Euroapi, Sanofi’s Spinout CDMO Details Restructuring Plan, Including Mfg

When launched in 2022, Euroapi, the spinout API and CDMO business of Sanofi, now a stand-alone entity, had ambitions to be the leader in small-molecule APIs and number two in the global API market. This week, the company detailed a restructuring plan. What is its plan going forward?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Restructuring and growth plan to address profitiability issues

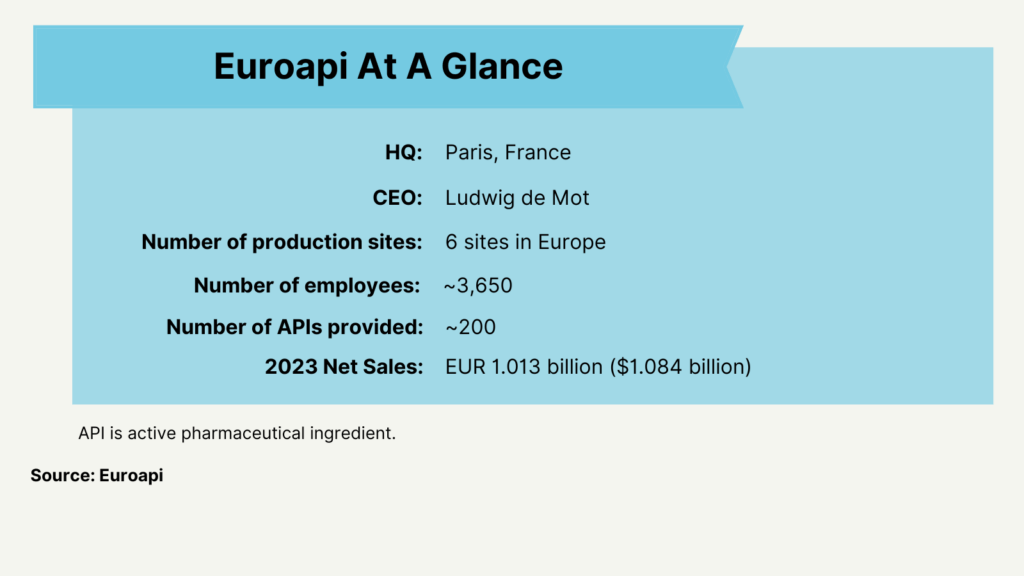

Euroapi, a supplier/CMDO of active pharmaceutical ingredients (APIs) that was previously spun off from Sanofi in 2022, provided the details of the company’s restructuring plan that the company had first announced this past February (February 2024). It is the first major action taken by Ludwig de Mot, Euroapi’s CEO, who took over as CEO this past January (January 2024) after serving as the company’s Executive Vice President and Chief Transformation Officer.

Chief Executive Officer

Euroapi

In taking over the helm of Euroapi, de Mot faces the challenge of improving the profitability of the company. Sanofi first announced its plan to form the stand-alone API supplier/CDMO in February 2020 with the strategic aim that the new European company will help balance “the industry’s heavy reliance on APIs sourced from other regions” while simplifying Sanofi’s industrial footprint by spinning off six chemical API production sites. At the time of its spinoff, Euroapi had ambitions to rank number one in small-molecule APIs and number two in the global API market. Euroapi launched as a stand-alone, separate publicly traded company in 2022, and although meeting revenue goals of being a $1-billion-plus API supplier/CDMO in 2023, it has faced profitability issues.

Although the company reported revenue gains in 2023, its net loss increased. The company reported 2023 net sales of EUR 1.013 billion ($1.084 billion), up 3.8% over 2022, but a net loss of EUR 189.7 million ($202.84 million) in 2023 compared to a net loss of EUR 15 million ($16.03 million) in 2022.

Euroapi currently has two main business activities. It is a supplier of APIs, with a current portfolio of approximately 200 APIs, which in 2023 accounted for 72% of the company’s net sales, evenly divided between net sales to Sanofi (36%) and other clients (36%). The other piece, its CDMO business, accounted for the remaining 28%, of which 10% were attributed to net sales to Sanofi and 18% to other clients. Overall, Sanofi accounted for 47% of the company’s net sales in 2023 and other clients, 53%. A decline in sales to products supported by Sanofi negatively impacted Euroapi in 2023.

Restructuring and growth plan

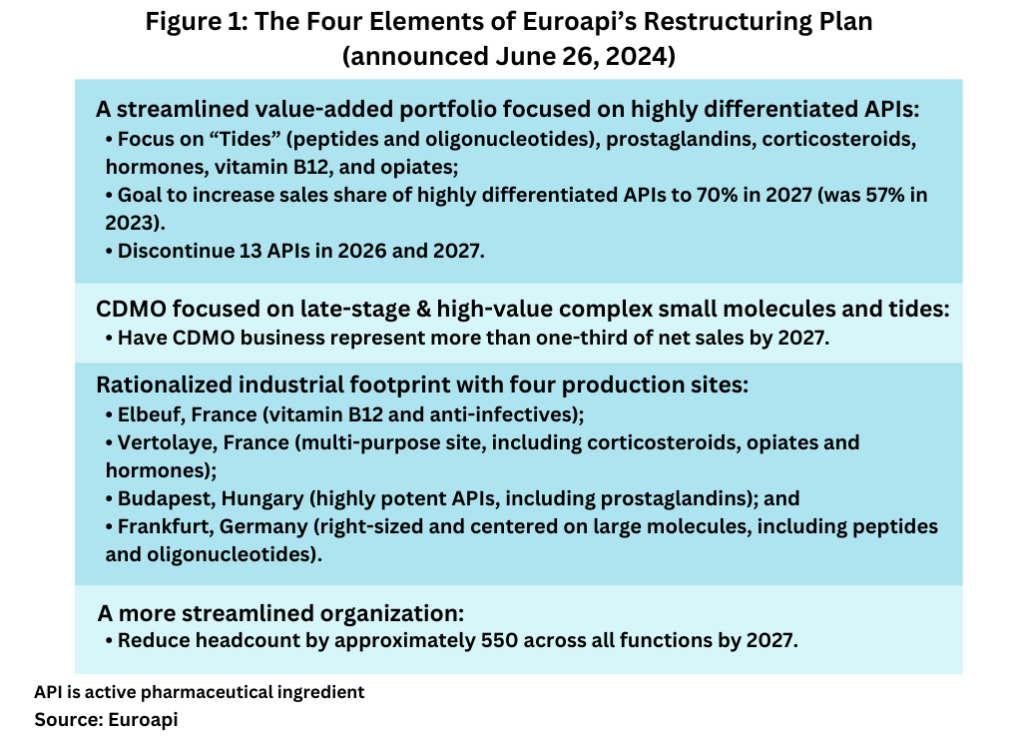

The company’s restructuring and growth strategy, dubbed Focus 27, is a four-year plan aimed at improving profitability. It involves four main elements (see Figure 1): streamlining its API portfolio to more value-added products, increasing the revenue share of its CDMO business, consolidating its manufacturing footprint, and reducing headcount. Details of each of those elements are outlined below.

Streamlining API portfolio. With respect to its API business, the company plans to shift to more value-added differentiated products, including peptides and oligonucleotides, high-potency APIs (prostaglandins, corticosteroids, and hormones), vitamin B12 and derivatives, and opiates. Thirteen APIs will be discontinued in 2026 and 2027. These APIs accounted for approximately EUR 80 million ($85.6 million) of the company’s net sales in 2023 and weighted approximately EUR 15 million ($16.0 million) on gross margins in 2023. The company aims to increase the share of highly differentiated APIs in its portfolio to more than 70% of its sales in 2027, compared to 57% in 2023.

Increasing its CDMO business. With respect to its CDMO business, Euroapi says its CDMO business will remain the main driver for growth and profitability with its projects progressively shifted toward more customized and high-value CDMO segments, with a focus on late-stage projects of complex small molecules and complex “tides” (peptides and oligonucleotides). The company aims to have its CDMO business represent more than one-third of its net sales by 2027; in 2023, it accounted for 28%.

Consolidating its manufacturing footprint. The third element of its restructuring and growth plan is to consolidate its manufacturing footprint with plans to divest two of its now six European manufacturing sites. The sites planned to be divested are in Haverhill, UK, and Brindisi, Italy. The company said it has already received expressions of interest for these sites.

The company plans to divest these two sites by the end of its strategic plan, which would leave the company with four manufacturing sites: (1) its site in Elbeuf, France, which provides a bio-fermentation platform and produces vitamin B12 and anti-infectives; (2) a multi-purpose site in Vertolaye, France, which has capabilities for producing corticosteroids, opiates, and hormones; (3) its site in Budapest, Hungary, focused on highly potent APIs (prostaglandins); and (4) its site in Frankfurt, Germany, right-sized and centered on large molecules, including peptides and oligonucleotides.

Euroapi says the footprint rationalization will increase its capacity utilization rate from a current average of 60% to around 80%. At the same time, the company says it plans to invest EUR 350 million ($374 million) to EUR 400 million ($428 million) in capital expenditures (CAPEX) throughout the implementation of its growth plan. These CAPEX will be focused on strategic initiatives, including: (1) increased capacities for large molecules at its Frankfurt site, for vitamin B12 at its site in Elbeuf, France, and for prostaglandins at its site in Budapest; (2) new capabilities for corticosteroids, hormones, and opiates at its site in Vertolaye, France; and (3) a steam-generation biomass boiler at its site in Elbeuf, France, to reduce carbon dioxide emissions and achieve the company’s 2030 decarbonation plan. The company said that approximately 59% of its total CAPEX will be dedicated to growth or performance.

Reducing headcount. The company says that its growth plan involves a more streamlined organization supporting a more efficient and leaner operating model. This organizational change will reduce its headcount by approximately 550 across all functions by 2027, which represents approximately 15% of its employee count of approximately 3,650 as of year-end 2023.

Implementation costs and financial targets

Overall, the company estimates restructuring costs in the range of EUR 110 million ($118 million) to EUR 120 million ($128 million) between 2024 and 2027, excluding the potential costs related to the divestment of its Haverhill and Brindisi sites.

The implementation of its restructuring and growth plan will be funded by a combination of financial resources. The company is in advanced discussions with its banks to amend the terms and extend the duration of its EUR 451-million ($483 million) revolving credit facility signed in 2022. Upon the completion of these discussions, Sanofi has agreed to support the financing of the Focus-27 plan through a EUR 200-million ($214 million) perpetual subordinated hybrid bond. On any interest payment date, and subject to certain conditions, Euroapi may decide to defer the interest payment related to this bond. To support the successful execution of its growth plan, Sanofi also agreed in principle to reserve minimum available capacities for selected products manufactured by Euroapi through a EUR 54-million ($58 million) payment over the plan. In addition to enhanced operational efficiency, Euroapi says its plan will be bolstered by improved cash-flow management, including reduced inventories. Between 2024 and 2027, the company estimates that total working capital should improve by approximately EUR 140 million ($150 million).

For the full-year 2024, the company has updated its financial outlook updated to include the impact of a temporary suspension of production at its site in Brindisi, Italy. The Brindisi site is expected to progressively resume API shipments and production during the third quarter of 2024. Overall, for the full-year 2024, the company estimates a decrease in net sales between 8% and 11% compared to 2023 on a comparable basis. It expects net sales will be negatively impacted by the downsizing of two large CMO contracts, the strong decrease in sales to Sanofi, and the impact of the temporary suspension of production at its site in Brindisi. The company says that its second-half performance in 2024 should exceed that of the first half due to the phasing impact of CDMO activity. Overall profitability will be impacted by the company’s transformation and early restructuring costs, including industrial under-activity resulting from the execution of the Focus-27 plan.