Bio/Pharma Watchlist: Small-Molecule Drugs

Specialty small-molecule drugs are growing more than twice as fast as those of traditional small-molecule drugs. What are some key drugs contributing to this growth, and how is product innovation faring?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

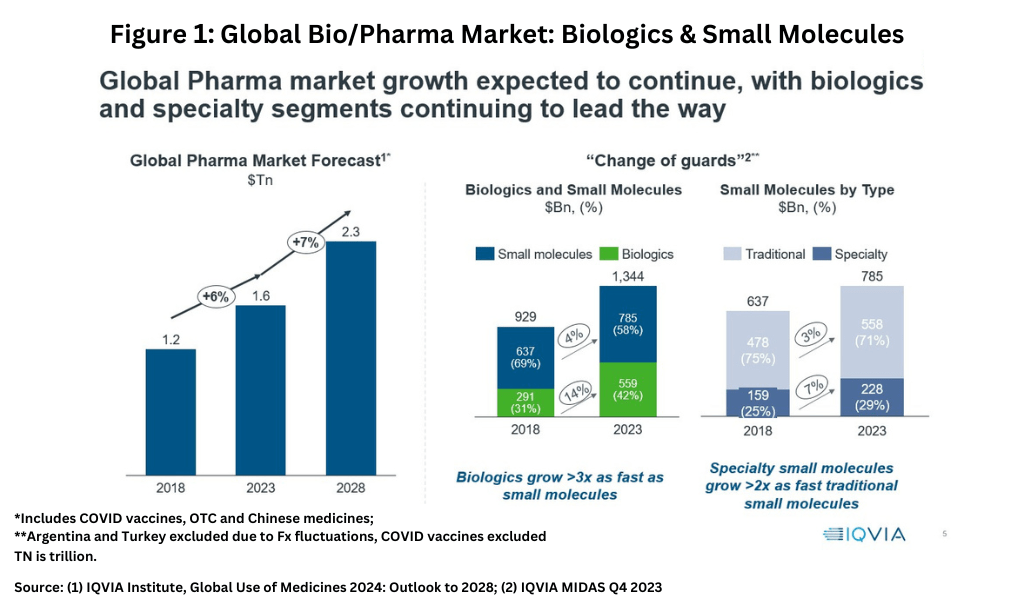

Market share and growth rates of small-molecule drugs

In looking at market share and growth rates on a modality basis, small-molecules drugs versus biologics, there is a mixed story for small-molecule drugs. Although small-molecules still account for the largest market share in 2023 globally, biologics are growing more than three times faster, according to information from IQVIA (1). In 2023, small-molecules drugs accounted for $785 billion (58% of the market) and biologics $559 billion (42% of the market) compared to a 69% share for small-molecules and a 31% market share for biologics in 2018 (see Figure 1).

Within small molecules, specialty small-molecule drugs are growing more than twice as fast as those of traditional small-molecule drugs (see Figure 1). However, traditional small-molecule drugs still dominate the small-molecule sector, accounting for 71% of small-molecule drugs in 2023 (see Figure 1). Specialty medicines, as defined by the IQVIA, are those medicines that treat specific, complex diseases with four or more of the following attributes: initiated only by a specialist; administered by a practitioner; requires special handling; unique distribution; high cost; warrants intensive patient care; or requires reimbursement assistance.

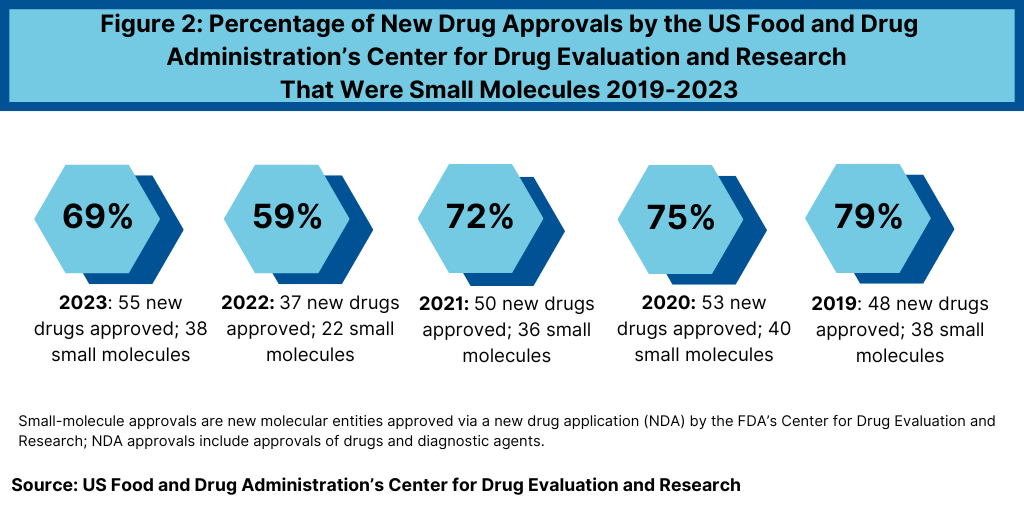

Small-molecule new drug approvals

In looking at new drug approvals, small-molecule drugs still outpace new drug approvals for biologics. In 2023, the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 38 small-molecule products, representing 69% of new drug approvals (see Figure 2). FDA’s CDER reviews and approves new molecular entities and new biological therapeutics. Other biologic-based products, including blood products, vaccines, allergenics, tissues, and cellular and gene therapies, are reviewed and approved by a separate center within FDA, the Center for Biologics Evaluation and Research (CBER). The percentage of small-molecule approvals by FDA’s CDER in 2023 was in line with recent years, except in 2022, which represented a recent low. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules or 22 of the 37 new drug approvals, Between 2018 and 2021, small molecules averaged 74% of new drug approvals. In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, and 79% in 2019.

The 69% of new drug approvals being small molecules in 2023 was an improvement over 2022 levels, which represented a recent low in small-molecule drug approvals. The decrease in small molecules’ share of new drug approvals in 2022 was largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics. The 17 new biologics approvals in 2023 surpassed 2022 levels and matched a recent high in 2018, when 17 new biologics were also approved by FDA’s CDER. The 17 new biologic drug approvals in 2023 far exceeded approvals of new therapeutic biologics by FDA’s CDER of 14 in 2021, 13 in 2020, and 10 in 2019.

Product innovation: small-molecules and first-in-class drugs

Aside from just the overall number of new drug approvals, product innovation can also be evaluated by the number of new drug approvals classified as “first-in-class,” which FDA’s CDER characterizes as drugs with a different mechanism of action than existing drugs. In 2023, FDA’s CDER approved 20 new drugs that it characterized as first-in-class, which represented approximately 36% of new drug approvals.

Of these 20 first-in-class new drug approvals, 17 were small molecules, representing 85% of first-in-class new drug approvals in 2023 by FDA’s CDER. Of these 17 first-in-class, small-molecule new drug approvals in 2023, eight were from large to mid-sized bio/pharma companies. These eight drugs were: Astellas’ Veozah (fezolinetant) for reducing moderate-to-severe vasomotor symptoms due to menopause; AstraZeneca’s Truqap (capivasertib) for treating advanced HR-positive breast cancer; Bausch and Lomb’s Miebo (perfluorohexyloctane ophthalmic solution) for treating dry-eye disease; Biogen’s Qalsody (tofersen) for treating amyotrophic lateral sclerosis (ALS, i.e., Lou Gehrig’s disease); GlaxoSmithKline’s Jesduvroq (daprodustat) for treating anemia due to chronic kidney disease; Novartis’ Fabhalta (iptacopan) for treating paroxysmal nocturnal hemoglobinuria, a rare blood disorder; Novo Nordisk’s Rivfloza (nedosiran) for treating primary hyperoxaluria, a rare condition characterized by recurrent kidney and bladder stones; and Pfizer’s Paxlovid (nirmatrelvir tablets; ritonavir tablets, co-packaged) for treating COVID-19.

Although small-molecule drugs were well represented with 85% of the first-in-class new drug approvals in 2023, more than half of these drugs were for niche indications. Of the 17 small-molecule first-in-class drug approvals in 2023, nine, or 53%, were for treating orphan/rare diseases, defined as a disease affecting 200,000 individuals or less in the US.

Reference

1. P. Van Arnum, “Global Pharma Industry Outlook: The Ups and Downs & Projections Near Term,” DCAT Value Chain Insights, May 30, 2024.