Bio/Pharma Outlook 2025: The Year Ahead

What are the key issues on the bio/pharma industry’s radar in 2025? DCAT Value Chain Insights weighs in on the key trends and developments shaping the industry in the year ahead: from manufacturing and supply lines to product innovation and new drug development.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Bio/pharma supply chains: what’s ahead

For bio/pharma supply chains, a key variable in 2025 and near-term will be how US trade policy, in the form of tariffs, evolve with the new Administration when President-elect Donald Trump officially takes office later this month (January 20, 2025). Although specifics for tariffs under a new Administration are still to be determined, some proposals that have been discussed are to implement a universal minimum tariff rate of 10% to 20% on all US imports, a separate tariff of up to 60% on imports from China, as well as potential additional country-specific tariffs.

“The implications of the new US Administration’s focus on tariffs could potentially be significant on bio/pharma supply chains because of the proposed volume of tariffs,” says Derron Stark, EY-Parthenon Partner, Strategy & Transactions – Health Sciences & Wellness, Supply Chain, Ernst & Young. “One area that has been less of a focus but that potentially would have an impact are proposed tariffs for other countries, notably the European Union, which would potentially be subject to tariffs of 10% to 20%. When you consider that approximately 40% of bio/pharma product imports into the US market come from Europe, there could be a substantial financial impact if World Trade Organization (WTO) tariff reliefs are not observed, which has been another issue being considered,” he says. “In general, the industry should start to look at what the potential product impacts would be for these potential inbound import tariffs and to be aware that it would relate to country of origin for the active pharmaceutical ingredient (API), not the formulation–how this would exactly work under potential tariffs is still to be determined, but is something the industry should be evaluating in considering potential impacts in companies’ overarching supply chains.”

On a strategic and operational basis, another key focus in bio/pharma supply chains in 2024 and continuing in 2025 is on ways to enhance risk monitoring and mitigation. “A big area of focus that we saw in 2024 and continuing into 2025 is upstream supplier risk monitoring and predictive risk planning and responses and how to govern the process of responding to risk,” says EY’s Stark. “In that area, there was a continued focus on digitalization and integration in manufacturing and broader supply chains, which included digital tools and implementation, particularly around planning systems, and how to apply artificial intelligence (AI) as an enhanced technology enabler,” he says.

Those more proactive measures in risk management extend to how external supply management organizations within pharmaceutical companies better manage their suppliers. “It is not a case of relying just on traditional category management and supply relationship management, but we see companies apply tools to monitor potential risk areas and integrate those into supplier relationship management processes or risk management processes to create centers of excellence, which focus on predictive risk monitoring and intervention.”

Separately, another key issue for bio/pharma supply chains in 2025 relate to certain product-specific areas, such as sterile injectables and antibody drug conjugates (ADCs), which saw strong product demand and constrained capacity in 2024, which will continue to be an area of focus in manufacturing and supply lines in 2025. In addition, on a broader level, ESG (environmental, social and governance) factors will also continue to play a role in bio/pharma supply chains in 2025 as companies seek to achieve more sustainable products and supply chains, says EY’s Stark.

Listen to the full interview with Derron Stark, EY-Parthenon Partner, Strategy & Transactions – Health Sciences & Wellness, Supply Chain, Ernst & Young, in the latest episode of DCAT Value Chain Insights’ Production to Prescription podcast, which features thought leaders with expert views on the major happenings impacting the global bio/pharmaceutical manufacturing value chain and industry performance.

Product innovation: what lies ahead

Glucagon-like peptide 1 (GLP-1) agonists, used to treat Type 2 diabetes and obesity, were the product story of 2024, with both Eli Lilly and Company and Novo Nordisk riding the blockbuster wave, and momentum is going to continue in 2025 and beyond. Lilly’s Mounjaro (tirzepatide), for treating Type 2 diabetes, registered revenues of $8.0 billion for the first nine months of 2024. Mounjaro was approved in the US for treating Type 2 diabetes in 2022, and in November 2023, the same active ingredient, tirzepatide, was approved in the US for chronic weight management under the brand name, Zepbound, which posted revenues of $3.0 billion in the first nine months of 2024. In late December (December 2024), Zepbound was also approved for treating adults with moderate-to-severe obstructive sleep apnea and obesity and only prescription medicine for adults with moderate-to-severe obstructive sleep apnea and obesity. Zepbound is a dual-activating GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 obesity medication

Novo Nordisk has several GLP-1-based products for treating Type 2 diabetes—Ozempic (semaglutide, injection), Rybelsus (semaglutide, tablets), and Victoza (liraglutide)— and two obesity-care GLP-1 products, Wegovy (semaglutide) and Saxenda (liraglutide). Through the first nine months of 2024, revenues for its top GLP-1 agonist diabetes drug, Ozempic, was DKK 86.5 billion ($12.3 billion) and DKK 38.3 billion ($5.4 billion) for its top GLP-1 agonist obesity drug, Wegovy.

The GLP-1 agonist market is poised for strong growth, with a projected compound annual growth rate of 19.2% through 2029 to reach a market size of $105 billion, according to estimates (as of March 6, 2024) by GlobalData, a market research and business intelligence firm. It points to five key drugs: Lilly’s Mounjaro and four drugs by Novo Nordisk—Ozempic, Wegovy, CagriSema (semaglutide and cagrilintide) (now in late-stage development), and Rybelsus. But these companies are not alone in pursuing drug candidates in the obesity drug market. More than 400 companies are actively developing obesity drugs, from discovery to pre-registration candidates, according to information from GlobalData (as reported in a December 20, 2024, press release).

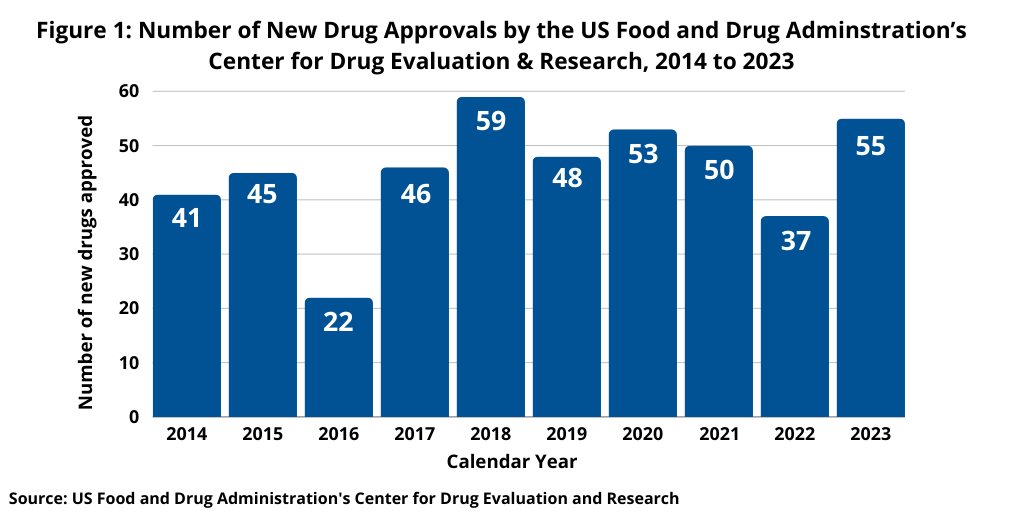

How about overall product innovation in the industry? In 2024, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 50 new molecular entities (NMEs) and biological therapeutics, compared to 55 new drugs approved in 2023, keeping pace with recent trends of reaching at least 50 new drug approvals by FDA’s CDER. The 50 new drugs approved by FDA’s CDER in 2024 marked the fifth year out of the past seven years with new drug approvals reaching or exceeding 50 (2018–2024), only dipping below 50 twice (in 2019 with 48 new drug approvals and 2022 with 37) (see Figure 1).

Although the obesity drug market captured major headlines in 2024, oncology drugs continue to be the leading therapeutic sector in the industry. Global spending on cancer medicines increased to $223 billion in 2023, $25 billion more than in 2022, and is projected to rise to $409 billion by 2028, according to a recent analysis, Global Oncology Trends 2024: Outlook to 2028., from the IQVIA Institute for Human Data Science. This growth is attributed to the volume of protected brands and the introduction of new products in the past five years despite losses of exclusivity for some treatments, including the introduction of some biosimilars in major markets.

On a product basis, notably, six major tumor categories experienced double-digit growth in spending due to breakthrough medicines and improved patient access, according to the IQVIA Institute analysis. PD 1/PD-L1 inhibitors, which are widely used in solid tumor treatments, accounted for $52 billion in spending in 2023, with expectations to increase to more than $90 billion by 2028. In new products, the future of next-generation biotherapeutics in oncology is marked by clinical and commercial uncertainties, yet annual spending could still potentially rise from $4 billion to $23 billion by 2028.

In 2023, more than 2,000 oncology trials started, and Emerging Bio/pharma companies accounted for 60% of these trials. Novel modalities, including cell and gene therapies, antibody-drug conjugates (ADCs) and multi-specific antibodies, show significant promise for cancer treatment and represent a growing share of clinical research, according to information from the IQVIA Institute. Trials involving PD-1/PD-L1 inhibitors grew 29% over the last five years, investigating across more tumors and in earlier lines of therapy. More than 250 trials testing CAR T-cell therapies in oncology started in 2023 and while the majority investigated for hematological cancers, the therapies were increasingly viewed across a range of solid tumors. The number of ADC trials grew 26% from 2022 to 2023 as more companies invested in these targeted chemotherapeutics.

The economy & deal-making: the year ahead

One of the key variables to watch for in 2025 is how the overall business environment will evolve and the impact it will have on deal-making, capital markets and private financing overall and in the bio/pharma industry specifically. How a confluence of factors—interest rates, inflation, and policy moves by a new Administration in the US—will play out will be important in determining the business environment for mergers and acquisitions and financing, with early indications that lower interest rates, a possible further curbing of inflation, and more pro-business policies will contribute to a better foundation for deal-making and capital flow in 2025.

On a macroeconomic basis, the global economy is projected to remain stable despite significant challenges, according to the latest economic outlook (as of December 4, 2024) from the Organization for Economic Co-operation and Development (OECD), which consists of 38 member countries, including developed countries in North America, Asia-Pacific and Europe as well as countries in South America. OCED projects global gross domestic product (GDP) growth of 3.3% in 2025, up from 3.2% in 2024, and GDP growth of 3.3% in 2026. Growth prospects vary significantly across regions. GDP growth in the US is projected to be 2.8% in 2025, before slowing to 2.4% in 2026. In the euro area, GDP growth is projected at 1.3% in 2025 and 1.5% in 2026. Growth in Japan is projected to expand by 1.5% in 2025 but then decline to 0.6% in 2026. China is expected to continue to slow, with GDP growth of 4.7% in 2025 and 4.4% in 2026. Inflation in the OECD is expected to ease further, from 5.4% in 2024 to 3.8% in 2025 and 3.0% in 2026, supported by still restrictive stance of monetary policy in most countries. Headline inflation has already returned to central bank targets in nearly half of the advanced economies and close to 60% of emerging market economies, according to the OCED.