EU, Industry Meet for Pharma Supply-Chain Resiliency

The European Commission held a kick-off meeting of the structured dialogue process of the EU’s Pharmaceutical Strategy to address ways to improve the resilience of the EU’s pharmaceutical manufacturing value chain. High-level representatives from the EU, EU member states, and the chemical and pharma industries were at the table. What was discussed, and what’s next?

EU’s Pharmaceutical Strategy and the pharma supply chain

A reduction of reliance on offshore drug manufacturing is on the policy table in the European Union (EU) as part of the European Commission’s Pharmaceutical Strategy for Europe, which the European Commission adopted in late November (November 2020). It includes a plan for initiating a structured dialogue with and between stakeholders in pharmaceutical manufacturing and public authorities to identify vulnerabilities in the supply chain of critical medicines and shape policy options to strengthen the continuity and security of supply in the EU. The plan seeks to better understand and address those aspects that impact the resilience of the whole pharmaceutical manufacturing chain, starting with raw materials, intermediates, active pharmaceutical ingredients, and including finished dosage forms. The Pharmaceutical Strategy for Europe contributes to the Industrial Strategy for Europe, which was adopted in March 2020. The Industrial Strategy recognizes the importance of pharmaceuticals for EU security and autonomy.

Kick-off meeting: participants and focus

The European Commission held a kick-off meeting late last month (February 2021) of the structured dialogue process. The purpose of the meeting was to discuss the objective of increasing the EU’s pharmaceutical supply-chain resilience and also to discuss the contributions by meeting participants to the process of the structured dialogue. In addition to high-level representatives from the EU, EU member states, the European Medicines Agency (EMA), and the European Directorate for the Quality of Medicines & HealthCare (EDQM), pharma companies and CDMOs participated in the February 26, 2021 meeting. Among the companies listed as participants in the meeting were: AstraZeneca, Sanofi, Pfizer, Merck KGaA, Novartis’ Sandoz, Novo Nordisk, Teva, Fresenius Kabi, Seqens, Olon, Hovione, and Siegfried. Industry groups included: the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator pharmaceutical companies in Europe; Medicines for Europe, which represents generic and biosimilar manufacturers in Europe; the European Fine Chemicals Groups, which represents fine chemical manufacturers in Europe; and the European Chemical Industry Council (CEFIC), which represents chemical manufacturers in Europe.

|

|

Stella Kyriakides |

“Public authorities and industry work towards the same purpose[:] to make our pharma supply chains more resilient.” said Stella Kyriakides, the European Commissioner for Health and Food Safety,” in addressing participants at the February 26, 2021 meeting. “You can bring invaluable insight, expertise and perspective. You can help us understand the functioning of the pharmaceutical supply chain, identify its vulnerabilities, gather the necessary knowledge and data. Through this knowledge, we can propose concrete solutions to ensure the security of supply of critical medicines in the EU and reinforce the resilience of our health systems.”

In reporting on the discussion at the kick-off meeting, the European Commission said that stakeholder representatives showed a willingness to engage and contribute to the discussion about EU supply-chain resilience. Participants agreed that the road toward robustness must not focus only on the current situation but also future considerations. They also agreed that the ability to maintain and optimize open and well-functioning supply chains will require long-term policy measures to accelerate innovative and green production capacities. Participants also emphasized that challenges to manufacturing capability and capacity from a supply-security view depend on the form of products (solid, sterile/aseptic, or complex molecules).

What’s next

The structured dialogue initiative is a two-phase process steered by the European Commission. The main objective of Phase 1 is to close the knowledge gaps by gaining a better understanding of the functioning of global pharmaceutical supply chains and identifying the precise causes and drivers of different potential vulnerabilities. Building on the evidence gathered in Phase 1, Phase 2 will result in concrete measures that will address the identified issues. The structured dialogue initiative aims to deliver results by the end of 2021 and will cover all major steps of manufacturing of medicines in the EU and globally. Any potential measures will comply with EU competition and World Trade Organization (WTO) rules.

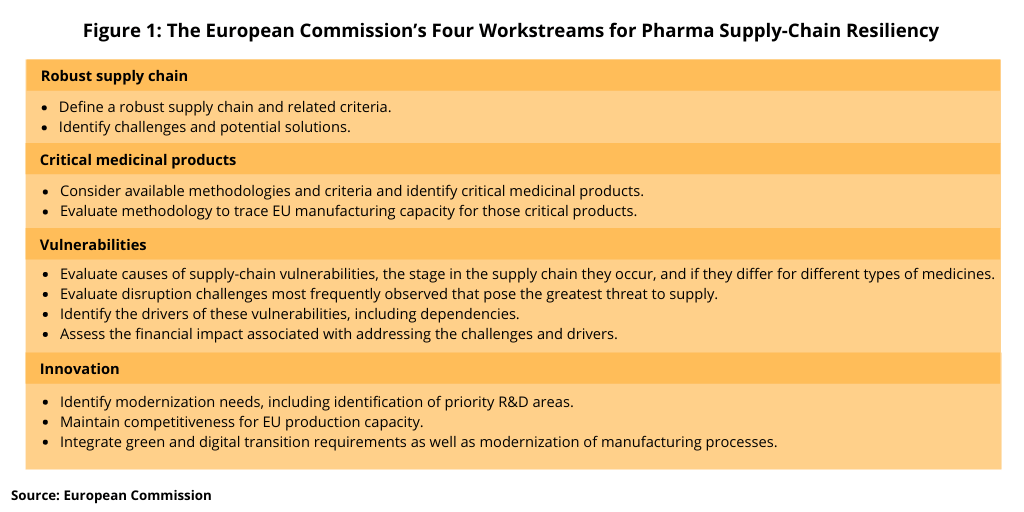

The February 26 meeting launched Phase 1 of the structured dialogue process. The first broad operational meeting is planned for this week (March 25, 2021). The purpose of this meeting is to refine the scope of each workstream identified in the process (see Figure 1) and agree on key questions to be tackled as well as to discuss and agree on the working arrangements. Four workstreams were identified in Phase 1: (1) robust supply chains; (2) critical medicinal products; (3) vulnerabilities; and (4) innovation. The operational meeting will be followed by two rounds of meetings for each workstream. Each of the workstreams will prepare a document answering key questions predefined by each workstream. The contribution of the workstreams will be a basis for the European Commission to propose the way forward.

Key areas of focus

Across the four workstreams (see Figure 1), the operational groups will work together to present detailed information on the functioning of global supply chains and identify different potential vulnerabilities and their causes, including dependencies threatening the supply of critical medicines. The four workstreams will be coordinated to run in parallel or sequentially. This data collection, analysis and sharing of perspectives will inform the scope and understanding of the key issues. Based on agreed deliverables, each workstream will produce a written report. The goals of each workstream are outlined below.

Robust supply chain. The purpose of robust supply-chain workstream is to define a robust supply chain, including analysis of the key criteria to achieve a robust supply chain, with consideration of the need for agility, flexibility, and resilience. Where challenges in achieving robustness are identified, these challenges are to be explored to determine if they are shared or if solutions have already been recognized.

Critical medicinal products. The purpose of the critical-medicine-product workstream is to consider available methodologies and criteria and identify medicinal products that are considered to be critical to public health and discuss methodology to trace EU manufacturing capacity for those critical products.

Vulnerabilities. The purpose of the vulnerabilities workstream is to reflect on the causes of vulnerabilities by considering at what stage in the supply chain they occur and if they differ for different types of medicines. The discussion is to include consideration of disruption challenges most frequently observed that pose the greatest threat to supply and to identify the drivers of these vulnerabilities, including dependencies. This workstream will also assess the financial impact associated with addressing the challenges and drivers.

Innovation. The purpose of the innovation workstream is to identify modernization needs, including identification of priority R&D areas, and to ensure supply chains are adequately robust and resilient to meet EU public health needs. This includes innovation needed to address challenges in deployment of new measures and for maintaining competitive production capacity in the EU. These considerations would further integrate green and digital transition requirements as well as modernization of manufacturing processes.