Global Pharma Industry Outlook: The Ups and Downs & Projections Near Term

Global bio/pharma sales growth was strong on a value basis at ex-manufacturers’ prices in 2023 although volume growth was relatively flat. What are the growth prospects in leading geographic markets, therapeutic sectors, and in the mix between small molecules and biologics?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Charting industry growth

How did the global bio/pharma market perform in 2023, and what can be expected in 2024 and over the next several years? Graham Lewis, Vice President of Global Pharma Strategy, IQVIA, provided an analysis of current and projected industry performance at the Pharma Industry Outlook education program at DCAT Week, held on March 18, 2024. Note: The analyses of market value size and/ or market value growth, which are referred to throughout the article, have been performed at ex-manufacturers’ prices based on the IQVIA MIDAS database.

Global and regional growth trends

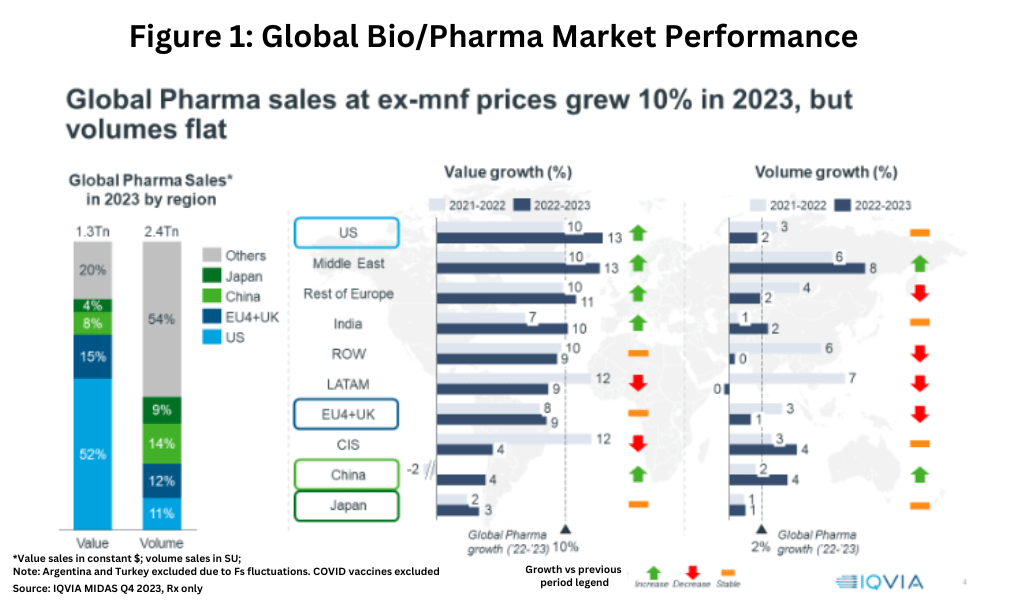

Last year (2023) was a mixed story for the global bio/pharma industry. On a value basis, the global prescription-based market increased 10% in 2022–2023, but volume growth was only 2%. Overall, the global bio/pharmaceutical market was valued at $1.3 trillion in 2023, with the US representing 52% of the global market on a value basis. The US market experienced value growth of 13% in 2022-2023, but volume growth of only 2%, down from the 3% seen in 2021-2022 (see Figure 1).

The value/volume growth differential occurred in other developed markets as well. In 2023, the EU4 (France, Germany, Italy, and Spain) and the UK collectively represented 15% of the global pharma market, with value growth of 9% in 2022-2023, but volume growth of only 1%. Japan, which represented 4% of the global market, saw value growth of 3% in 2022-2023 but only 1% in volume growth. China, the third largest geographic market behind the US and the EU4 and UK, with an 8% market share in 2023, improved both on a value and volume growth basis. Value growth in China improved to 4% in 2022-2023 compared to negative growth (decline) of 2% in 2021-2022, and volume growth in 2022-2023 was 4%, commensurate with its value growth (see Figure 1).

Looking ahead through 2028, spending and volume growth will continue to show diverging regional trends. Spending growth through 2028 is expected to be high in North America and Western Europe, driven by a wider use of novel drugs at higher average prices. Above-average volume and spending growth through 2028 is expected for India and Asia-Pacific (excluding Japan), but below-average volume and spending growth is projected for Japan through 2028. A mixed story is projected for China, which will see below-average spending growth through 2023, but expanded access to novel drugs will drive spending growth faster than volume.

Small molecules versus biologics

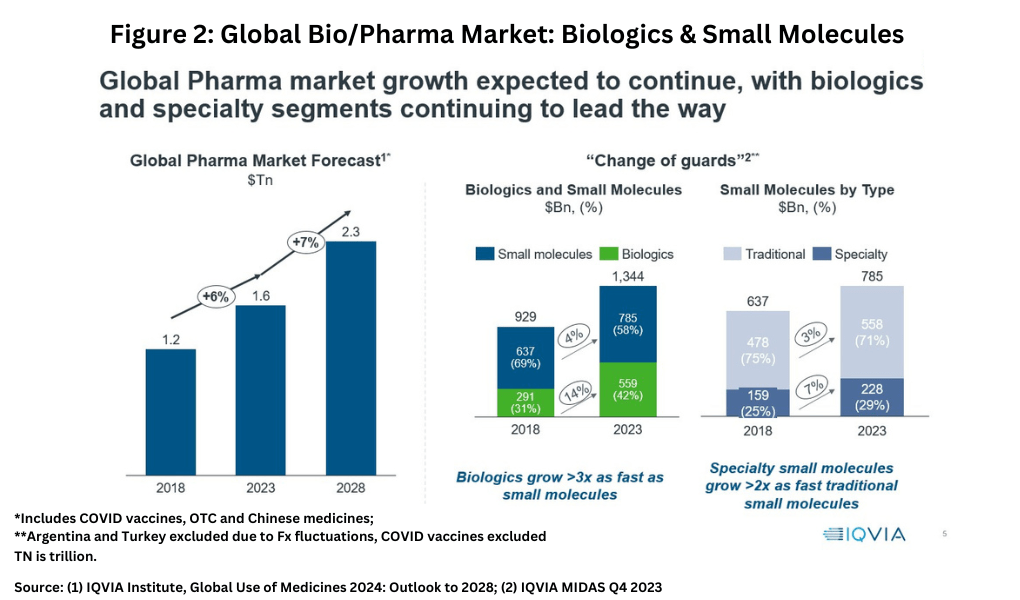

In looking at market share and growth rates on a modality basis, small-molecules drugs versus biologics, a “changing of the guards” is taking place, noted IQVIA’s Lewis. Although small-molecules still account for the largest market share in 2023 globally, biologics are growing more than three times faster. In 2023, small-molecules drugs accounted for $785 billion (58% of the market) and biologics $559 billion (42% of the market) compared to a 69% share for small-molecules and a 31% market share for biologics in 2018 (see Figure 2). Within small molecules, specialty small-molecule drugs are growing more than twice as fast as those of traditional small-molecule drugs (see Figure 2). However, traditional small-molecule drugs still dominate the small-molecule sector, accounting for 71% of small-molecule drugs in 2023 (see Figure 2). Specialty medicines, as defined by the IQVIA, are those medicines that treat specific, complex diseases with four or more of the following attributes: initiated only by a specialist; administered by a practitioner; requires special handling; unique distribution; high cost; warrants intensive patient care; or requires reimbursement assistance.

Therapeutic sector growth trends

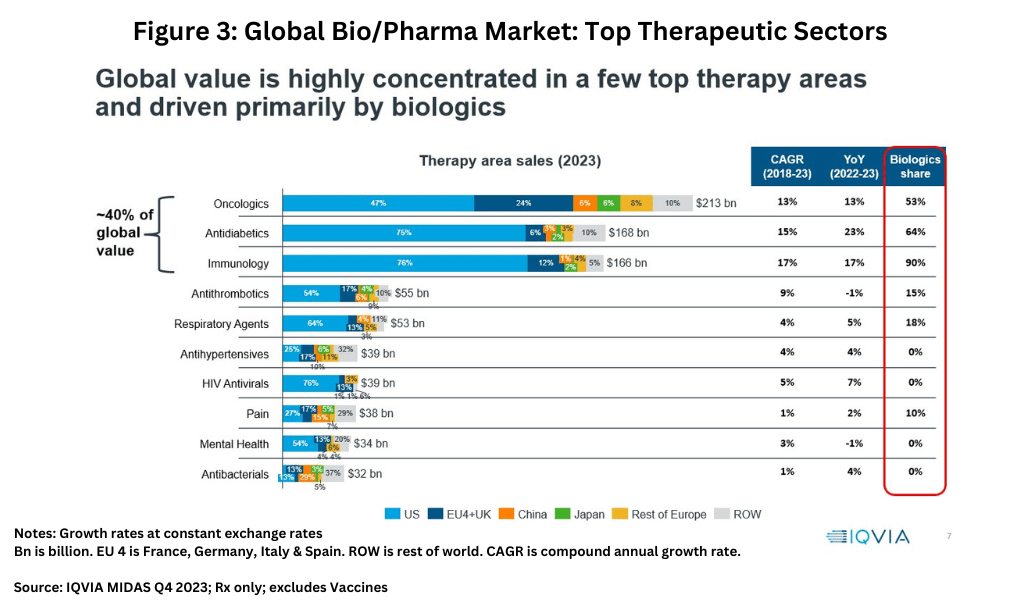

On a therapeutic sector basis, “global value is highly concentrated in a few top therapy areas and driven primarily by biologics,” said IQVIA’s Lewis. Oncology was the largest market segment, valued at $213 billion globally in 2023, followed by anti-diabetics at $168 billion, and immunology at $166 billion (see Figure 3). Combined, these three sectors represented approximately 40% of the global market on a value basis.

While these three areas—oncology, diabetes, and immunology—are the top therapy areas, there are cost, price, and innovation challenges in each sector, explained Lewis. Overall, oncology drugs represent approximately 35% of all pipeline assets, but market opportunities are increasingly fragmented due to the rapid expansion of targeted therapies. “Me-too” therapies are finding it increasingly difficult to challenge the standards of care. Payers are scrutinizing cost-effectiveness more intensely than had previously been the case. However, oncology is and will remain the largest therapy area by 2030, particularly if antibody drug conjugates and bispecific antibodies show signs of success in hard-to-treat cancers and CAR-T therapies can become more widely available.

Innovative drugs in immunology are challenged by the difficulty in replacing current standard-of-care products and pricing pressures in an increasingly competitive market. In the diabetes sector, strong pricing pressures now exist, with gross-to-net discounts of more than 70%. Looking ahead over the next five years, the emergence of glucagon-like peptide 1 (GLP-1) drugs for obesity in addition to Type 2 diabetes, and growing evidence of benefit across the wider cardiometabolic space, is likely to lead to them becoming the second largest sector by 2030. The willingness of consumers to pay for obesity treatment is another sign that citizens are beginning to disrupt conventional modes of behavior in healthcare management. The morbidity of central nervous system (CNS) disorders is growing rapidly, accentuated by COVID, but this is not yet reflected in sales as there has been little innovation in this area over the past 15 years, and generics dominate therapies for many of the disorders in the CNS space. However, the slow but steady progress evident in Alzheimer’s disease and a more promising pipeline in other CNS conditions suggest there is likely to be significant growth in CNS sales over the next decade. In terms of broader global health challenges, such as antimicrobial resistance (AMR), there has been little progress in innovation despite the estimate that AMR-related deaths could reach 10 million annually by 2050, up from 1.25 million in 2019.

Pharma’s growth challenges

In looking at growth challenges, IQVIA’s Lewis explained that pharma companies are confronting three main issues: payer pressures, stressed and evolving healthcare systems and capacity, and their own internal challenges, including achieving higher returns on investment In research and development (R&D). He explained that pharma companies must develop a much more rigorous evaluation of pipeline assets in relation to the standard of care: establish it in disorders with no previous treatment, exceed it in disorders with existing therapies, or alter the value proposition for the system and/or patients by re-engineering existing treatment modalities.

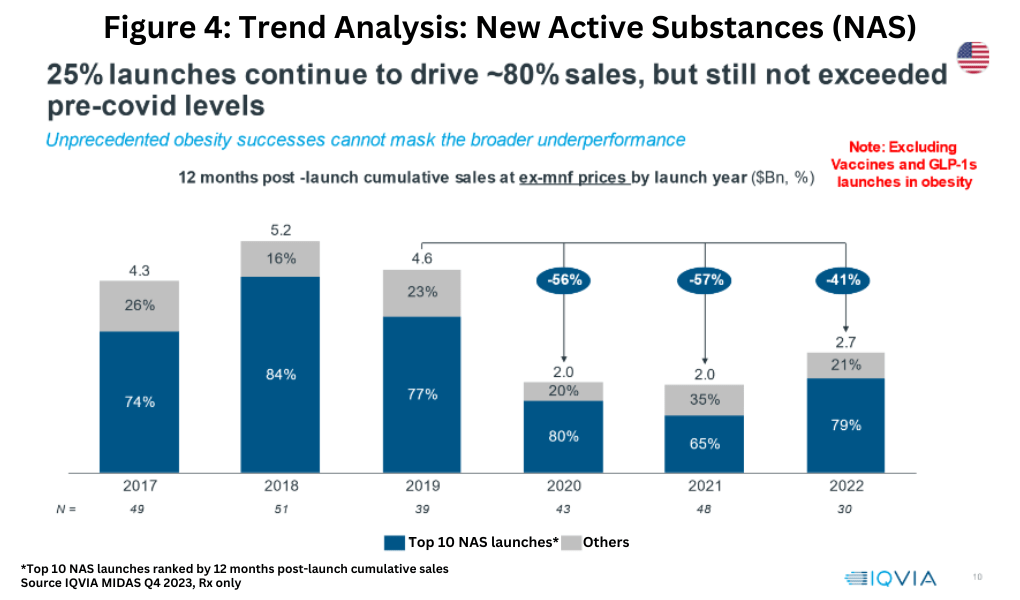

Within this framework, overall product innovation, as measured by the sales of new active substances (NAS), shows mixed results in the US, by far the most important market for new products. A consistent recent trend has been that the top 10 NAS launches (based on 12-month post-launch cumulative sales at ex-manufacturers’ prices) have accounted for approximately 80% of overall NAS sales, but NAS growth has not returned to pre-COVID-19 pandemic levels when excluding launches in vaccines and GLP-1 drug launches in obesity (see Figure 4).

Generics and biosimilars market

Turning to generics, always a very competitive market, there has been a shift in the competitive landscape. Already a highly fragmented market, that fragmentation has further increased. In 2023, the top 10 generics companies accounted for 21% of the global market, down from 28% in 2016. Indian companies have had a major impact, especially in the US. Illustrative of that trend is that in 2023, 50% of the abbreviated new drug applications (ANDAs) in the US were from Indian manufacturers. In 1990, only 15% were from Indian companies.

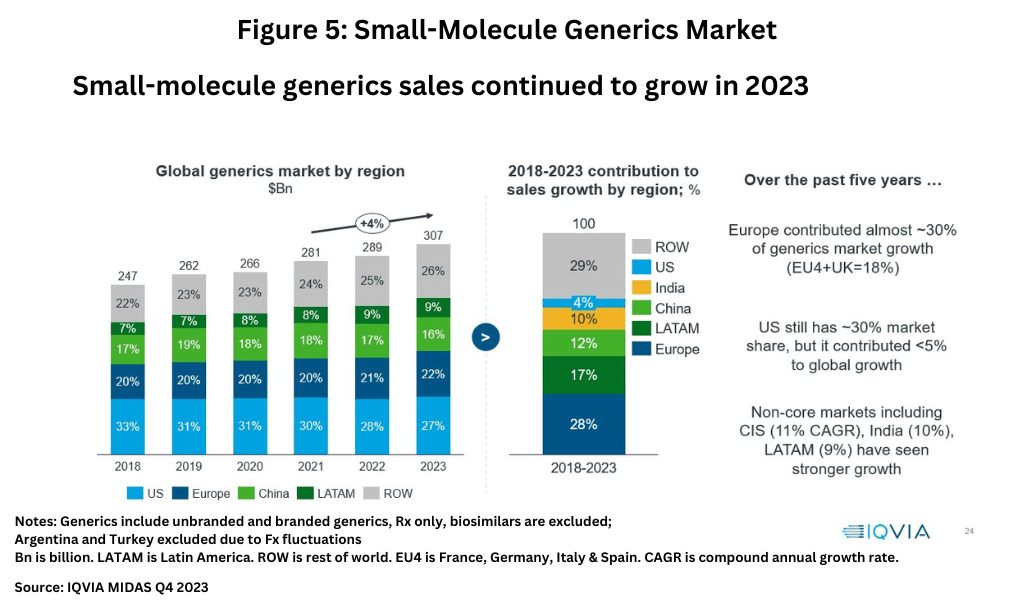

On a product basis, the market for small-molecule generic drugs continues to grow with global sales reaching $307 billion in 2023, growing at a compound annual growth rate (CAGR) of 4% between 2021-2023 (see Figure 5). On a regional basis, the US accounts for the largest market share with 27% of the market, followed by Europe at 22%, and China at 18%. Over the past five years (2018-2023), Europe as a whole contributed almost 30% of generics market growth, which includes 18% combined growth in the EU4 (France, Germany, Italy, and Spain) and the UK, while the US has contributed less than 5% to global growth. Non-core markets have experienced stronger growth than the US, including the Commonwealth of Independent States (CIS) with a CAGR of 11%, India with a CAGR of 10%, and Latin America with a CAGR of 9% (see Figure 5).

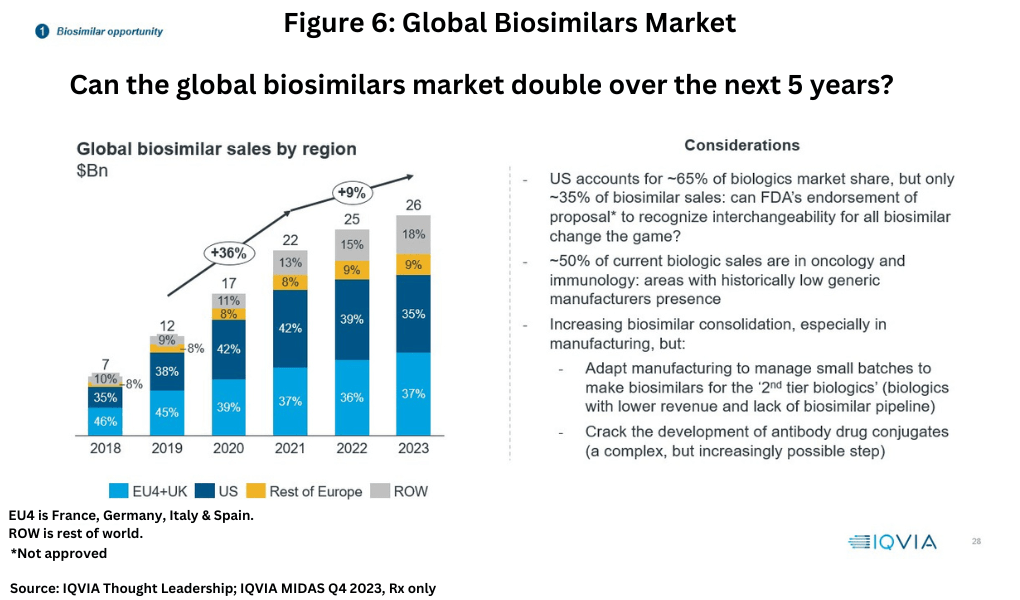

Biosimilars represent a much smaller market than small-molecule generic drugs, with the global biosimilars market valued at $26 billion in 2023, but growth has been higher, approximately 9% between 2021-2023 (see Figure 6). The EU4 (France, Germany, Italy and Spain) and the UK combined are the leading market for biosimilars with a 37% market share, followed by the US at 35%, the rest of Europe (9%), and the rest of the world (18%).

Given the quality of biosimilars which are now recognized globally, and although the US has been much slower to acknowledge this, biosimilar sales are likely to grow much faster than the market as a whole over the next 10 years, although current technologies in manufacturing make it clear that many biologics are not financially viable as biosimilars.