Blockbuster Contenders: Drugs to Watch in 2025

Which new market entrants should be on the industry’s radar in 2025? What new products, recently or expected to launch in 2025, show blockbuster potential? A look at the leading contenders.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Potential blockbusters in the making

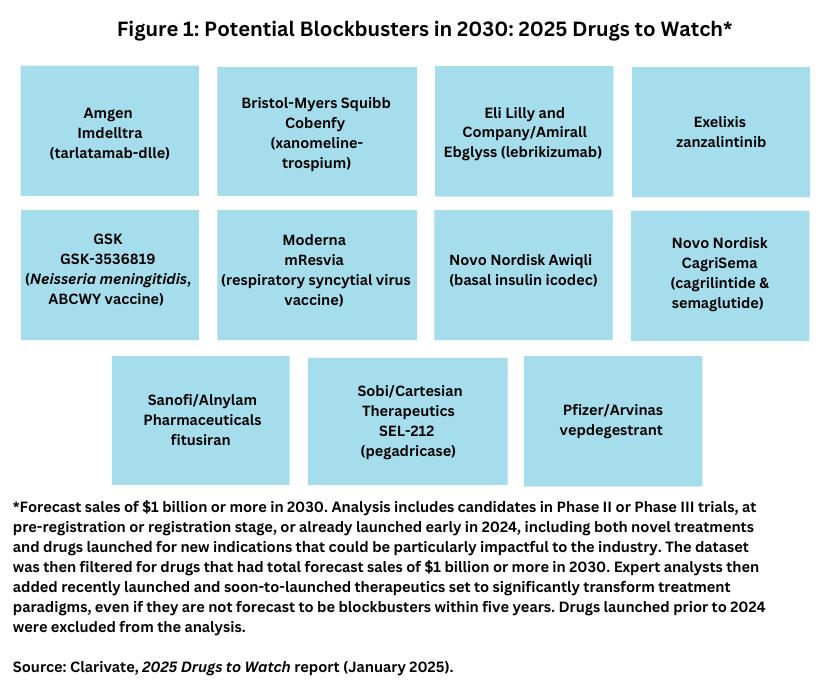

Each year brings the promise of new market entrants, so what is on tap for 2025? Clarivate, a business intelligence firm, in its 2025 Drugs To Watch report, identifies 11 new-to-market therapeutics and drugs poised to launch in 2025 or newly-launched that are projected to achieve blockbuster/near blockbuster status (defined as sales of $1 billion or more) by 2030.

The analysis includes candidates in Phase II or Phase III trials, at pre-registration or registration stage, or already launched early in 2024, including both novel treatments and drugs launched for new indications that could be particularly impactful to the industry. The dataset was then filtered for drugs that had total forecast sales of $1 billion or more in 2030. Expert analysts then added recently launched and soon-to-launch therapeutics set to significantly transform treatment paradigms, even if they are not forecast to be blockbusters within five years. Drugs launched prior to 2024 were excluded from the analysis.

On top of the list of the 11 drugs noted by Clarivate as potential blockbusters, based on projected sales in 2030, is Eli Lilly and Company’s and Amirall’s Ebglyss (lebrikizumab) for treating atopic dermatitis (eczema). Novo Nordisk placed with two projected blockbusters: Awiqli (basal insulin icodec) for treating diabetes and CagriSema (cagrilintide and semaglutide), a combination therapy and follow-on to its blockbuster Type 2 and obesity drugs, Ozempic/Wegovy (semaglutide). Other top contenders by the large biotech/pharma companies, either developed singularly or in partnership, include: Bristol-Myers Squibb’s Cobenfy (xanomeline-trospium) for treating schizophrenia and psychosis related to Alzheimer’s disease; Amgen’s Imdelltra (tarlatamab-dlle) for treating extensive small-cell lung cancer; Sanofi’s and Alnylam Pharmaceuticals’ fitusiran for treating hemophilia A and B; GSK’s Neisseria meningitidis (A, B, C, W, and Y) vaccine, GSK-3536819; and Pfizer’s/Arvinas’ vepdegestrant for treating a certain form of advanced breast cancer (see Figure 1).

Rounding out the top 11 drugs to watch in 2025 were contenders from mid-sized to smaller companies: Moderna’s mRESVIA (respiratory syncytial virus vaccine); Exelixis’ zanzalintinib for treating chronic gout; and Sobi’s and Cartesian Therapeutics’/Selecta Biosciences’ SEL-212 (pegadricase with proprietary technology) (see Figure 1). The competitive positions and projected sales of all 11 drugs to watch for 2025 are outlined below.

Inside look: drugs to watch in 2025

Novo Nordisk’s Awiqli (basal insulin icodec). Novo Nordisk’s Awiqli (basal insulin icodec) for treating Type 1 and Type 2 diabetes mellitus, the first once-weekly, subcutaneous insulin, offers potential advantages over daily basal insulin by reducing frequency of injections for the long-acting insulin from daily to weekly injections. Projected sales in 2030 in G7 markets (Canada, France, Germany, Italy, Japan, the UK, and the US) are $4.70 billion, according to Clarivate estimates.

The drug has already launched in Australia, Canada, the European Union (EU), Mainland China and Japan, but approval and launch in the US have been delayed due to the company receiving a Complete Response Letter (CRL) last July (July 2024) by the US Food and Drug Administration At the time of receiving the CRL in July 2024, Novo Nordisk said that FDA had requested information related to the manufacturing process and the Type 1 diabetes indication before the review of the application could be completed. Novo Nordisk said it would work with FDA to fulfill the requests and did not expect to complete FDA’s requests during 2024. The CRL followed a meeting of the FDA Endocrinologic and Metabolic Drugs Advisory Committee in May 2024, which concluded that the data available at that time were not sufficient to conclude a positive benefit-risk in Type 1 diabetes. The Advisory Committee did not discuss the use of once-weekly insulin icodec in Type 2 diabetes.

The therapeutic pipeline for Type 2 diabetes is extremely crowded, with more than 150 drugs in active clinical development, according to information from Clarivate. In addition, glucagon-like peptide-1 receptor agonists (GLP-1 Ras) are dominating the Phase III pipeline and include more convenient oral options (e.g., Eli Lilly and Co.’s orforglipron), GLP-1 combination therapies (e.g., Novo Nordisk’s IcoSema (insulin icodec and semaglutide), and Novo Nordisk’s CagriSema (cagrilintide and semaglutide) and other insulin analogs (Eli Lilly and Co.’s insulin efsitora alfa)..

Novo Nordisk’s CagriSema (cagrilintide and semaglutide). Novo Nordisk’s CagriSema (cagrilintide and semaglutide), a combination therapy for treating Type 2 diabetes and obesity, is also projected for blockbuster status by 2030. It contains the same active ingredient, semaglutide, found in Novo’s Type 2 diabetes and obesity treatments, Ozempic and Wegovy, with the addition of cagrilintide, a long-acting amylin analog. It potentially holds improved efficacy over Novo’s GLP-1’ agonists, Ozempic/Wegovy, and Lilly’s GLP-1 agonists, Mounjaro/Zepbound (tirzepatide) in treating obesity and Type 2 diabetes. it leverages the benefits of GLP-1s, such as enhanced insulin secretion and appetite reduction while incorporating amylin’s effects, including slowed glucose absorption and release, according to the Clarivate report. If approved, CagriSema will be the first fixed-dose combination of amylin and GLP-1 receptor agonists in the obesity and Type 2 diabetes markets. Clarivate projects sales of $4.7 billion in the G7 markets in 2030 for the obesity and $3.6 billion in the G7 markets in 2030 for Type 2 diabetes.

Bristol-Myers Squibb’s Cobenfy (xanomeline-trospium). Bristol-Myers Squibb’s Cobenfy (xanomeline-trospium), for treating schizophrenia and psychosis related to Alzheimer’s disease, was approved by FDA in September 2024 for treating schizophrenia, marking the first antipsychotic drug to treat schizophrenia that targets cholinergic receptors, a novel mechanism of action, instead of dopamine receptors, which has been the standard of care. Further evaluation is also ongoing for a second indication. While further data are needed to assess the drug’s effectiveness in Alzheimer’s disease-related psychosis, the addition of that indication adds further strong commercial potential. Cobenfy shows strong commercial potential if proven effective in treating Alzheimer’s disease-related hallucinations and delusions. Forecast sales of $1.60 billion is estimated for 2030.

Eli Lilly and Company’s and Amirall’s Ebglyss (lebrikizumab). Lilly’s abd Amirall’s Ebglyss (lebrikizumab) is the third biologic for treating atopic dermatitis (eczema) that targets the interleukin-13 (IL-13) pathway, considered important in addressing inflammatory diseases, such as atopic dermatitis. The other two IL-13 biologics for treating atopic dermatitis are Sanofi’s Dupixent (dupilumab) and Leo Pharma’s Adbry/Adtralza (tralokinumab). Ebglyss’sless-frequent dosing, more selective IL-13 inhibition, and strong efficacy and safety data position it as a likely first-line treatment for moderate-to-severe atopic dermatitis when topical corticosteroids are inadequate, according to Clarivate, which projects $6.00 billion in sales in the G7 markets in 2030.

Sanofi’s and Alnylam Pharmaceuticals’ fitusiran. Sanofi’s and Alnylam Pharmaceuticals’ fitusiran is an investigational RNAi therapeutic for treating hemophilia A and B, with or without inhibitors. It was developed as part of an RNAi therapeutics rare-disease alliance between Sanofi and Alnylam Pharmaceuticals. Sanofi expects to secure FDA approval by the Prescription Drug User Fee Act (PDUFA) target action date of March 28, 2025. This small interfering RNA (siRNA) therapy works by inhibiting SerpinPC1 mRNA, reducing antithrombin levels, promoting thrombin generation, and helping to rebalance hemostasis to prevent bleeds and leverages Alnylam’s ESC-GalNAc conjugate technology, according to Clarivate. Fitusiran could become the first antithrombin-lowering therapy based on a double-stranded RNA molecule, pending approval. Clarivate projects sales of $1.00 billion in the G7 markets in 2030.

GSK’s Neisseria meningitidis (A, B, C, W, and Y) vaccine candidate, GSK-3536819. GSK’s Neisseria meningitidis (A, B, C, W, and Y) vaccine candidate, GSK-3536819 is a five-in-one, first-generation formulation that targets the five groups of Neisseria meningitidis (A, B, C, W, and Y), which is responsible for the most invasive meningococcal disease cases worldwide. It combines the antigenic components of GSK’s licensed meningococcal vaccines, Bexsero (MenB) and Menveo (MenACWY), both of which have established efficacy and safety profiles. Clarivate projects sales of $905 million in the US and EU 4 (France, Italy, Germany, and Spain) markets in 2030.

Amgen’s Imdelltra (tarlatamab-dlle). Amgen’s Imdelltra (tarlatamab-dlle) is a first-in-class immunotherapy for extensive-stage small cell lung cancer (ES-SCLC.). The drug was granted accelerated approval by FDA in May 2024 and was given orphan drug and breakthrough drug designation. The drug uses Amgen’s proprietary bispecific T cell engager (BiTE) molecules and targets CD3 on T cells and DLL3 on tumor cells, enabling T cells to attack and lyse the tumor. DLL3 is expressed on the surface of small-cell lung cancer cells in more than 85% of patients but is minimally expressed on healthy cells, thereby making it an attractive target, according to Clarivate. This mechanism positions it as a potential standard of care for previously treated ES-SCLC. Clarivate projects sales of $2.10 billion in the G7 markets in 2030.

Moderna’s mRESVIA (respiratory syncytial virus vaccine). Moderna’s mRESVIA (respiratory syncytial virus [RSV] vaccine) was approved by FDA in May 2024 and joins two RSV vaccines, which made Clarivate’s Drug to Watch list in 2024, GSK’s Arexvy and Pfizer’s Abrysvo. Clarivate projects sales of $1.40 billion in G7 markets in 2030.

Sobi’s and Cartesian Therapeutics’/Selecta Biosciences’ SEL-212. Sobi’s and Cartesian Therapeutics’/Selecta Biosciences’ SEL-212 offers potential advantages in the treatment of gout. It is a once-monthly treatment combining pegylated uricase (pegadricase) with ImmTOR, an immune tolerance technology designed to inhibit formation of anti-drug antibodies (ADAs). For this application, ImmTOR consists of SEL-110.36, an inhibitor of uricase-specific ADA. This approach may help overcome the limitations of reduced efficacy and tolerability seen with other biologic treatments, such as Amgen’s Krystexxa (pegloticase) for treating chronic gout. Clarivate project sales of $1.70 billion in the G7 markets in 2030

Pfizer’s/Arvinas’ vepdegestrant. Pfizer’s/Arvinas’ vepdegestrant is an investigational oral medication designed to treat estrogen receptor (ER)-positive, human epidermal growth factor receptor 2 (HER2)-negative (ER+/HER2-) advanced breast cancer. If approved, it would become the first PROteolysis Targeting Chimera (PROTAC) protein degrader on the market. Designed to target and degrade the estrogen receptor protein, early studies suggest PROTAC-induced degradation is more complete than with oral selective estrogen receptor degraders, thereby potentially overcoming endocrine resistance in breast cancer. Potential label expansions include the drug in combination with another breast cancer drug by Pfizer, Ibrance (palbociclib). Clarivate estimates sales of $1.19 billion in the G7 markets in 2030.

Exelixis’ zanzalintinib. Exelixis’ zanzalintinib is being explored in multiple cancers and is an oral tyrosine kinase inhibitor targeting VEGF receptors, MET, and TAM kinases involved in tumor growth and immunosuppression. Currently in Phase II trials for non-clear-cell renal cell carcinoma (nccRCC), colorectal cancer (CRC), and squamous cell carcinoma of the head and neck (SCCHN), it is expected to gain FDA approval first for nccRCC. Compared to Exelixis’s Cabometyx (cabozantinib), zanzalintinib may offer benefits, including approval for nccRCC histology and a broader patient population, according to information from Clarivate, which projects sales of $2.60 billion for CRC, RCC and SCCHN in the G7 markets in 2030.