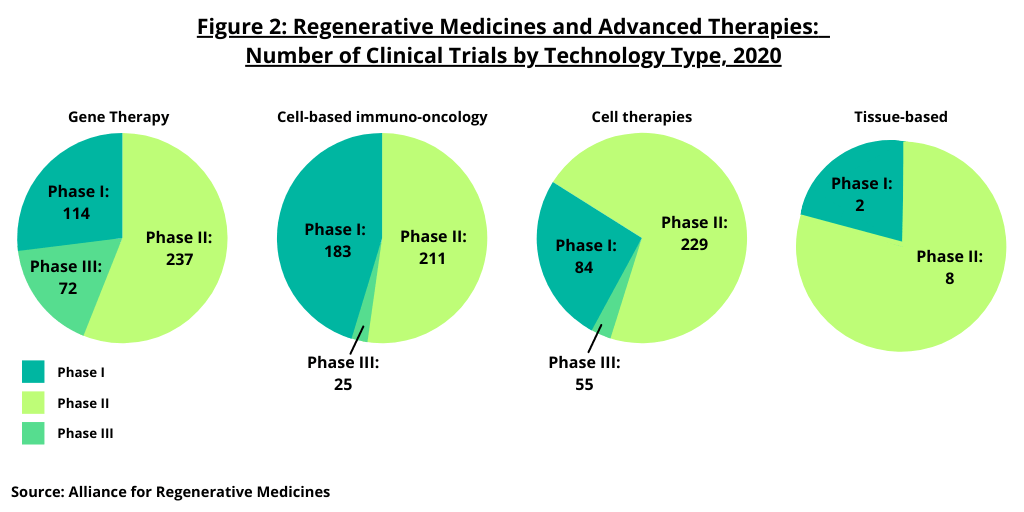

There were 1,085 developers of cell, gene, and tissue-based therapies active worldwide at the end of 2020, an increase of about 100 developers from the previous year, according to the ARM analysis. Of these 1,085 companies, 50%, or 545, were based in North America, with the US accounting for the lion’s share with 512 companies. Asia-Pacific is the second largest region for developers of cell- gene-, and tissue-based therapies, accounting for 27% of the global total, or 295 companies, followed by Europe, which accounted for 19%, or 209 companies. The Middle East and Africa accounted for 2%, or 25 companies, and South America for 1%, or 13 companies.

Product approvals in 2020 and 2021 to date

On a global basis, in 2020 and 2021 to date, several new advanced therapy products have been approved and existing products have received approval for new indications.

Among approvals from the large pharmaceutical companies, in February (February 2021), the US Food and Drug Administration (FDA) approved Bristol-Myers Squibb’s (BMS) Breyanzi (lisocabtagene maraleucel), a chimeric antigen receptor (CAR) T-cell therapy for treating relapsed or refractory large B-cell lymphoma. In March (March 2021), BMS and bluebird bio, a Cambridge, Massachusetts gene-therapy company, received FDA approval for Abecma (idecabtagene vicleucel) for treating relapsed or refractory multiple myeloma.

Gilead Sciences gained two product approvals in 2020. Earlier this year (March 2021), Gilead received FDA accelerated approval for Yescarta (axicabtagene ciloleucel), a CAR T-cell therapy for treating adult patients with relapsed or refractory follicular lymphoma, making it another indication for the therapy. It was earlier approved in the US and Europe to treat adult patients with certain types of large B-cell lymphoma.

In July (July 2020), Gilead gained accelerated approval from the FDA for Tecartus (brexucabtagene autoleucel), a CAR T-cell therapy for treating adults with relapsed/refractor mantle-cell lymphoma. It was later (December 2020) granted conditional marketing approval in Europe.

In 2020, Novartis received approval for its gene therapy, Zolgensma (onasemnogene abeparvovec-xioi), for treating spinal muscular atrophy (SMA), a rare neuromuscular disorder in Japan, Europe, and Canada. It had been earlier approved by the FDA to treat pediatric SMA in 2019.

Also in 2020, Novartis received approval from Health Canada for Luxturna (voretigene neparvovec-rzyl) for treating confirmed biallelic RPE65 mutation-associated retinal dystrophy, a degenerative disease of the retina. In 2018, Novartis entered into a licensing agreement with Spark Therapeutics, which was acquired by Roche in 2019 for $4.8 billion, to develop and commercialize voretigene neparvovec outside the US with Spark Therapeutics exclusively commercializing the gene therapy in the US. The FDA approved Luxturna in 2017, which made it the first directly administered gene therapy approved in the US that targeted a disease caused by mutations in a specific gene. It was subsequently approved in Europe.

Among smaller companies, Orchard Therapeutics, a London-based gene-therapy company, received approval in Europe in 2020 for Libmeldy (atidarsagene autotemcel) for treating metachromatic leukodystrophy, a rare hereditary disease characterized by accumulation of fats that destroy the protective fatty layer surrounding the nerves in both the central nervous system and the peripheral nervous system.The company plans to complete additional interactions with the FDA by mid-2021 to determine the path to a biologics license application filing.

Among some companies with upcoming regulatory reviews in 2021 of new products are Legend Biotech and J&J’s Janssen, which are partnered for ciltacabtagene autoleucel (cilta-cel), a CAR T-cell therapy for treating relapsed or refractory multiple myeloma. In December 2017, the companies entered into an exclusive worldwide license and collaboration agreement to develop and commercialize cilta-cel. A biologics license application (BLA) seeking approval of cilta-cel was accepted by the FDA, and a marketing authorization application was accepted by the European Medicines Agency. Last month (May 2021), the FDA granted priority review for the drug with a Prescription Drug User Fee Act target action date set for November 29, 2021.

Last month (May 2021), the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) adopted a positive opinion recommending marketing authorization for bluebird bio’s Skysona (elivaldogene autotemcel, Lenti-D, or eli-cel), a one-time gene therapy for treating cerebral adrenoleukodystrophy (CALD), a rare pediatric neurodegenerative disease. The CHMP’s positive opinion is under review by the European Commission (EC), which has the authority to grant marketing authorization in the European Union. A final decision by the EC is anticipated in mid-2021. The FDA granted eli-cel orphan drug status, rare pediatric disease designation, and breakthrough therapy designation for the treatment of CALD. bluebird bio says it is currently on track to submit the BLA to the FDA in mid-2021.

Pipeline progress

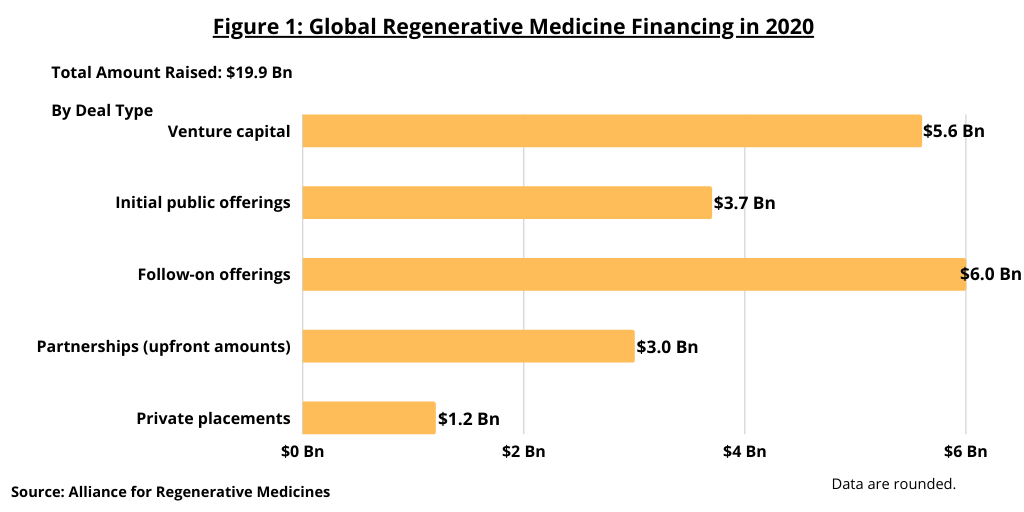

In looking at the industry’s pipeline of cell and gene therapies and clinical activity, there were 1,220 ongoing regenerative medicine clinical trials worldwide at the end of 2020, according to the ARM analysis, which includes 152 trials in Phase III development. Figure 2 outlines the number of ongoing clinical trials by technology type (gene therapy, cell-based immune-oncology therapies, cell therapies, and tissue-based therapies) by phase of development. Of the 152 Phase III trials, almost half, 72 were for gene therapies, 55 were for cell therapies, and 25 were for cell-based immuno-oncology therapies.

Figure 3 further breaks down the industry’s pipeline among developers and clinical trial sites in the US and Europe. At the end of 2020, in the US, there were 512 companies developing cell and gene therapies in the US with 505 ongoing clinical trials sites in the US, according to the ARM analysis. In Europe, there were 209 companies developing cell and gene therapies in Europe and 378 ongoing clinical trials sites in Europe. By technology type, in both the US and Europe, gene therapies and cell-based immuno-oncology therapies account for the largest number of clinical trials (see Figure 3).