CDMO Outlook: Headwinds Loom for the Industry

By Jim Miller, Consultant and Content Advisor, DCAT

After a robust 2021, the CDMO industry entered 2022 with a lot of momentum, but at the close of the first quarter of 2022, market conditions are more uncertain. Highlights from my DCAT Week 2022 presentation are below.

CDMOs face new pressures in 2022

After a strong showing in 2021, the CDMO industry entered 2022 with a lot of momentum. As the first quarter of 2022 came to a close, however, an increasingly uncertain business environment is creating challenges for the industry. That was the key message in my presentation made at the Pharma Industry Outlook program on March 21, 2022, at DCAT Week 2022, the flagship event of the Drug, Chemical & Associated Technologies Association (DCAT).

Most CDMOs that report their results publicly enjoyed outstanding results in 2021, with revenues and profits (as measured by earnings before interest, depreciation and amortization [EBITDA]) growing by 20% or more during the year. Those companies reporting public results, however, are just a small percentage of all CDMOs, most of which do not report their results publicly. Moreover, most of the reporting companies are heavily involved in the biologics and injectable segments of the industry, which benefitted mightily from spending on development and manufacture of COVID vaccines and therapeutics. Many CDMOs that have capabilities for small molecules and oral and topical dosage forms also did well in 2021, but did not get the boost that the biologics CDMOs received.

CDMOs entered 2022 with the wind at their back thanks to a robust pipeline, substantial fundraising in 2020–2021, and a post-COVID backlog of projects. But one quarter into 2022, they are facing increasingly stiff headwinds emanating from multiple fronts, including difficulties in hiring staff, long lead times for raw materials, logistics challenges, declining government purchases of vaccines and medicines, and ongoing difficulties in patient recruitment for clinical trials. Russia’s invasion of Ukraine and the global response to it have compounded these problems by causing energy costs to soar and further interfering with clinical trials.

These challenges will make it difficult for CDMOs to show significant growth in revenues and profits in 2022 relative to their very strong 2021 results. Profit margins, in particular, will be squeezed by rising costs for staff, materials, and energy, and companies could see a decline in profitability even if they achieve top-line growth. Supply and development contracts that allow materials cost pass-throughs and price escalators linked to government price indices may provide some protection, but margin erosion is still likely.

Slowing M&A on the horizon

The benchmarks set in 2021 may also impede merger and acquisition (M&A) activity in 2022, according to investment bankers and private equity executives. Last year (2021) saw records set for the total value of CDMO deals and the valuations paid for those acquisitions. Over 60 deals were closed for CDMO businesses or facilities acquired by CDMOs, with a total value of $37 billion, two-and-a-half times the $14 billion closed in 2016, the next biggest year. Further, the median acquisition multiple was 17 times EBITDA, well above the previous record of 15x set in 2019.

According to investment bankers, the level of activity and multiples paid in 2021 have set expectations for sellers that buyers may not be willing to meet in 2022. In addition to less favorable performance comparables resulting from demand uncertainties and high inflation, buyers are facing higher interest costs for the debt portions of their acquisition prices, if they can raise debt at all. Further, the closing of the window for initial public offerings (IPOs) has denied sellers an alternative exit channel. For deals to get done, sellers are going to have to lower their expectations, or buyers have to be willing to stretch their resources and take on more risk.

The need for deep pockets

The health of capital markets is impacting CDMOs in areas other than M&A. Rising interest rates, a raft of clinical trial failures, and general economic uncertainty are impacting an industry that is increasingly dependent on external capital.

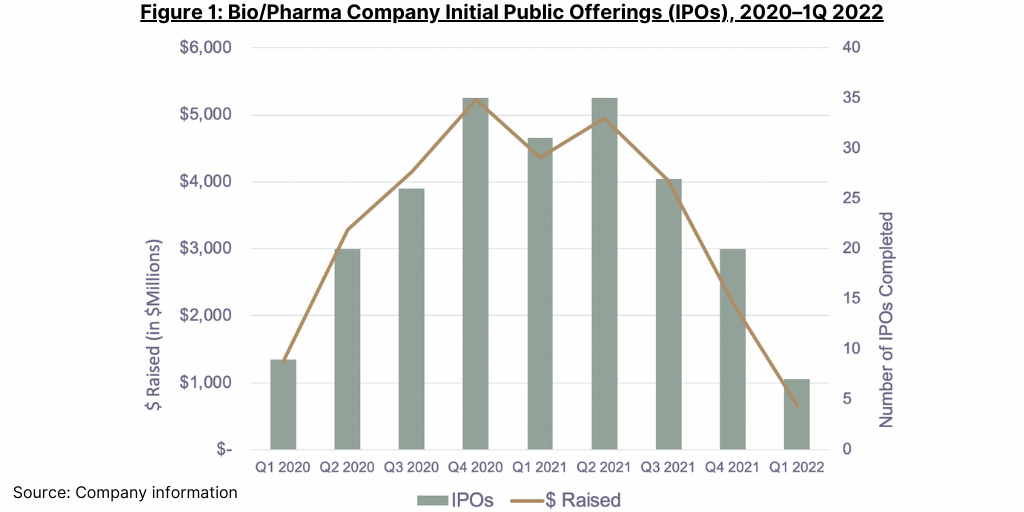

A major CDMO customer segment, emerging bio/pharma companies, is certainly being impacted. According to a recent report from Jefferies Equity Research, companies that depend on funding from venture capital, initial and secondary public offerings, and other sources of external capital account for 20–30% of spending for CDMO and CRO services. However, after several years of record activity, emerging bio/pharma companies are having problems accessing funding sources. IPO activity has dropped sharply (see Figure 1), and venture capital investors appear to be getting more discerning. While emerging bio/pharma companies that raised funding in 2020–2021 have considerable cash in the bank that can support development for the next several years, a decline in the availability of funding could depress demand for CDMO services in the future.

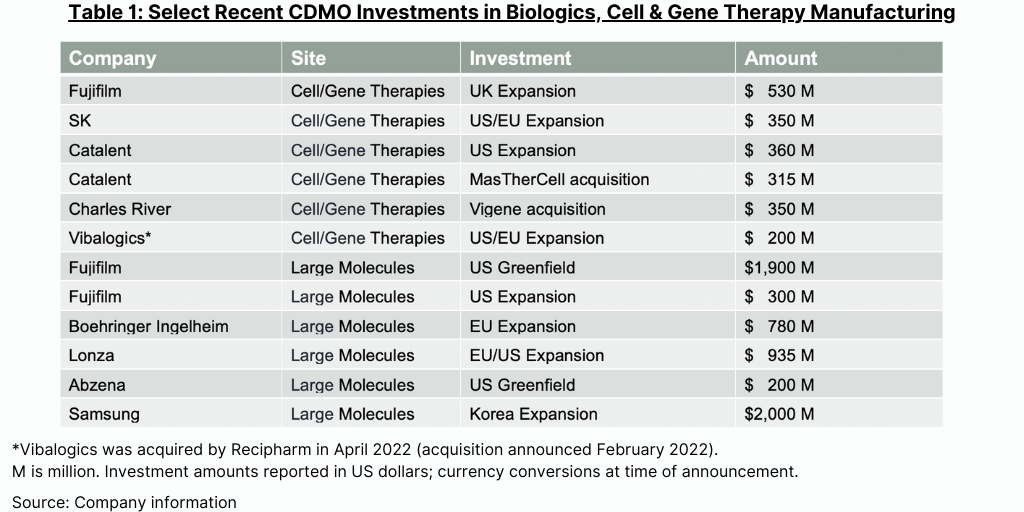

The health of capital markets is also critical to CDMOs because an industry that was built on inexpensive acquisitions of manufacturing sites no longer needed by large global bio/pharma companies now requires large amounts of capital to fund acquisitions and investment in new facilities. In particular, CDMOs are making major investments in capacity to manufacture biologics, including monoclonal antibodies and cell and gene therapies, and those investments are running into the hundreds of millions, and even billions, of dollars (see Table 1). To support its growth, the CDMO industry needs access to capital markets, something that large public companies and major private equity firms can provide. But rising interest rates are impacting the cost of that capital and lowering the returns on those investments.

A look ahead

There are, however, enough elements in place for CDMOs to have a good year in 2022, even if it is somewhat disappointing compared to 2021, but executives will face longer-term challenges. Investors in CDMOs may be the most disappointed as 2021’s torrid pace of M&A is unlikely to be repeated.