EU Tackles Drug Supply-Chain Vulnerabilities: Is Onshoring in Play?

The European Commission has released results from a pilot study evaluating the supply-chain vulnerabilities of 11 critical medicines, including manufacturing dependencies of APIs from outside the EU. What did the study show, and what is next?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Evaluating drug supply chains in the EU

The European Commission is moving forward with how to address medicine shortages in the European Union (EU). It has put forward a broad set of short-term and longer-term actions to address shortages of medicines and enhance their security of supply in the EU. The aim is to develop coordinated actions with all relevant stakeholders to prevent or mitigate shortages at the EU level, focusing on the most critical medicines for which security of supply needs to be assured. These actions build on work already underway, including the proposed revision of the EU pharmaceutical legislation, the first major reform of the EU’s pharmaceutical legislation in more than 20 years.

A major part of the European Union’s evaluation of drug shortages relate to supply chain vulnerabilities and the manufacturing and supply of active pharmaceutical ingredients (APIs) and related inputs taking place inside the EU and outside the EU. The European Commission has put forth that the EU needs to boost the resilience of its supply chains, which would require ensuring access to key capabilities at different levels of the supply chain, from sourcing of key input materials, APIs, and precursor production, to the actual manufacturing of finished products. At the same time, the European Commission says the EU needs to reconsider its manufacturing dependencies and enhance its strategic autonomy in health, by exploring the potential for expansion of internal EU manufacturing capacity while also building on strategic relations with neighborhood countries and like-minded countries globally.

Pilot study on EU drug supply chains

In this context, in December 2023, the European Commission, the Heads of Medicines Agencies (HMA), and the European Medicines Agency (EMA) published the first version of the Union list of critical medicines. The list features over 200 active substances deemed critical based on therapeutic indications and the availability of suitable alternatives in the EU/European Economic Area (EEA). Following the publication of the Union list, the European Commission performed a pilot exercise to assess the supply chain vulnerabilities of a first tranche of 11 critical medicines from the Union list to guide coordinated actions at the EU level. The 11 medicines selected for the pilot study were: alteplase, amoxicillin, amoxicillin/clavulanic acid, benzathine benzylpenicillin, clonazepam, fludarabine, glucagon, hepatitis B vaccine, rifampicin, verteporfin, and vincristine.

The European Commission collected data from marketing authorization holders, EU member states, and EMA on the supply chains of the selected medicines. Last month (June 2024), the European Commission issued the results of that pilot study that looked at 11 critical medicines from the Union list. This information is the first step in evaluating the supply chain vulnerabilities of critical medicines that will guide discussions among the various stakeholders and EU governmental authorities on how to address drug shortages, and potentially, reduce dependency on non-EU-based drug supply. The aim is to provide recommendations and strategic advice to the European Commission, EU member states, and other EU decision-makers on how to address medicine shortages, including from an industrial policy perspective.

Information and data evaluated in the pilot study

The methodology to derive the pilot study followed a data-driven approach for identifying a subset of critical medicines from the HMA/EMA Union list, balancing public health need and potential supply chain vulnerability in the process. For this purpose, the European Commission organized a workshop in January 2024 with the participation of EU member states, industry associations, EMA, and other Commission services to discuss the criteria for selecting the first tranche from the Union list to be subjected to the supply-chain vulnerability assessment. Participants identified historical shortages as the most suitable criterion for a quantitative, data-driven selection procedure with respect to data availability and relevance. They also highlighted the importance of other criteria, such as the location of API producers and market concentration, for which data are not readily available. Based on the feedback from the workshop’s participants and follow-up discussions with EMA, the European Commission decided to follow a combination of quantitative and qualitative data.

Information from bio/pharma companies and suppliers

After the selection of the 11 medicines to be analyzed in the pilot study, the key suppliers for these medicines were identified based on sales data from the year 2022 (most recent available) in the EU/EEA using a commercial database. Suppliers were ranked based on their market shares in each EU member state (aggregated data). This step ensured a broad geographical coverage of the suppliers across the different member states. Based on this ranking, suppliers covering at least 70% of the EU/EEA market were selected. This step ensured sufficiently high overall EU/EEA market share coverage and led to the identification of 49 key suppliers for the 11 selected medicines. The data from marketing authorization holders and EU member states were collected via dedicated questionnaires. Additionally, EMA provided information regarding the shortages and manufacturing sites of centrally authorized medicines. The data requests to industry and EU member states, as well as the data selection process, were discussed with industry associations, EU member states, and EMA at a dedicated in-person workshop in January 2024 and follow-up online meetings in February 2024 with industry representatives and EU member states. The questionnaires and the processes were adjusted based on constructive input from the relevant stakeholders.

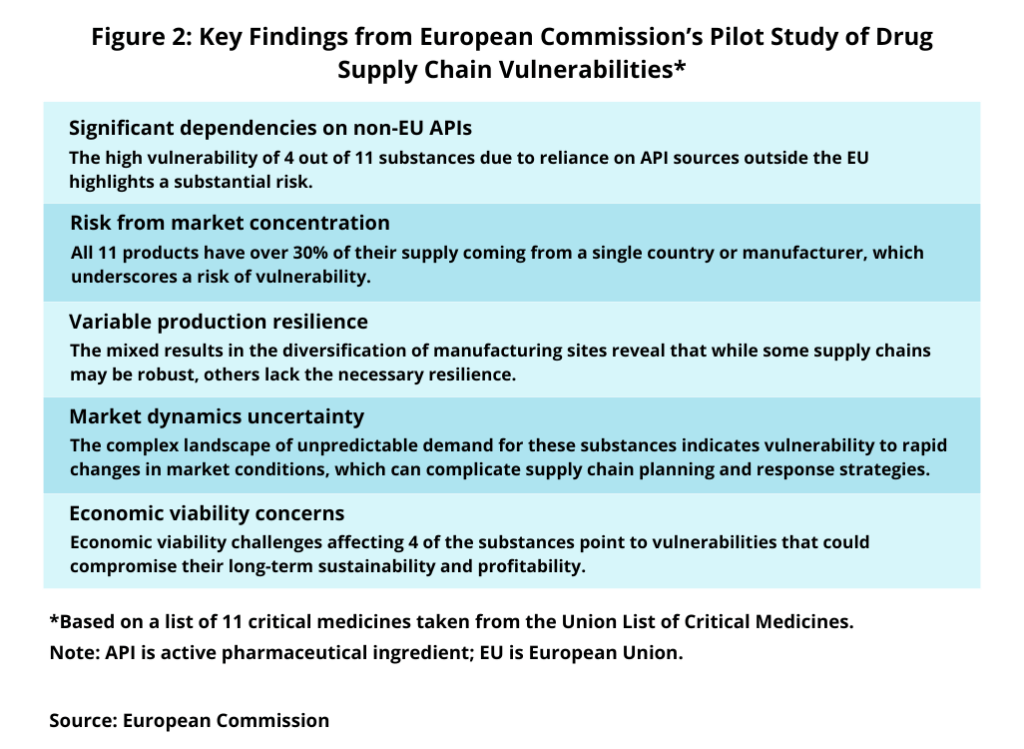

Figure 1 outlines the data taken from marketing authorization holders, and Figure 2, the key findings from the pilot study. Information from marketing authorization holders (see Figure 1) involved supply chain and manufacturing information, including location of production sites, the status of the production site (active/inactive and inhouse/contracted), and production volume for the fill-finish process, packaging and labelling, and API production. In addition, shortage information was collected covering the last three years, including the shortage status, duration of the shortage, the root cause of the shortage, and the point of supply chain disruption. Information on supply-chain risk assessment, including potential vulnerabilities based on the current draft of the Shortage Prevention Plan currently developed by EMA in cooperation with the industry, was also collected. In addition, information on the past and expected economic viability of the drug was collected based on the marketing authorization holder’s subjective assessment using a three-scale response option (high, medium, low).

With the data collected, data analysis focused on two primary tasks: computing six indicators (EU industrial presence, manufacturer and site diversification, supply chain risks, market concentration, unpredictable demand of the drug, and the economic viability of the drug) and applying risk thresholds to each indicator.

The “industrial presence” indicator indicates low risk if more than 70% of production is within the EU, medium risk if 30-70% of production is within the EU, and high risk if less than 30% is within the EU. For a high-risk “market concentration,” the definition of the indicator requires more than 30% of production coming from one supplier or one country. Less than 10% of production from one supplier or one country indicates low risk. The indicator of “diversification” assumes low diversification, hence high risk, when there are less than four active manufacturing sites of the molecule and high diversification, hence low risk, when there are more than six different suppliers. The risk level of the “unpredictable demand” indicator was attributed by assessing the frequency of “unexpected increased demand” in the reported root causes of shortages, weighted by the market share of the reporting marketing authorization holder. The two self-assessment indicators, “supply chain risks” and “economic viability”, report the weighted average of the assessments by marketing authorization holders.

Results of the pilot study

What did the pilot study show? First, concerning the EU industrial presence, four out of the 11 substances displayed high vulnerability, highlighting a significant dependence on API production/supply sources outside the EU (see Figure 2). Supply chain risks were assessed as high by the marketing authorization holders for three molecules, indicating that there might be a link with low diversification as these marketing authorization holders are dependent on a limited number of suppliers across their supply chain tiers. The marketing authorization holders of the other eight drug substances reported medium risks in their supply chains. Lastly, the economic viability indicator points to pressing economic challenges for four substances, with marketing authorization holders citing economic challenges, such as cost/price pressures, high competition, energy costs and inflation, continuous delays, and unsustainability of the market because product prices are below costs in certain EU member states.

Data collected and analyzed from EU member states showed that the root causes of medicines shortages vary from manufacturing issues, quality issues, and an unexpected increase in demand. The study pointed out that a lot of information on shortage notifications lacked specificity regarding the root cause. The analysis of the information available revealed that shortages of critical medicines analyzed at an EU/EEA level primarily come from manufacturing issues and unexpected increases in demand.

Several other key findings were noted in the pilot study (see Figure 2). All 11 products analyzed in the study have over 30% of their supply coming from a single country or manufacturer, which underscores a risk of vulnerability as this concentration increases the risk of supply chain disruption due to geopolitical issues, trade restrictions, or production problems. The mixed results in the diversification of manufacturing sites reveal that while some supply chains may be robust, others lack the necessary resilience. The study concluded that this variable resilience suggests a need for targeted strategies to diversify production sites to mitigate risks associated with localized disruptions. Moreover, the complex landscape of unpredictable demand for these substances in the pilot indicates vulnerability to rapid changes in market conditions, which can complicate supply chain planning and response strategies. The study concluded that uncertainty may require more flexible and responsive supply chain systems to adapt quickly to changing market demands. Economic viability challenges affecting four of the substances point to vulnerabilities that could compromise their long-term sustainability and profitability. The study says that addressing these economic challenges is crucial to maintaining the health and viability of these supply chains.