CDMOs/CMOS: The Movers and Shakers of 2021

As 2021 comes to a close, what were the largest mergers and acquisitions and expansions made by CDMOs/CMOs in 2021? DCAT Value Chain Insights looks at which companies topped the headlines this year and the leading moves they made.

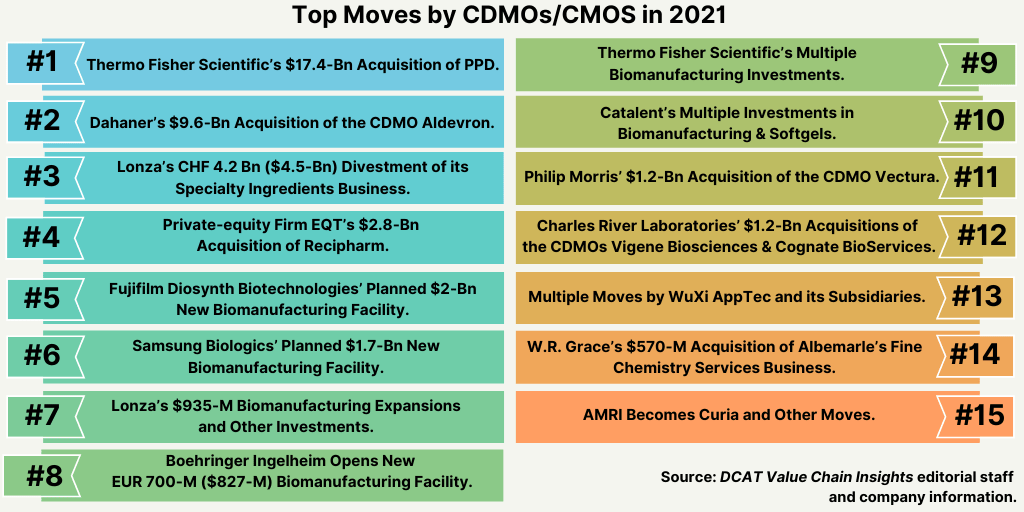

Top moves by CDMOs/CMOS in 2021

In reviewing the top news developments of CDMOs/CMOs in 2021, investment in traditional biomanufacturing as well as manufacturing for cell and gene therapies was a leading area of investments in 2021 with several companies announcing or proceeding with large-scale acquisitions or expansions. These investments and other key moves from 2021 are highlighted below.

1. Thermo Fisher Scientific’s $17.4-Billion Acquisition of PPD. The largest acquisition in the CDMO/CMO space from 2021 was Thermo Fisher Scientific’s $17.4-billion acquisition of PPD, a contract research organization. Announced in April (April 2021), the deal closed earlier this month (December 2021). Thermo Fisher acquired PPD for $17.4 billion in cash plus the assumption of approximately $3.0 billion of net debt. Thermo Fisher says it expects to realize total synergies of approximately $125 million by year three following close, consisting of approximately $75 million of cost synergies and approximately $50 million of adjusted operating income benefit from revenue-related synergies.

The move positions Thermo Fisher in the contract research space, along with its existing end-to-end capabilities in the CDMO/CMO space for active pharmaceutical ingredients (small molecules and biologics) and drug products. PPD provides a range of clinical research and laboratory services for drug development. In 2020, the company generated revenue of $4.7 billion and has approximately 26,000 employees globally. Upon close of the transaction, PPD will become part of Thermo Fisher’s Laboratory Products and Services Segment, which houses its CDMO business, which includes development and manufacturing services for drug-products, drug-substances (small molecules and biologics), and cell and gene therapies.

2. Dahaner’s $9.6-Billion Acquisition of CDMO Aldevron. Another large deal in the CDMO/CMO sector in 2021 was Danaher’s $9.6-billion acquisition of Aldevron, a Fargo, North Dakota-based CDMO of DNA plasmid, mRNA, and proteins. The acquisition, announced in June (June 2021) and completed in August (August 2021) adds to Danaher’s life-sciences business, which includes Cytiva (formerly GE Healthcare Life Sciences, which Danaher acquired in 2020 for $21.4 billion), Pall, and Beckman Coulter Life Sciences. Following the close of the transaction, Aldevron is operating as a standalone operating company and brand within Danaher’s Life Sciences segment.

3. Lonza’s CHF 4.2 Billion ($4.5 Billion) Divestment of its Specialty Ingredients Business. In a move that showed its strategic emphasis on its core CDMO business, in July (July 2021), Lonza completed the divestment of its former Specialty Ingredients business and operations to Bain Capital and Cinven, two private-equity firms, for an enterprise value of CHF 4.2 billion ($4.5 billion). The divestment strategically puts Lonza as a pure-player in bio/pharmaceuticals. The CDMO business of Lonza provides end-to-end development and manufacturing services for drug substances (small molecules, biologics, and cell and gene therapies) and drug products, principally oral solid dosage products through its $5.5-billion acquisition of Capsugel in 2017 as well as services for inhalation and parenteral drugs. The former Lonza’s Specialty Ingredients business provides microbial control services for professional hygiene and personal-care products and custom development and manufacturing of specialty chemicals and composites to support the electronics, aerospace, food, and agrochemical industries.

4. Private-equity Firm EQT’s $2.8-Billion Acquisition of Recipharm. Earlier this year (2021), the private-equity firm, EQT, closed its $2.8-billion acquisition of Recipharm, a CDMO of APIs and drug products. EQT already owned CDMOs Aldevron (plasmid DNA for viral vectors) and Fertin Pharma (specialty dose forms); it also owns SHL Medical, a developer and manufacturer of injectable delivery devices.

5. Fujifilm Diosynth Biotechnologies’ $2-Billion Planned New Biomanufacturing Facility and Other Investments. In October (October 2021), Fujifilm Diosynth Biotechnologies broke ground on a new, $2-billion, large-scale cell-culture biomanufacturing facility in Holly Springs, North Carolina. The company had announced the investment in January 2021. The facility is expected to be operational by the spring of 2025.

The new facility is one of several biomanufacturing investments announced or proceeding by Fujifilm Diosynth in 2021. Earlier this month (December 2021), the company announced plans to invest £400 million ($533 million) to expand its site in Billingham, Teesside, UK, with the addition of a viral gene-therapy facility and a mammalian cell-culture facility. The new facilities are expected to be operational by late 2023. The investment is part of a 90 billion Yen ($797 million) global capital investment package initially outlined by the company in June 2021. In addition to the gene-therapy and cell-culture manufacturing expansion in the UK, the investment includes doubling cell-culture production for recombinant vaccines in the US and and doubling microbial fermentation capacity at an existing UK facility.

In addition, the company is investing approximately 100 billion Yen ($928 million) at its site in Hillerød, Denmark, near Copenhagen, to double drug-substance biomanufacturing capacity, expand its capabilities to include fill–finish, and enhance its current assembly, labeling, and packaging services. Fujifilm Diosynth acquired the facility from Biogen in 2019 for approximately $890 million. The investment will expand production lines for bulk drug substances with the addition of six mammalian-cell bioreactors, which would bring the total capacity to 12 x 20,000-liter bioreactors by the fall of 2023.

6. Samsung Biologics’ $1.7-Billion Biomanufacturing Expansion. One of the largest expansions announced or ongoing in 2021 by CDMOs/CMOs is Samsung Biologics’ KWR 2-trillion ($1.7-billion) investment for a new biomanufacturing plant, the company’s fourth, in Incheon, South Korea, and for a second bio complex. The company broke ground on the new facility in November 2020, which, upon completion, will provide 256,000 liters in total biomanufacturing capacity. The plant will have a modular design that will allow flexibility for certain parts of the plant to begin manufacturing activities by the end of 2022, with the goal to commence full operations in 2023.

In a smaller invest announced earlier this year (2021), Samsung Biologics announced plans to add mRNA vaccine drug-substance manufacturing at its current facility in Songdo, South Korea, with the goal of having operations ready in early 2022. The addition will enable Samsung Biologics to provide end-to-end mRNA vaccine manufacturing services from bulk drug substance to aseptic fill–finish, including labeling and packaging, as well as cold-chain storage. Separately, the company opened a new R&D center in San Francisco, California.

7. Lonza’s $935-Million Biomanufacturing Expansions and Other Investments. Lonza is proceeding with expansions in the US, Switzerland, and China. Earlier this year (2021), Lonza announced plans to invest approximately CHF 850 million ($935 million) to add two mammalian drug-substance manufacturing facilities at its sites in Visp, Switzerland, and Portsmouth, New Hampshire. The expansion in Visp will add a new 27,500-square-meter large-scale mammalian drug-substance manufacturing facility. The facility is expected to be completed in 2024 with an investment of approximately CHF 650 million ($715 million). The expansion will complement the company’s existing large-scale biomanufacturing global network at its sites in Tuas, Singapore; Porriño, Spain; and Portsmouth, New Hampshire.

In Portsmouth, New Hampshire, the company is adding a new biomanufacturing facility for small-to-mid-volume production. The CHF 200-million ($220-million) facility will add capacity for up to eight 2,000-L single-use bioreactors to support Phase III clinical and commercial small- to mid-volume products. The facility is expected to be completed in 2023, and will complement the company’s existing single-use network at sites in Hayward, California; Slough, UK; Tuas, Singapore; and Visp. In addition, Lonza began operations in the second quarter of 2021 at its new 17,000–square-meter mammalian-cell biomanufacturing facility in Guangzhou, China.

In addition, last month (November 2021), Lonza announced an investment to expand microbial development capacity at its facility in Visp, Switzerland. The expansion is slated to be operational by the end of 2021. Also, in 2021 (October 2021), Lonza announced plans to expand its mammalian-based biologics development services at its site in Tuas, Singapore, by adding additional capacity for cell culture, purification, and analytical services.

8. Boehringer Ingelheim’s New EUR 700-million ($827-million) Biomanufacturing Facility. In October (October 2021), Boehringer Ingelheim (BI) inaugurated a new EUR 700-million ($827-million) large-scale, cell-culture biomanufacturing facility in Vienna, Austria. The facility has up to 150,000-L manufacturing capacity for BI products and contract manufacturing activities. The company broke ground on the facility in 2017, and the facility adds to the company’s biomanufacturing network in Biberach, Germany; Vienna, Austria; Fremont, California; and Shanghai, China.

9. Thermo Fisher Scientific’s Multiple Biomanufacturing Investments. Thermo Fisher made several moves in 2021 to expand both cell- and gene-therapy manufacturing and traditional biomanufacturing. Earlier this year (2021), Thermo Fisher added to its contract viral vector manufacturing services with the acquisition of Henogen S.A., Novasep’s viral vector manufacturing business in Belgium, for approximately EUR 725 million ($875 million).

Also in 2021, Thermo Fisher Scientific opened a new plasmid DNA (pDNA) manufacturing facility in Carlsbad, California. The site expands the company’s clinical and commercial capabilities for pDNA, which is used as a raw material to develop and manufacture cell- and gene-based therapies. The site also has capability to produce large-scale pDNA as a primary drug substance for DNA therapies.

In addition, earlier this year (2021), Thermo Fisher Scientific and the University of California, San Francisco (UCSF) formed a strategic alliance to accelerate the development and manufacturing of cell-based therapies by opening a cell-therapy manufacturing and collaboration center. Under the agreement, Thermo Fisher will build and operate a 44,000-square-foot cell-therapy development, manufacturing, and collaboration center in leased space on UCSF’s Mission Bay campus. The site will offer clinical and commercial cGMP cell-therapy manufacturing services, along with associated technology development support, to UCSF and other partners. The center is expected to open in 2022.

These expansions build on the company’s continued investment in cell- and gene-therapy manufacturing facilities, including: (1) viral vector facilities in Cambridge, Lexington, and Plainville, Massachusetts, and Alachua, Florida; (2) a new cell-therapy manufacturing facility in Princeton, New Jersey; and, (3) a new dedicated cryocenter in Weil am Rhein, Germany, to provide specialized cryogenic and cold-chain supply-chain services to support clinical trials across Europe and globally. The new commercial manufacturing site in Plainville, Massachusetts, a $180-million project, will more than double the company’s commercial viral vector capacity for gene therapies and vaccines. Construction of the new 290,000-square-foot facility is expected to be completed in 2022.

In addition, earlier this year, Thermo Fisher Scientific assumed operational responsibility for a new biologics manufacturing site, currently under construction, in Lengnau, Switzerland, as part of its partnership with CSL Limited, a Melbourne, Australia-based bio/pharmaceutical company. The companies announced the partnership last year (2020). Following completion of site construction in 2022, Thermo Fisher will initially support manufacturing of CSL’s recombinant factor IX product, Idelvion, which is used to treat hemophilia B. Over time, Thermo Fisher says it plans to expand the use of the site to include additional bio/pharma customers. Thermo Fisher Scientific is also investing $82.5 million to expand operations at its biologic drug-substance manufacturing facility in St. Louis, Missouri.

10. Catalent’s Multiple Investments in Biomanufacturing and Softgels. In 2021, Catalent made several investments to increase biologics drug-substance manufacturing and cell- and gene-therapy manufacturing. In July (July 2021), Catalent announced that it will begin the first phase of a planned $100-million expansion at its facility in Anagni, Italy, to add biologics drug-substance manufacturing. The initial expansion is expected to be commissioned and operational for customer projects in April 2023. Later phases of the planned expansion contemplate the provision of 16,000 liters of total flexible manufacturing capacity to enable 2,000-liter to 8,000-liter batch production scale. Catalent’s Anagni site now provides aseptic filling, secondary packaging, and oral dose manufacturing for late-stage and commercial product launches. Since Catalent acquired the facility in January 2020, it has become a European hub for COVID-19 vaccine manufacturing as well.

Also, on the biologics drug-substance side, earlier this year (2021), Catalent completed the expansion of two new suites at its biologics drug-substance development and manufacturing facility in Madison, Wisconsin. The expansion increased the number of manufacturing suites at the site to five, which more than doubled its overall cGMP-scale capacity.

In cell and gene therapies, earlier this year (2021), Catalent acquired RheinCell Therapeutics, a Langenfeld, Germany-based developer and manufacturer of human induced pluripotent stem cells, which became part of Catalent’s Cell & Gene Therapy business. In May (May 2021), Catalent acquired Promethera Biosciences’ cell-therapy manufacturing subsidiary, Hepatic Cell Therapy Support SA (HCTS), including its 32,400-square-foot facility in Gosselies, Belgium. The facility will accommodate Catalent’s commercial-scale plasmid DNA (pDNA) manufacturing and is located on Catalent’s existing campus in Gosselies, adjacent to the Delphi Genetics building. Catalent announced the acquisition of Delphi Genetics earlier this year (2021), a spinoff from the Université libre de Bruxelles and a bioproduction CDMO with capabilities in pDNA development and cGMP manufacturing. Catalent gained its facilities in Gosselies, Belgium, with its $315-million acquisition of MaSTherCell, a provider of cell- and gene-therapy development and manufacturing services in 2020.

In addition, in October (October 2021), Catalent announced a $230-million expansion project to add three commercial-scale viral-vector manufacturing suites and associated support facilities and services at its gene-therapy campus in Harmans, Maryland, which brings its total investment at the site to $360 million. A second facility is under construction following an initial $130 million investment by Catalent in 2020, which will add five new manufacturing suites that are expected to be operational mid-2022. When completed at the end of 2022, the campus will house a total of 18 viral-vector manufacturing suites, each designed to accommodate multiple bioreactors up to 2,000-liter scale and enable the execution of commercial manufacturing from cell bank to purified drug substance.

In August (August 2021), Catalent announced a large acquisition to build its position on the finished product side by agreeing to acquire Bettera Holdings, a Plano, Texas-based manufacturer of gummy, soft chew, and lozenger products, for $1 billion. The pending acquisition, which is expected to closed by the end of 2021, complements Catalent’s softgel and oral dose formulation development and manufacturing business.

11. Philip Morris’ $1.2-Billion Acquisition of CDMO Vectura. Another large deal in the CMDO/CMO sector in 2021 was the acquisition of the Vectura Group, a Chippenham, UK-based CDMO of inhaled drug-delivery Philip Morris International (PMI), a cigarette and tobacco manufacturing company for £852 million ($1.2 billion). The acquisition is part of PMI’s “Beyond Nicotine” strategy, announced in February (February 2021), which sets a goal to generate more than 50% of its total net revenues (at least $1 billion) from smoke-free products by 2025. PMI is seeking to leverage its expertise in inhalation and aerosolization into adjacent areas, including respiratory drug delivery and selfcare wellness.

12. Charles River Laboratories’ $1.2-Billion Acquisitions of CDMOs Vigene Biosciences and Cognate BioServices. Charles River Laboratories, a CRO, made three deals to fortify its position in early development of cell and gene therapies. In May (May 2021), the company agreed to acquire Vigene Biosciences, a Rockville, Maryland-based CDMO specializing in viral vectors, in a deal worth up to $350 million ($292.5 million upfront and contingent additional payments of up to $57.5 million). The deal is expected to close in the third quarter. With operations based in Rockville, Maryland, Vigene will geographically expand and be complementary to Charles River’s existing gene-therapy CDMO capabilities, which it expanded through the $875-million acquisition of Cognate BioServices, a CDMO specializing in cell and cell-mediated gene-therapy products, in March (March 2021). Also, in March (March 2021), Charles River acquired Retrogenix, a UK-based early-stage CRO providing specialized bioanalytical services utilizing its proprietary cell microarray technology.

13. Multiple Acquisitions by WuXi AppTec and its subsidiaries. WuXi AppTec and its subsidiaries announced several acquisitions in 2021 to further build its capabilities in biomanufacturing, including for cell and gene therapies, as well as drug-product manufacturing. In May (May 2021), WuXi Biologics announced the completion of three acquisitions: (1) Pfizer’s biologics drug-substance and drug-product manufacturing facilities in Hangzhou, China; (2) CMAB Biopharma, a biologics CDMO headquartered in Suzhou, China; and (3) a former Bayer biomanufacturing site in Wuppertal, Germany. All these acquired facilities are expected to be ready for GMP manufacturing in 2021.

In addition, in March (March 2021), WuXi AppTec completed the acquisition of Oxgene, an Oxford, UK-based contract provider of discovery and biomanufacturing services for cell and gene therapies. Oxgene became a fully owned subsidiary of WuXi Advanced Therapies, WuXi AppTec’s cell and gene therapy contract testing, development and manufacturing business unit.

Also, in 2021, WuXi STA, a subsidiary of WuXi AppTec, agreed to acquire a drug-product manufacturing facility from Bristol-Myers Squibb in Couvet, Neuchâtel, Switzerland. The facility has commercial-scale production capacity for capsule and tablet dosage forms. In June (June 2021), WuXi STA named Middletown, Delaware, as the location of its new pharmaceutical manufacturing campus, which is expected to open in 2024. The future Middletown site will become WuXi STA’s second site in the US and will have clinical- and commercial-scale manufacturing capabilities.

14. W.R. Grace’s $570-Million Acquisition of Albemarle’s Fine Chemistry Services Business. In the small-molecule space, in June (June 2021), Albemarle completed the sale of its Fine Chemistry Services business to W. R. Grace & Co. for approximately $570 million. The acquisition adds analytical, regulatory, and manufacturing capabilities to Grace’s pharma portfolio focused on chromatographic resins, formulation excipients, drug delivery, and pharmaceutical intermediates and active pharmaceutical ingredients (APIs). As part of the transaction, Grace acquired Albemarle’s operations in Tyrone, Pennsylvania, and South Haven, Michigan.

15. AMRI Becomes Curia and Other Moves. In 2021, AMRI rebranded as Curia and made two key acquisitions. Already an end-to-end provider of small-molecule APIs and contract sterile manufacturing services, Curia added biologics capabilities with its acquisition of LakePharma, a San Carlos, California-based contract research, development, and manufacturing organization specializing in the production and evaluation of DNA vectors, viral vectors, cell lines, proteins, antibodies, mRNA, and conjugates. Curia also added to its drug-product capabilities with its acquisition of Integrity Bio, a Thousand Oaks, California-based CDMO of biologics formulation development and fill–finish manufacturing services.

Curia also announced in August (August 2021) that it is investing more than $35 million to expand its commercial small-molecule manufacturing capacity at its Rensselaer, New York, facility. The expansion will include new vessel capacities that more than double the site’s batch-size scaling and product output. The expansion is expected to be completed within 18 months (as reported on August 19, 2021), adding to Curia’s existing API manufacturing facilities in the US, France, Spain, Italy, and India.