Market Outlook for Orphan Drugs: Niche No More

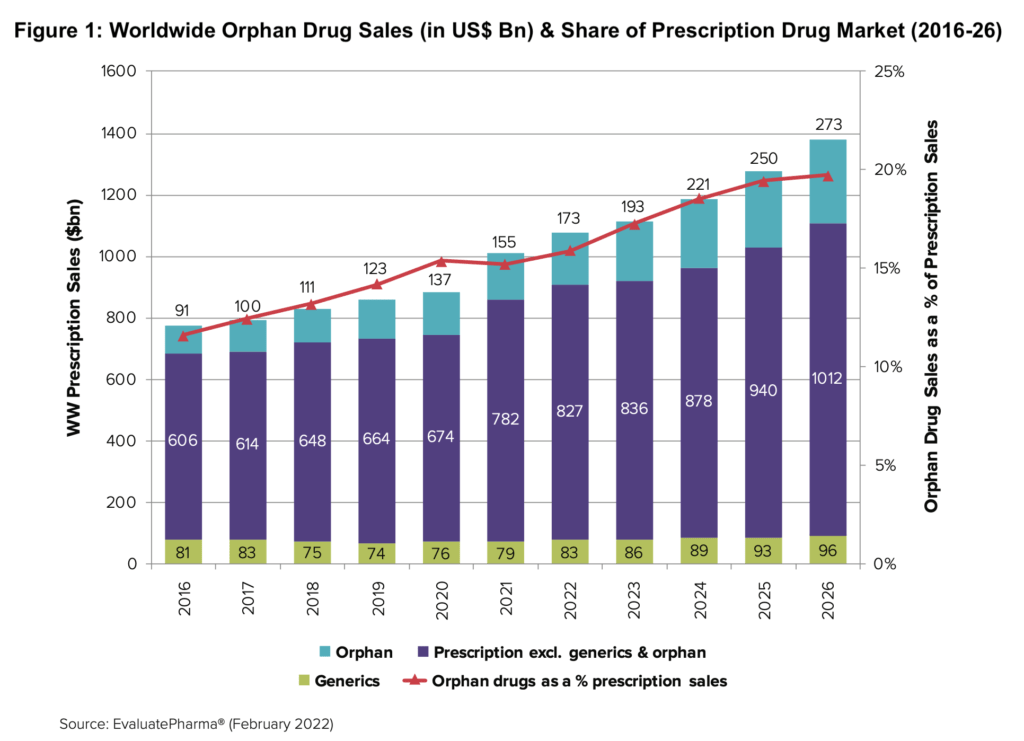

The orphan-drug sector is growing twice as fast as the non-orphan drug market and is projected to represent at least 20% of the global market by 2026 with several blockbusters. Which companies and products are leading the charge?

* Market growth and outlook for orphan drugs

* Top 10 Companies in Orphan Drugs

* Top 10 Selling Orphan Drugs Projected for 2026

* Most Promising Orphan Product Candidates

The rise of orphan drugs

Although a niche area in terms of the patient populations served, orphan drugs are increasingly becoming an important part of the growth strategy of both the large bio/pharmaceutical companies as well as smaller companies with several orphan products poised or already achieving blockbuster status (defined as products with sales of $1 billion or more).

Orphan drugs are defined as prescription medicines developed for rare diseases and conditions, which, in the US, affect fewer than 200,000 people, or, in the European Union, affect 5 per 10,000 people or fewer. In 2021, 26 of the 50 (52%) of the new molecular entities (NMEs) approved by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) were orphan drugs. This continues a recent trend in which approximately 40% to roughly 50% of NME approvals were for orphan drugs. In 2020, 58%, or 31, of the 53 NME approvals in 2020 were orphan drugs. The 58% of NME approvals in 2020 matched a recent high in the share of orphan drugs in NME approvals; in 2018, 58%, or 34, of the 59 NMEs approved were orphan drugs (1).

“The orphan drug sector continues to experience rapid growth. Over half of the FDA’s approvals in 2021 were assigned to orphan drugs intended to treat rare diseases, a development that signals that orphan drugs should no longer be regarded as niche products,” said Paul Verdin, Vice President of Consulting and Analytics at Evaluate Ltd., a provider of market intelligence and predictive analytics for the pharmaceutical industry, in an April 27, 2022 press release in commenting on a recent Evaluate report on orphan drugs. “Orphans’ strong growth is leading to crowding in some corners of the market, but many of the estimated 7,000 rare diseases remain under-served, so the opportunity for further investment and R&D is high. As other diseases are better understood and sliced into narrower sub-categories, they are they are more likely to meet the criteria for a rare condition,” he said.

Market growth for orphan drugs outpaces non-orphan drugs

The orphan drug market is growing more than twice as fast as the non-orphan pharmaceutical market, according to a recent analysis, The Orphan Drug Report 2022, by Evaluate Ltd. The compound annual growth rate (CAGR) for orphan drugs in the forecast period of 2021–2026 is projected at 12% according to the Evaluate report. By 2026, orphan drug sales will account for 20% of all prescription drug sales globally and almost one-third of the global drug pipeline’s value. Each of the top 10 orphan blockbusters in 2026 will be worth between $3 billion and $13 billion. The net present value of forecast 2026 sales of the top 10 pipeline orphan drugs is more than $42 billion.

For purposes of the Evaluate analysis, the firm identifies products that have been granted orphan drug designations in the US, European Union, or Japan and are included in the analysis with the following conditions:

- The product is approved only for use in the indication/s for which it was awarded orphan designation and these indications are covered by Evaluate Pharma, Evaluate Ltd.’s proprietary pharmaceutical market analysis offering.

- Approximately one-fifth of products have designations in orphan and non-orphan indications. Products that have orphan and non-orphan drug designations and are expected to generate less than 50% of their sales in 2021 and 2026 from their orphan-designated indication/s, are excluded from this analysis.

This has led to the exclusion of therapies such as Avastin, Opdivo, Enbrel, Herceptin, Humira and Remicade.

Evaluate Pharma will also classify R&D products as “orphan drugs” prior to the products receiving this status from regulatory bodies in the following cases: (1) the product is being developed in an indication that is classified by regulatory bodies as an orphan disease, and other products for this disease were granted orphan drug designation; and (2) the company developing the product states it is seeking orphan drug designation for the product’s lead indication.

Figure 1 shows the continued ascent of orphan drugs in the global market with 12% CAGR between 2021–2026 and projected market share of 20% by 2026.

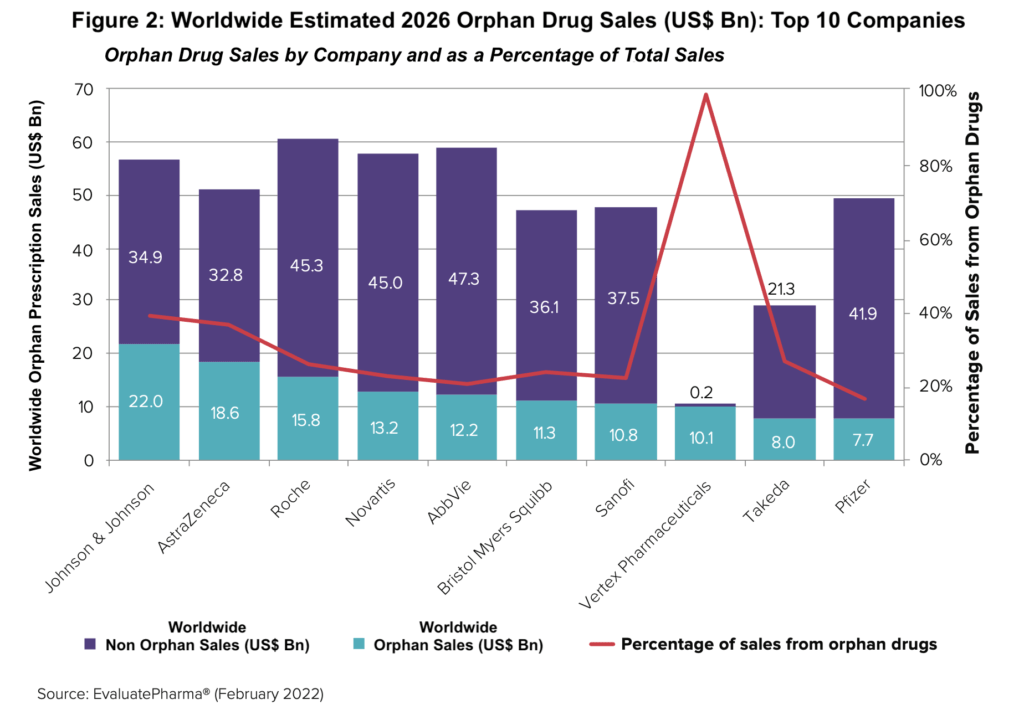

Big Pharma and orphan drugs

Big Pharma’s increasing reliance on orphan drugs for sales is anticipated to continue, with nine of the top 10 best-selling orphan drugs in 2026 expected to be marketed or co-marketed by the large bio/pharmaceutical companies (see Figure 2). In 2026, Big Pharma will sponsor eight of the top 10 best-selling orphan drugs, which rises to nine when Novartis’ ex-US rights to Incyte’s Jakafi (ruxolitinib) is included. Vertex Pharmaceuticals is projected to be the only non-Big Pharma company among the top 10 companies with orphan-drug blockbusters following Alexion Pharmaceuticals’ $39-billion acquisition by AstraZeneca in 2021 and Celgene’s acquisition by Bristol Myers Squibb for $74 billion in 2019. Over one-fifth of sales at eight large bio/pharma companies will be from orphan products.

The importance of orphan drugs in the growth strategies of the top bio/pharmaceutical companies is seen in the rising share of orphan drugs in their overall sales. Among the top 10 companies in orphan drug sales, the top nine large bio/pharmaceutical companies are projected to have orphan drug sales account for between 16% and 39% of their projected 2026 sales (see Figure 2 above), according to the Evaluate report. Vertex Pharmaceuticals, the only non-Big Pharma company in the top 10 companies with orphan products, will have nearly all its sales (98%) be attributed to orphan products.

J&J is projected to lead among the large bio/pharma companies with approximately 39% of its pharma sales from orphan products in 2026, up from 25% in 2021, according to the Evaluate report. AstraZeneca follows with approximately 36% of its projected 2026 sales from orphan products compared to 21% in 2021, and then Takeda with approximately 27% of its sales projected for 2026 in orphan drugs, up from 23% in 2021. The breakdown of the percentage share of orphan drugs in the total projected 2026 sales of the other top companies projected are as follows: Roche, 26%; Bristol-Myers Squibb, 24%; Novartis, 23%; Sanofi, 22%; AbbVie, 20%; and Pfizer, 16%.

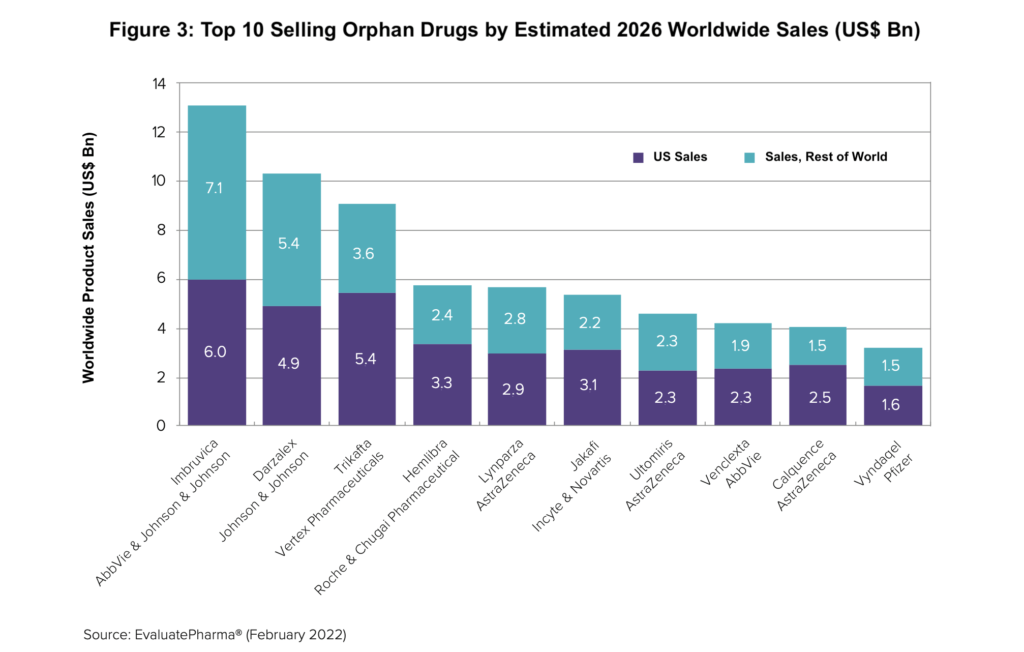

Which orphan drug among these top companies will lead estimated sales in 2026? Figure 3 highlights the projected top 10-selling orphan products based on estimated 2026 revenues. AbbVie’s/J&J Imbruvica (ibrutinib), a drug for treating chronic lymphocytic leukemia, is projected to top orphan drug sales in 2026 with $13 billion in worldwide sales, according to the Evaluate analysis, rivalling two of the top-selling non-orphan mass-marketed drugs globally based on projected 2026 sales: Bristol-Myers Squibb’s/Pfizer’s Eliquis (apixaban), an anticoagulant, and Sanofi’s Dupixent (dupilumab), an anti-inflammatory drug for treating allergic diseases such as eczema, asthma and nasal polyps that result in chronic sinusitis.

The number two orphan drug, J&J’s Darzalex (daratumumab) for treating certain types of multiple myeloma, is expected to post $10 billion in sales 2026, which would exceed projected revenues for two non-orphan mass-marketed drugs: Novo Nordisk’s diabetes best-seller Ozempic (semaglutide) and AbbVie’s rheumatoid arthritis drug, Rinvoq (upadacitinib).

Rounding out the other projected top-selling orphan drugs in the top 10 are (see Figure 3 above): Vertex Pharmaceuticals’ Trikafta (elexacaftor/tezacaftor/ivacaftor and ivacaftor) for treating certain forms of cystic fibrosis; Roche’s and Chugai Pharmaceuticals’ Hemlibra (emicizumab-kxwh) for preventing or reducing the frequency of bleeding episodes; AstraZeneca’s Lynparza (olaparib) for treating BRCA-mutated advanced ovarian cancer; Novartis’ and Incyte’s Jakafi (ruxolitinib) for treating myelofibrosis, polycythemia vera, and graft-versus host disease; AstraZeneca’s Ultomiris (ravulizumab) for treating two rare blood disorders, paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome; AbbVie’s Venclexta (venetoclax) for treating certain blood cancers; AstraZeneca’s Calquence (acalabrutinib) also for treating mantle cell lymphoma, chronic lymphocytic leukemia, or small lymphocytic lymphoma; and Pfizer’s Vyndaqel (tafamidis) treating cardiomyopathy caused by transthyretin mediated amyloidosis.

Five of these top 10 orphan drug (based on 2026 estimates), representing over half (56%) the combined $65 billion sales in projected 2026 sales of orphan drugs, address blood cancers, according to the Evaluate report. They include: AbbVie’s/J&J’s Imbruvica (ibrutinib); J&J’s Darzalex (daratumumab); AbbVie’s Venclexta (venetoclax); AstraZeneca’s Calquence (acalabrutinib); and Novartis’ and Incyte’s Jakafi (ruxolitinib), which treats rare bone marrow cancers myelofibrosis and polycythemia vera. Two others in the top 10 projected orphan drugs in 2026 treat other rare blood disorders: Roche’s Hemlibra addresses hemophilia A, a blood-clotting disorder, and AstraZeneca’s Ultomiris (ravulizumab) is used for treating paroxysmal nocturnal hemoglobinuria and atypical haemolytic uremic syndrome.

Overall, however, oncology continues to dominate orphan drug sales, accounting for 48% of global orphan drug sales in 2021 and projected to account for 47% of orphan drug sales in 2026, according to the Evaluate report. Blood diseases, including hemophilia and beta thalassemia, are the second most popular therapy area (15% of orphan drug sales in 2021, 12% projected for 2026) followed by drugs to treat central nervous system diseases (9% of orphan drug sales in 2021, 9% projected for 2026).

Promising pipeline candidates

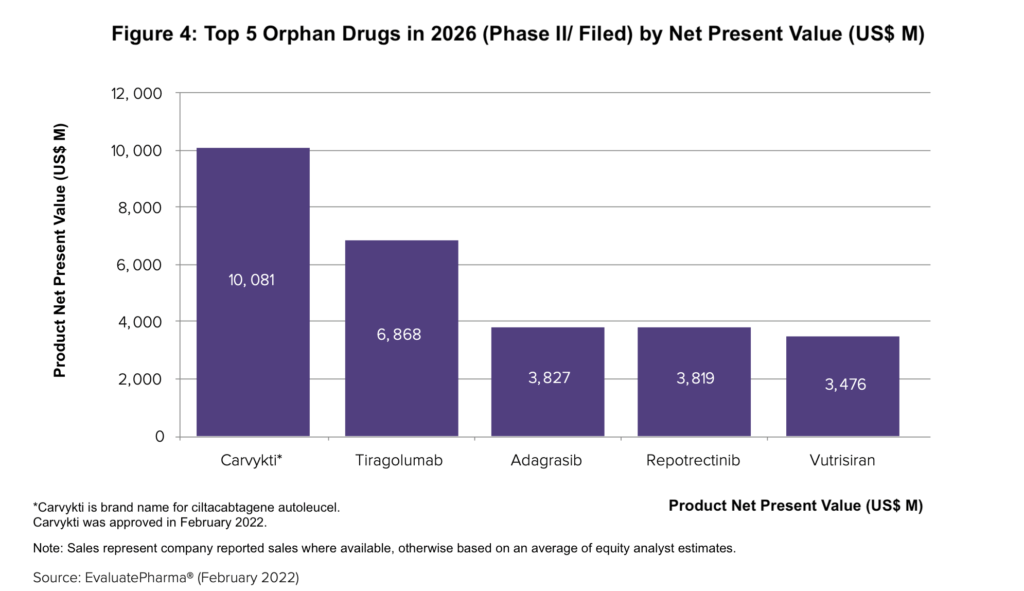

New modalities, such as CAR-T therapies or gene-edited medicines, often start as orphan indications, and in looking at the most promising pipeline candidates among orphan drugs, J&J’s Carvykti (ciltacabtagene autoleucel), a CAR-T therapy, leads the pact with forecast 2026 sales of $1.7 billion and a net present value of more than $10 billion, according to the Evaluate report. Carvykti was approved in February 2022 for treating relapsed or refractory multiple myeloma after four or more prior treatment rounds. Carvykti is the sixth CAR-T cell therapy to reach the US market, and the second that targets the B-cell maturation antigen. Novartis’ Kymriah (tisagenlecleucel) was the first CAR-T therapy to be approved in the US in 2017; it had sales of $587 million in 2021 and is expected to be just below the $1 billion mark by 2026 with 2026 estimated sales of $944 million), according to the Evaluate report.

Figure 4 identifies the top five orphan pipeline products (Phase III or filed with regulatory authorities) based on net present value. In addition to J&J’s Carvykti, the other top orphan pipeline candidates are: Roche’s tiragolumab, an oncology drug; Mirati Therapeutics’ adagrasib, an oncology drug; Turning Point Therapeutics’ repotrectinib, an oncology drug; and Alnylam Pharmaceuticals’ vutrisiran for treating transthyretin-mediated amyloidosis.

Note: the full report, The Orphan Drug Report 2022, by Evaluate Ltd., may be found here.

Reference

1. P. Van Arnum, “New Drug Approvals in 2021: The Numbers and Trends,” DCAT Value Chain Insights, January 27, 2022.