Biomanufacturing Capacity and Supplies: COVID’s Impact

COVID-19 was the most important development impacting biomanufacturing in 2020. What have been, and what will be, the adjustments required of biopharma companies, CMOs, and suppliers to fortify production capacity and supplies and respond to increased demand for both COVID-19 projects and overall biopharmaceutical growth?

The impact of COVID-19

For 2020, the most important developments affecting biopharmaceutical manufacturing (bioprocessing) were due to the COVID-19 pandemic, with industry response to the pandemic including rapid adaptation and acceleration of existing trends, nearly all of which were positive in terms of adoption, approvals, and collaborative developments.

In 2020, BioPlan’s annual survey and report on biopharmaceutical manufacturing capacity and production included analysis of the segment’s initial responses to COVID-19 (1). In BioPlan’s upcoming (2021) annual survey, we have added coverage of the industry’s long-term responses to the pandemic. The new study, which includes input from bioprocessing professionals from biopharma companies, CDMOs/CMOs, and other suppliers, will be released in April 2021. BioPlan is currently gaining input from the industry; to participate, click here.

COVID-19-related developments

A consistent finding in BioPlan’s annual report of biopharmaceutical manufacturing capacity and production and a white paper on COVID-19 was that the industry considers itself up to the challenge of the pandemic. As noted by one respondent, “The industry has been part of the pandemic and biodefense response for decades.” However, the pandemic has changed the industry’s perception of the need for flex capacity, risk management, and supply-chain and inventory control.

Key developments impacting bioprocessing as a result of the pandemic relate to near-term adaptation, long-term adaptation and an acceleration of existing trends.

Near-term adaptation

Unlike most other high-tech industries, biopharmaceutical R&D and bioprocessing adapted in real-time and continued throughout 2020 generally without major disruptions. Among bioprocessing leaders interviewed by BioPlan in 2020, 86% responded their “operations running at full capacity.”

Biopharmaceutical companies worldwide have generally rapidly and successfully adapted to staffing, supply-chain, and other near-term disruptions caused by the pandemic, with many undergoing rapid growth and expansion, particularly for COVID-19 vaccines and biotherapeutics R&D and manufacturing. Biopharmaceutical R&D and manufacturing in most regions were considered “essential” and generally continued undisrupted even during the first few months of the pandemic, Short-term adaptation included relatively seamless work-from-home versus onsite for many functions.

Supply chains at many levels, however, did show weaknesses and risks from pandemic-associated disruptions. Some resulting supply shortages have led to most every bioprocessing facility being forced to reconsider its bioprocessing supply-chain strategies to minimize future disruptions. Industry and governments rapidly budgeted and invested billions of dollars in new pandemic-related vaccines and biotherapeutics R&D and manufacturing facilities, with much more expected.

Longer-term adaptation

|

|

Eric S. Langer |

Bioprocessing sector longer-term adaptations to the pandemic include many new bioprocessing facilities and players entering biopharmaceutical R&D and manufacturing starting with COVID-19-related projects. Bioprocessing facilities are almost universally working on improving their supply chains, including lining-up second/backup manufacturing sources for critical supplies, and many expanding their in-house storage of bioprocessing and personal protective supplies as a buffer against future supply disruptions. The rapid investments of billions of dollars in new pandemic products R&D and manufacturing facilities will continue.

A negative consequence of this will be a shortage of competent staff, as pandemic-related projects compete for staff with the still-growing mainstream biopharmaceutical sector, and the rapidly growing cellular and gene therapies and biosimilars sectors.

In the longer-term, there will also be changes in global patterns of manufacturing, including:

- More regionalization;

- Off-shoring or placing of new bioprocessing facilities in more countries worldwide to handle their domestic needs;

- Reversing the ‘internationalization’ trend of one or two bioprocessing facilities handling R&D or manufacturing; and

- More bioprocessing in developing regions, especially China, to initially address domestic market needs and then to expand to GMP product export.

Acceleration of existing trends

Most of the preexisting trends in the bioprocessing sector are accelerating as further discussed below and reported in BioPlan’s annual survey and review, now in its 18th year. These trends include: (1) growth in outsourcing; (2) increases in bioprocessing/business revenues; (3) CMO expansions; (4) need for flexibility in bioprocessing; (4) increased adoption of single-use systems; and (5) increased pressure on supply chains resulting in shortages of materials for bioprocessing and production capacity.

Growth in outsourcing

|

|

Ronald A. Rader |

In terms of impact on CMOs, business overall grew significantly in 2020 as many developers outsourced all or portions of new pandemic-related R&D. Many of those bioprocessing facilities involved with pandemic responses now have found it necessary to outsource portions of less critical, non-pandemic-related projects. Even smaller CMOs without capabilities in infectious diseases are seeing increased business as pandemic-related projects at other CMOs displace non-pandemic projects to smaller and less capable CMOs.

Bioprocessing suppliers have also seen a rapid increase in sales related to pandemic R&D and manufacturing, with more expected, with multiple major equipment suppliers reporting unprecedented growth of greater than 20% in recent quarterly revenue. Major near-term disruption continues to broadly affect biopharmaceutical development by the halt and slowing of many clinical trials, but not so with aspects of bioprocessing.

The bioprocessing sector has already adapted to the staffing and other operational disruptions caused by the pandemic and has initiated an unprecedented response, including investment of billions of dollars to support rapid vaccine and biotherapeutics development and deployment. Industry pandemic response now includes nearly 400 products, mostly vaccines, in R&D worldwide. Of course, the current three or four leading vaccines candidates in developed regions are most likely the ones to meet the global need for a commercial vaccine. However, many of the other 200–250 vaccines candidates are coming from diverse sources. This trend toward regionalization and vaccines self-sufficiency can be seen as regional organizations, from Australia to India, Russia, China, and many others seek to develop their own domestic pandemic responses.

Bioprocessing/business revenues on the rise

Most every company involved in bioprocessing, whether services or equipment supplier or developer company, has seen an increase in investments, revenue and/or R&D in 2020. Although this industry has historically seen consistent growth even during recessions, unlike other industries during the pandemic, it has proven to be pandemic-responsive. The industry’s normal approximately 12% annual growth in revenues will likely expand in 2020/2021. In the coming years, the biopharmaceutical market and its bioprocessing sector may continue this growth rate. Among the industry leaders interviewed by BioPlan, 82% of suppliers (both hardware and services) and 50% of biotherapeutic developers cited expansion and increased investments in R&D as one of their strategies for pandemic response, with 30% expecting increased collaborations and partnerships with other companies.

CMO expansions

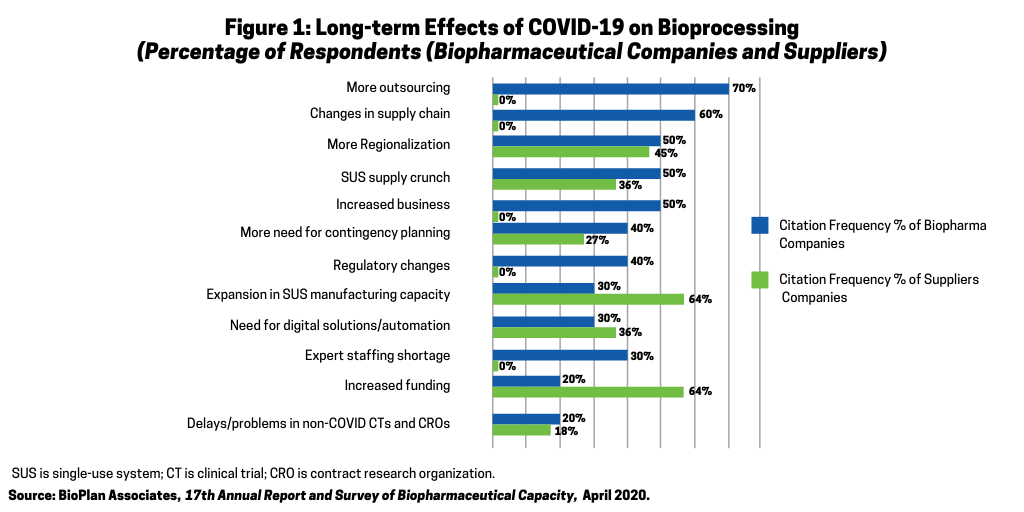

Bioprocessing CMOs are seeing more business. As shown in Figure 1, when bioprocessing leaders were interviewed about expected long-term impacts of COVID-19, the most common response, cited by 70%, was “more outsourcing.”

This includes outsourcing as both new COVID-19-related and non-related projects that were displaced by COVID-19 projects are outsourced to CMOs. Often, these displaced projects have lower priority or less complexity and are outsourced to smaller and less capable CMOs. Most CMOs up and down the “food chain” are seeing more business, generally resulting in even longer lead times to start new projects. Bioprocessing CMOs are increasingly falling short in terms of having capacity to address available business. The increased demand for pandemic-associated CMO capacity has to compete against similar accelerating rapid growth in cellular and gene therapies projects while some CMOs are still adapting to prior increased business due to biosimilars. Many CMOs, likely nearly all of those other than the very largest and affluent few, will be stressed in terms of which area(s) to concentrate future growth, such as whether to add new cellular/gene therapy or add more pandemic and infectious disease capacity.

Bioprocessing flexibility

Increased flexibility in bioprocessing is increasingly required, if only to be able to deal with uncertainties and disruptions. This includes facilities and process lines having the ability to manufacture multiple products at different scales with quick turnover between processes.

Single-use systems

With the increased flexibility and lower capital investments enabled using single-use (versus stainless steel) bioprocessing equipment, use of single-use is even further increasing. Despite an estimated 85% of clinical-scale bioprocessing now using single-use systems, this is even further increasing slowly. The current early trend for more adoption of single-use for commercial manufacturing is accelerating, with more commercial manufacturing involving scaling-out with multiple 1,000-2,000-L single-use bioreactor-based process lines operating in parallel. Other than single or similar product type-dedicated facilities, fewer stainless-steel facilities and process lines will be coming on line.

Shortages/supply chains

The pandemic has placed greater pressure on supply chains, biomanufacturing, and staffing. These issues are further outlined below.

Shortage of supplies and CMO capacity. Existing short supplies and shortages, including of key bioprocessing supplies and CMO capacity, are worsening, due to increased demand in the upstream supply chains. Most orders for supplies and services are now being prioritized, favoring pandemic-related projects. Shortages include many of the high-purity polymers used in single-use supplies, already in short supply, with increased shortages and lead times. In 2020 BioPlan interviews, 57% responded that less critical, non-production-related tasks have been moved to other facilities.

Contingency planning. Most facilities and companies are re-examining their current suppliers and looking harder at their upstream supply chains, seeking to better avoid any future supply disruptions.

Staff shortages. While supply shortages can be resolved fairly quickly through expansions and new supplies manufacturing facilities, staff shortages, where needed knowledge and experience are already in short supply, take much longer to resolve. We have seen increased general hiring difficulties as rapid COVID-19-related hiring competes with similar rapid hiring in the gene and cellular therapy sectors. This is on top of the expansions in biosimilars and mainstream biopharmaceutical industry activities.

Regionalization/more facilities. The prior nascent trend toward regionalization and spreading of manufacturing to more countries to serve regional markets is now increasing. Rather than one or a few large manufacturing facilities servicing world markets, more bioprocessing facilities are coming online worldwide. CMOs are being hired to service domestic markets and serve as backup manufacturing facilities if needed.

Smaller facilities. New manufacturing facilities will tend to be smaller. Besides there being more of them, increasing process intensification (discussed below) is allowing production of comparable product volumes at smaller scales.

Process intensification. Bioprocessing productivity continues to incrementally increase, for example with the BioPlan survey now showing that the average titer for commercial-scale manufacturing is approximately 3.5 grams/liter (1). Ever-improving equipment and methods, including with expression systems and adoption of perfusion, support making the same with less or making more with the same resources.

Increased automation. With the cost of retaining and managing in-house staff, there will be increased efforts to reduce staffing levels and increase automation to realize the many benefits process and facility automation can bring.

R&D pipelines. R&D pipelines will continue to increase in the near-term as more pandemic, biodefense, and eventually broader infectious-disease vaccines and biotherapeutics enter R&D and the market in the coming years. With most pandemic-related projects having been added on top of existing R&D and bioprocessing projects, total R&D and manufacturing are increasing, but eventually non-pandemic projects will see some reductions.

Conclusion

The biopharmaceutical industry’s robust response to COVID-19 has potentially been the single most impressive technical, scientific, and logistical feat in modern history. Although the response to the pandemic has simply been an acceleration of many ongoing trends, the long-term impact, the lessons-learned, and the resulting billions of dollars invested in logistics, supply-chain management, risk reduction, and new R&D and bioprocessing capacity will likely be with us well into the future, and will very probably impact the way future health challenges and pandemics are addressed.

The biopharmaceutical industry’s robust response to COVID-19 has potentially been the single most impressive technical, scientific, and logistical feat in modern history. Although the response to the pandemic has simply been an acceleration of many ongoing trends, the long-term impact, the lessons-learned, and the resulting billions of dollars invested in logistics, supply-chain management, risk reduction, and new R&D and bioprocessing capacity will likely be with us well into the future, and will very probably impact the way future health challenges and pandemics are addressed.

To keep on top of these important trends, particularly as the industry evolves its response to the COVID-19 pandemic, BioPlan Associates asks for your participation in its annual survey on biopharmaceutical manufacturing capacity and production.

Reference

1. E.S. Langer, et al, BioPlan Associates, 17th Annual Report and Survey of Biopharmaceutical Capacity and Manufacturing, April 2020, see here for report.

About the authors

For further information, contact the authors, Ronald Rader, Senior Director, Technical Research, BioPlan Associates (rrader@bioplanassociates.com, +1 301-921-5979) and Eric Langer, President and Managing Partner, BioPlan Associates (elanger@bioplanassociates.com, +1 301-921-5979).