API Manufacturing: A New Medicine Security Proposal for Europe

Medicines for Europe, which represents generic drug manufacturers in Europe, has proposed a new medicine security contract for Europe as a means to address potential drug shortages in 2023, including ways to assure manufacturing capacity and combat inflationary pressures.

A new medicine security contract for Europe

Inflation has played heavily into manufacturing and supply lines in the bio/pharmaceutical industry in the form of higher raw materials, production, and transportation costs, particularly in Europe, where higher energy resulting from the war in Ukraine had particular impact. Medicines for Europe, which represents generic and biosimilar producers in Europe, had put forth recommendations to European Union (EU) officials to address the energy situation and its impact on pharmaceutical production and the supply chain. Earlier this month (February 2023), Medicines for Europe issued an open letter to EU officials, including Stella Kyriakides, the European Commissioner for Health and Food Safety, Thierry Breton, the European Commissioner for Internal Market, and Roberta Metsola, President of the European Parliament, calling for a new medicine security contract for Europe to address not only current market volatility but also structural causes for drug shortages and supply-chain risk for essential medicines in Europe, as illustrated through recent shortages of some antibiotics.

“While the current medicines in shortage were triggered by an earlier-than-expected infectious surge across Europe, there are deeper structural causes that must be addressed,” said Medicines for Europe in its open letter of February 3, 2023. “Given the huge stress on global supply chains and the extreme consolidation of generic medicine production, there are significant risks of more medicine shortages in 2023. We propose an agreement with the EU and Member States with solutions, based on concrete policy reforms and industry commitments to reduce these risks.”

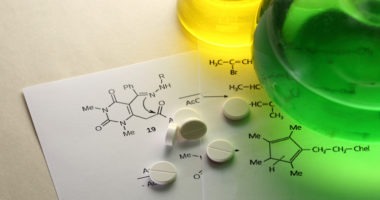

Structural causes of shortages and supply-chain risk in the EU

In its open letter, Medicines for Europe points out that market consolidation resulting the economic model for generic medicines in the EU has made the EU vulnerable to drug shortages and supply-chain risk (see Figure 1). It says that since the 2009 financial crisis, the EU and its member states have based the generic medicines market model exclusively on cost-containment and have applied mechanisms such as procurement price ceilings and other tools designed to reduce prices to the lowest level.

“To adapt, the generic medicines industry has consolidated manufacturing supply chains, optimized capacity, and looked for lower cost inputs, often outside of Europe,” said Medicines for Europe in its open letter. “Factories in the supply chain are run at maximum utilization rates to remain profitable as GMP rules require continuous investment in manufacturing plant upgrades. Consequently, there is no spare capacity in manufacturing supply chains to deal with demand surges caused by illness or when one manufacturer in the supply chain has a manufacturing problem. This is why the industry is challenged to quickly ramp up production in a shortage. These issues are exacerbated for small volume medicines with long supply chains as was acknowledge in the Commission’s research to support the production of critical APIs, key intermediates and medicines to reduce the vulnerability of supply chains causing shortages.“

At the same time, additional external factors have placed additional stress on manufacturing and supply chains for pharmaceuticals in Europe, Medicines for Europe outlined in its open letter. These included post-Brexit regulations, the COVID-19 pandemic, Russia’s invasion of Ukraine and resulting inflation and the limitation on the generic drug industry to pass on higher costs due to capped pricing in the EU market, and the disruption of industrial supply chains, including for generic medicines due to China’s zero-COVID-19 policy. “Our industry has absorbed the costs of these major events because EU medicines prices are capped for the generic industry,” said Medicines for Europe in its open letter. “This has resulted in further consolidation. “

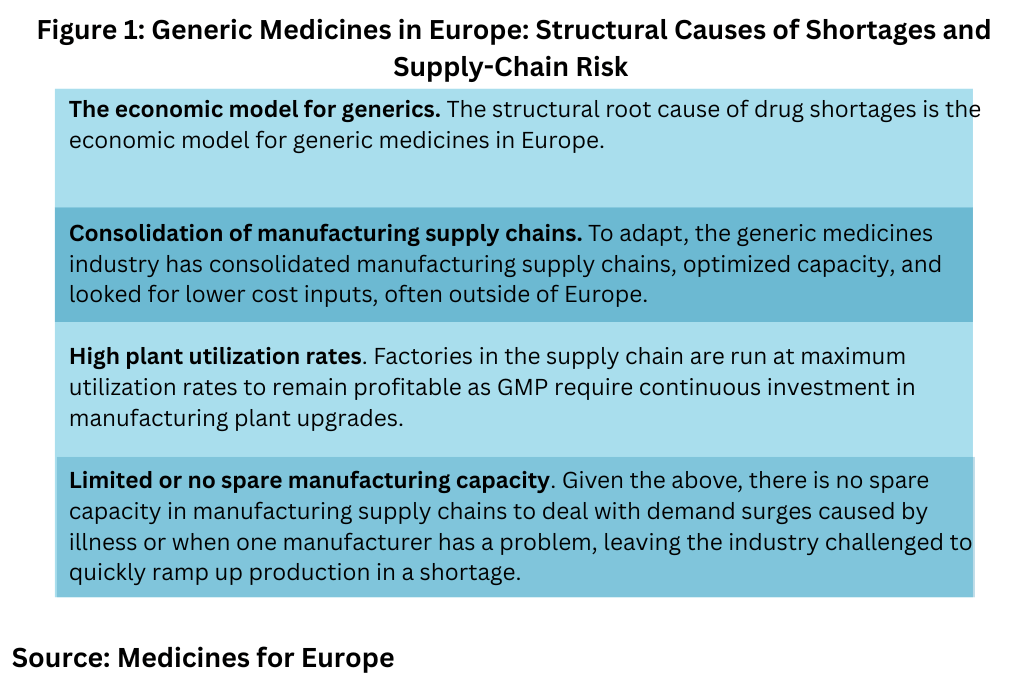

Short term measures to mitigate the risk of shortages in 2023

While noting that the policy of continuous cost-containment measures cannot be addressed “overnight”, Medicines for Europe says that collective action can be taken to address drug shortages and supply risk in 2023. Figure 2 outlines the short-term measures that the association is proposing for 2023 and are further outlined below.

Introduce regulatory flexibility. Medicines for Europe is calling for increased regulatory flexibility in certain areas, such as packaging, especially for patient information leaflets, to allow

manufacturers to rapidly reallocate medicines across internal EU borders. It is also recommending a process to facilitate rapid variations to mitigate a shortage, as was done during COVID-19 to enable manufacturers to rapidly make a change in case of a production problem in the supply chain.

It is also suggesting that the European Commission can also provide implementation flexibility for any new regulations that may cause a stockout such as the revised GMP Annex 1, clearer thresholds for nitrosamines, and avoiding new regulations that have disproportionate impact on low-margin medicines. It says that EU member states can take additional measures related to shelf life and local flexibilities.

Engage in a dialogue with the generic industry and with EU member states on immediate measures to tackle the cost of inflation on generic medicines. Medicines for Europe says says that EU member states are pursuing totally contradictory policies on the issue of inflation. “While countries like Germany and Portugal are revising their laws to adapt prices to inflation, countries like France and the UK are reducing prices (in a shortage) though hidden price reductions in the form of clawback taxes. The [European] Commission can help solve this by encouraging best practices and implementing the MEAT security of supply criteria in the Public Procurement directive,” it said in its open letter.The most economically advantageous tender (MEAT) criteria security of supply criteria in the EU’s Public Procurement Directive takes into consideration aspects other than the lowest price, such as security of supply, environmental investments, and long‑term sustainability.

Improve demand predictability by sharing more aggregate data and analysis with the generic industry about demand surge risks. Medicines for Europe points to the potential for a dialogue between the working groups of the European Medicines Agency and the Heads of Medicines Agencies and the generics industry to warn of shortage risks earlier to adapt supply chains.

Medicines for Europe also recommends more sharing of information about epidemiological risks in the EU such as expected timing of the infectious/flu season and other infectious risks since many of them are increasing globally or important changes to prescribing guidelines that increase volume demand. It also says that the European Commission should also consider how to better use data – such as the European Medicines Verification System – to understand demand and supply dynamics for shortage prevention.

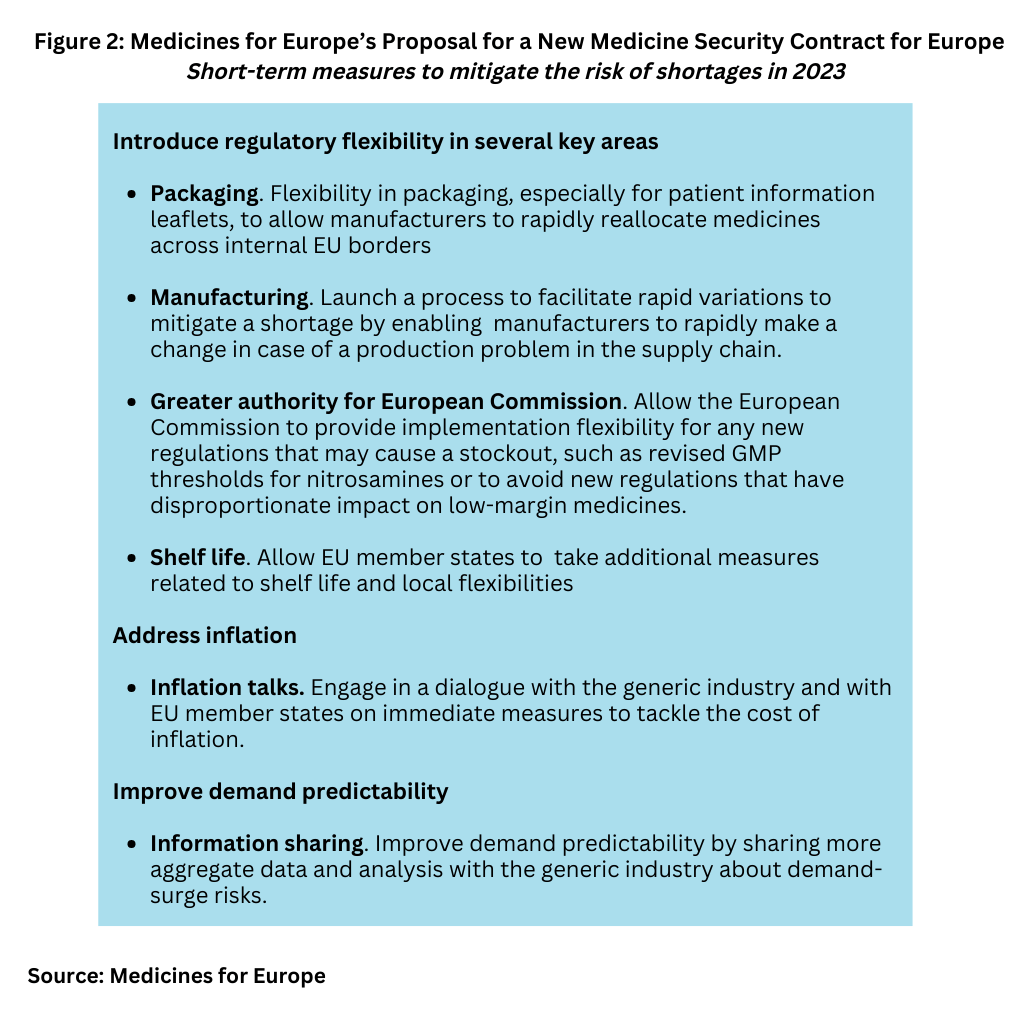

Medium-term measures to encourage more generic medicines supply and supply chain resilience by 2025

Medicines for Europe also says that the EU can help coordinate a strategy to improve supply- chain resilience with clear policies to encourage more manufacturers to invest in diversified supply chains and to improve the efficiency of supply across EU member states in the context of EU legislation and policies. Figure 3 outlines those recommendations.

Among its measures, Medicines for Europe recommends that EU authorities fast-track the regulatory efficiency and harmonization measures in the EU’s Pharmaceutical Strategy. The Pharmaceutical Strategy for Europe was adopted in November 2020 and includes an ambitious agenda of legislative and non-legislative actions to be launched over the coming years. One element of the strategy includes enhancing crisis preparedness and response mechanisms and addressing security of supply.

To that end, Medicines for Europe is calling for EU commitment to digitalize the medicines regulatory network and to make better use of Big Data. For example, one suggestion is to replace paper patient leaflets with electronic patient information as a means to reduce complexity, stockouts, and misallocation across countries. Other suggestions involve addressing process variations more effectively, the management of API sources, and the harmonization of packs and requirements at national levels to improve supply-chain efficiency. It highlighted the importance to address heavily consolidated supply chains through IDMP-SPOR. IDMP (standing for IDentification of Medicinal Products) standards were established by the International Organization for Standardization (ISO) to specify standardized definitions for the identification and description of medicinal products for human use. SPOR is the European Medicines Agency’s concept to implement the standards on data on medicines

Medicines for Europe is also calling for a Medicines Security Act, which would create investments to diversify manufacturing and encourage greener technologies pharmaceutical manufacturing. It says that a coherent EU strategy is needed to support the development of industrial infrastructure to increase production capacities for both APIs and medicines in Europe.