2024: The Bio/Pharma Industry’s Year in Review

As we begin to look back at 2024, what were the top developments from the bio/pharma industry this year? DCAT Value Chain Insights gives its take on the most significant news in the industry spanning manufacturing, product innovation, and deal-making.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

The year of the GLP-agonists

Glucagon-like peptide 1 (GLP-1) agonists, used to treat Type 2 diabetes and obesity, were the product story of 2024, with both Eli Lilly and Company and Novo Nordisk riding the blockbuster wave. Lilly’s Mounjaro (tirzepatide), for treating Type 2 diabetes, registered revenues of $8.0 billion for the first nine months of 2024. Mounjaro was approved in the US for treating Type 2 diabetes in 2022, and in November 2023, the same active ingredient, tirzepatide, was approved in the US for chronic weight management under the brand name, Zepbound. Zepbound posted revenues of $3.0 billion in the first nine months of 2024..

Novo Nordisk has several GLP-1-based products for treating Type 2 diabetes—Ozempic (semaglutide, injection), Rybelsus (semaglutide, tablets), and Victoza (liraglutide)— and two obesity-care GLP-1 products, Wegovy (semaglutide) and Saxenda (liraglutide). Through the first nine months of 2024, revenues for its top GLP-1 agonist diabetes drug, Ozempic, was DKK 86.5 billion ($12.3 billion) and DKK 38.3 billion ($5.4 billion) for its top GLP-1 agonist obesity drug, Wegovy.

The GLP-1 agonist market is poised for strong growth, with a projected compound annual growth rate of 19.2% through 2029 to reach a market size of $105 billion, according to estimates (as of March 6, 2024) by GlobalData, a market research and business intelligence firm. It points to five key drugs: Lilly’s Mounjaro and four drugs by Novo Nordisk—Ozempic, Wegovy, CagriSema (semaglutide and cagrilintide) (now in late-stage development), and Rybelsus—which collectively are forecast to capture 83% of the GLP-1 agonist market by 2029. Eli Lilly’s Mounjaro is expected to lead in sales, with projected 2029 sales of $33.4 billion, according to estimates by GlobalData. With a large portfolio of products of GLP-1 drugs, Novo Nordisk is expected to capture 55% of the GLP-1 market in 2029.

Lilly, Novo lead manufacturing charge

Driven by strong demand for their GLP-1 agonists as well as other products, both Novo Nordisk and Lilly announced several large-scale manufacturing expansions in 2024. For Novo, that took the form of a mega deal, its $16.5-billion pending acquisition of Catalent, which was one of the largest acquisitions in 2024. Announced in February (February 2024), the acquisition will net Novo three fill–finish sites and related assets in Anagni, Italy, Bloomington, Indiana, and Brussels, Belgium. After closing, Novo Holdings, the parent company of Novo Nordisk, plans to sell the three fill–finish sites to Novo Nordisk for $11 billion. The Catalent acquisition is expected to gradually increase Novo Nordisk’s filling capacity from 2026 and onwards.

The acquisition is in addition to a multi-billion-dollar capital expansion plan by Novo Nordisk to increase manufacturing capacity. In June (June 2024), Novo Nordisk announced plans to invest $4.1 billion to build a second fill–finish manufacturing facility at its site in Clayton, North Carolina. As one of the largest manufacturing investments in Novo Nordisk’s history, the expansion will add 1.4 million square feet of production space for aseptic manufacturing and finished production processes, doubling the combined square footage of all three of the company’s existing facilities in North Carolina. Construction will gradually be finalized between 2027 and 2029. Overall, in 2024, Novo Nordisk announced manufacturing investments of approximately $6.8 billion to expand its manufacturing network, which has five strategic production sites in Denmark, the US, France, Brazil, and China.

This week (December 5, 2024), Lilly also continued its manufacturing capacity additions by announcing a $3-billion expansion of its sterile manufacturing facility in Pleasant Prairie, Wisconsin, which the company acquired from Nexus earlier this year (2024). The company plans to start construction on the expansion next year (2025). Also, in 2024, Lilly opened an $800-million facility expansion at its site in Kinsale, Ireland, to increase capacity for its diabetes and obesity treatments.

Outside of its obesity/Type 2 diabetes drugs, Lilly announced in September (September 2024), a $1-billion expansion of its Limerick, Ireland, manufacturing site to increase production of biologic active ingredients, including those for its recently approved treatment for early symptomatic Alzheimer’s disease. Production of biologic active ingredients for Lilly medicines is on track to start in 2026. In October (October 2024), Lilly announced a $4.5-billion investment to create the Lilly Medicine Foundry, a new center for advanced manufacturing and drug development in Lebanon, Indiana. The facility will give Lilly the ability to research new ways of producing medicines while also scaling up manufacturing of medicines for clinical trials. Overall, since 2020, Lilly has committed more than $23 billion to construct, expand, and acquire manufacturing sites worldwide.

Other billion-dollar-plus manufacturing expansions

Lilly and Novo Nordisk were not alone among the large bio/pharma companies in announcing billion-dollar-plus manufacturing expansions. Here’s a roundup of some of the more noteworthy investments from 2024.

Sanofi. Earlier this month (December2024), Sanofi signed a memorandum of cooperation with the Beijing Municipal Bureau of Economy and Information Technology and the Beijing Economic and Technological Development Zone to establish a new EUR 1 billion ($1.05 billion) insulin production base in China. The company’s investment will create a second Beijing production base to enhance local end-to-end insulin production and manufacturing capabilities. This will be Sanofi’s fourth production and supply base in China and represents the company’s single largest investment in China. The new production base in Beijing will add to Sanofi’s manufacturing network in China, which includes another Beijing production base that was expanded last year (2023) and production bases in Shenzhen and Hangzhou. Also, in May 2024, Sanofi announced an investment of EUR 1.1 billion ($1.2 billion) to create new bioproduction capacity at its sites in France: Vitry-sur-Seine (Val de Marne), Le Trait (Seine-Maritime), and Lyon Gerland (Rhône). This biomanufacturing investment project is in addition to EUR 2.5 billion ($2.71 billion) already committed in major projects in France.

Amgen. This week (December 5, 2024), Amgen announced a $1-billion expansion to establish a second drug-substance manufacturing facility in Holly Springs, North Carolina. This brings the company’s total planned investment in Holly Springs to more than $1.5 billion, building on its previously announced $550 million commitment.

Roche/Lonza. October (October 2024), Lonza completed its $1.2-billion acquisition of a large-scale biologics manufacturing site in Vacaville, California, from Roche’s Genentech. The deal was announced in March 2024. The Vacaville facility has a total bioreactor capacity of approximately 330,000 liters. Lonza plans to invest an additional CHF 500 million ($586 million) to upgrade the facility. The Vacaville site expands Lonza’s capacity for mammalian manufacturing in the US and creates a West Coast commercial manufacturing presence, which complements Lonza’s existing East Coast manufacturing site in Portsmouth, New Hampshire. The company also has mammalian operations its sites in: Visp, Switzerland; Slough, the UK; Porriño, Spain; and Tuas, Singapore.

Johnson & Johnson. Johnson & Johnson (J&J) announced an investment of more than $2 billion to build a biologics manufacturing facility in Wilson, North Carolina. J&J says the new facility is part of a broader plan to advance more than 70 novel therapy and product expansion filings and launches by the end of the decade. Construction of the new facility is anticipated to begin in the first half of 2025. When fully operational, the site will employ approximately 420 full-time employees.

AstraZeneca. Earlier this year (May 2024), AstraZeneca announced plans to build a $1.5-billion manufacturing facility in Singapore for antibody drug conjugates (ADCs). The planned greenfield facility, supported by the Singapore Economic Development Board, will be AstraZeneca’s first end-to-end ADC production site, fully incorporating all steps of the manufacturing process at a commercial scale. AstraZeneca says it aims to begin design and construction of the manufacturing facility by the end of 2024, with targeted operational readiness from 2029.

The company also plans to invest £450 million ($482 million) to research, develop, and manufacture vaccines at its site Speke, Liverpool, UK, according to information from the UK government. In addition, AstraZeneca is investing $300 million in a new cell-therapy manufacturing facility in Rockville, Maryland, initially for clinical-trial-material supply. This is part of a $3.5-billion capital investment plan in the US focused on expanding the company’s research and manufacturing footprint by the end of 2026. This includes $2 billion of new investment.

GSK. Although not quite reaching the $1-billion mark, in October (October 2024), GSK announced an up to $800-million investment to bring drug-substance manufacturing and additional drug-product manufacturing capabilities to its site in Marietta, Pennsylvania, making it the company’s largest US manufacturing investment to date. This expansion will double the size and capacity of the Marietta site. The new facility will be capable of manufacturing sterile liquid vaccines and medicines. This facility will also house an R&D pilot plant to manufacture medicines for clinical trials. Additionally, GSK will establish a new vaccines drug-substance facility at the site, dedicated to manufacturing products based on the company’s Multiple Antigen Presenting System (MAPS), a vaccine technology platform. Construction of the new facilities is expected to start by the end of this year (2024). The drug-substance facility is anticipated to be operational by the end of 2027, with the drug-product facility following by the end of 2028. Since 2017, GSK has invested close to $1.3 billion in US-based. manufacturing capabilities.

Product innovation: new drug approvals in 2024

The annual scorecard of new drug approvals is an important measure of product innovation, so how has the industry fared thus far in 2024? Through December 2, 2024, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) had approved 44 new molecular entities (NMEs) and biological therapeutics, compared to 52 new drugs approved at the same point in time in 2023.

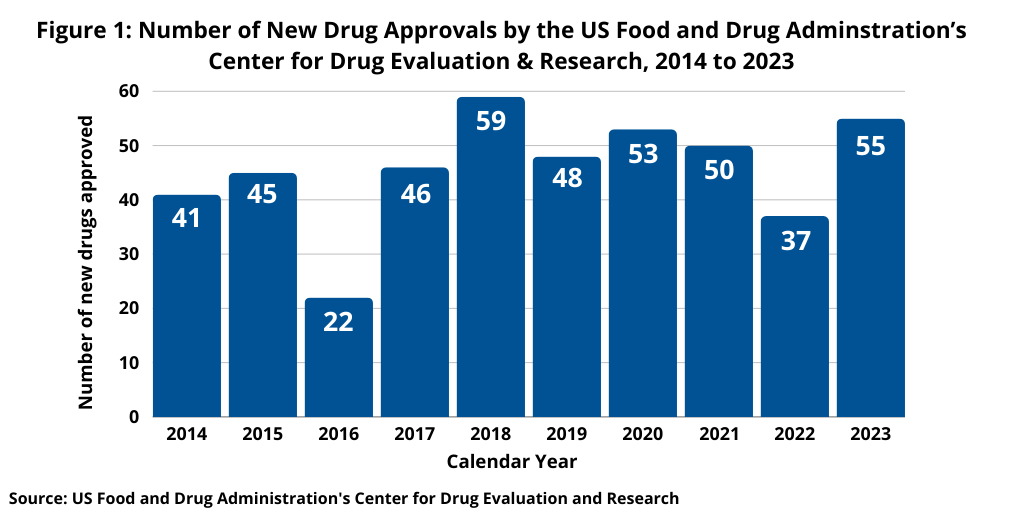

Although off the mark thus far in 2024, drug approvals do not follow a strictly chronological path, and the end of the year typically sees some additional approvals. How new drug approvals in 2024 will eventually tally will be known in the coming weeks, but they would have to increase to meet recent levels. New drug approvals by FDA’s CDER have exceeded 50 in four of the past six years (2018–2023), only dipping below 50 twice (in 2019 with 48 new drug approvals and 2022 with 37) (see Figure 1).

US Presidential election aftermath: drug pricing & trade

Two major policy issues loom large for the industry in the wake of the US Presidential election in November: drug pricing and trade. What priority drug pricing will take on the agenda of President-elect Donald Trump and the new Congress when they take office in January 2025 has yet to be fully determined, but a key decision will be how to proceed with drug-pricing measures enacted under the Inflation Reduction Act of 2022, which for the first time authorized and required the US government to negotiate prices for certain drugs under Medicare, the US federal government program for healthcare for individuals 65 years or older.

As a whole, the industry has been critical of the drug-pricing measures authorized under the Inflation Reduction Act. The Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies in the US, has raised concerns over a lack of transparency and accountability in the drug-negotiation process and the overall dampening effect of drug-pricing measures on product innovation. While supporting efforts to lower overall healthcare costs, PhRMA contends that the drug-pricing measures under the drug-negotiation process do not achieve the desired goal of lowering drug prices as they do not take into account the role that third-parties, insurance companies, and pharmacy benefit managers have in setting drug prices.

In August (August 2024), the US government released the negotiated drug prices for the first 10 drugs selected under the Medicare Drug Price Negotiation Program, with the first negotiated prices set to go into effect in 2026 under current law. Under the program, each year the Secretary of the US Department of Health and Human Services is authorized to select a set number of drugs for price negotiation on the basis of total Medicare spending on the drugs and certain other criteria. Eligibility for price negotiation is limited to small-molecule drugs that have been on the market for at least seven years and have no generic competitors, as well as to biologic drugs that have been on the market for at least 11 years and have no biosimilar competitors. Each drug’s negotiated price is subject to a ceiling amount that is based on its previous price, rebate amount, and length of time on the market. The program limits the number of eligible drugs for negotiations to 10 Medicare Part D drugs in 2026, 15 Medicare Part D drugs in 2027, 15 Medicare Part B and D drugs in 2028, and 20 Medicare Part B and D drugs in 2029 and thereafter. In all, over the next several years under current policy, the US government would negotiate prices for up to 60 drugs covered under Medicare Part D and Part B, and up to an additional 20 drugs every year after that.

Trade, in the form of tariffs, is another major issue on the table for the incoming Administration. In late November, President-Elect Trump announced his intention to impose additional tariffs of 10% on US imports from China as well as additional tariffs of 25% on US imports from Mexico and Canada. These three countries represent major trading partners with the US, and as in all industries, would represent additional costs on goods from these countries. Whether the new Administration would proceed with those plans for tariffs or would exempt certain products, such as pharmaceuticals, from any proposed tariffs are key items to watch for in 2025.