Manufacturing Investments: Cell and Gene Therapies

Although a niche area, cell and gene therapies represent an active area of investment by CDMOs/CMOs to build manufacturing capabilities as well as having new CDMOs/CMOs enter this sector. Which companies are making the moves?

Building capabilities in cell and gene therapies

Several CDMOs/CMOs are building their capabilities in development and manufacturing services for cell and gene therapies through acquisitions as well as organically through recent or planned investments as outlined below.

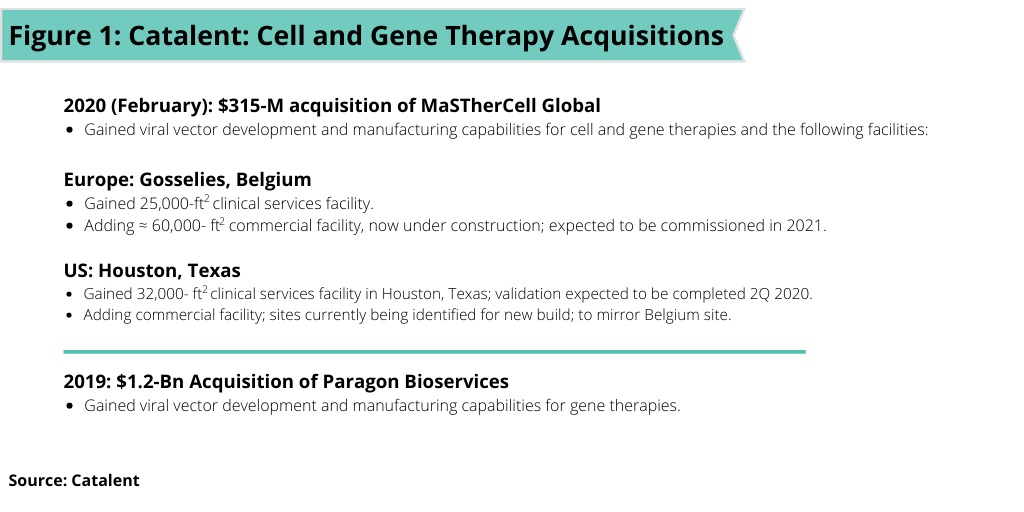

Catalent. Earlier this year (February 2002), Catalent completed its $315-million acquisition of MaSTherCell, a cell-and gene-therapy CDMO, which builds on the company’s $1.2-billion acquisition of Paragon Bioservices, a CDMO of gene therapies in 2019 (see Figure 1 ). The acquisition of MaSTherCell adds development and manufacturing capabilities of both autologous and allogeneic cell therapies to the company. MaSTherCell’s cell-therapy capabilities span a variety of cell types, including mesenchymal stem cells (MSCs), tumor-infiltrating leukocytes (TILs), natural killer cells (NKs), induced pluripotent stem cells (iPSCs), and chimeric antigen receptor T cells (CAR-T).

On a facility basis, with the acquisition, Catalent acquired planned and existing clinical and commercial manufacturing facilities in Gosselies, Belgium and Houston, Texas. In Gosselies, Catalent gained a 26,000-square-foot clinical manufacturing site with four process development labs, 10 cleanrooms for cGMP manufacturing, Grade B storage, nitrogen storage, fill–finish services, and in-house quality-control labs. Under construction adjacent to the existing site in Gosselies, is a large-scale 60,000-square-foot manufacturing facility that will have dedicated commercial suites and that is expected to be fully commissioned in 2021. In Houston, Catalent is gaining a 32,000-square-foot clinical facility with eight cleanrooms, three development labs, and in-house quality-control labs, which is expected to be fully validated in the second quarter of 2020 and that will employ a team of over 50 employees. In addition, a commercial manufacturing site, which will mirror the facility in Belgium, is in the preliminary planning stages with sites in Texas being identified.

Thermo Fisher Scientific. Thermo Fisher Scientific, too, added to its development and manufacturing capabilities in cell and gene therapies with its $1.7-billion acquisition in 2019 of Brammer Bio, a cell- and gene-therapy CDMO. Following that acquisition, Thermo Fisher has expanded its viral vector development and manufacturing capabilities by opening a new site in Lexington, Massachusetts and expanding sites in Cambridge, Massachusetts and Alachua, Florida. The company also plans to open a new cell-therapy development and manufacturing collaboration center in Princeton, New Jersey to combine pharma services and biosciences expertise from across the broader Thermo Fisher network. A new cell-therapy facility will come on line at the same location later this year (2020).

The CDMO business of Merck KGaA. Earlier this week (April 21, 2020), Merck KGaA announced a second Carlsbad, California-based facility for its BioReliance viral and gene therapy service offering from its life-science business. The new EUR 100-million ($109-million) commercial facility is expected to open next year (2021). Merck KGaA gained the initial Carlsbad site through its $17-billion acquisition of Sigma-Aldrich in 2015, which included Sigma Aldrich’s custom manufacturing business, SAFC, including the viral product manufacturing facility in Carlsbad. Merck KGaA’s life-sciences business facility in Carlsbad manufactures gene therapies on a contract basis. The new, 140,000-square-foot manufacturing facility will support viral and gene therapy production at the 1,000-liter scale. The Carlsbad site now has 16 modular viral bulk manufacturing cleanroom suites with single-use equipment and two fill–finish suites for gene therapy, viral vaccine and immunotherapy products. The expansion will add 11 suites, bringing the total to 27, used in various steps of manufacturing.

Last year (2019), MilliporeSigma, part of Merck KGaA’s life-sciences business, acquired FloDesign Sonics, a developer of an acoustic cell-processing platform used for the industrialization of cell- and gene-therapy manufacturing. Acoustic cell processing is a technology that allows for the manipulation of cells with ultrasonic waves. FloDesign Sonics’ platform allows enhanced cell washing and concentration for manufacturing cell therapies and supports MilliporeSigma’s position in the industrialization of the manufacturing of autologous cell therapies, such as chimeric antigen receptor T (CAR T) cell therapies.

Lonza. Lonza reported in its full-year 2019 results several clinical and commercial contracts in its cell and gene-therapy business with new customers, including, among others: Cellectis, a biopharmaceutical company focused on developing immunotherapies based on gene-edited allogeneic CAR T-cells; Prevail Therapeutics, a developer of gene therapies; and DiNAQOR, a gene-therapy platform company. The business also signed new contracts with existing partners, including Mesoblast, a developer of allogeneic cellular medicines, and Gamida Cell, a company focused on cell therapies for treating blood cancers and blood disorders, for commercial supply. In its results announcement in January 2020, Lonza said its cell-and gene-therapy business expects at least five late-stage registrations in 2020 within its global network. As part of its pact with Mesoblast, the company announced last year (2019) that it agreed to expand its Singapore cGMP facilities if required to meet long-term growth and capacity needs for the allogeneic cell therapy candidate, remestemcel-L, from Mesoblast.

Lonza has four centers of excellence in cell and gene therapies. The Lonza sites in Pearland, Texas and Geleen/Maastricht, The Netherlands provide an integrated range of cell- and gene-therapy services, including process and analytical development, clinical product supply, and commercial product supply. Lonza’s sites in Portsmouth, New Hampshire and Singapore serve both as clinical and commercial manufacturing sites.

Also in 2019, Lonza and Vineti, a company offering a commercial, configurable cloud-based platform for patient access to cell and gene therapies, have formed a partnership in which they will be preferred partners, respectively for patient-tissue tracking and CDMO services in cell and gene therapies.

Fujifilm Diosynth Biotechnologies. Fujifilm Diosynth Biotechnologies (FDB), a contract biologics manufacturer, announced late last year (November 2019) an expansion of its gene-therapy services with the addition of dedicated process and analytical development laboratories. As part of a capital investment of approximately YEN 13 billion ($120 million) in the gene-therapy field by Fujifilm, FDB is investing approximately $55 million to establish a new 60,000 square-foot Gene Therapy Innovation Center adjacent to FDB’s existing cGMP gene-therapy manufacturing facility in College Station, Texas. The company says the new facility is expected to triple its gene-therapy development capabilities and add approximately 100 jobs to its Texas campus. At the time of the company’s announcement in November 2019, the facility was expected to be operational in the fall of 2021. In addition to the new innovation center, Fujifilm also announced in 2019 additional investments to expand FDB’s gene-therapy cGMP capacity to include the addition of new cleanrooms and the expansion of its upstream capacity with eight new 500-L/2,000-L single-use bioreactors. The site has been offering gene-therapy fill–finish services for both clinical and commercial products since early 2019. At the time of the announcement in November 2019, the first stage of the manufacturing expansion was expected to be completed and in operation during 2021.

WuXi Advanced Therapies. WuXi Advanced Therapies, part of WuXi AppTec and a CDMO for advanced therapies, announced earlier this year (2020) an expansion of its service capabilities by offering an adeno-associated virus (AAV) Vector Suspension Platform for cell- and gene-therapy development, manufacturing and release. The service provides an integrated platform for AAV vector production that includes: in-stock raw materials with established batch records; regulatory and technical expertise; process and analytical development; in-process and release testing; quality control and quality assurance oversight; and facilities with capacity for scalability that ranges up to 1,000 L.

AGC Biologics. AGC Biologics, a CDMO for protein-based therapeutics, announced an expansion late last year (December 2019) of its CDMO services with plasmid DNA (pDNA) offerings from its site in Heidelberg, Germany. The pDNA have been used for many years in the manufacturing of DNA adjuvants and vaccines and as a starting material for RNA drugs and cell-free protein expression platforms. However, in more recent years, pDNA has been key for gene-therapy applications for the creation of lentivirus and adeno-associated viruses as well as direct gene therapy. The company’s facility in Heidelberg has been manufacturing pDNA for 10 years. The site completed a pDNA manufacturing process improvement project that enables the extension of the offer in hosts and plasmids (low and high copy pDNA expression systems) via a large toolbox in process development with scales of 1 liter to 10 liters for high-quality pDNA. These processes can be scaled up to fit into 50-liter, 100-liter, 500-liter or 1,000-liter GMP manufacturing.

New CDMOs/CMOs enter the market; others expand

In addition to established CDMOs/CMOs expanding their development and manufacturing capabilities in cell and gene therapies, several new or recently formed service providers are entering the market and/or expanding as outlined below.

New CDMO of The Discovery Labs. Earlier this year (2020), The Discovery Labs, a provider of cGMP manufacturing, turnkey laboratory solutions, materials and office space for building life-sciences and technology companies, and Deerfield Management Company, an investment firm, launched The Center for Breakthrough Medicines, a new CDMO and specialty investment company with a planned investment of $1.1-billion for a cell- and gene-therapy manufacturing facility in King of Prussia, Pennsylvania. The CDMO is occupying over 40% of The Discovery Labs’s 1.6-million-square-foot biotech, healthcare and life-sciences campus in King of Prussia. The new CDMO will provide preclinical through commercial manufacturing of cell and gene therapies and component raw materials as well as process development, plasmid DNA, viral vectors, cell banking, cell processing, and support testing capabilities. Renovations are underway to construct a total of 86 plasmid, viral vector production, universal cell processing, cGMP testing, process development and cell-banking suites. As of the company’s announcement in January 2020, the company was in the process of reserving capacity for late 2020.

Hitachi Chemical Advanced Therapeutics Solutions. Earlier this year (2020), Hitachi Chemical Advanced Therapeutics Solutions (HCATS), a cell-therapy CDMO and a subsidiary of Hitachi Chemical Co., Ltd. representing Hitachi Chemical’s Regenerative Medicine Business Sector in North America, opened a new cell- and gene-therapy manufacturing facility in Allendale, New Jersey. The new facility more than doubles HCATS’ existing manufacturing capacity in New Jersey. The new facility will require up to 500 more employees to reach full operational capacity over the next several years. Hitachi Chemical has operations in North America (Allendale, New Jersey and Mountain View, California), Europe (Munich, Germany), and Japan (Yokohama) with CDMO operations for cell and gene therapies at its sites in New Jersey and California. Earlier this year (2020), HCATS also formed an alliance with Ori Biotech, a CDMO of cell and gene therapies, to commercialize technology solutions specific to cell and gene therapies.

Univercells’ Exothera. Last month (March 2020), Univercells, a technology company specializing in bioprocessing, launched Exothera, a new viral vector CDMO targeting cell- and gene-therapy and vaccine developers, in a refurbished 161,000-square-foot facility in Jumet, Belgium. The GMP areas at Jumet will contain Exothera’s CDMO activities and ongoing Univercells vaccine development and manufacturing initiatives. Earlier this year (2020), Univercells announced EUR 50 million ($54 million) in financing from Gamma Biosciences, a new investment platform supported by the investment firm, KKR, to fund new bioprocessing technologies for the production of advanced biologic therapies, including gene-and cell-based therapies.

Aldevron Last year (2019), Aldevron, a contract provider specializing in the production of nucleic acids, proteins, and antibodies, announced expansion plans for a new 14-acre campus for gene- and cell-therapy manufacturing at its headquarters in Fargo, North Dakota. One of the new two-story buildings is expected to increase Aldevron’s GMP and GMP-Source production capacity up to 10 times its current output. The company’s GMP-Source plasmid DNA can be used as an ancillary or critical raw material for producing protein and viral candidates used in clinical trials. The first building will be 189,000 square feet and is scheduled to operational by the first quarter of 2021. In total, three new buildings will be built over the next three to five years. The company’s overall manufacturing network includes sites in Fargo, North Dakota; Madison, Wisconsin; and Freiburg, Germany.