A Top 10 Emerging Pharma Watch List

Emerging pharma companies play an important role in new product development. Which companies are making strong plays based on recent high-value partnering deals? DCAT Value Chain Insights’ Top 10 highlights the rising players.

Emerging pharma strength

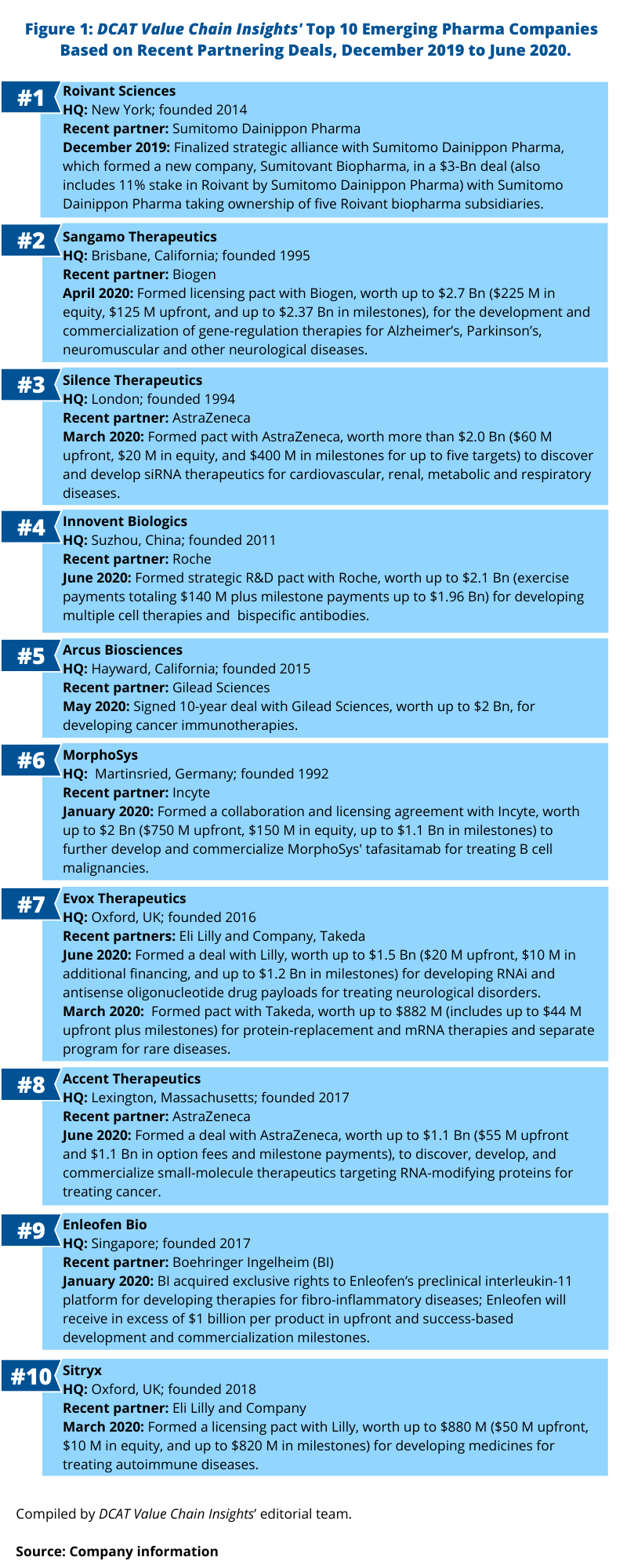

With the multitude of emerging pharma companies, largely defined as clinical-stage pharmaceutical/ biopharmaceutical companies, an important measure of market strength is to see which companies have garnered the interest of the large pharmaceutical companies through major partnering deals. As common with drug-development partnerships, these deals are structured so that the emerging pharma company realizes a large return in drug candidates that reach development, regulatory, and/or commercial milestones (so called “biobucks”) with the large pharma company providing some upfront funding and at times, if of particular interest, an equity stake in the emerging pharma company. Given that premise, below are 10 noteworthy deals, announced from December 2019 to June 2020 (as of June 15, 2020), making DCAT Value Chain Insights’ Top 10 Emerging Pharma Watch List (see Figure 1).

An Emerging Pharma Top 10 Watch List

1. Roivant Sciences. Leading the top of the list for both the value of the deal and its unique structure is Roivant Sciences. Founded in 2014 by Vivek Ramaswamy, who was cited by Forbes as one of the leading entrepreneurs under forty, and who now functions as the company’s Chief Executive Officer (CEO), Roivant consists of multiple wholly owned or majority-owned biopharmaceutical subsidiaries (so-called “Vants”), each focused on a different disease area. The company employs a “hub and spoke” model for research and development, whereby each biopharmaceutical subsidiary functions as an independent entity (“spoke”) using shared resources from the parent (“hub”). Other Vants consist of technology-based platforms that support the operations of the biopharmaceutical Vants and underscore the company’s emphasis of data-driven tools and capabilities in drug development.

Ramaswamy earned a strong reputation for his ability to raise large capital in building Roivant, and last December (December 2019), he finalized one of his largest moves to date: a $3-billion deal with Sumitomo Dainippon Pharma under which the companies formed a strategic alliance and which Sumitomo Dainippon Pharma formed a new company, Sumitovant Biopharma, which took the ownership interest of five Roivant “Vants” or biopharma companies. These “Vants” or Roivant biopharma companies were: Myovant Sciences (women’s health and prostate cancer), Urovant Sciences (urinary diseases), Enzyvant Therapeutics (pediatric rare diseases), Altavant Sciences (respiratory rare diseases) and Spirovant Sciences (genetic lung disease). In addition, Sumitovant will provide strategic guidance and direct the operations of the proprietary technology platforms now owned by Sumitomo Dainippon Pharma that were developed by Roivant: DrugOme and Digital Innovation.

DrugOme is a technology platform that facilitates asset selection and informs clinical development and commercial strategy through computational analytics and techniques. Digital Innovation is a platform for applying technology to business problems to optimize business value. The involved technologies are embedded in each Vant and improve workflow and decision making and enable automation. Sumitovant, Sumitomo Dainippon Pharma, and Roivant will each have access to these platforms.

Sumitomo Dainippon Pharma also acquired an 11% stake in Roivant and options to acquire Roivant’s ownership interests in six additional biopharma companies. For its consideration, Roivant received $3 billion from Sumitomo Dainippon Pharma, which includes $2.0 billion for the acquisition of all the stock of Roivant’s 100%-owned new company, Sumitovant Biopharma, and $1.0 billion for the acquisition of 11% of Roivant’s shares.

Roivant now consists of 12 “Vants,” consisting of both biopharmaceutical and technology-based subsidiaries. Roivant established its newest “Vant” earlier this year (January 2020) with the creation of Lokavant, which provides real-time data monitoring with predictive analytics in clinical trials to identify risks in pharmaceutical development. A growing corpus of over 1,000 de-identified clinical trials provides the basis for the Lokavant predictive analytics engine.

2. Sangamo Therapeutics. Sangamo Therapeutics, a Brisbane, California-based genomic medicine company, formed a global licensing collaboration in February (February 2020) with Biogen for gene-regulation therapies in neurology in a deal worth up to $2.72 billion ($350 million upfront and $2.37 billion in potential milestones).

Under the agreement, the companies have agreed to develop and commercialize two investigational drug candidates (ST-501 and ST-502) of Sangamo’s for treating neurodegenerative disorders, including Alzheimer’s disease and Parkinson’s disease, a third undisclosed neuromuscular disease target, and up to nine additional undisclosed neurological disease targets.

The companies will use Sangamo’s proprietary zinc finger protein (ZFP) technology delivered via adeno-associated virus (AAV) vectors to modulate the expression of key genes involved in neurological diseases. Sangamo’s genome regulation technology, zinc finger protein transcription factors (ZFP-TFs), is currently delivered with AAVs vectors and functions at the DNA level to selectively repress or activate the expression of specific genes to achieve a desired therapeutic effect.

Sangamo will be responsible for GMP manufacturing activities for the initial clinical trials for the first three products of the collaboration and plans to leverage its in-house manufacturing capacity. Biogen will assume responsibility for GMP manufacturing activities beyond the first clinical trial for each of the first three products.

With the closing of this transaction, Sangamo receives $350 million comprised of $125 million in a license-fee payment and $225 million from the sale of new Sangamo stock, or approximately 24 million shares at $9.21 per share. In addition, Sangamo may receive up to $2.37 billion in other development, regulatory, and commercial milestone payments, including up to $925 million in pre-approval milestone payments and up to $1.445 billion in first commercial sale and other sales-based milestone payments. Sangamo will also be eligible to receive from Biogen tiered high single-digit to sub-teen double-digit royalties on potential net commercial sales of products arising from the collaboration.

3. Silence Therapeutics. Silence Therapeutics, a London-based biopharmaceutical company, formed a collaboration in March (March 2020) with AstraZeneca, worth up to $2.0 billion ($80 million in upfront and equity investments), to discover, develop, and commercialize small interfering RNA (siRNA) therapeutics for treating cardiovascular, renal, metabolic and respiratory diseases.

Small interfering RNA (siRNA) are double-stranded RNA molecules that offer opportunities for therapeutic intervention because they act inside the cell to influence protein production by targeting RNA to prevent the production of disease-causing proteins, according to the information from Silence Therapeutics.

Under the collaboration, Silence will be responsible for designing siRNA molecules against gene targets selected by AstraZeneca and for manufacturing of material to support GLP toxicology studies and Phase I clinical studies. AstraZeneca and Silence will collaborate during the discovery phase, and AstraZeneca will lead clinical development and commercialization of molecules arising from the collaboration. Silence will have the option to negotiate for co-development of two programs of their choice starting from Phase II.

Under the deal, AstraZeneca will make an upfront cash payment of $60 million and an equity investment of $20 million in Silence. The parties anticipate initiating work on five targets within the first three years of the collaboration, with AstraZeneca having the option to extend the collaboration to a further five targets. For each disease target, Silence is eligible to receive up to $400 million in milestones, plus tiered royalties as further outlined. AstraZeneca will pay Silence an option fee of $10 million for each selected target at the point of candidate nomination and thereafter for each target selected. Silence will be eligible for up to $140 million in development milestones and up to $250 million in commercialization milestones as well as tiered royalties on net sales ranging from high single digit to low double digits.

4. Innovent Biologics. Earlier this month (June 2020), Innovent Biologics, a Suzhou, China-based biopharmaceutical company, entered into a strategic research and development collaboration with Roche in a deal worth up to $2.1 billion (exercise payments totaling $140 million plus milestone payments up to $1.96 billion) for the discovery, clinical development, and commercialization of bispecific antibodies and multiple cell therapies directed to the treatment of hematological and solid cancers.

Under the agreement, Innovent will pay upfront, development and commercial milestone payments, and royalties, to non-exclusively access certain Roche technologies that enable the discovery and development of specific 2:1 T-cell bispecific antibodies (TCB) and an universal CAR-T platform. Innovent will create, develop, manufacture, and commercialize the products. Roche retains an option right to license each product for ex-China development and commercialization. Should Roche exercise all of its options, it will pay option-exercise payments totaling $140 million plus additional development, approval, and sales milestone payments of up to $1.96 billion if all products are successfully developed and commercialized. Additionally, Roche will pay double-digit up to mid-teen percentage royalties on each product.

Innovent was established in 2011 and was listed on the Hong Kong Stock Exchange in 2018. The company has a pipeline of 23 assets in oncology, metabolic diseases and other therapeutic areas, Eighteen have entered into clinical development, and five are in Phase III or other pivotal clinical trials. Four monoclonal antibodies are under regulatory review, and one drug, TYVYT (sintilimab injection), a PD-1 inhibitor, is approved for relapsed or refractory classical Hodgkin’s lymphoma in China and was added to China’s National Reimbursement Drug List in November 2019. The drug was jointly developed between Innovent and Eli Lilly and Company.

5. Arcus Biosciences. Arcus Biosciences, a Hayward, California clinical-stage company focused on cancer immunotherapies, and Gilead Sciences announced earlier this month (June 2020) a 10-year partnership, worth up to $2 billion, to co-develop and co-commercialize current and future therapeutic product candidates in Arcus’s pipeline and for ongoing funding to support Arcus’s R&D programs.

Arcus has a clinical-stage pipeline of four immuno-oncology programs, as well as an oncology discovery pipeline with six preclinical compounds consisting of small-molecule products and antibody products that target immune checkpoint receptors.

The deal is pending US regulatory approval and is expected to close in the third quarter of this year (2020). Under the agreement, Arcus will receive $375 million upon closing, consisting of a $175-million upfront payment and a $200-million equity investment from Gilead. Arcus is eligible to receive up to $1.225 billion in opt-in and milestone payments with respect to its current clinical product candidates. Gilead will gain access to Arcus’s current and future investigational immuno-oncology products through the agreement, which includes immediate rights to zimberelimab, an investigational anti-PD-1 monoclonal antibody, as well as the right to opt-in to all other current Arcus clinical candidates upon payment of an opt-in fee that ranges from $200 million to $275 million per program, after delivery of a qualifying data package. Arcus is also eligible to receive up to $500 million in potential future US regulatory approval milestones if Gilead opts-in to the company’s AB154 program, an investigational anti-TIGIT monoclonal antibody. Gilead will also receive the right to opt-in to all other programs that emerge from Arcus’s research portfolio over the next 10 years, upon payment of an opt-in fee of $150 million per program after Arcus’s delivery of a qualifying data package. Gilead will further provide ongoing R&D support of up to $400 million over the collaboration term.

Arcus Biosciences was founded in 2015 by two of its top executives, Terry Rosen, CEO, and Juan Jaen, President, with both most recently founding and serving leadership roles with Flexus Biosciences, a San Carlos, California-based pharmaceutical company focused on anticancer therapies that Bristol-Myers Squibb acquired in 2015.

6. MorphoSys. MorphoSys, a Martinsried, Germany-based biopharmaceutical company, announced earlier this year (January 2020) a collaboration and licensing agreement with Incyte, a Wilmington, Delaware-based biopharmaceutical company, worth up to $2 billion ($750 million upfront, $150 million in equity, up to $1.1 billion in milestones) to further develop and commercialize MorphoSys’s tafasitamab for treating B cell malignancies.

Tafasitamab is an Fc-engineered antibody against CD19 currently in clinical development for the treatment of B cell malignancies. MorphoSys and Incyte will co-commercialize tafasitamab in the US while Incyte has exclusive commercialization rights outside of the US. Incyte’s key commercial product is Jakafi/Jakavi (ruxolitinib), a drug to treat polycythemia vera and myelofibrosis, disorders of the bone marrow, for which it is partnered with Novartis. Incyte has commercial rights in the US and Novartis outside the US.

MorphoSys recently submitted a biologics license application for tafasitamab, in combination with lenalidomide, to the US Food and Drug Administration for the treatment of relapsed/refractory diffuse large B cell lymphoma (r/r DLBCL); the FDA decision regarding a potential approval is expected by mid-2020. The submission of a marketing authorization application to the European Medicines Agency in r/r DLBCL is planned for mid-2020.

The agreement between MorphoSys and Incyte, including the equity investment, was approved by regulatory authorities and became effective in March (March 2020).

MorphSys is not a new company with more than 20 years of experience in antibody drug discovery and development with partnering programs, including specific in-licensing and co-development activities, with pharmaceutical companies. Tremfya (guselkumab), developed by Johnson & Johnson’s Janssen Research & Development, is the first antibody based on MorphoSys’s technology approved in the US, European Union as well as several other countries.

7. Evox Therapeutics. Evox Therapeutics, an Oxford, UK-headquartered biopharmaceutical company, announced this month (June 2020) a research collaboration and license agreement with Eli Lilly and Company, worth up to $1.5 billion, to develop RNA interference (RNAi) and antisense oligonucleotide drug payloads for the potential treatment of neurological disorders.

Under the deal, Evox will receive a $20-million upfront payment, research funding over three years, as well as a $10-million investment from Lilly in exchange for a convertible bond from the company. Evox will also be eligible for potential preclinical and clinical development, regulatory and commercial milestones of up to approximately $1.2 billion, as well as tiered royalties up to low double digits on net sales of products arising from the collaboration.

Evox is focused on developing therapeutics made to modify exosomes, extracellular vesicles, to target the delivery of exosomes to organs of interest. Exosome-based drugs have the potential to address some of the limitations of protein, antibody, and nucleic acid-based therapies by enabling delivery to cells and tissues that are currently out of reach using other drug-delivery technologies, according to information from the company.

In a second deal with Takeda, announced in March (March 2020), Evox formed a licensing pact, worth up to $882 million ($44 million upfront) focused on developing up to five novel protein-replacement and mRNA therapies, including Evox’s preclinical program in Niemann-Pick disease type C and a second new program directed at another undisclosed rare disease. As part of the deal, Takeda also has the option to select up to three additional rare-disease targets.

8. Accent Therapeutics. Earlier this month (June 2020), Accent Therapeutics, a Lexington, Massachusetts-based pharmaceutical company focused on developing oncology-focused small-molecule therapies, formed a deal with AstraZeneca, worth up to $1.1 billion ($55 million upfront and $1.1 billion in additional payments in the form of option fees and milestone payments), to discover, develop and commercialize therapeutics targeting RNA-modifying proteins (RMPs) for the treatment of cancer.

RMPs are proteins that control many aspects of RNA biology and represents a new approach for addressing the process disruptions that can lead to cancer and can cause resistance to medicines, according to the companies.

Under the agreement, Accent will be responsible for research and development activities for a nominated preclinical program through to the end of Phase I clinical trials. Following completion of Phase I, AstraZeneca will lead development and commercialization activities for the nominated program, with Accent having the option to jointly develop and commercialize with AstraZeneca in the US. AstraZeneca will also have the exclusive option to license worldwide rights to two further preclinical discovery programs, for which Accent will conduct certain preclinical activities.

Accent will receive an upfront payment of $55 million and, in the event that Accent elects to jointly develop the nominated program, is eligible to receive up to $1.1 billion in additional success-based payments across all programs in the form of option fees and milestone payments as well as tiered royalties on net sales ranging from mid-single digit to low-double digits. In the event Accent opts into co-developing and co-commercializing the nominated program, profits and losses will be split in the US.

Accent Therapeutics was co-founded in 2017 by Robert A. Copeland, who now serves as its President and Chief Scientific Officer. He was formerly President of Research and Chief Scientific Officer of Epizyme, a Cambridge, Massachusetts-based biopharmaceutical company, and before that, Vice President of Cancer Biology in the Oncology Center of Excellence in Drug Discovery at GlaxoSmithKline.

9. Enleofen Bio. Enleofen Bio, a Singapore-based biopharmaceutical company, formed a pact with Boehringer Ingelheim (BI) under which BI acquired worldwide exclusive rights to Enleofen’s preclinical interleukin-11 (IL-11) platform. Under the deal, which was announced in January 2020, Enleofen may receive in excess of $1 billion per product in upfront and success-based development and commercialization milestones.

Enleofen is a spin-out from the National Heart Centre Singapore at SingHealth and Duke-NUS Medical School under the SingHealth Duke-NUS Academic Medical Centre (AMC), Singapore. Enleofen exclusively licensed a suite of patents and a number of antibody products when it was founded in 2017 from the AMC. Subsequent to this, Enleofen built an anti-IL-11 antibody platform and advanced its drug-development programs toward the clinic. BI says it will now develop this platform further and plans to work jointly with scientists at the AMC to accelerate the platform into clinical development. The initial focus will be on therapies for patients with non-alcoholic steatohepatitis (NASH) and interstitial lung disease (ILD), two of BI’s core disease focus areas, with a potential to expand into further fibro-inflammatory conditions based on IL-11’s central role in disease.

10. Sitryx. Earlier this year (March 2020), Sitryx, an Oxford, UK-based biopharmaceutical company focused on developing therapeutics in immuno-oncology and immuno-inflammation, formed a licensing pact with Eli Lilly and Company in a deal worth up to $880 million ($50 million upfront, $10 million in equity investments, and up to $820 million in milestones) for the development of potential new medicines for autoimmune diseases.

Sitryx, which was founded in 2018, is focused on ways to regulate cell metabolism to develop disease-modifying therapeutics in immuno-oncology and immuno-inflammation. The collaboration will study up to four novel preclinical targets identified by Sitryx that could lead to potential new medicines for autoimmune diseases.

Under the deal, Sitryx receives an upfront payment of $50 million, and Lilly will make a $10-million equity investment in Sitryx. Sitryx will be eligible to receive potential development milestones of up to $820 million as well as commercialization milestones and royalty payments on potential sales in the mid- to high-single digit range. In return, Sitryx will grant Lilly a worldwide license to develop and commercialize up to four preclinical immunometabolism-targeted therapeutics, including Sitryx’s two lead projects. Lilly and Sitryx will establish a five-year research collaboration to support the development of the therapeutics, with Sitryx responsible for drug discovery while Lilly will fund and manage the clinical development and commercial phase of the collaboration.