FDA Scorecard: Drug Shortages and Inspections

How has the FDA performed in mitigating drug shortages and in its inspection activity since the COVID-19 pandemic? Has it been able to keep drug shortages down and keep pace with its inspection activity on levels on par pre-pandemic? Two recent reports tell the story.

Drug shortages: 2021

Monitoring drug shortages is an ongoing priority for the US Food and Drug Administration (FDA), but it became an even greater priority with the COVID-19 pandemic and unique circumstances that could contribute to supply disruptions. The agency recently released its annual report to Congress to provide the status of drug shortages in the US, which showed drug shortages remained at fairly constant levels in calendar year 2021 despite challenges caused by the pandemic.

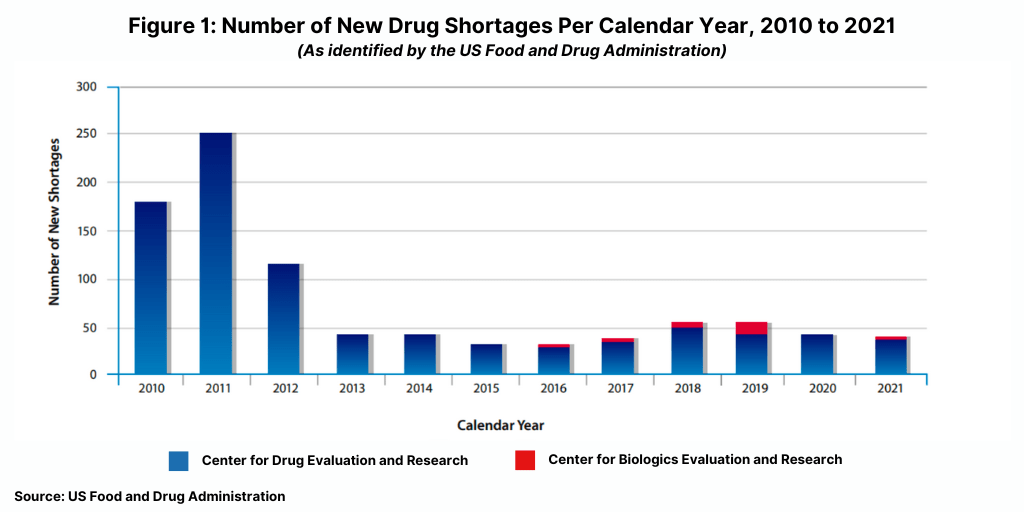

The number of new drug shortages has not increased significantly during the COVID-19 pandemic; there were 41 new drug shortages in 2021, down from 43 in 2020 and significantly down from a peak of 251 new shortages in 2021 (see Figure 1).

Although the number of new drug shortages has declined since 2011, the FDA says 2021 was a challenging year for shortages due to higher demand for certain drugs used in COVID-19 treatments, supply constraints, and increased competition of manufacturing sites tasked with producing COVID-19 products other than other products.

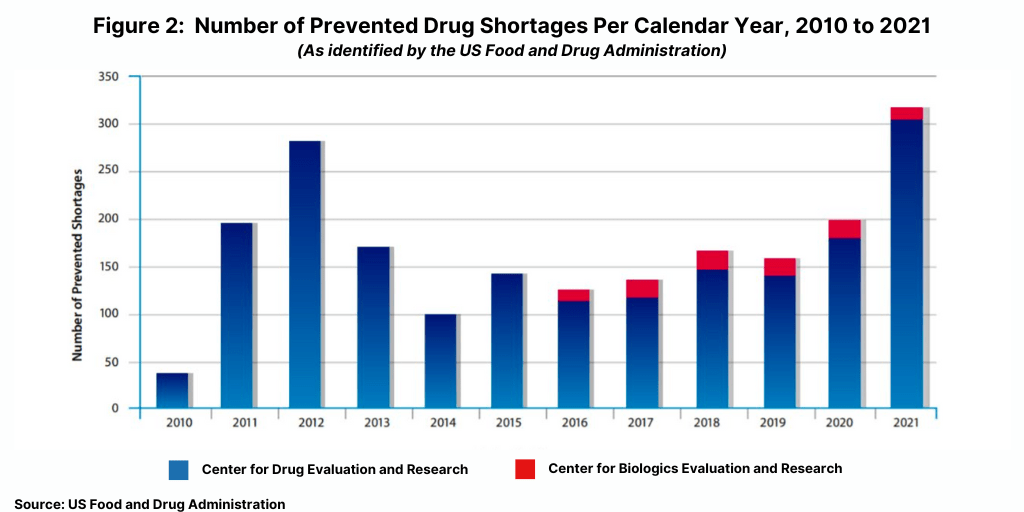

One way that the FDA dealt with these issues was to require earlier notifications by manufacturers of actual or potential shortages. These early notifications gave the FDA additional time to work with manufacturers and other stakeholders to identify ways to maintain treatment options and prevent a shortage. During calendar year 2021, the FDA worked with manufacturers to successfully prevent 317 drug shortages (see Figure 2) through the use of a range of available tools, including regulatory flexibility and discretion when appropriate. The 317 drug shortages prevented in 2021 was the highest number of shortages prevented since 2012 when 282 drug shortages were prevented.

Figure 2 shows the number of prevented drug shortages, identified by calendar year, from 2010 through 2021. As tracked by FDA’s Center for Drug Evaluation and Research (CDER), the FDA helped prevent 282 drug shortages in 2012, 170 shortages in 2013, 101 shortages in 2014, and 142 shortages in 2015. As tracked by CDER and FDA’s Center for Biologics Evaluation and Research (CBER), FDA helped prevent 126 shortages in 2016, 145 in 2017, 160 in 2018, 154 in 2019, 199 in 2020, and 317 in 2021.

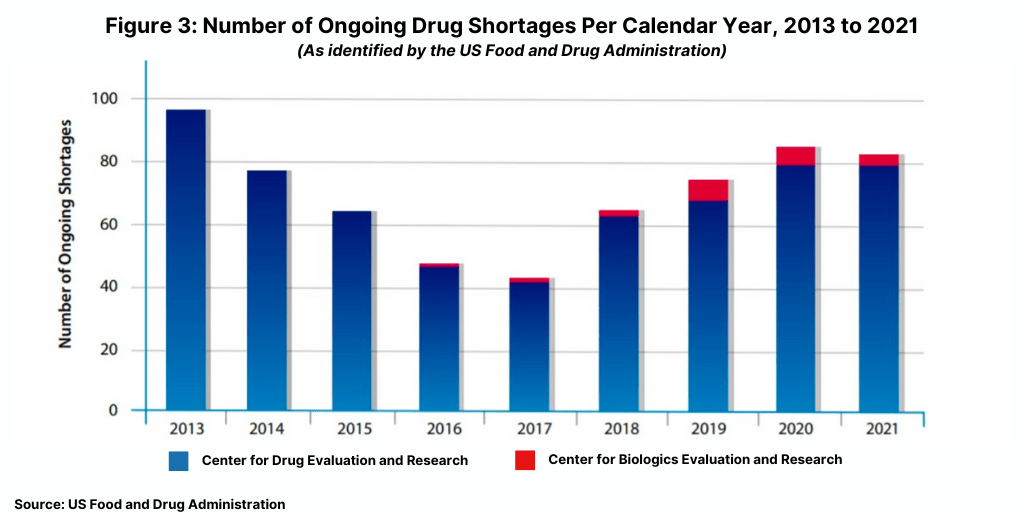

Another data point tracked by the FDA is the number of ongoing drug shortages yet to be resolved from previous years (see Figure 3). At the end of 2021, there were 83 ongoing CBER- and CDER-tracked shortages, comparable to the 86 ongoing shortages reported in 2020.

Impact of COVID-19 pandemic on drug shortages and supply lines

The FDA also addressed other issues related to the COVID-19 pandemic to mitigate drugs shortages. With the pandemic, the risk of drug shortages increased due to sudden increases in demand for drugs used in hospitalized patients, particularly the most critically ill. To respond to this risk, CDER’s Drug Shortage Staff requested that manufacturers evaluate their entire supply chain, including key starting materials, active pharmaceutical ingredients (APIs), packaging components, and finished dosage forms and to continue to communicate on any new issues that arise. Additional challenges during 2021 was the potential of shortages of drug products from manufacturers not only in the US but also from manufacturers abroad. The FDA says in its report that there continues to be concern surrounding the supply chain and reliance on overseas manufacturing, but that it is not aware of any new shortages directly related to the effects of overseas manufacturing.

“…We are working closely with our colleagues in foreign regulatory authorities and directly with manufacturers to understand what the future impact on supply disruptions might be,” said the FDA in its report. “We are also not aware of shortages caused by restrictions on exports from Asia or other regions although we continue to monitor for any supply impact related to exports of pharmaceuticals, raw materials and components. Should the situation change, we would rely on our established shortage surveillance programs to inform the public and to mitigate the impact of supply constraints as we have been doing throughout the pandemic.”

Manufacturers are required to notify FDA of certain permanent discontinuances and interruptions in manufacturing. In response to the COVID-19 pandemic, the FDA also requested, on a voluntary basis, additional information, including inventory levels, production plans, and distribution quantities, to better understand the supply chain.

Another area of concern rising from the COVID-19 pandemic was the increased use of manufacturing sites making COVID-19 products and therefore possible displacement of other drugs made at those sites. FDA said it has monitored approximately 90 different potentially impacted products involving multiple manufacturing sites. The issues involve potential finished dosage form, API, and component constraints. The FDA says that shortages of these drugs are being prevented thus far through working with the manufacturers on various actions, including qualifying alternate manufacturing sites, raw materials, and components, in addition to the agency exercising regulatory flexibility and discretion.

In addition, the FDA says it continues to work to implement the authorities and requirements added by the CARES Act and plans to issue guidance on these topics, including on reporting manufacturing discontinuances and interruptions to the agency and risk-management plans. Last month (May 2022), the FDA issued a draft guidance, Risk Management Plans to Mitigate the Potential for Drug Shortages, which builds on the agency’s efforts to mitigate drug shortages and supply-chain disruptions, by assisting drug manufacturers and related manufacturers with the development, maintenance, and implementation of risk-management plans.

FDA inspection activity: impact of COVID-19 pandemic

The COVID-19 pandemic also added additional challenges as they related to FDA’s inspections of drug-manufacturing facilities. From March 2020, the COVID-19 pandemic impacted the day-to-day operations at the FDA, which impacted inspections conducted by the FDA, including travel restrictions affecting the number of inspections conducted by the FDA. The pandemic also required a reallocation of the agency’s resources needed for the pandemic response and required the agency to use new approaches and tools to conduct virtual/remote inspections in lieu of onsite inspections.

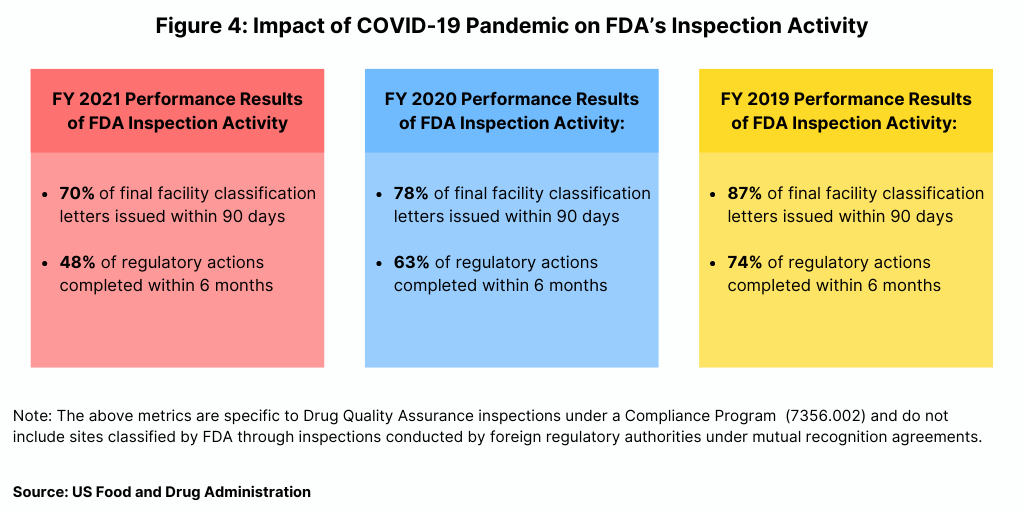

In fiscal year 2021, the FDA reported a decline in some of its performance metrics related to its inspection activity. As part of a Concept of Operations (ConOps) agreement between the FDA’s CDER and the FDA’s Office of Regulatory Affairs, the agency reports on metrics related to its inspection activity. Figure 4 outlines two key metrics: (1) issuance of a final facility classification letter within 90 days of inspection closing (2) and (2) complete regulatory actions for “Official Action Indicated” (OAI) facilities (referring to facilities for which regulatory and/or administrative actions is recommended) within six months of inspection closing. These measures enable transparency to facilities regarding inspection outcomes, which can enable timely implementation of corrective actions and continued access to medicines by offering industry faster access to data to inform business decisions to help identify suitable suppliers.

Using these metrics, the FDA reported a decline in performance in fiscal year 2021 (see Figure 4). In fiscal year 2021, the agency issued 70% of final facility classification letters issued within 90 days, compared to 78% in fiscal year 2020 and 87% in fiscal year 2019. In term of completing regulatory actions within six months after inspection closing, the FDA completed less than half (48%) of regulatory actions within six months in fiscal year 2021, down from 63% in fiscal year 2020 and 74% in fiscal year 2019 (see Figure 4).