Incorporating Sustainability into the Bio/Pharma Supply Chain: Where Does the Industry Stand?

By Jim Miller, Consultant and Content Advisor, DCAT

A newly released DCAT benchmarking study examines the targets and progress made by bio/pharma companies and suppliers in reaching their sustainability goals.

Sustainability and the bio/pharma supply chain

Sustainability has emerged as a major consideration in bio/pharma supply-chain management. Climate change, national “green” policies, and expectations of investors are driving bio/pharma companies and their suppliers to address sustainability in their operations. Sustainability concerns for bio/pharma companies have gone beyond the dependability of their raw material supplies to include the challenges of carbon emissions, water usage, and waste.

As they articulate their sustainability initiatives, bio/pharma companies are extending their commitments to their entire supply chains, and that will have significant ramifications for how companies select and manage their suppliers. To better understand how sustainability goals will impact supply-chain management, the Research & Benchmarking Committee of the Drug, Chemical & Associated Technologies Association (DCAT) undertook a survey of DCAT Member Companies, both bio/pharma companies and suppliers, to determine where their supply-chain sustainability initiatives stand, where they are heading, and what challenges they face. The full results of that study are available to DCAT Member Companies in the report, Incorporating Sustainability into the Bio/Pharma Supply Chain. Employees of DCAT Member Companies may access the report on a complimentary basis as a value-added member benefit. See here for further information on the report, and here to access the report. Highlights of the study were also presented in a special program on March 21, 2022, at DCAT Week 2022, DCAT’s flagship event for companies engaged in the bio/pharmaceutical manufacturing value chain.

The DCAT Research & Benchmarking Committee developed a survey, consisting of approximately 20 questions, plus several demographic questions, which was administered to DCAT Member Companies. The survey was conducted from November 2021 to January 2022. The survey questions were essentially the same for bio/pharma companies and suppliers but were written for each group’s point of view. DCAT received a total of 82 responses to the survey, including 17 from bio/pharma companies and 65 from suppliers.

The study revealed several key findings as outlined below.

Key finding: External stakeholders drive efforts

The overwhelming majority of responding companies have either established, or are in the process of establishing, sustainability objectives and programs for achieving them, including 94% of suppliers and 88% of bio/pharma companies. Nearly all responding companies with revenues of $1 billion or more have already established sustainability objectives and programs, including 100% of suppliers and 80% of bio/pharma companies.

The survey showed that external stakeholders are playing an important role in driving companies’ decisions to pursue sustainability objectives. For bio/pharma companies, that especially means investors, such as asset-management companies, pension funds, and university endowments; 93% of bio/pharma companiesreported that expectations of their shareholders have been a motivating factor. Suppliers are being pushed by their global bio/pharma customers (80% said this), but also by investors, both public and private. Government regulations do not yet appear to be a primary motivation for sustainability initiatives just now. with less than 30% respondents indicating they are a major factor.

Key finding: Supply-chain sustainability lags internal efforts

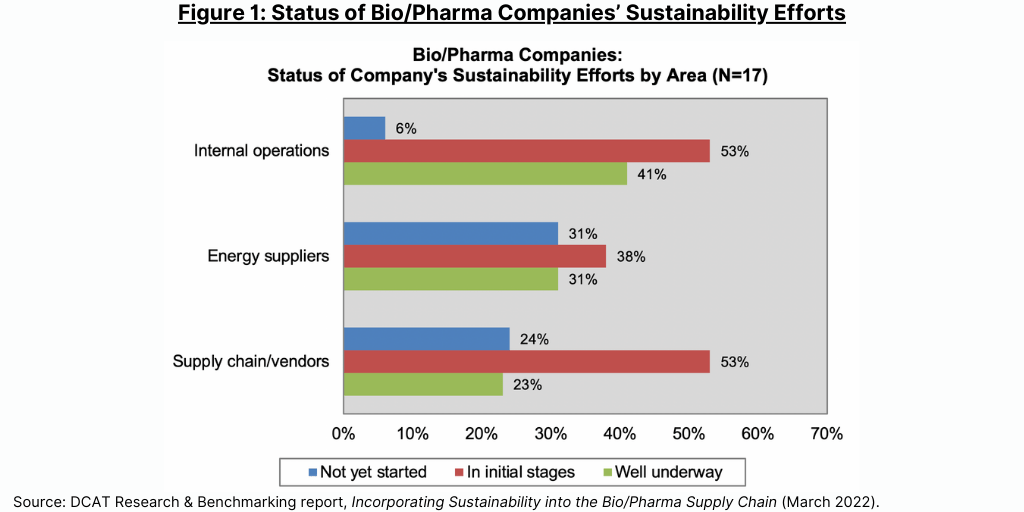

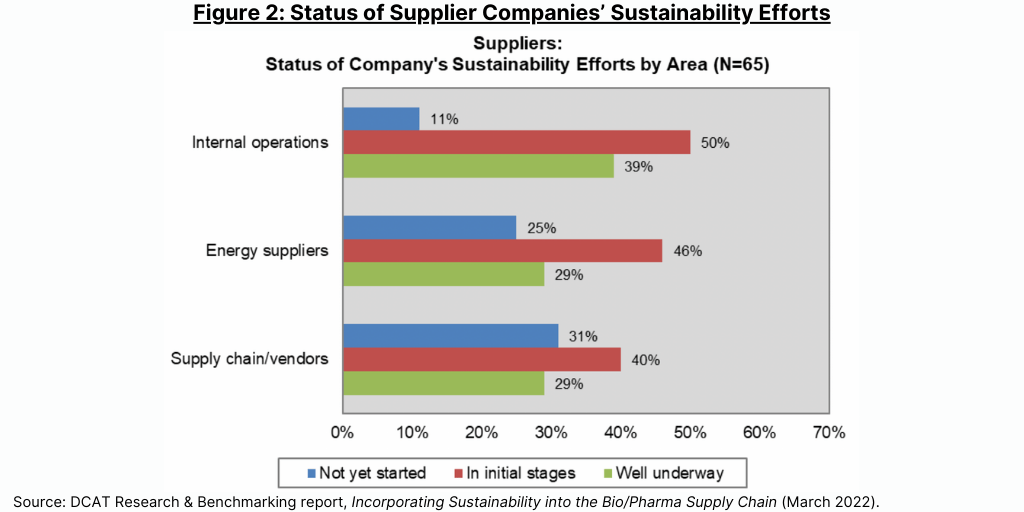

While companies are setting targets, achieving those targets is still a work in progress. Only about 40% of responding bio/pharma and supplier companies indicated that sustainability efforts targeted at internal operations are “well underway,” and only 30% so-characterized efforts to address sustainability in their energy suppliers’ operations. Other companies have either just started or are still in the process of forming plans (see Figures 1 and 2 below).

Efforts to address sustainability in the supply chain are much further behind, with 23% of bio/pharma companies and 29% of suppliers judging their efforts to be “well underway.” Most companies have not yet established sustainability goals for their supply chains. Not surprisingly, efforts being made by bio/pharma companies and suppliers with revenues of $1 billion are further along than efforts by smaller companies, but all still have much room for further progress. (For a review of sustainability initiatives of major bio/pharma companies, see the article, “Big Pharma and Sustainability: Tracking Companies’ Goals,” in the January 20, 2022, issue of DCAT Value Chain Insights).

A further indication of the slow implementation of supply-chain sustainability initiatives is that most respondent companies are not yet requiring their suppliers to set and commit to their own sustainability goals: only 29% of bio/pharma companies and 19% of suppliers responded that they are requiring them. This raises a question of how customers will link supplier performance to their own sustainability objectives.

For the most part, respondent companies that are imposing sustainability requirements on suppliers are doing so only on direct suppliers, also known as Tier 1 suppliers, and are not reaching down further into their supply chains. However, it must be noted that about 30% of responding companies are not imposing sustainability requirements on their Tier 1 suppliers.

Company sustainability efforts undertaken thus far appear to have the dual benefits of reducing cost-of-goods and enhancing sustainability. Reductions in operational waste and energy consumption, primarily in their internal operations, were the top focus of efforts at both bio/pharma companies and suppliers. This is noteworthy because one of the oft-cited concerns about sustainability initiatives is that they will add costs, but the survey suggests that they also provide opportunities to harvest cost savings. Several bio/pharma company respondents noted the potential cost savings that suppliers could realize in funding their sustainability efforts.

Key finding: Measuring achievement a major challenge

As companies ramp up their supply-chain sustainability efforts, they expect to measure and monitor suppliers’ efforts at all steps in the purchasing process. A majority of both bio/pharma and supplier respondents expect to assess suppliers at the initial vendor qualification step while most will incorporate sustainability reviews into supplier audits and regular reporting and oversight activities.

Monitoring and enforcing sustainability objectives will require measurement mechanisms, but as the survey showed, companies are using various methods for that reporting and evaluation. About half of responding companies have joined initiatives intended to develop and implement measurement systems. Examples of sustainability reporting mechanisms cited by responding companies included Ecovadis, a provider of sustainability ratings (48% of supplier respondents and 41% of bio/pharma respondents cited using it) and the Pharmaceutical Supply Chain Initiative, a consortium of bio/pharmaceutical companies and suppliers working on a range of supply-chain improvement issues.

The survey showed that companies are still evolving on how to measure supplier sustainability performance. Most of the companies that are attempting to measure supplier sustainability performance say they will accept their suppliers’ measurement system (27% of supplier company respondents and 29% of bio/pharma company respondents) while a few are implementing their own systems or will use internationally recognized standards.

Key finding: Factoring sustainability into purchasing decisions

Although sustainability is part of the criteria used in making purchasing decisions by bio/pharma companies and suppliers, companies are still evaluating the degree to which sustainability objectives will factor into that decision-making. Key findings show:

- Among bio/pharma companies responding to the survey, 41% do not yet know how they will weigh sustainability factors in procurement decisions.

- Suppliers are equally split 50–50 on whether they expect their customers to weigh sustainability objectives heavily in purchasing decisions.

More than half of responding companies (59% of bio/pharma companies and 54% of suppliers) also reported that they are still evaluating how they will encourage supplier compliance with their sustainability objectives. Among bio/pharma respondents, 29% indicated they would only extend or renew contracts for suppliers that are in compliance with sustainability objectives, and a similar percentage indicated they will provide technical assistance (respondents could choose multiple answers to this question). Among supplier respondents, 19% indicated they would only renew compliant suppliers, and 16% said they will provide technical assistance.

Concluding thoughts

To contribute to international climate-change goals, the bio/pharmaceutical industry has launched sustainability initiatives for internal operations and their supply chains. This DCAT Research & Benchmarking study on supply-chain sustainability provides a good baseline for understanding where the bio/pharma industry stands today in its efforts to address an important global issue.

Most of the largest responding companies, both bio/pharma companies and suppliers, indicated that they have established sustainability goals for their supply chains, and many have made those goals public. Factoring in those sustainability targets and evaluating performance, however, adds further complexity to already complex bio/pharmaceutical supply chains.

A key issue in the bio/pharma industry, as with other industries, is coming to standardized measures and data sets, especially science-based measurement schemes, for objectives, such as carbon emissions and water quality, which can be used in sustainability reporting and commonly applied by companies throughout a supply chain. Given the multitude of suppliers in the bio/pharma supply chain, both Tier 1 and secondary and tertiary suppliers, the study showed that how to measure supplier sustainability performance is a key issue now and will continue to be going forward. Of equal significance is how supplier sustainability performance will factor into purchasing decisions and be weighted against other more traditional supplier criteria.

For the most part, bio/pharma companies do not present the sustainability threats of extractive industries, such as petroleum, or industries that generate large volumes of carbon emissions, such as the transportation industry. The bio/pharma industry, however, is reliant on those industries, and investors and governments will oblige that the bio/pharma industry, like other industries, do its part to address global sustainability challenges.