Innovation Scorecard: The New Drug Approvals Thus Far in 2024

As we move past the mid-way mark in 2024, how has the industry fared with new drug approvals? Is the industry keeping pace with prior years’ innovation levels? What is the mix between small molecules and biologics, and which companies are meeting the mark?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

New drug approvals thus far in 2024

Although not following a strictly chronological path, examining the pace of new drug approvals is an important measure of product innovation in the bio/pharmaceutical industry. At the halfway point of 2024 (as of July 15, 2024), the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) has approved 22 new molecular entities (NMEs) and therapeutic biologics, which keeps pace with recent history of new drug approvals.

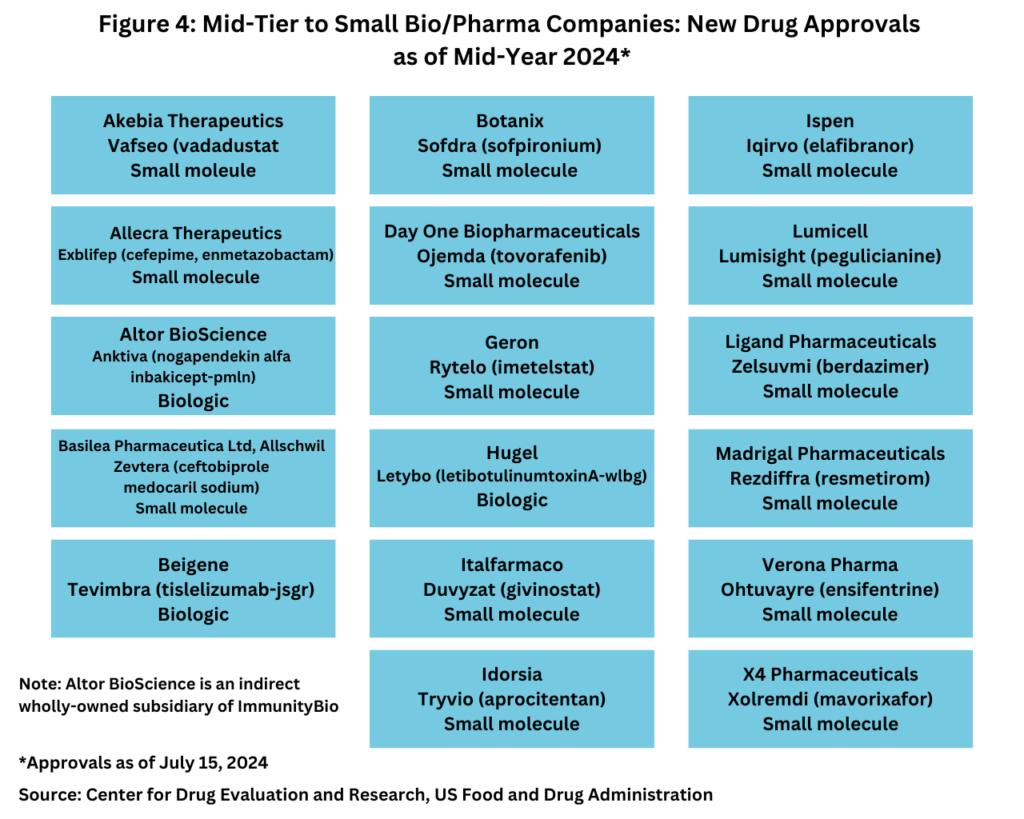

Last year (2023) saw an uptick in new drug approvals compared to 2022, which was a recent dip in new drug approvals. In 2023, FDA’s CDER approved 55 NMEs and new therapeutic biologics, a 49% increase in the number of new drug approvals compared to 2022, when 37 new drugs were approved. The 55 new drugs approved in 2023 by FDA’s CDER was in line with recent years. In 2021, 50 NMEs and new therapeutic biologics were approved by FDA’s CDER and 53 in 2020. The 55 new drugs approved in 2023 represented the second highest level of approvals in the past decade, except for 2018 when 59 new drugs were approved (see Figure 1).

Small molecules versus biologics

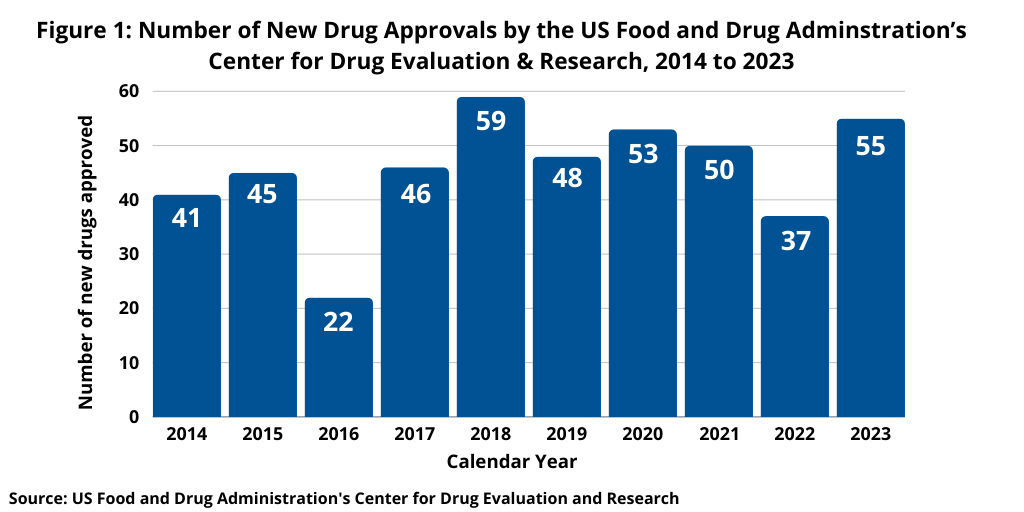

Another important trend is to look at the product mix of new drug approvals. Of the 22 new drug approvals approved thus far in 2024 (as of July 15, 2024), 15, or 68%, were small molecules, and 7, or 32%, were biologics. That is on par with the mix in 2023, when FDA’s CDER approved 17 new therapeutic biologics, which represented 31% of new drug approvals and 38 small-molecule products or 69% of new drug approvals (see Figure 2). The percentage of small-molecule approvals in 2023 was in line with recent years, except in 2022, which represented a recent low. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules or 22 of the 37 new drug approvals in 2022. Between 2018 and 2021, small molecules averaged 74% of new drug approvals. In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, 79% in 2019, and 71% in 2018 (see Figure 2).

The decrease in small molecules’ share of new drug approvals in 2022 was largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics. The 17 new biologics approvals in 2023 surpassed 2022 levels and matched a recent high in 2018, when 17 new biologics were also approved by FDA’s CDER. The 17 new biologic drug approvals in 2023 far exceeded approvals of new therapeutic biologics by FDA’s CDER of 14 in 2021, 13 in 2020, and 10 in 2019.

Large bio/pharma companies versus mid-tier/smaller bio/pharma companies

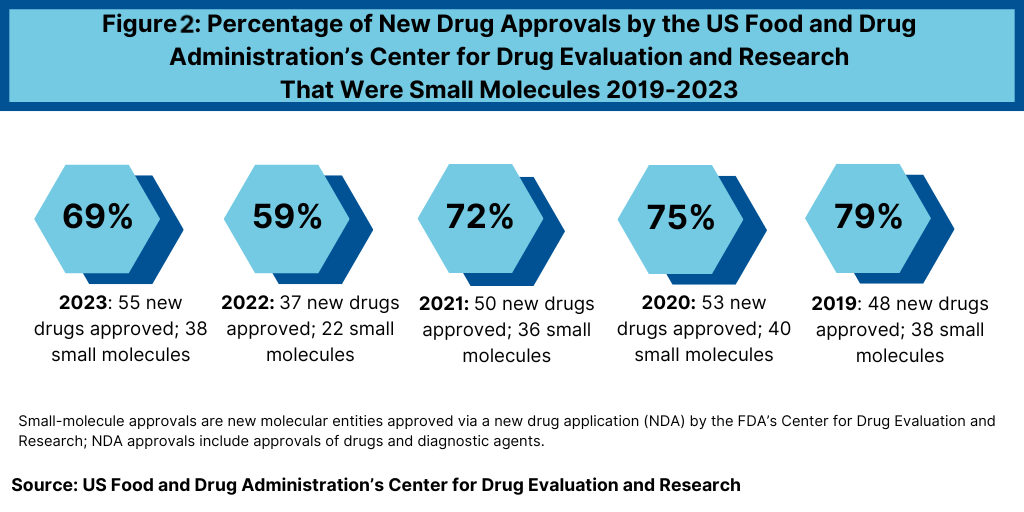

Although the quantity of new drug approvals alone is not indicative of market strength and product innovation, it is interesting to note, that in looking at new drug approvals at the mid-year mark, only five of the new drugs approved thus far in 2024 were from the bio/pharma majors (defined as the top 20 companies based on 2023 revenues of human health bio/pharmaceuticals and vaccines), and four of these five new drug approvals were biologics (see Figure 3).

The four biologics approved thus far in 2024 by the large bio/pharma companies were: Amgen’s Imdelltra (tarlatamab-dlle) for treating extensive-stage small cell lung cancer; Eli Lilly and Company’s Kisunla (donanemab-azbt) for treating early symptomatic Alzheimer’s disease; Merck & Co.’s Winrevair (sotatercept-csrk) for treating pulmonary arterial hypertension, a rare disease in which blood vessels in the lungs thicken and narrow, causing strain on the heart; and Roche’s Piasky (crovalimab-akkz) for treating paroxysmal nocturnal hemoglobinuria (PNH), a rare blood disorder. The only small-molecule drug approved by a large bio/pharma company thus far in 2024 was AstraZeneca’s Voydeya (danicopan), also for treating PNH, as an add-on therapy to ravulizumab or eculizumab for treating extravascular hemolysis (red blood cell destruction that takes place outside of the blood vessels) in adults with PNH (see Figure 3).

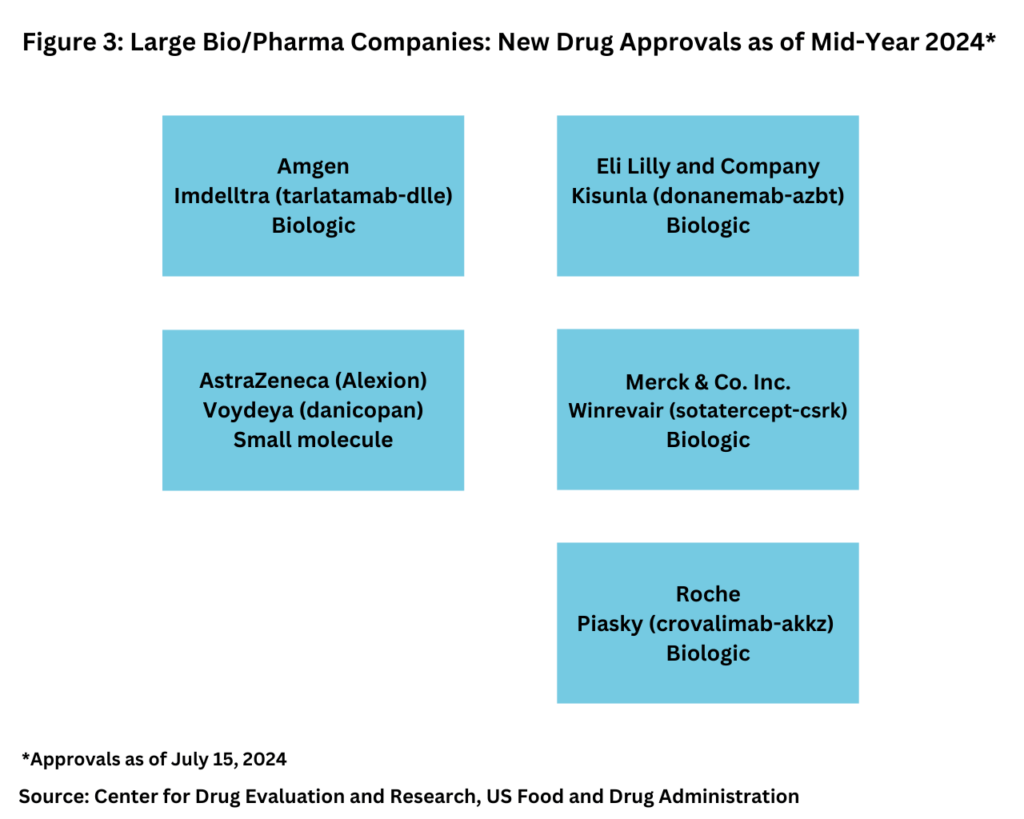

Instead, the bulk of new drug approvals thus far in 2024 have come from mid-tier and smaller bio/pharmaceutical companies, with 17, or 77% of the new drug approvals from these companies. Of these 17 new drug approvals, 14, or 82%. were small molecules, and three, or 18%, were biologics (see Figure 4).