Industry Perspectives: Low-Volume Drugs and Manufacturing

The rise in the number of orphan-drug approvals and an increase in the development of more targeted therapies with smaller patient populations results in lower-volume drugs. What is the impact on production economics, and how can pharma companies and CDMOs/CMOs adjust accordingly?

Trends in orphan-drug approvals

An important trend in the pharma industry is the rise of orphan drugs approved as new molecular entities (NMEs). Orphan drugs are defined as prescription medicines developed for rare diseases and conditions, which, in the US, affect fewer than 200,000 people, or, in the European Union, affect 5 per 10,000 people or fewer. The share of new drug approvals worldwide for rare diseases doubled from 29% of all approvals in 2010 to a recent high of 58% in 2018, according to a 2019 analysis by the Tufts Center for Drug Development.

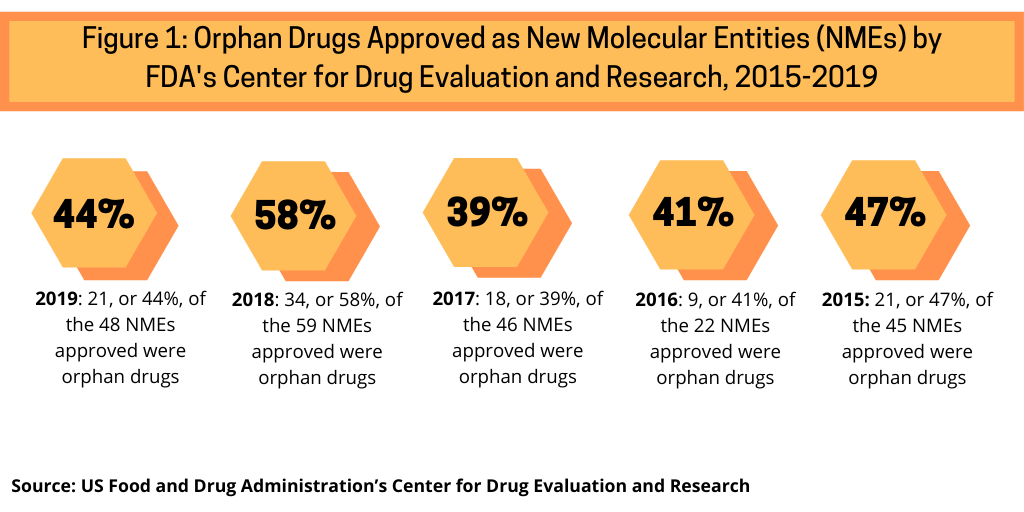

Examining NME approvals by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) from 2015 to 2019 shows the increasing share of orphan drug approvals (see Figure 1). Between 2015 and 2019, orphan drug approvals accounted for between 39% and 58% of NME approvals by the FDA’s CDER. In 2019, orphan drugs accounted for 44%, or 21 of the 48 NMEs approved by the FDA’s CDER. In 2018, orphan drugs accounted for 58%, or 34 of the 59 NMEs approved by the FDA’s CDER, which represented a recent high. Between 2015 and 2017, orphan drug NME approvals averaged 42% of NME approvals by the FDA’s CDER: 39% of NME approvals in 2017, 41% in 2016, and 47% in 2015. In the five-year period between 2015 and 2019, which includes the high mark of orphan drug approvals in 2018, orphan drugs have accounted for 46% of NME approvals by FDA’s CDER (see Figure 1). These trends point to an important development in the pharmaceutical market: rare-disease drug approval rates in the US are now approaching non-rare drug approval rates, according to the Tufts Center for Drug Development study.

Industry insights on manufacturing and low-volume drugs

Low-volume drugs, whether as an orphan drug or as a targeted therapy serving smaller patient populations, represent unique challenges and opportunities on a manufacturing basis for both the active pharmaceutical ingredient (API) and drug product. DCAT Value Chain Insights gained perspectives from several CDMOs/CMOs on manufacturing and in-source/outsource decisions with respect to low-volume drugs. Participating are: Giorgio Bertolini, Senior Vice President Research & Development, Olon, a CDMO of APIs; Richard Sidwell, PhD, Senior Vice President and Chief Scientific Officer, and Brittany L. Hayes, PhD, Director, Applied Technology, both of Recro, a CDMO of oral solid drug products; and Stu Needleman, Chief Commercial Officer, Piramal Pharma Solutions, a CDMO of drug-discovery services, drug substances, and drug products.

|

|

Giorgio Bertolini |

Overall impact from a manufacturing and supply perspective

Q: What is the impact of low-volume drugs from a manufacturing/supply perspective?

Bertolini (Olon): The increase of the number of lower-volume drugs has a huge impact in both the manufacturing and the supply of APIs. From a manufacturing point of view, this trend has caused most of current production lines to become outdated as current plants are dimensioned for medium- and large-scale volume products. This change requires new investments for the reconversion of the plants by installing new, smaller equipment (reactors, dryers, etc). In addition, a tailor-made plant is required as many of these newly approved drugs are highly selective, so, in many cases, their activity is quite high, thereby requiring medium- to high-containment systems for their handling, which adds additional costs to the reconversion of the manufacturing plants.

Sidwell and Hayes (Recro): From a business point of view, low-volume products create a two-pronged challenge with respect to manufacturing efficiency and supply chain. A low-volume product presents the manufacturer with a trade-off in process batch size (efficiency) versus business risk per batch. Making fewer, larger batches is preferable from a manufacturing efficiency point of view, but with a low-volume product, the number of annual batches can then become so low that maintaining consistency with very infrequent production becomes a challenge. On a positive note, low-volume batches fit in and can be scheduled into the production schedule more easily than high-volume runs. They nicely fill gaps and reduce idle time for multi-use equipment trains.

Supply management and low-volume drugs

Q: What particular challenges arise from a supply planning/management perspective when working with low-volume drugs?

Bertolini (Olon): Lower-volume APIs require lower-volume raw materials and intermediates. This effect diversifies the business (i.e., more compounds to be sourced), thereby reducing the overall value of each raw material/intermediate. The first consequence of having smaller business with a supplier is reducing the negotiation power of the customer and reducing the interest and willingness of the supplier in supporting the API producer for all the quality assurance/regulatory affairs requests/needs, such as statements, declarations, and sharing of process and analytical information.

|

|

Richard Sidwell |

In addition, the complexity of these new lower-volume APIs, due to their high selectivity, require ‘sophisticated’ raw materials and/or intermediates produced usually with non-trivial technology. This higher chemical complexity reduces the number of potential suppliers, thereby reducing the competition among them with negative impact in reducing the price of these goods.

Both affects lower competition and result in smaller business volume, thereby leading to an inefficient supply chain of the system with impact on final production costs. This higher cost could partially compensate the reduction of the business volume from a financial point of view. The key strategy to mitigate these challenges is to cluster the raw materials and intermediates, based on the technology required, and source this list of products to the same organization to strengthen the partnership with selected suppliers.

Sidwell and Hayes (Recro): The challenge of low-volume products to the supply chain is a counterpoint to the manufacturing challenge. Making larger batch sizes improves production efficiency and lowers unit conversion cost, but increases supply-chain risk. If you lose a single larger batch to recall or an out-of-specification result, there is a large impact to the annual product revenue and possibly a shortage in the supply chain. Making more, smaller batches reduces the supply-chain risk, but increases the unit conversion cost as it takes a similar amount of time and effort to manufacture and release a small batch as a large one.

|

|

Brittany L. Hayes |

Production economics, cost of goods sold, and resolving challenges

Q: How may higher cost of goods sold (COGS) or potential diseconomies of scale be resolved when working with low-volume drugs?

Bertolini (Olon): In addition to the potential higher cost of the raw materials and intermediates sourced, the higher production cost of lower-volume APIs is due to two other factors. First, the smaller batch size used for this type of API impacts the contribution of labor and depreciation on overall costs. The second factor relates to less efficient chemical processes used for the manufacturing of the lower-volume API.

The lower efficiency of the chemical processes is a consequence of the absence of large-scale economy. In addition, the costs for the implementation of a more efficient second-generation chemical process (validation, regulatory changes, etc.) are not justified by the low production volume. As a consequence, the processes used for the manufacturing of these lower-volume APIs have lower efficiency compared to those used for large-volume drugs. A potential solution to this issue could be the reduction, as much as possible, of the continuous optimization of the chemical processes by generating several new generation processes by investing at the beginning and during the development phases in process-optimization studies in order to run the first validation already using a high-efficiency process.

In several cases, these new lower-volume APIs require tailor-made new plants for their manufacturing due to their chemical complexity. They require the use of state-of-the-art chemistry (e.g., cryogenic conditions, photochemistry), and highly reactive (and toxic) reagents (e.g., organolithium strong bases, hydrides, carbon monoxide, fluorination, etc.). In this scenario, return on investments for these new plants is too long and cannot be sustainable by a single product. For this reason, the new investment plan should be focused not on a single product but on a specific technology that can be used for a class of products. This strategy allows spreading the investment cost on different APIs and larger overall volume of products.

Sidwell and Hayes (Recro): Low-volume drug products lack the economy of scale of larger products, and this inevitably leads to higher unit conversion costs and therefore COGS. That said, there are things manufacturers can do to mitigate the impact and lessen the diseconomies of scale. Ensuring production efficiency and robustness for smaller products is a critical first step. When you are only manufacturing a few batches a year, each one counts, and you need high confidence of success. The other aspect of low-volume manufacturing is equipment change-over. It is not cost effective to manufacture low-volume products on dedicated equipment due to the lengthy periods out of production. Non-dedicated facilities and equipment are a must. This makes production flexibility and change-over times a significant driver of overall facility productivity.

In-source/outsource decisions and low-volume drugs

|

|

Stu Needleman |

Q: From your experience, is there a greater tendency among pharma companies to outsource manufacturing of low-volume drugs than to keep in house due to production economics or does that not factor into in-source/outsource decisions?

Bertolini (Olon): In the pharma company strategy, usually for a new chemical entity (NCE), a new dedicated tailor-made plant is designed and built. For a lower-volume NCE, in the case of an economically reasonable batch size, the risk is to have a plant not fully utilized on a yearly basis because the annual consumption of the API is manufactured in only a limited number of batches. On the other hand, you can plan for a very small batch size to keep operating in the plant all year long but with higher production cost per mass unit. Both cases result in higher production costs.

For these reasons, based on our experience, pharma companies are considering to outsource the production of these lower-volume APIs to CDMOs/CMOs that can guarantee the availability of multi-purpose, flexible, and state-of-the art chemical plants.

Sidwell and Hayes (Recro): This depends somewhat on the pharma companies’ manufacturing capacity, equipment, and portfolio of products. If they are set up for high-volume manufacturing runs or have dedicated equipment for certain products, then it makes more sense to outsource small-volume manufacturing to a CMO that may have equipment better-suited for the scale. In general, low-volume traditional products are good candidates for outsourcing to contract manufacturers with non-dedicated manufacturing facilities. Many smaller pharma companies operating in the low-volume product space do not have manufacturing capabilities of their own. For a low-volume product requiring a few batches a year, it may make more sense to outsource rather than maintain a manufacturing capability whose capacity you cannot fill. Idle manufacturing capacity is still expensive to maintain.

Needleman (Piramal Pharma Solutions): Orphan drugs are often highly complex molecules that are particularly challenging to produce because they require special handling and manufacturing processes. In many cases, CDMOs are ideally suited to address these challenges.

Although production economics can be a key factor in developing orphan drugs, it is superseded by several other elements, chief among them being possession of the expertise, technology, and infrastructure required to handle and manufacture these niche products. Working with a CDMO partner offers flexibility and access to technologies that are not available in house, which fundamentally increases the expertise of the customer. Since CDMOs cater to a large number of customers with a wide variety of needs, they must regularly invest in upgrading their facilities and capabilities to meet the growing demands of customers. Small and emerging pharma companies benefit most from partnering with CDMOs since they get access to a global network of facilities, experience, talent, capabilities, and regulatory support. An important consideration is the value of integration. Opting for a single-source approach as compared to a multi-vendor model can bring in efficiencies and accelerate the development process by compressing the time required to get to the next milestone. To address the number of orphan drug approvals in recent years, CDMOs are adapting their facilities and infrastructure to be able to support multiple low-volume projects.