Generics Outlook: Small Molecules and Biosimilars

Small-molecule drugs dominate the global generics market, but biosimilars’ projected growth rate is double that of small-molecule drugs. Near-term projections and analysis of the generics and biosimilars market.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Market outlook

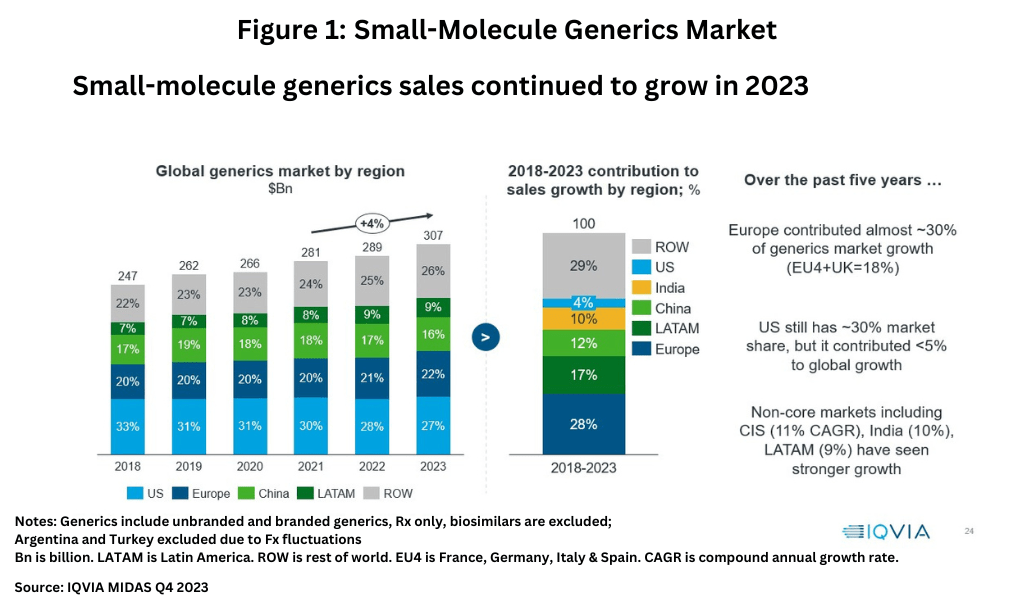

The market for small-molecule generic drugs continues to grow with global sales reaching $307 billion in 2023, growing at a compound annual growth rate (CAGR) of 4% between 2021-2023 (see Figure 1), according to information from IQVIA (1). On a regional basis, the US accounts for the largest market share with 27% of the market, followed by Europe at 22%, and China at 18%. Over the past five years (2018-2023), Europe as a whole contributed almost 30% of generics market growth, which includes 18% combined growth in the EU4 (France, Germany, Italy, and Spain) and the UK while the US has contributed less than 5% to global growth. Non-core markets have experienced stronger growth than the US, including the Commonwealth of Independent States (CIS) with a CAGR of 11%, India with a CAGR of 10%, and Latin America with a CAGR of 9% (see Figure 1).

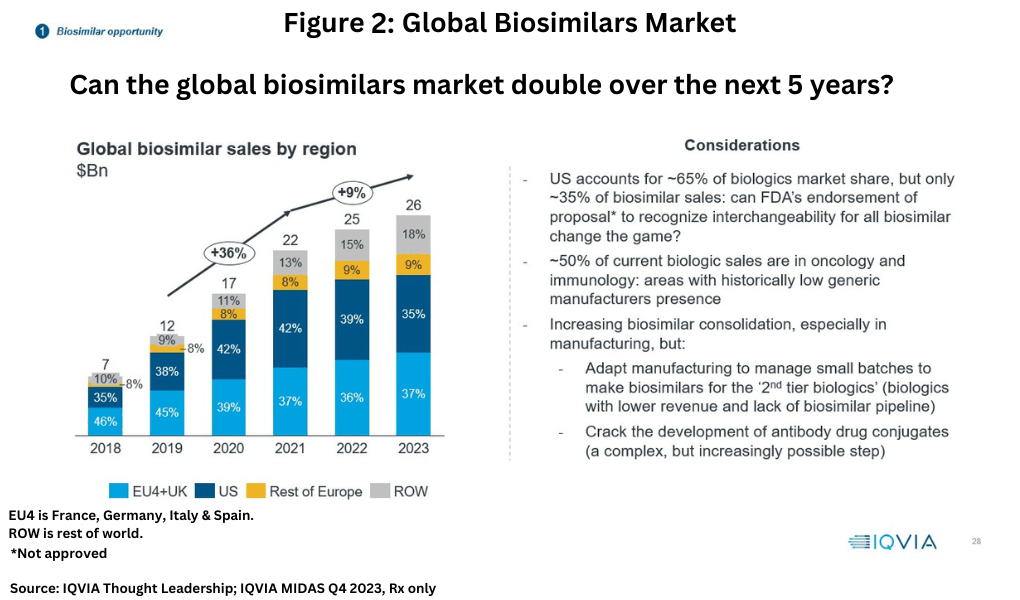

Biosimilars represent a much smaller market than small-molecule generic drugs, with the global biosimilars market valued at $26 billion in 2023, but growth has been higher, approximately 9% between 2021-2023 (see Figure 2), according to information from IQVIA (1). The EU4 (France, Germany, Italy and Spain) and the UK combined are the leading markets for biosimilars with a 37% market share, followed by the US at 35%, the rest of Europe (9%), and the rest of the world (18%).

In the US market, biosimilars account for 25% of the total volume of referenced molecules prescribed in the US, according to an April 2023 report by the IQVIA Institute for Human Data Science, The Use of Medicines in the US 2023: Usage and Spending Trends and Outlook to 2027, although there is wide variation in uptake across molecules reflecting differences in strategies adopted by originator and biosimilar manufacturers, payer and pharmacy benefit managers’ (PBM) decisions, as well as clinician and patient preferences. The impact from losses of exclusivity for biologics and the introduction of biosimilars has increased in the past several years, with brand sales of those products dropping by $33 billion over the past several years compared to $4 billion over the prior years and reflecting a growing role for biosimilars (2).

Biosimilars represent 7% of the total biologics volume in the US with an additional 20% of volume accessible to biosimilars (i.e., originator medicines for which a biosimilar is on the market), according to the IQVIA report. Beginning in 2023, an additional 4% of volume was expected to become accessible as immunology drugs, such as adalimumab (reference product, AbbVie’s Humira), ustekinumab (reference product, Johnson & Johnson’s Stelara), and tocilizumab (reference product, Roche’s Actemra) face biosimilar competition.

Most of the impact from losses of exclusivity in 2020 through 2022 in the US market was from biosimilars introduced in the prior three years, including three molecules in the oncology market —bevacizumab (reference product, Roche’s Avastin), rituximab (reference product, Roche’s and Biogen’s Rixutan), and trastuzumab (reference product, Roche’s Herceptin), which have contributed to a significant increase in brand losses due to loss of exclusivity. Biologic brand losses were $8 billion each in 2020 and 2021 and $9 billion in 2022 in the US market, lifting the total to $33.4 billion in the past several years, according to the IQVIA report.

Small-molecule brand losses were much less than historic averages as few products with higher spending lost exclusivity, and deflationary effects of earlier expiries were not as strong. Small molecules contributed $49.4 billion in brand losses to loss of exclusivity over the past several years, down from $68.4 billion in prior years.

Reference

1. P. Van Arnum, “Global Pharma Industry Outlook: The Ups and Downs & Projections Near Term,” DCAT Value Chain Insights, May 30, 2024.

2. P. Van Arnum, “Generics Outlook: Biologics Patent Cliff Looming,” DCAT Value Chain Insights, June 29, 2023.