The EU’s API Supply Chain Under Focus

The European Commission has updated the EU’s Industrial Strategy, which was first put forth in March 2020 with goals of realizing a green and digital economy while increasing the EU’s global competitiveness. The strategy involves improving supply-chain resilience, including for APIs. What’s next for EU API supply?

EU policy moves and APIs

Earlier this month (May 2021), the European Commission updated the European Union’s (EU) Industrial Strategy, which was first issued in March 2020, to ensure that the strategy takes into account new circumstances following the COVID-19 pandemic. The updated strategy reaffirms the priorities of making the EU a more sustainable, digital, resilient and globally competitive economy that were set out in the European Commission’s March 2020 Communication on the strategy, published the day before the Word Health Organization declared COVID-19 a pandemic. The updated strategy provides a further review of information for supply-chain resilience in certain industries, including the bio/pharmaceutical industry, and specifically for the supply of active pharmaceutical ingredients (APIs) in the EU.

“Medicinal products are critical for society,” said the European Commission in outlining the EU’s updated Industrial Strategy. “They offer therapeutic options for diagnosis, treatment and prevention of diseases and are important to address threats to public health, including the COVID-19 and any future pandemic. In this context, it is essential to ensure citizens’ access to safe, effective and high-quality medicines at an affordable price. However, our analysis shows that the EU appears to be dependent on foreign supply chains in a number of inputs and products in the health ecosystem.”

The updated strategy includes what the European Commission calls a “bottom-up” analysis based on EU trade data in which it identifies what it terms as “sensitive ecosystems” for which the EU is highly dependent, which includes health ecosystems, such as pharmaceutical ingredients. The updated strategy is accompanied by three Staff Working Documents, of which one is an analysis on Europe’s strategic dependencies and capacities with an in-depth review of certain industries, including pharmaceuticals.

Inside the EU: API imports and exports

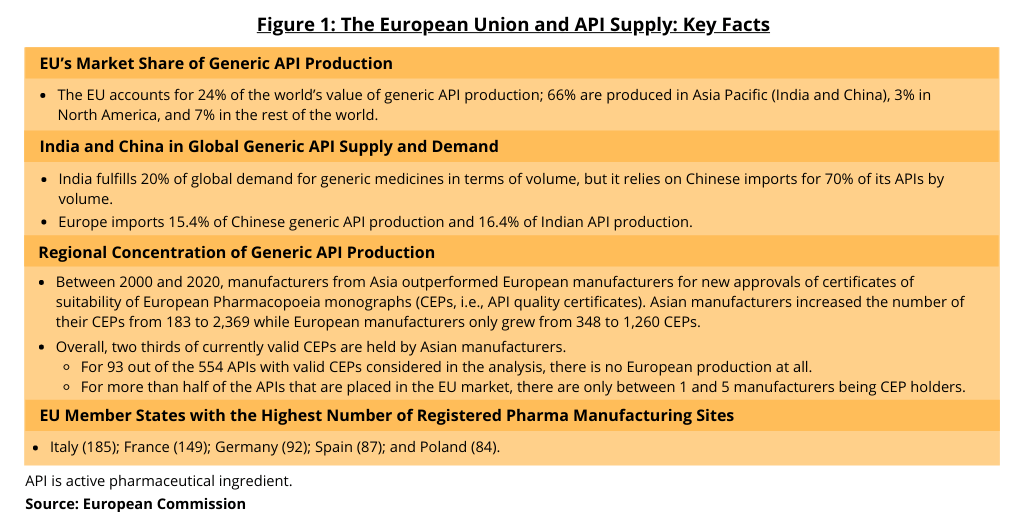

Figure 1 provides data provided by the European Commission in its assessment of the EU’s dependence on non-EU sources for APIs, in particular generic APIs. The EU’s share of global generic API production (on a value basis) is 24%; compared to 66% in Asia Pacific (India and China); 3% in North America; and 7% in the rest of the world. Additionally, European imports of APIs come from only a few sources. Eighty percent of API import volume for the EU comes from five countries: China (which accounts for 45%), India, the US, the UK, and Indonesia. Eighty percent of API import value comes from four countries: Switzerland, the US (Switzerland and US both 30%), Singapore, and China.

The assessment provides further data on the regional concentration of API supply into the EU. Between 2000 and 2020, manufacturers from Asia outperformed European manufacturers for new approvals of certificates of suitability of European Pharmacopoeia monographs (CEPs, i.e., API quality certificates). Asian manufacturers increased the number of their CEPs from 183 to 2,369 while European manufacturers only grew from 348 to 1,260 CEPs. Overall, two thirds of currently valid CEPs are held by Asian manufacturers. For 93 out of the 554 APIs with valid CEPs considered in the analysis, there is no European production at all. For more than half of the APIs that are placed in the EU market, there are only between one and five manufacturers being CEP holders (see Figure 1).

In terms of registered pharmaceutical manufacturing sites in the EU, Italy holds the most with (185) followed by France (149), Germany (92), Spain (87), and Poland (84), according to information from the European Commission. Italy followed by Spain are the largest producers of generic APIs in Europe. They both export more than 95% of their production.

Next action by the EU

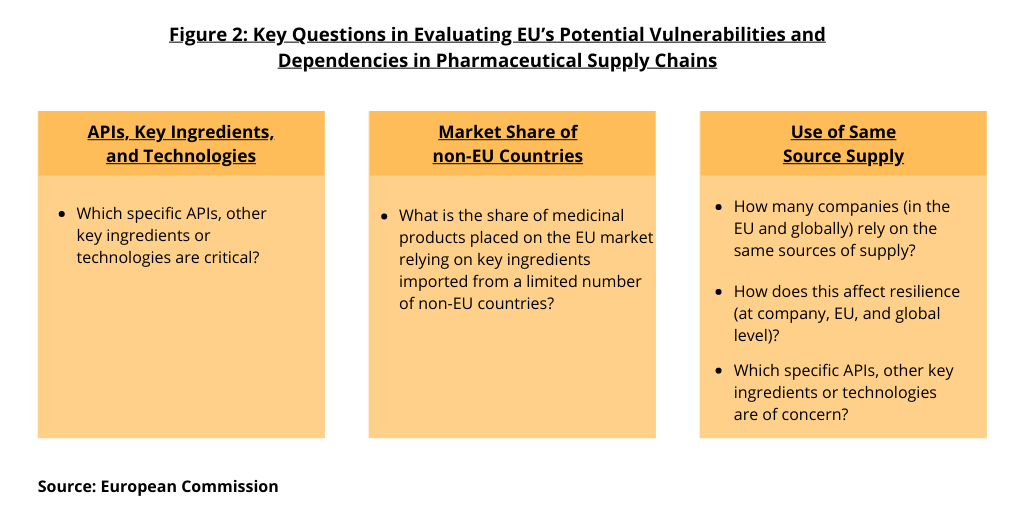

In its analysis, the European Commission says it is not sufficiently clear to what extent the EU relies on capacities in third countries (i.e., non-EU countries) in terms of processes and input required for the manufacturing of APIs. “It is essential to determine critical products, relevant from the point of view of public health, for which the EU does not have sufficient capacity to produce them. Figure 2 outlines key issues that the EU is seeking to address. These include: (1) which specific APIs, other key ingredients, or technologies are critical; (2) what is the share of medicinal products placed on the EU market relying on key ingredients imported from a limited number of suppliers; (3) how many companies (in the EU and globally) rely on the same sources of supply; (4) how does this affect resilience (at company, EU, and global levels); and (5) which specific APIs, other key ingredients, or technologies are of concern.

To address these questions, the European Commission has set up a structured dialogue on the security of medicines supply as announced in the Pharmaceutical Strategy for Europe in November 2020. The European Commission has initiated a structured dialogue with relevant public and private actors of the pharmaceutical supply chain.

The structured dialogue will first focus on identifying the causes and drivers of potential vulnerabilities, including dependencies in the often global and complex supply chains of critical medicines, their raw materials, APIs and intermediates. In the second phase, after closing knowledge gaps and gaining a better understanding of the current situation, the European Commission will consider possible solutions to address issues identified.

As part of an overall approach (not industry-specific) on how the EU can reduce its dependency in strategic areas, the European Commission says that in most cases, industry itself is best placed—through its corporate policies and decisions—to improve resilience and reduce any dependencies that may lead to vulnerabilities, including through diversification of suppliers, increased use of secondary raw materials, and substitution with other input materials. “There are, however, situations where concentration of production or sourcing in only one single geographical area results in the unavailability of alternative suppliers,” says the European Commission. In areas of strategic importance, the European Commission is identifying policy measures that can support industry’s efforts to address strategic dependencies and to develop necessary strategic capacity. Such measures are generally based on a mix of actions, targeted and proportionate to ecosystems’ needs and identified risks.