2020 Vision: What is Impacting Global Supply Lines?

From a more pessimistic macroeconomic view, to uncertainty arising from ongoing trade conflicts, and geopolitical tensions, executives weigh in on key issues that will impact performance in 2020.

Taking the pulse

To gain a perspective on what is on the minds of CEOs, we turn to PwC, which shared the results of its Annual CEO Survey at the World Economic Forum in Davos, Switzerland earlier this month. PwC conducted 1,581 interviews with CEOs in 83 countries between September and October 2019. The sample was weighted by national gross domestic product to ensure that CEOs’ views were fairly represented across all major regions. Among the companies surveyed, approximately 46% of companies had revenues of $1 billion or more; 35% of companies had revenues between $100 million and $1 billion; and 15% of companies had revenues of up to $100 million. Fifty-five percent of companies were privately owned. What did the CEOs have to say?

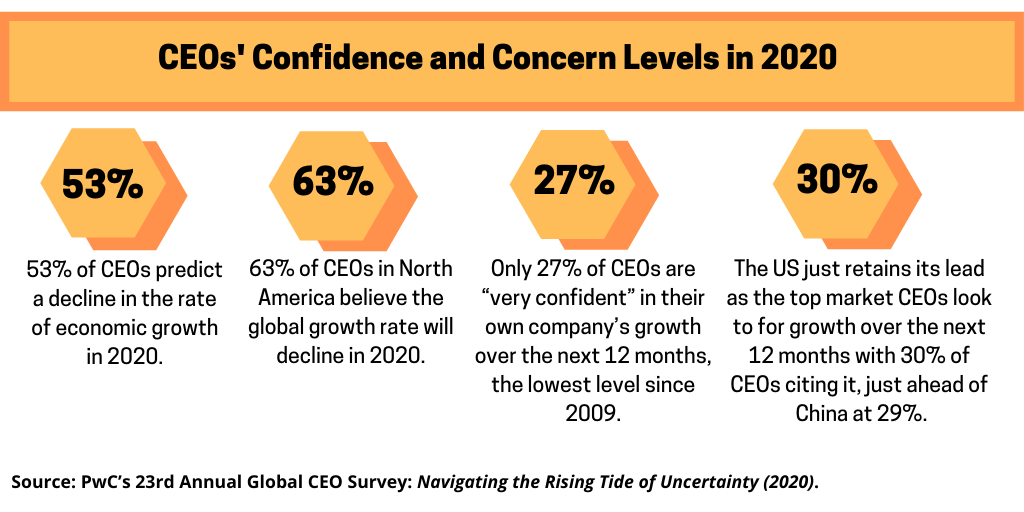

Economic growth. According to the PwC survey, CEOs are showing record levels of pessimism in the global economy, with 53% predicting a decline in the rate of economic growth in 2020. This is up from 29% in 2019 and just 5% in 2018, which represented the highest level of pessimism since PwC started asking this question in its CEO survey in 2012. By contrast, the number of CEOs projecting a rise in the rate of economic growth dropped from 42% in 2019 to only 22% in 2020.

CEO pessimism over global economic growth is particularly significant in North America, Western Europe and the Middle East, with 63%, 59% and 57%, respectively, of CEOs from those regions predicting lower global growth in the year ahead. In every region—Africa, Asia-Pacific, Central and Eastern Europe (CEE), Latin America (including Mexico), the Middle East, North America and Western Europe—the prevailing sentiment is the same: global economic growth will slow in 2020, according to the PwC survey. The percentage of CEOs citing a decline in the rate of growth exceeds 50% in all but two regions: Asia-Pacific and CEE. The change in sentiment by CEOs for global economic growth has been more pronounced among CEOs in North America, where a record 63% of CEOs believe the global growth rate will decline. Two years ago, the same record share of North America CEOs (63%) said the opposite, that the global economy would improve driven by strong growth and US corporate tax cuts and related stimulus.

”Given the lingering uncertainty over trade tensions, geopolitical issues and the lack of agreement on how to deal with climate change, the drop in confidence in economic growth is not surprising—even if the scale of the change in mood is,” said Bob Moritz, Chairman of the PwC Network, in commenting on the survey results. “These challenges facing the global economy are not new; however, the scale of them and the speed at which some of them are escalating is new. The key issue for leaders gathering in Davos is: how are we going to come together to tackle them.”

Company performance. CEOs are also not so positive about their own companies’ prospects for the year ahead, with only 27% of CEOs saying they are “very confident” in their own organization’s growth over the next 12 months, the lowest level in PwC’s annual CEO survey since 2009 and down from 35% last year (2019).

While confidence levels are generally down across the world according to the PwC survey, there is a wide variation from country to country, with CEOs from China and India showing the highest levels of confidence for company growth at 45% and 40% respectively. The US follows at 36%, Canada at 27%, the UK at 26%, Germany at 20%, and France 18%. Japan has the least optimistic CEOs with only 11% of CEOs “very confident” of growing revenues in 2020.

When asked about their own revenue-growth prospects, the change in CEO sentiment has proven to be a strong predictor of global economic growth, according to the PwC analysis. Analyzing CEO forecasts since 2008, the correlation between CEO confidence in their 12-month revenue growth and the actual growth achieved by the global economy has been very close. If the analysis continues to hold, global growth could slow to 2.4% in 2020 below many estimates, including the 3.4% October 2019 growth prediction from the International Monetary Fund, according to the PwC analysis.

Geographic economic growth. The US just retains its lead as the top market CEOs look to for growth over the next 12 months at 30%, one percentage point ahead of China at 29%, according to the PwC analysis. The PwC report, however, notes that “ongoing trade conflicts and political tensions have seriously dented the attractiveness of the US for China CEOs.” In 2018, 59% of China CEOs selected the US as one of their top three growth markets; in 2020, this has dropped to just 11%. The US loss has been Australia’s gain, with 45% of CEOs in China now looking to Australia as a top three key growth market compared with only 9% two years ago.

The other countries making the top five for growth are unchanged from 2019: Germany (13%), India (9%) and the UK (9%), which PwC comments is a strong result for the UK given the uncertainty created by Brexit. Australia is just outside the top five boosted by its increased attractiveness for China CEOs.

CEO concerns. In 2019, when asked about the top threats to their company’s growth prospects, uncertain economic growth ranked outside the top 10 concerns for CEOs at number twelve, according to the PwC study. In 2020, concerns over economic growth has jumped to third place, just behind trade conflicts, another risk that has risen up the CEOs agenda–and the perennial over-regulation, which has again topped the table as the number one threat for CEOs.

CEOs are also increasingly concerned about cyber threats and climate change and environmental damage. Despite the increasing number of extreme weather events and the intensity of debate on the issue, however, the magnitude of other threats continues to overshadow climate change, which still does not make it into the CEOs’ top 10 threats to growth, according to the PwC study.

Although climate change does not appear in the top 10 threats to CEOs’ growth prospects, CEOs are expressing a growing appreciation of the upside of taking action to reduce their carbon footprint. Compared to a decade ago, when PwC last asked this question, CEOs are now twice as likely to “strongly agree” that investing in climate-change initiatives will boost reputational advantage (30% in 2020 compared with 16% in 2010). In addition, 25% of CEOs in 2020 compared with 13% in 2010 see climate-change initiatives leading to new product and service opportunities for their companies.

The PwC study notes that while views of climate-change-driven product and service opportunities have remained relatively stable in the US and the UK, there has been a dramatic shift in views in China over the last 10 years. In 2010, only 2% of China CEOs saw climate change leading to opportunities, but in 2020, this has risen to 47%, by far the largest increase of CEOs in any country included in the PwC survey.