DCAT Benchmarking Study Provides Insight into Supply-Chain Challenges

How are executives from biopharma companies, CDMOs/CMOs, and suppliers confronting real and potential risks in the wake of new trade policies? A recent DCAT Benchmarking study, conducted prior to COVID-19, examines companies’ response to trade-related risks and sourcing and supply-chain challenges

Examining trade-related risks

The coronavirus crisis has focused national policy makers’ attention on the risks posed by global biopharma supply chains to domestic supplies of critical medicines. But even before the crisis hit, supply chains were at serious risk from the deteriorating global trade environment and the associated prospect of tariffs, quotas, and other trade barriers. Now, those policies are even more likely as countries seek to assure domestic supplies of critical medicines.

In light of evolving trade policies and debates surfacing in 2019, the Drug, Chemical & Associated Technologies Association (DCAT) launched a member study in the latter part of 2019 that surveyed biopharma, CDMO/CMO, and supplier executives to gauge their level of concern and actions they were taking to confront the trade-related risks to their supply chains. Now that the coronavirus has made the logistical and political risks to global supply an even more pressing issue, the study’s findings, published in the report, Managing Biopharma Supply Chains in an Uncertain Global Trade Environment, provide valuable insights into where the biopharma industry’s practices were before the crisis and just how far it will have to go in its aftermath. The study is part of DCAT Benchmarking, a DCAT member service providing in-depth studies that examine the crucial issues impacting the pharmaceutical manufacturing value chain and the pharma customer–supplier relationship. The full report and past studies from DCAT Benchmarking may be found here.

Study’s background

The global trade environment in 2019 was dominated by major trade disputes, including Brexit, the US-China dispute, and the renegotiation of the US-Mexico-Canada trade relationship. Those disputes included the threat or actual imposition of tariffs, quotas, and other trade sanctions on a number of industries such as electronics and automobiles. The biopharma industry was a potential target for such policies given its strategic importance and broad global supply chain. The US Food and Drug Administration (FDA) has reported that 80% of drug-substance suppliers to the US are located outside of the US. For Europe, EuroStat, the statistical office of the European Union (EU), reported that biopharmaceutical imports into and exports out of the EU totaled EUR 250 billion ($275 billion) in 2018. In most countries, the biopharma industry is a source of high-paying jobs and intellectual property creation.

To address these risks, the DCAT Benchmarking study surveyed representatives from DCAT member companies about their awareness of trade-related risks and steps to mitigate them. The survey was developed and results analyzed by the volunteer members of the DCAT Benchmarking Task Force and administered with external consultation in the fall of 2019. Biopharma companies and their suppliers were surveyed separately.

Sources of supply-chain risk

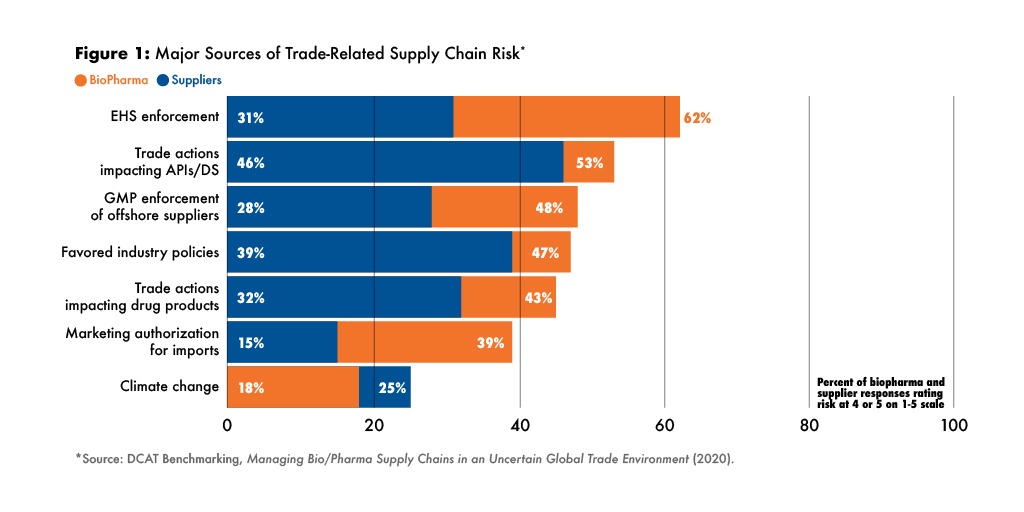

Biopharma companies and their suppliers had somewhat different perspectives on the greatest trade-related risks, but all were particularly concerned about the impact of trade disputes on supplies of active pharmaceutical ingredients (APIs) and other materials (see Figure 1).

At the time of the survey, many biopharma companies were dealing with supply-chain disruptions caused by enforcement of environmental, health and safety (EHS) regulations in China, as well as ongoing FDA compliance efforts with foreign suppliers. Those were foremost in the minds of respondents, but trade-related risks impacting APIs were also very much on the radar.

Among suppliers, trade-related supply-chain risks for both raw materials and finished products were in the top three concerns, but suppliers were also worried about national policies to develop industries to replace imports. Presciently as it turns out.

Biopharma companies and suppliers were in agreement that the greatest supply-chain risks related to drug substances/APIs sourced from China and India. The trade dispute between the US and China was viewed as a major source of risk. Brexit was viewed as a potential source of drug substance/API risk for about 30% of both groups.

Awareness of supply-chain risk

The tense global trade environment had already caused biopharma company executives to pay more attention to risks in their supply chains. Among biopharma company respondents, 53% indicated that senior management was paying more attention to risks relating to import and export of drug substances and APIs while 39% indicated increased senior management attention to risks to import and export of finished products. Nearly all indicated that trade-related risks are recognized as a major or moderate supply-chain risk in their strategic planning.

Fewer senior managers at materials suppliers were focused on trade-related supply chain risks although the large majority agreed that they were addressed as a major or moderate risk in their strategic plans.

Supply-chain risk management is a joint responsibility at most companies, by way of standing or ad hoc working groups. A number of biopharma companies, especially the largest companies, have staff dedicated to managing supply-chain risk.

Managing supply-chain risks

While the survey found recognition of trade-related supply chain risks to be high, it also found the implementation of mitigating tactics was less widespread.

Many companies had developed contingency plans to respond to trade-related supply-chain disruptions, but many hadn’t. Most of the largest biopharma companies had such plans, but less than half of suppliers had developed them.

Companies were asked if they had increased inventories in response to recent trade-related developments such as Brexit and the US-China dispute. Among biopharma company respondents, 44% said they had done so for APIs, but only 35% had done so for finished products. Nearly 40% had not adjusted inventories at all.

Among suppliers, 42% reported that their customers had increased their inventories of the supplier’s products in response to trade developments, and 44% indicated they had increased their own inventories. Neither the customer nor the supplier had increased inventories in 37% of responses.

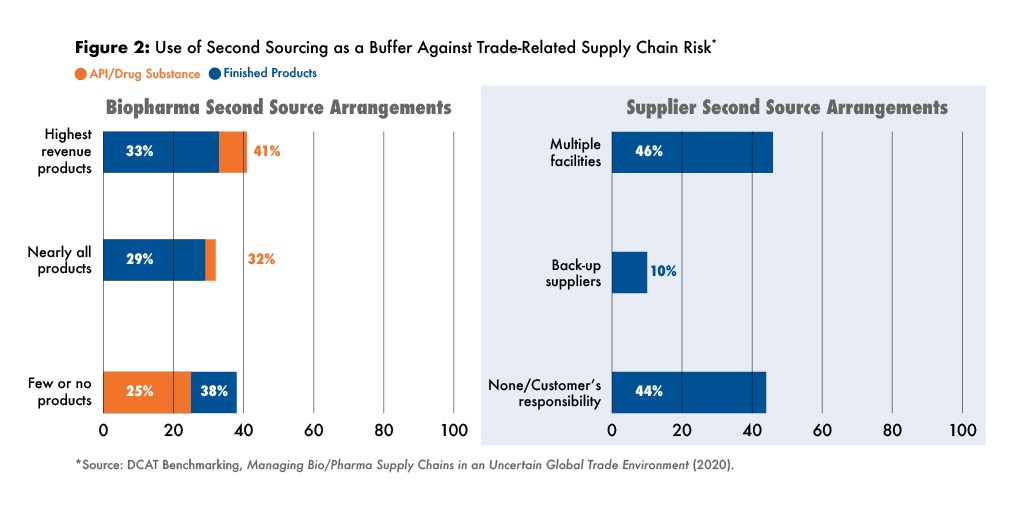

Having alternative sources for important products and inputs is a well-accepted supply-chain risk-management practice. A majority of biopharma company respondents reported that they had second-source arrangements for either most of their APIs and finished products, or for their biggest revenue generators, but nearly 40% indicated that few or none of their finished products had alternative sources (see Figure 2).

Second-sourcing arrangements are less effective if they are subject to the same trade-related risks as the primary sources, but this did not seem to be a major consideration for many respondents. Among biopharma company respondents, 43% reported that trade-related risks were not explicitly considered in second-source arrangements, but a similar number reported that second sources were always located in a different country or region than the primary source.

Most supplier respondents reported that customers required them to have second-source arrangements or maintain safety stocks for products they supply to them, at least for products that the customer considers to be very high value. Still, one-third of supplier respondents reported that customers seldom required them to maintain safety stocks or back-up sources.

Among supplier respondents, nearly half indicated that they had multiple facilities within their manufacturing networks that can serve as a second source while others had back-up arrangements with other manufacturers (see Figure 2). In one of the most eye-opening findings of the study, 44% of suppliers said it was their customers’ responsibility to maintain second-source arrangements.

An important question for the Benchmarking Task Force was whether a less trade-friendly world with more tariffs or quotas could affect decisions on when and where to build manufacturing sites. For biopharma respondents, tariff and other trade concerns were well behind tax/financial and local content requirements when considering where to build new facilities.

Among supplier respondents, the two factors indicated as most important for siting new facilities were size of the country or regional market opportunity, and tax and other financial considerations. Trade-related factors, including tariffs and disputes, were less important.

US market scenarios

Because the US is the largest market for biopharmaceuticals and because it has been the major actor roiling the global trade outlook, it seemed appropriate to address the possibility that the import of finished drugs and key ingredients could be subject to tariffs or other limiting actions. So, the study asked biopharma company and supplier respondents to address how their companies might respond to such events.

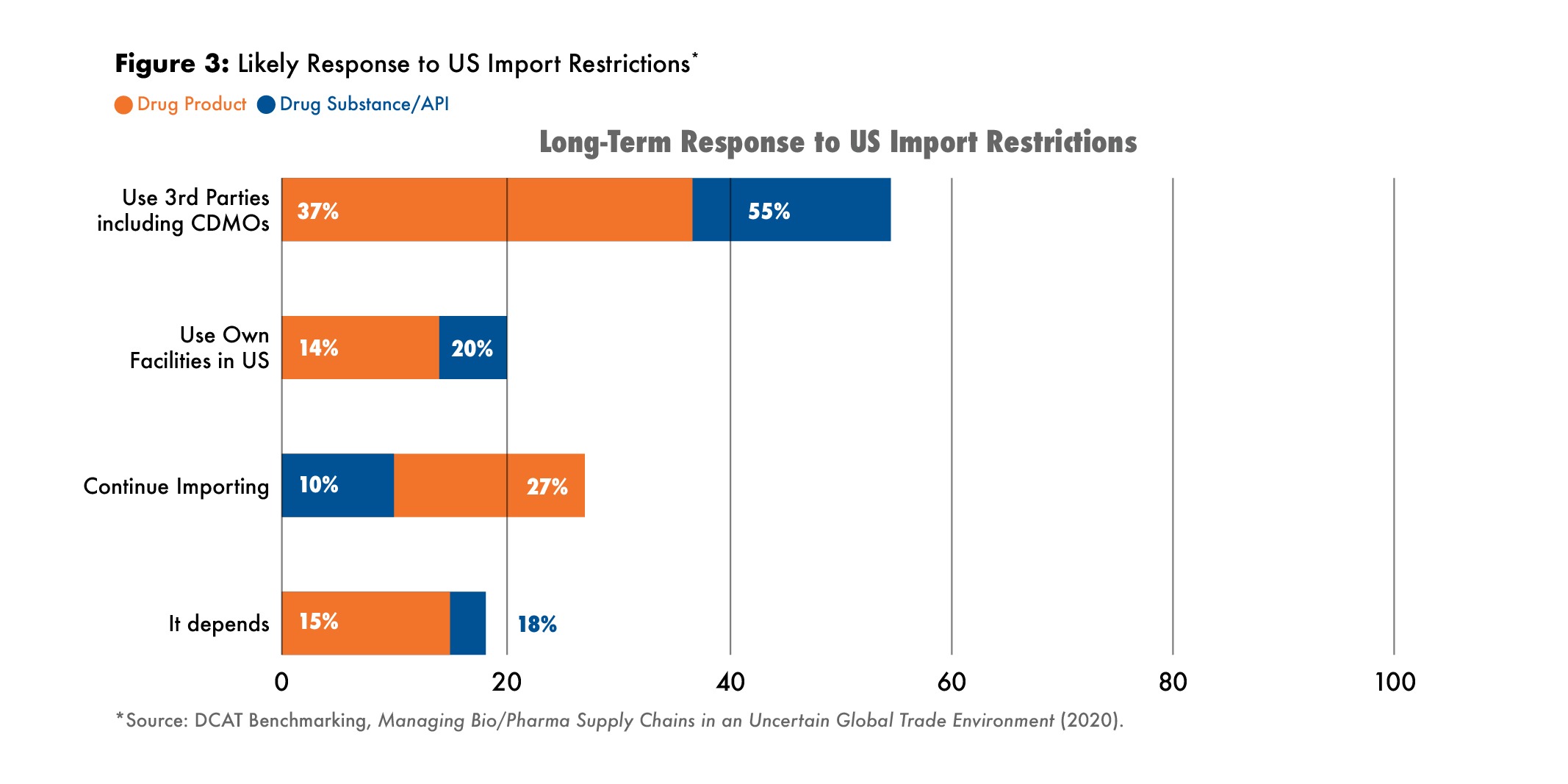

If the US were to impose import controls or tariffs on APIs and finished goods, biopharma companies would most likely either continue to import products, or turn to CDMOs, even as their long-term responses. Most biopharma respondents did not expect their companies to fill the gap from in-house facilities (see Figure 3).

Most suppliers, on the other hand, expected they would reduce imports in favor of producing in their own facilities or at CDMOs.

Vulnerable industry supply chains

The general takeaway from the DCAT Benchmarking study is that, prior to the crisis triggered by the COVID-19 pandemic, there was a general level of awareness of trade-related risks, but they were probably not at the top of supply-chain concerns for biopharma companies. Issues other than the possibility of tariffs, quotas, or other actions, including tax, financial and cost considerations, seemed to dominate company supply-chain decisions.

Further, even though there was awareness of the risks, tactics and strategies to mitigate them had not been adopted widely. Many companies had not increased inventories and even when they had established second sources, the trade-related risks were often not considered when awarding the contract, so a second source could have as much risk as the primary supplier. Risks were often addressed as they arose by ad hoc committees, and few companies appeared to have ongoing surveillance of the risk environment. As a result, many companies were vulnerable when the coronavirus shut down suppliers and interrupted supply-chain logistics.

While a less-friendly trade environment was a relatively new business development in 2019, there is a clear realization today that there is a risk in elongated supply chains and a recognition that national policies are likely to require repatriation of at least part of the supply chain in many countries. The study suggested that CDMOs could be beneficiaries of restructured supply chains as biopharma companies are unlikely to want to maintain sub-scale facilities in many countries. But, many CDMOs, especially those manufacturing drug substance and even drug product manufacturers in North America, were operating at high levels of utilization even before the pandemic crisis, so it’s not clear where the incremental capacity will come from.

In the coming months and years, biopharma companies and suppliers will have to redesign their supply-chain strategies and practices in response to the new trade environment and national protectionist policies. The last year should have taught them that more robust supply-chain intelligence will be needed to monitor risks, and policies and practices must be more consistent with the goal of maintaining a secure and dependable supply chain.

Note: The full report, Managing Biopharma Supply Chains in an Uncertain Global Trade Environment, and past studies from DCAT Benchmarking may be found here.

Jim Miller is Content Advisor/Consultant to the Drug, Chemical and Associated Technologies Association (DCAT) and led the DCAT Benchmarking Task Force for this study.